|

市场调查报告书

商品编码

1689978

英国地板覆盖材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)United Kingdom Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

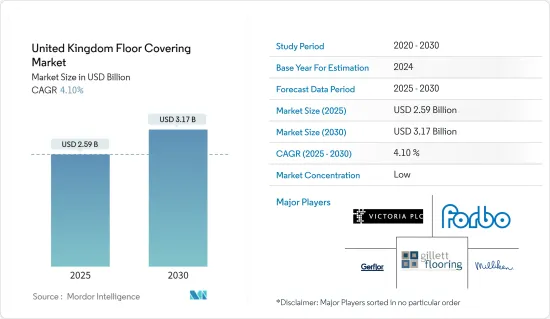

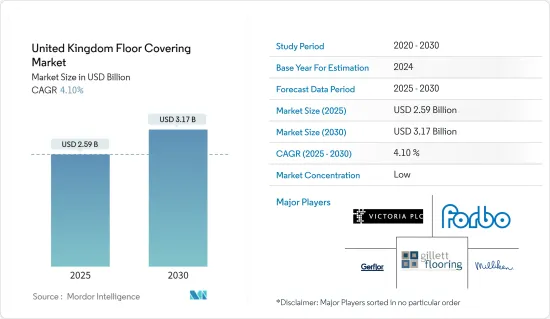

预计 2025 年英国地板覆盖材料市场规模将达到 25.9 亿美元,到 2030 年预计将达到 31.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.1%。

由于人们越来越重视室内装潢的美观以及可支配收入的增加,英国地板覆盖材料市场正在蓬勃发展。地板覆盖材料是改变空间外观、增加居住者舒适度的绝佳方式,并且易于清洁和维护。设计师地板覆盖材料、复杂地板覆盖材料和豪华石材地板材料的发展是英国地板材料市场的主要趋势。随着各种有吸引力的地板覆盖材料在各种价格分布的出现,越来越多的人开始投资地板材料。随着越来越多的人寻求具有隔热等其他功能的地板覆盖材料,英国地板覆盖材料市场将继续成长。隔热地板覆盖材料有助于防止热量损失、减少噪音并提供隐私。

由于对永续和环保地板材料的需求不断增加,地板覆盖材料市场正在蓬勃发展。市面上使用的地板材料主要类型有硬木地板材料、超耐磨地板、乙烯基地板材料、地毯地板材料和瓷砖地板材料。市场对环保地板材料的需求很高,尤其是在英国,绿色住宅预计将占据很大的市场占有率。人们越来越意识到建筑材料对环境的影响,并正在寻找使其更具永续的方法。

由于所有开发中国家的商业发展不断加快,地板材料产业也预计将扩大。城市人口的不断增长带动了商业发展的活性化。 3D瓷砖由于其创新和有吸引力的设计在英国市场越来越受欢迎。因此,3D 瓷砖正成为更具吸引力的选择。对优质设计和图案的需求不断增长,推动了英国瓷砖市场的发展。

英国地板覆盖材料市场的趋势

建设产业快速成长

英国不断增长的人口和都市化推动了对住宅和非住宅建筑的需求,这反过来又推动了对地毯和地垫等地板覆盖材料产品的需求。这些产品是按需使用的。例如,硬木地板因其强度、耐用性和装饰感而被用于住宅领域。

生活水准和住宅购买力的快速提高推动了对地毯和地垫等现代地板覆盖物的需求。英国人口的成长意味着住宅建设的需求不断增加,政府正在采取倡议提供经济适用住宅。

永续地板材料产品製造业的成长

由于英国政府重视成本效益并支持环保製造,对永续生产、天然和再生地毯的需求正在增加。另一方面,挥发性有机化合物(VOC)污染室内环境,影响人体健康,因此製造商正致力于降低其产品中的VOC含量。因此,VOC含量越低,产品的永续性就越强。

借助先进技术,行业领先公司正在创建新的流程和系统来回收产品废弃物。利用废弃物製造产品可以提高公司的盈利并有助于保护环境。因此,消费者对永续产品的偏好推动了英国对地板覆盖材料的需求。

英国地板覆盖材料产业概况

英国地板覆盖材料市场较为分散。领先的公司正致力于创新新的地板覆盖材料产品以满足日益增长的消费者需求。中小企业正在透过赢得新契约和开拓新市场来扩大其市场占有率。市场的一些主要参与者包括 Gerflor、Milliken、Victoria PLC、Forbo 和 Carpet and Flooring。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 高抗刮痕和污垢能力推动市场

