|

市场调查报告书

商品编码

1842495

美国地板材料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)United States Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

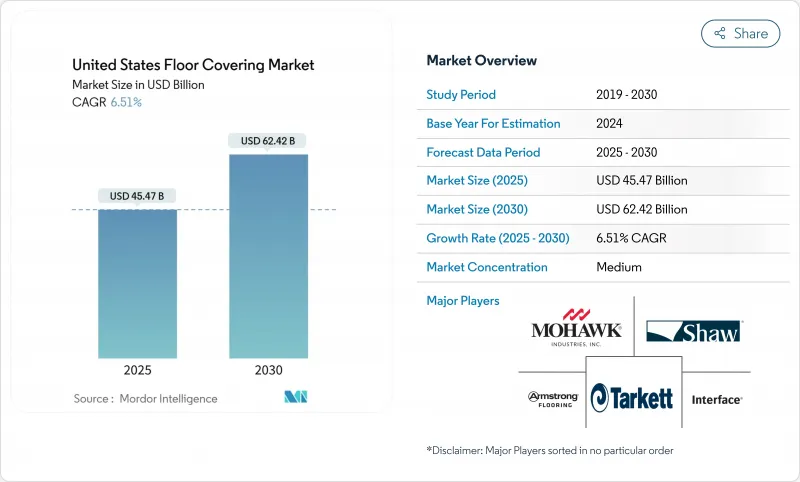

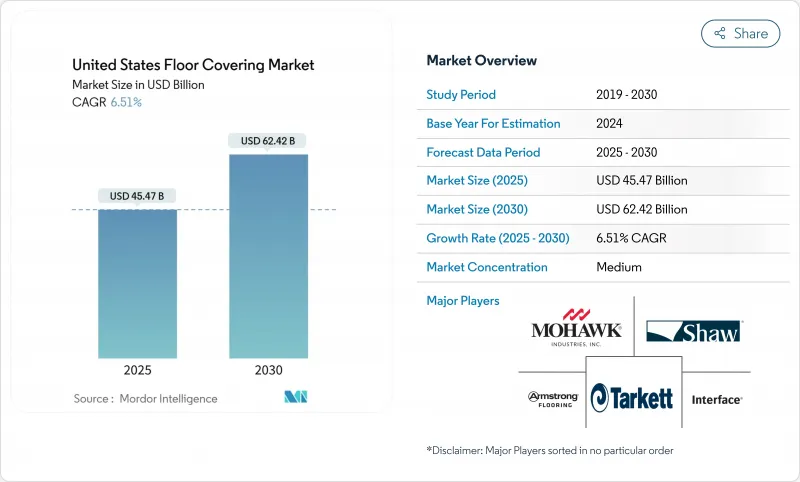

预计2025年美国地板材料市场规模将达454.7亿美元,2030年将达624.2亿美元,复合年增长率为6.51%。

美国地板材料市场当前的成长势头得益于房屋翻新活动、强劲的产品创新以及阳光地带各州强劲的人口增长。税收优惠的商业维修也支撑了需求,抵消了高借贷成本的限制。大型製造商正专注于防水和防刮擦技术,而透过电子商务进行的直销模式正在迅速改变市场模式。持续的原材料价格上涨和严重的安装人员短缺是抑制美国地板材料市场乐观前景的关键成本压力。

美国地板材料市场趋势与洞察

IRA支援的商业维修税收优惠加速地板材料升级

扩大免税范围正在释放政府和非营利机构的需求,这些机构先前推迟了地板更换。由于翻新工程与疫情后室内装修相吻合,兼具隔音和隔热功能的地板材料升级成为首要要求。维修公司正在根据税表调整竞标,为密集商业区的承包商创造了稳定的订单。这项转变为优质、高弹性的地毯砖以及采用再生材料并符合能源目标的地毯砖提供了平台。

灵活办公空间的繁荣推动了办公室和共享办公中心对模组化地板的需求

混合办公模式正在推动对模组化地板材料的需求,这种地板可在座位布局变化时抬起并重新铺设。由于营运商在租赁重新谈判期间寻求快速解决方案,地毯砖的销售量超过了疫情前的商业预测。设计师指定了兼顾脚感和座椅脚轮耐用性的系列。隔音靠背系统可降低开放式空间的噪音,并支援健康认证。点击锁定係统是狭窄安装区域的首选,因为它们可以最大限度地减少停机时间——这项功能受到共享办公室供应商的青睐,他们透过空间週转收益。因此,供应商正在投资染料熔融印刷技术,该技术可实现快速定制,而无需延长前置作业时间。

