|

市场调查报告书

商品编码

1644850

高端半导体封装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)High-end Semiconductor Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

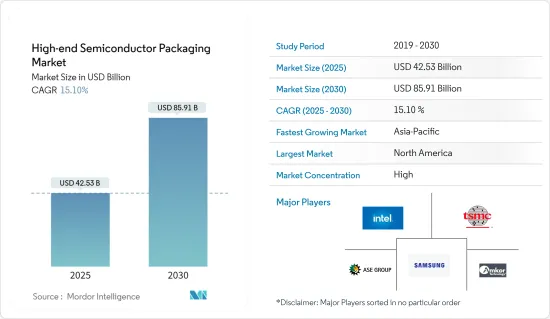

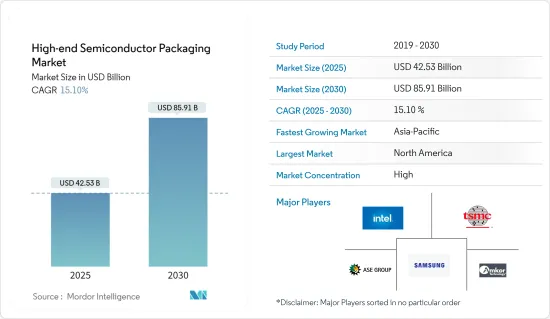

高端半导体封装市场规模预计在 2025 年为 425.3 亿美元,预计到 2030 年将达到 859.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.1%。

使用封装来提高电子系统的性能、可靠性和成本效益,正在推动各个行业终端用户垂直领域的需求不断增长,而整合度、能源效率和产品特性的不断进步则推动着市场的成长。

主要亮点

- 封装可保护电子系统免受高频噪音辐射、静电放电、机械损坏和冷却的影响。全球半导体产业的不断成长是推动半导体封装市场成长的主要因素之一。此外,2023年2月,半导体产业协会(SIA)宣布,2022年全球半导体产业销售额将达到5,741亿美元,创历史最高年度总合,较上年的5,559亿美元成长3.3%。

- 此外,物联网和人工智慧的兴起以及复杂电子设备的激增,正在推动家电和汽车行业的高端应用领域。这些因素正在推动更先进的半导体封装技术来维持需求。该领域研究活动的活性化进一步推动了市场需求。

- 此外,由于 5G、物联网、汽车和 HPC 等多个长期成长动力,半导体封装市场预计将扩大。例如,印度政府已核准一项 100 亿美元的奖励计划,用于建立包括晶圆厂、本土晶片设计和复合半导体工厂在内的完整的半导体生态系统。

- 此外,新冠疫情对电子产业产生了重大影响,半导体供应链问题和晶片短缺在一段时间内影响了该产业。然而,预计全球范围内对半导体行业的投资增加和半导体製造设施的建立将推动后疫情时代的市场成长。

高端半导体封装市场趋势

消费性电子产业可望推动市场

- 消费性电子部门正大力投资半导体封装市场。智慧型手机的成长、穿戴式装置和智慧型装置的日益普及以及消费性物联网装置在智慧家庭等应用中的不断渗透是影响这一领域成长的一些因素。爱立信预计,2022年全球智慧型手机行动网路用户数将达到约66亿,到2028年将超过78亿人。

- 此外,由于复杂的半导体元件所能提供的功能和特性越来越多,智慧型手錶和智慧扬声器市场近年来变得极为受欢迎。因此,对Wi-Fi和蓝牙晶片的需求急剧增加。家电製造商也正在利用半导体元件为其产品配备物联网和人工智慧模型,以改善用户体验并使其产品更加明亮。

- 例如,华为在2023年3月宣布,计划在未来几年推出一款电池功能重大升级的折迭式智慧型手机。该设备具有电池升级功能。此外,华为预计将采用高硅阳极材料来增强智慧型手机的电池容量,预计将达到 5,060 mAh。

