|

市场调查报告书

商品编码

1644381

申请人追踪系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Applicant Tracking System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

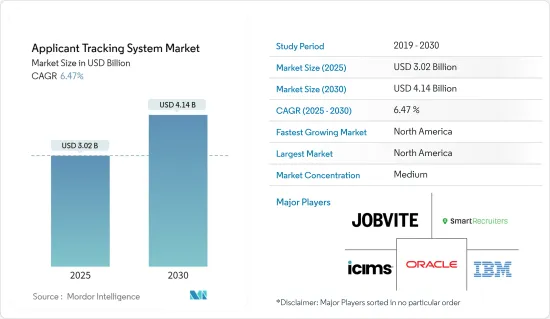

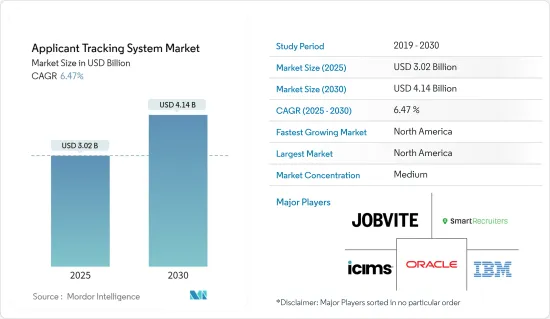

申请人追踪系统市场规模预计在 2025 年为 30.2 亿美元,预计到 2030 年将达到 41.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.47%。

申请人追踪系统 (ATS) 市场正在迅速发展成为现代招聘流程的基石。 ATS 软体可让企业管理大量候选人、监控申请并简化招募工作流程。在过去几年里,人才获取日益复杂以及对先进招聘管理工具的需求刺激了该行业的创新和成长。组织正在转向自动化招募解决方案,不仅是为了提高效率,也是为了增强整体招募体验。

主导技术正在透过自动化候选人筛检、预测招募结果和优化招募广告来增强招募流程,从而重塑 ATS 格局。供应商的因应措施是为 IT、医疗保健和零售等各行业提供日益复杂、可客製化的平台。向云端基础的ATS 平台的转变尤其值得注意,因为它们提供了灵活性、扩充性和与其他 HR 工具的无缝整合。儘管在实施 ATS 的技术复杂性方面仍然存在挑战,但大量招募需求的行业已经使得此类解决方案变得至关重要。

招募自动化需求日益增加

主要亮点

- 招募自动化:招募流程自动化的需求是 ATS 市场的主要动力。公司,尤其是那些处理大量求职者的公司,正在使用自动化来简化操作并减少花在筛选求职者等手动任务上的时间。

- 透过自动化提高效率:自动化招募工具(包括人工智慧系统)使负责人能够专注于更高价值的业务,缩短招募时间并改善候选人体验。这些系统可以处理候选人寻找和安排等重复性任务,使人力资源团队更有效率地业务。

- 人工智慧整合:人工智慧进一步增强了 ATS 平台,提供了预测功能,帮助公司更快地识别最佳候选人,从而降低每次招募的成本。自动化还可以最大限度地减少招募过程中的瓶颈并加快决策速度。

- 云端基础的需求:随着公司寻求与其他人力资源工具整合并提供即时招募资料存取的系统,基于云端基础的ATS 平台的趋势持续成长。这些平台对于需要扩充性远端解决方案的企业尤其有价值,尤其是在远距工作趋势日益增长的背景下。

人才招募的多元性

主要亮点

- 使用 ATS 减少偏见:随着多元化成为公司关注的重点,ATS 平台正在不断发展以减少招聘过程中的偏见。现代 ATS 软体演算法有利于公平评估候选人,并确保多元化的人才库得到平等的考虑。

- 包容性主导工具:招募软体供应商也正在开发旨在提高整体性的功能,帮助雇主接触广泛的人才。这与公司更加重视劳动力多样性并确保遵守就业平等标准相吻合。

- 多元化人工智慧:人工智慧驱动的申请人追踪系统正在帮助公司减少无意识的偏见并促进更具包容性的招募实践。这些工具还促进了盲目招聘,使公司能够将其招聘策略与多元化目标相结合。