高利率抑制新建设

商业不动产交易量将在2023年下降37%,2024年再下降14%。开发商正在推迟投机性新建项目,抑制了大型核心-计划的地板材料需求。传统办公大楼的空置延长了维修週期,迫使业主选择渐进式升级,而非全面更换地板。由于电子商务占据了可自由支配支出的主导地位,零售资本支出也同样谨慎。因此,美国地板材料市场正将重点转向可在有限预算内进行的维修项目。供应商正在将价值工程产品线与融资支援捆绑在一起,但门户城市的产量短缺继续抑制整体成长。

細項分析

到 2024 年,地毯和地垫将占美国地板材料市场的 36.01%,这要归功于它们在多用户住宅和办公室的隔音优势。然而,弹性地板材料预计将以 7.91% 的复合年增长率成长,比美国整体地板材料市场高出近 2.3 个百分点。豪华乙烯基地砖和硬芯系列凭藉其防水性能和易于维护的特点,在应用方面处于领先地位。这种转变正在从入门级价格分布的非弹性硬质表面(如现场饰面和陶瓷)手中夺走市场份额。值得注意的是,不含 PVC 的弹性材料(如 Mohawk 的 PureTech)正在获得注重永续发展的买家的广泛认可。

2024年,弹性地板材料也受惠于碳酸钙填充材成本的稳定,在繁忙的装修季,促销价格也大幅上涨。 SPC ClickLock 地板在社群平台上的直销套装中占据了显着位置。製造商透过提供独特的耐磨层和延长保固来提高净利率,这引起了注重长期价值的房主的共鸣。

美国地板材料市场按产品类型(地毯、弹性地板材料、豪华乙烯基瓷砖 (LVT) 等)、终端用户(住宅、商业办公室)、分销管道(地板材料专卖店、大型五金店等)和地区(东北部、东南部等)细分。市场预测以美元计算。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

第五章 市场概况

- 市场驱动因素

- IRA商业房地产维修优惠加速地板维修

- 灵活办公空间的繁荣推动了办公室和共享办公中心对模组化地板的需求

- 医疗保健建筑对低VOC弹性表面的需求激增

- 电子商务仓库的扩张导致耐用硬质地板的安装增加

- 房屋建造和装修增加

- 消费者越来越偏好永续性和低维护

- 市场限制

- 高利率限制新办公室和商店的建设

- 石化原料波动挤压乙烯基和橡胶利润

- 熟练承包商短缺导致人事费用上升和计划延误

- 掩埋转移规定推高了报废地毯的成本

- 价值/供应链分析

- 监理展望

- 技术展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 产业竞争

- 定价分析

第六章市场规模及成长预测

- 依产品类型

- 地毯和地垫

- 宽幅地毯

- 地毯砖

- 块毯

- 弹性地板

- 豪华乙烯基瓷砖(LVT)

- 乙烯基片材和 VCT

- 橡胶地板

- 油布

- 非弹性硬质表面

- 陶瓷和陶瓷瓷砖

- 天然石瓷砖

- 实木地板

- 人造木地板

- 强化木地板

- 竹子和软木地板

- 地毯和地垫

- 按最终用户

- 住宅

- 商业

- 零售

- 饭店与休閒

- 卫生保健

- 教育

- 公共设施

- 其他的

- 按分销管道

- 地板专卖店

- 大型家居装饰店

- 独立贸易商/经销商

- 直接面向消费者的电子商务

- 批发商/经销商

- 按地区(美国)

- 东北

- 东南

- 中西部

- 西南

- 西方

第七章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介莫霍克工业公司

- Shaw Industries Group Inc.

- Tarkett SA

- Armstrong Flooring Inc.

- Interface Inc.

- Mannington Mills Inc.

- Gerflor Group

- Forbo Flooring Systems

- LG Hausys(Hanwha)

- Beaulieu International Group

- The Dixie Group Inc.

- Milliken & Company

- Engineered Floors LLC

- Karndean Designflooring

- Roppe Corporation

- Congoleum Corporation

- AHF Products(Bruce)

- Somerset Hardwood Flooring

- Quick-Step USA

- LL Flooring Holdings Inc.

- COREtec Floors

- Tandus Centiva(Tarkett)

- Market Opportunities & Future Outlook

- White-Space & Unmet-Need Assessment

The US flooring market is valued at USD 45.47 billion in 2025 and is forecast to reach USD 62.42 billion by 2030, expanding at a 6.51% CAGR.