- 对于在技术上投入大量资金的年轻消费者来说,电脑和笔记型电脑已经成为必需品。此外,预计未来十年电子领域的技术创新和进步将推动半导体封装销售。物联网和人工智慧的采用预计将推动全球新兴市场和已开发市场的半导体封装销售成长。

- 英特尔公司和伦敦大学学院 (UCL) 联手推出了一款可透过手势和脸部手势进行操作和控制的新型非接触式电脑。电子市场不断追求更高的功耗、更快的速度、更高的引脚数、更小的占用空间和更薄的外形。半导体的小型化和整合化使得智慧型手机、平板电脑和新兴的物联网设备等消费性电子产品变得更轻、更小、更便携。

北美:市场正在经历显着成长

- 美国和加拿大的半导体产业在未来的关键技术中占据重要地位,包括人工智慧、量子运算和 5G 等先进无线网路。

- 例如,根据GSMA的预测,到2025年,5G将成为美国领先的网路技术。 5G 网路的不断部署与对更即时、高效能运算设备的需求不断增长相吻合,而半导体是其中的关键要素。

- 美国政府正大力投资推动先进技术的应用,从而增强对高端半导体封装的需求。美国参议院提出《促进美国製造半导体(FABS)法案》。该法案可能为半导体製造设备和工厂的投资提供25%的投资税额扣抵。

- 此外,美国是最大的电动车市场之一,近年来电动车销量快速成长。根据汽车创新联盟的数据,2023 年第四季该国的电动车销量将超过 377,000 辆,较 2022 年第四季成长 34%。

- 近年来,日本推出了多项法规以推广电动车的使用。例如,纽约州立法机构通过了一项法案,要求到 2035 年该州销售的所有新乘用车都必须是电动车。此外,美国也设定了2030年国内销售的汽车中有一半是电动车的目标。

高端半导体封装产业概况

高端半导体封装市场正在整合。公司正在利用产品创新、扩张和伙伴关係来保持竞争优势并扩大其市场范围。

- 2024 年 5 月着名半导体封装测试公司硅品精密工业 (SPIL) 最近在槟城 Bandar Cassia 科技园区开设了马来西亚 P1 工厂。未来15年,硅品计画推出包括晶圆凸块加工在内的新技术,并提供包括晶圆凸块加工、晶圆级晶片封装、覆晶构装和测试在内的完整承包解决方案。

- 2024 年 3 月韩国 Nepes 公司与西门子 EDA 合作,解决先进 3D-IC 封装中复杂的热、机械和IC封装设计挑战。 Nepes 专注于晶圆级、扇出型晶圆级和麵板级封装设计。 Nepes 正在利用其专业知识透过西门子 EDA 技术(包括 Calibre nmPlatform、HyperLynx 和 Xpedition 软体)来推动封装创新。透过整合这些西门子解决方案,Nepes 增强了其设计能力,使其能够为全球 IC 客户提供 2.5D/3D 晶片设计的快速可靠服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 评估宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 各行业对半导体装置的消费不断增加

- 扩大 3D 列印在半导体封装的应用

- 市场限制

- 半导体IC设计初期投入高,复杂度增加

第六章 市场细分

- 依技术分类

- 3D SoC

- 3D堆迭内存

- 2.5D 中介层

- UHD FO

- 内建 Si 桥

- 按最终用户

- 消费性电子产品

- 航太和国防

- 医疗设备

- 电讯

- 车

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 东南亚

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Intel Corporation

- Taiwan Semiconductor Manufacturing Company

- Advanced Semiconductor Engineering Inc.

- Samsung Electronics Co. Ltd

- Amkor Technology Inc.

- JCET Group Co. Ltd

- TongFu Microelectronics Co. Ltd

- Fujitsu Limited

- Siliconware Precision Industries Co. Ltd

- Powertech Technology Inc.

第八章投资分析

第九章:市场的未来

The High-end Semiconductor Packaging Market size is estimated at USD 42.53 billion in 2025, and is expected to reach USD 85.91 billion by 2030, at a CAGR of 15.1% during the forecast period (2025-2030).