- 可客製化平台:随着多功能性变得越来越重要,可客製化平台在 ATS 市场上呈现上升趋势。供应商提供解决方案,使招募策略与特定的多元化目标保持一致,并提高整体性和对公司政策的遵守性。

申请人追踪系统 (ATS) 市场趋势

预测期内,雇主采用资料分析策略将推动市场成长

- 资料分析用于决策:资料分析正在成为招募的关键工具,ATS 平台越来越多地整合分析功能以改善招募策略。借助资料洞察,公司可以更好地评估候选人的适合性,缩短招募时间并改进招募方法。

- 透过人工智慧提高效率:人工智慧与 ATS 平台的整合,透过自动执行履历筛检和候选人配对等任务,提高了招募效率。主导工具还可以帮助改善多元化招聘,预测分析使负责人能够预测人才需求并优化招聘策略。

- 云端基础的解决方案:向云端基础的ATS 平台的转变正在加速,尤其是在医疗保健、IT 和金融等资料安全性和扩充性至关重要的行业。云端 ATS 平台支援远端访问,使招聘流程更加灵活和合规,尤其是在远端工作趋势下。

- 行动友善平台:行动友善 ATS 平台越来越受欢迎,因为它们满足了日益增长的敏捷招募流程需求。这些平台为求职者提供了无缝的求职体验,改善了用户体验,并加速了寻求高效招聘解决方案的公司招聘。

北美市场可望引领 ATS 市场

- 北美主导:北美是 ATS 市场的主导地区,这得益于先进的技术基础设施和高招聘软体采用率。该地区的大大小小的企业越来越多地转向 ATS 平台来优化他们的招募流程。

- 技术创新:人工智慧和机器学习的创新是北美采用 ATS 的主要驱动力。随着企业优先考虑效率和扩充性,由人工智慧驱动的 ATS 平台已成为 IT 和医疗保健等招聘需求旺盛的行业必不可少的一部分。

- 疫情后云端基础的招募:疫情后,北美云端基础的ATS 解决方案的激增尤为普遍,反映了向远端和虚拟招聘的转变。我们的云端平台的灵活性使我们成为寻求可扩展且安全的招募解决方案的企业的选择。

- 注重安全性和合规性:随着 GDPR 和 CCPA 等资料安全法规变得越来越突出,北美企业越来越寻求提供强大资料保护功能的 ATS 供应商。对安全性的重视是北美在全球 ATS 市场中占据主导地位的原因。

申请人追踪系统 (ATS) 行业概览

- 市场整合:ATS 市场处于半整合状态,大型科技公司和专业供应商占据市场主导地位。虽然 IBM 公司和 Oracle 公司等主要企业在该领域占据主导地位,但 Jobvite Inc. 和 iCIMS Inc. 等中型公司则提供更专业和灵活的解决方案。

- 主要企业主要企业:IBM、 Oracle、Bullhorn Inc.、Jobvite、iCIMS 等。这些公司提供一系列 ATS 解决方案,从云端基础的平台到人工智慧工具,使公司能够简化招募流程并增强候选人体验。

- 人工智慧和用户体验:ATS 市场的一个主要趋势是采用人工智慧和机器学习来改善候选人匹配并增强用户体验。提供可自订平台和与其他人力资源工具无缝整合的公司更有可能在这个竞争激烈的市场中取得成功。

- 灵活、可扩展的解决方案:ATS 产业未来的成功将取决于供应商提供扩充性、适应性强的解决方案的能力,以满足从新新兴企业到大型企业不断变化的需求。可自订的仪表板、与人力资源系统的无缝整合以及人工智慧功能对于市场的持续成长至关重要。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 市场驱动因素

- 招募活动对自动化的需求日益增加

- 吸引多元化人才显着成长

- 市场挑战

- 使用高级 ATS 的技术专业知识有限,且 ATS 软体与其他系统整合起来很复杂

- 评估新冠肺炎对市场的影响

第五章 市场区隔

- 按组件类型

- 解决方案

- 服务

- 按部署

- 本地

- 云

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 零售

- 卫生保健

- 其他最终用户(汽车、工业製造)

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- IBM Corporation

- Oracle Corporation

- Jobvite Inc.