Residential renovation activity, resilient product innovation, and strong population growth in Sunbelt states underpin the current momentum of the US flooring market. Demand is reinforced by tax-advantaged commercial retrofits that offset the drag from high borrowing costs. Scale manufacturers concentrate on waterproof and scratch-resistant technologies, while direct-to-consumer e-commerce rapidly reshapes go-to-market models. Sustained raw-material inflation and an acute installer shortage remain the key cost pressures that temper the otherwise upbeat outlook of the US flooring market.

United States Floor Covering Market Trends and Insights

IRA-Backed Commercial Retrofit Tax Incentives Accelerating Flooring Upgrades

Expanded eligibility for tax-exempt entities unlocks demand from government and nonprofit facilities that have historically delayed floor replacements. Retrofits dovetail with post-pandemic reconfiguration of interiors, so flooring upgrades that deliver both acoustic and thermal performance rise to the top of specification lists. Design firms are aligning bids with tax schedules, creating a steady backlog for installers in dense commercial districts. The change supports premium resilient and carpet-tile platforms that incorporate recycled content while meeting energy targets.

Flexible Workspace Boom Driving Modular Flooring Demand in Offices and Co-working Hubs

Hybrid work models catalyze demand for modular flooring that can be lifted and re-laid when seating plans change. Carpet tile volumes surpassed pre-pandemic commercial forecasts as operators seek quick-turn solutions during lease renegotiations. Resimercial aesthetics blend soft textures with hard-surface accents so designers specify collections that balance underfoot comfort with chair-castor durability. Acoustic backing systems mitigate noise in open plans and support wellness certifications. Smaller installation zones favour click-lock systems that minimize downtime, a feature prized by co-working providers that monetize space churn. Suppliers are therefore investing in dye-infusion print technologies that enable rapid customization without extending lead times.

High Interest Rates Suppressing New Office and Retail Build-outs

Transaction volumes in commercial real estate fell 37% in 2023 and a further 14% in 2024 . Developers defer speculative ground-ups, curbing floor covering demand in large core-shell projects. Vacancies in legacy office towers extend retrofit cycles, pushing landlords to phase upgrades rather than execute full-floor replacements. Retail capital expenditure is similarly cautious as e-commerce captures discretionary spending. The US flooring market thus shifts focus toward refurbishment programs that can proceed under constrained budgets. Suppliers bundle value-engineered lines with financing support, yet volume shortfalls in gateway cities continue to temper overall growth.

Other drivers and restraints analyzed in the detailed report include:

- Healthcare Construction Surge Requiring Low-VOC Resilient Surfaces

- E-commerce Warehouse Expansion Increasing Durable Hard-Surface Installations

- Skilled Installer Shortage Elevating Labor Costs and Project Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Carpets and rugs retained 36.01% of the US flooring market in 2024 due to acoustic benefits in multifamily housing and offices. However, resilient flooring is forecast to grow at a 7.91% CAGR, almost 2.3 percentage points above the overall US flooring market. Luxury vinyl tile and rigid core collections spearhead adoption because they deliver waterproof performance and easy maintenance. The shift pulls share from non-resilient hard surfaces such as site-finished wood and ceramic in entry-level price tiers. Notably, PVC-free resilient lines led by Mohawk's PureTech have broadened acceptance among sustainability-focused buyers.

In 2024, the resilient category also benefited from cost stabilization in calcium carbonate fillers, supporting aggressive promotional pricing during peak remodeling season. As a result, SPC click-lock planks featured prominently in direct-to-consumer bundles marketed through social platforms. Manufacturers augment margins through proprietary wear layers that qualify for extended warranties, a feature that resonates with homeowners concerned about long-term value.

The US Floor Covering Market Segments Into by Product Type (Carpet and Rugs, Resilient Flooring Luxury Vinyl Tile (LVT), and More), End-User (Residential, and Commercial Office), Distribution Channel (Specialty Flooring Retailers, Big-Box Home Centers, and More), Region (Northeast, Southeast, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Shaw Industries Group Inc.

- Tarkett S.A.

- Armstrong Flooring Inc.

- Interface Inc.

- Mannington Mills Inc.

- Gerflor Group

- Forbo Flooring Systems

- LG Hausys (Hanwha)

- Beaulieu International Group

- The Dixie Group Inc.

- Milliken & Company

- Engineered Floors LLC

- Karndean Designflooring

- Roppe Corporation

- Congoleum Corporation

- AHF Products (Bruce)

- Somerset Hardwood Flooring

- Quick-Step USA

- LL Flooring Holdings Inc.