- 高耐用性推动市场

- 市场限制

- 过多的水分会损坏地板覆盖材料。

- 阳光照射可能会损坏地板覆盖材料

- 市场机会

- 地板覆盖材料市场的技术进步

- 硬地板需求不断增加

- 深入了解各种监管发展

- 价值链/供应链分析

- 波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 洞察技术变革对市场的影响

- COVID-19 市场影响

第五章 市场区隔

- 按材质

- 地毯和块毯

- 弹性地板材料

- 非弹性地板材料

- 按最终用户

- 住宅

- 商业

- 按分销管道

- 承包商

- 专卖店

- 家装中心

- 其他分销管道

第六章 竞争格局

- 市场竞争概况

- 公司简介

- Milliken

- Gerflor

- Victoria PLC

- Carpet Flooring

- Forbo

- Gillett Flooring

- Moduleo

- The Amtico Co Ltd

- Westbury Carpets & Floor Coverings

- Ecotile*

第七章 市场趋势

第八章 免责声明及发布者

The United Kingdom Floor Covering Market size is estimated at USD 2.59 billion in 2025, and is expected to reach USD 3.17 billion by 2030, at a CAGR of 4.1% during the forecast period (2025-2030).

The UK floor covering market is booming due to the increased emphasis on interior aesthetics and increasing disposable income. Floor coverings are a great way to change the look of a space, enhance user comfort, and are easy to clean and maintain. The development of designer and intricate floor coverings, as well as premium stone floorings, is a key trend in the UK floor covering market. With a wide range of attractive floor coverings at different price points, more and more people are investing in them. The UK floor coverings market is expected to continue to grow as more people look for floor coverings with additional benefits, such as insulation. Insulated floor coverings help to prevent heat loss and reduce loud noises for more privacy.

The floor covering market is experiencing rapid growth driven by increasing demand for sustainable and ecofriendly flooring. The main types of flooring used in the market are hardwood flooring, laminate flooring, vinyl flooring, carpet flooring, and tile flooring. There is a high demand for ecofriendly flooring materials in the market, particularly in the United Kingdom where green homes will account for a large portion of the market share. People are becoming more aware of the environmental effects of building materials and are looking for ways to make them more sustainable.

The flooring industry is projected to expand due to the rise of commercial development in all developing countries. The growth of the urban population is leading to an increase of commercial development activity. 3D ceramic tiles are becoming increasingly popular in the UK market because of their innovative and attractive designs. As a result, 3D tiles are becoming a more attractive option. The growing demand for high-end designs and patterns is driving the UK - ceramic tiles market.

United Kingdom Floor Covering Market Trends

Rapid Increase In Building And Construction Industry

The increasing population and urbanization in the United Kingdom are raising the demand for residential and non-residential construction, increasing the demand for floor-covering products like carpets and rugs. These products are used according to the requirements. For example, hardwood floors are used in the residential sector for strength, long life span, and decorative touch.

Since there is a rapid improvement in living standards and house purchasing power, it is driving the demand for modern floor coverings such as carpets and rugs. As the population is increasing in the United Kingdom, there is an increased demand for constructing houses, and the government is taking initiatives to provide affordable housing.

Growth in Manufacturing Of Sustainable Flooring Products

Due to the increased initiative of the United Kingdom government toward cost-effectiveness and support for green manufacturing, there is an increased demand for natural and recycled carpets made from sustainable products. On the other hand, manufacturers focus on reducing the product's volatile organic compounds (VOC) content because it pollutes the indoor environment, affecting human health. Hence, when VOC content is reduced, the product's sustainability increases.

Major companies in the industry are creating new processes and systems to recycle product waste with the help of advanced technologies. It will enhance the company's profitability by manufacturing products from waste, which also benefits the environment. Therefore, consumer preference for sustainable products boosts the demand for floor covering in the United Kingdom.

United Kingdom Floor Covering Industry Overview

The United Kingdom floor covering market is fragmented. Significant companies focus on innovating new floor-covering products to meet consumers' increasing demand. Midsize and smaller companies are growing their market presence by securing new contracts and tapping new markets. The major players in the market include Gerflor, Milliken, Victoria PLC, Forbo, and Carpet and Flooring.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Resistance to Scratches and Stains Drives the Market

- 4.2.2 High Durability Drives the Market

- 4.3 Market Restraints

- 4.3.1 Excess Water Damages the Floor Covering

- 4.3.2 Exposure to Sun Cause Damages to the Floor Covering

- 4.3.3 Market Oppurtunities

- 4.3.3.1 Technological Advancements in Floor Covering Market

- 4.3.3.2 Increasing Demand for Hardwood Floors

- 4.4 Insights on Various Regulatory Trends

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Impact of Technology and Innovation in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Carpet and Area Rugs

- 5.1.2 Resilient Flooring

- 5.1.3 Non Resilient Flooring

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Contractors

- 5.3.2 Specialty Stores

- 5.3.3 Home Centers

- 5.3.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Milliken

- 6.2.2 Gerflor

- 6.2.3 Victoria PLC

- 6.2.4 Carpet Flooring

- 6.2.5 Forbo

- 6.2.6 Gillett Flooring

- 6.2.7 Moduleo

- 6.2.8 The Amtico Co Ltd

- 6.2.9 Westbury Carpets & Floor Coverings

- 6.2.10 Ecotile*