- Bullhorn, Inc.(Vista Equity Partners)

- iCIMS, Inc.

- SmartRecruiters, Inc.

- Workday, Inc.

- SAP SE

- Workable Technology Limited

- Greenhouse Software, Inc.

第七章投资分析

第 8 章:市场的未来

The Applicant Tracking System Market size is estimated at USD 3.02 billion in 2025, and is expected to reach USD 4.14 billion by 2030, at a CAGR of 6.47% during the forecast period (2025-2030).

The applicant tracking system (ATS) market has rapidly evolved into a cornerstone of modern recruitment processes. ATS software enables companies to manage large volumes of candidates, monitor applications, and streamline hiring workflows. Over the past few years, the increasing complexity of talent acquisition and the demand for advanced recruitment management tools have spurred innovation and growth in this sector. Organizations are turning to automated hiring solutions, not only to improve efficiency but also to enhance the overall recruitment experience.

AI-driven technologies are reshaping the ATS landscape, enhancing the recruitment process by automating candidate screening, predicting hiring outcomes, and optimizing job postings. Vendors are responding by offering increasingly sophisticated and customizable platforms tailored to diverse industries such as IT, healthcare, and retail. The shift toward cloud-based ATS platforms is particularly notable, as they provide flexibility, scalability, and seamless integration with other HR tools. These solutions have become critical in industries with high-volume hiring demands, although challenges related to the technical complexity of ATS implementations remain.

Growing Need for Automation in Recruitment

Key Highlights

- Automation in recruitment: The demand for automating recruitment processes is a primary driver of the ATS market. Organizations, especially those handling large applicant pools, rely on automation to streamline tasks and reduce the time spent on manual processes such as application filtering.

- Efficiency through automation: Automated hiring tools, including AI-powered systems, allow recruiters to focus on higher-value tasks, reducing the time-to-hire and improving candidate experience. These systems can handle repetitive tasks like candidate sourcing and scheduling, allowing HR teams to work more efficiently.

- AI integration: Artificial intelligence has further enhanced ATS platforms, offering predictive capabilities that help companies identify the best candidates faster, thereby reducing cost-per-hire. Automation also facilitates quicker decision-making by minimizing bottlenecks in the recruitment process.

- Cloud-based demand: The trend toward cloud-based ATS platforms continues to rise, with companies seeking systems that integrate with other HR tools and offer real-time access to recruitment data. These platforms are particularly valuable for businesses needing scalable, remote solutions, especially in the wake of growing remote work trends.

Diversity in Talent Acquisition

Key Highlights

- Bias reduction through ATS: As diversity becomes a key focus for organizations, ATS platforms are evolving to reduce bias in hiring processes. Algorithms in modern ATS software promote fair candidate assessments, ensuring diverse talent pools are considered equitably.

- Inclusion-driven tools: Recruitment software vendors are also developing features aimed at improving inclusivity, helping employers reach underrepresented talent groups. This aligns with companies' increased emphasis on workforce diversity, ensuring compliance with equal employment standards.

- AI for diversity: AI-driven applicant tracking systems are aiding companies in reducing unconscious biases, promoting more inclusive hiring practices. These tools also facilitate blind recruitment, allowing organizations to tailor recruitment strategies that align with their diversity goals.

- Customizable platforms: As diversity gains more importance, the ATS market is seeing a rise in customizable platforms. Vendors are offering solutions that allow businesses to adapt their recruitment strategies to specific diversity objectives, enhancing inclusivity and compliance with corporate policies.

Applicant Tracking System (ATS) Market Trends

Recruitment Companies' Adoption of Data Analytics Strategies is Set to Drive Market Growth During the Forecast Period

- Data analytics for decision-making: Data analytics has emerged as a critical tool in recruitment, with ATS platforms increasingly integrating analytics capabilities to improve hiring strategies. By leveraging data insights, companies can better assess candidate fit, reduce time-to-hire, and refine their recruitment approaches.