- COREtec Floors

- Tandus Centiva (Tarkett)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

5 Market Overview

- 5.1 Market Drivers

- 5.1.1 IRA-Backed Commercial Retrofit Tax Incentives Accelerating Flooring Upgrades

- 5.1.2 Flexible Workspace Boom Driving Modular Flooring Demand in Offices & Co-working Hubs

- 5.1.3 Healthcare Construction Surge Requiring Low-VOC Resilient Surfaces

- 5.1.4 E-commerce Warehouse Expansion Increasing Durable Hard-Surface Installations

- 5.1.5 Growth in Residential Construction and Renovation Activity

- 5.1.6 Rising Consumer Preferences for Sustainability and Low Maintenance

- 5.2 Market Restraints

- 5.2.1 High Interest Rates Suppressing New Office & Retail Build-outs

- 5.2.2 Petrochemical Feedstock Volatility Compressing Vinyl & Rubber Margins

- 5.2.3 Skilled Installer Shortage Elevating Labor Costs & Project Delays

- 5.2.4 Landfill Diversion Mandates Raising Carpet End-of-Life Costs

- 5.3 Value / Supply-Chain Analysis

- 5.4 Regulatory Outlook

- 5.5 Technological Outlook

- 5.6 Porter's Five Forces

- 5.6.1 Bargaining Power of Suppliers

- 5.6.2 Bargaining Power of Buyers

- 5.6.3 Threat of New Entrants

- 5.6.4 Threat of Substitutes

- 5.6.5 Industry Rivalry

- 5.7 Pricing Analysis

6 Market Size & Growth Forecasts (Value)

- 6.1 By Product Type

- 6.1.1 Carpets & Rugs

- 6.1.1.1 Broadloom Carpet

- 6.1.1.2 Carpet Tiles

- 6.1.1.3 Area Rugs

- 6.1.2 Resilient Flooring

- 6.1.2.1 Luxury Vinyl Tile (LVT)

- 6.1.2.2 Vinyl Sheet & VCT

- 6.1.2.3 Rubber Flooring

- 6.1.2.4 Linoleum

- 6.1.3 Non-Resilient Hard Surface

- 6.1.3.1 Ceramic & Porcelain Tile

- 6.1.3.2 Natural Stone Tile

- 6.1.3.3 Solid Wood Flooring

- 6.1.3.4 Engineered Wood Flooring

- 6.1.3.5 Laminate Flooring

- 6.1.3.6 Bamboo & Cork Flooring

- 6.1.1 Carpets & Rugs

- 6.2 By End-User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.2.1 Retail

- 6.2.2.2 Hospitality & Leisure

- 6.2.2.3 Healthcare

- 6.2.2.4 Education

- 6.2.2.5 Public & Institutional

- 6.2.2.6 Others

- 6.3 By Distribution Channel

- 6.3.1 Specialty Flooring Retailers

- 6.3.2 Big-Box Home Centers

- 6.3.3 Independent Contractors / Dealers

- 6.3.4 Direct-to-Consumer E-commerce

- 6.3.5 Wholesale / Distributors

- 6.4 By Region (U.S.)

- 6.4.1 Northeast

- 6.4.2 Southeast

- 6.4.3 Midwest

- 6.4.4 Southwest

- 6.4.5 West

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)Mohawk Industries Inc.

- 7.4.1 Shaw Industries Group Inc.

- 7.4.2 Tarkett S.A.

- 7.4.3 Armstrong Flooring Inc.

- 7.4.4 Interface Inc.

- 7.4.5 Mannington Mills Inc.

- 7.4.6 Gerflor Group

- 7.4.7 Forbo Flooring Systems

- 7.4.8 LG Hausys (Hanwha)

- 7.4.9 Beaulieu International Group

- 7.4.10 The Dixie Group Inc.

- 7.4.11 Milliken & Company

- 7.4.12 Engineered Floors LLC

- 7.4.13 Karndean Designflooring

- 7.4.14 Roppe Corporation

- 7.4.15 Congoleum Corporation

- 7.4.16 AHF Products (Bruce)

- 7.4.17 Somerset Hardwood Flooring

- 7.4.18 Quick-Step USA

- 7.4.19 LL Flooring Holdings Inc.

- 7.4.20 COREtec Floors

- 7.4.21 Tandus Centiva (Tarkett)

- 7.5 Market Opportunities & Future Outlook

- 7.5.1 White-Space & Unmet-Need Assessment