- AI-driven efficiency: The integration of AI in ATS platforms is boosting recruitment efficiency by automating tasks such as resume screening and candidate matching. AI-driven tools also aid in improving diversity hiring, while predictive analytics allows recruiters to anticipate talent needs and optimize recruitment strategies.

- Cloud-based solutions: The shift to cloud-based ATS platforms is accelerating, particularly in industries such as healthcare, IT, and finance, where data security and scalability are crucial. Cloud ATS platforms enable remote access, improving flexibility and compliance in recruitment processes, especially in the context of remote work trends.

- Mobile-friendly platforms: Mobile-friendly ATS platforms are gaining traction as they cater to the increasing need for agile recruitment processes. These platforms offer seamless job application experiences for candidates, enhancing user experience and accelerating adoption among companies seeking efficient hiring solutions.

North America Geographic Segment Expected to Lead ATS Market

- North America's dominance: North America remains the dominant region in the ATS market, driven by advanced technological infrastructure and high adoption rates of recruitment software. The region's large enterprises and SMEs are increasingly leveraging ATS platforms to optimize recruitment processes.

- Technological innovation: AI and machine learning innovations are key drivers of ATS adoption in North America. As companies prioritize efficiency and scalability, AI-powered ATS platforms are becoming essential in industries with high hiring demands, such as IT and healthcare.

- Cloud-based adoption post-pandemic: The surge in cloud-based ATS solutions in North America, particularly following the pandemic, reflects a shift toward remote and virtual hiring. The flexibility of cloud platforms has made them a preferred choice for businesses seeking scalable and secure recruitment solutions.

- Focus on security and compliance: As data security regulations like GDPR and CCPA become more prominent, North American companies are increasingly turning to ATS vendors that offer robust data protection features. This focus on security has contributed to North America's leading position in the global ATS market.

Applicant Tracking System (ATS) Industry Overview

- Market consolidation: The ATS market is semi- consolidated, with a mix of large tech companies and specialized vendors holding significant market shares. Key players like IBM Corporation and Oracle Corporation dominate the space, while medium-sized firms like Jobvite Inc. and iCIMS Inc. offer more specialized, flexible solutions.

- Key industry players: Leading companies in the ATS market include IBM, Oracle, Bullhorn Inc., Jobvite, and iCIMS. These firms provide a range of ATS solutions, from cloud-based platforms to AI-powered tools, enabling businesses to streamline recruitment processes and enhance candidate experience.

- AI and user experience: A significant trend in the ATS market is the adoption of AI and machine learning for improving candidate matching and enhancing user experience. Companies offering customizable platforms and seamless integrations with other HR tools are well-positioned for success in this competitive market.

- Flexible and scalable solutions: Future success in the ATS industry will hinge on the ability of vendors to offer scalable, adaptable solutions that meet the evolving needs of businesses, from startups to large enterprises. Customizable dashboards, seamless integration with HR systems, and AI capabilities will be critical for sustained market growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Growing Need for Automation in Recruitment

- 4.3.2 Significant Growth in Diverse Talent Acquisition

- 4.4 Market Challenges

- 4.4.1 Limited Technical Expertise for Using Advanced ATS and Complexity Involved with the Integration of ATS Software with Other Systems

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Component Type

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 End-user Verticals

- 5.3.1 IT and Telecommunication

- 5.3.2 BFSI

- 5.3.3 Retail

- 5.3.4 Healthcare

- 5.3.5 Other End-user Verticals (Automotive, Industrial Manufacturing)

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Oracle Corporation

- 6.1.3 Jobvite Inc.

- 6.1.4 Bullhorn, Inc. (Vista Equity Partners)

- 6.1.5 iCIMS, Inc.

- 6.1.6 SmartRecruiters, Inc.

- 6.1.7 Workday, Inc.

- 6.1.8 SAP SE

- 6.1.9 Workable Technology Limited

- 6.1.10 Greenhouse Software, Inc.