The continuous advancements in integration, energy efficiency, and product characteristics because of the growing demand across various end-user verticals of the industry and the use of packaging for improving the performance, reliability, and cost-effectiveness of electronic systems accelerate the market's growth.

Key Highlights

- Packaging protects an electronic system from radio frequency noise emission, electrostatic discharge, mechanical damage, and cooling. The rise in the semiconductor industry worldwide is one of the major factors driving the growth of the semiconductor packaging market. In addition, in February 2023, the Semiconductor Industry Association (SIA) announced global semiconductor industry sales totaled USD 574.1 billion in 2022, the highest-ever annual total and an increase of 3.3% compared to the previous year's total of USD 555.9 billion.

- Furthermore, the rise of IoT and AI and the proliferation of complex electronics drive the high-end application segment in the consumer electronics and automotive industries. Due to these factors, more advanced semiconductor packaging technologies are being adopted to sustain demand. The growing research activities in the sector further bolstered the market's demand.

- Furthermore, the semiconductor packaging market is expected to expand due to multiple long-term growth drivers, like 5G, IoT, automotive, and HPC. For instance, the Government of India approved a USD 10 billion incentive package to build a complete semiconductor ecosystem, including fabs, home-grown chip design, and compound semiconductor plants.

- Moreover, the COVID-19 pandemic significantly impacted the electronics industry, with semiconductor supply chain issues and the chip shortage affecting the industry for some time. However, the growing investments in the semiconductor industry and increased establishments of semiconductor manufacturing facilities worldwide are anticipated to propel the market's growth in the post-pandemic era.

High-end Semiconductor Packaging Market Trends

Consumer Electronics Sector is Expected to Boost the Market

- The consumer electronics sector is significantly investing in the semiconductor packaging market. Growth of the smartphone, rising wearable and smart device adoption, and increasing consumer IoT device penetration in applications like smart homes are a few of the influential factors influencing the segment's growth. According to Ericsson, smartphone mobile network subscriptions worldwide reached nearly 6.6 billion in 2022, and they are predicted to exceed 7.8 billion by 2028.

- Additionally, markets for smartwatches and smart speakers have become extremely popular in recent years due to the growing number of features and functionalities they can offer due to sophisticated semiconductor components. As a result, the demand for Wi-Fi and Bluetooth chips increased dramatically. Consumer electronics manufacturers also use semiconductor components to equip their products with IoT and AI models, enhancing user experience and making products brighter.

- For instance, in March 2023, Huawei planned to launch its foldable smartphone with a significant battery upgrade in the coming years. The device will feature an upgrade to its battery. Further, Huawei is expected to use a high-silicon anode material to enhance the smartphone's battery capacity, which is expected to be 5,060 mAh.

- Personal computers and laptops are now essential for young consumers who are heavily invested in technology. In addition, over the next ten years, innovation and advancement in the electronics sector are anticipated to drive semiconductor packaging sales. Sales of semiconductor packaging are expected to increase globally in both developing and developed markets due to the introduction of IoT and AI.

- Intel Corporation and the University College London (UCL) have collaborated to introduce a new touchless computer that can be operated and controlled by gesturing the hands and face. Higher power dissipation, faster speeds, higher pin counts, smaller footprints, and lower profiles are all constant demands in the electronics market. Semiconductor miniaturization and integration have resulted in lighter, smaller, and more portable appliances such as smartphones, tablets, and emerging IoT devices.

North America to Experience Significant Market Growth

- The semiconductor sector in the United States and Canada has maintained a significant position in key future technologies, such as AI, quantum computing, and sophisticated wireless networks like 5G.

- For instance, as per GSMA, 5G will become the lead network technology in the United States by 2025. The increasing implementation of 5G networks coincides with the growing demand for more immediate high-performance computing appliances, for which semiconductors form a critical element.

- The US government has significantly invested in boosting the penetration of advanced technologies, bolstering the demand for high-end semiconductor packaging. The US Senate announced the Facilitating American-Built Semiconductors (FABS) Act, which may provide tax incentives to semiconductor manufacturers. The bill may establish a 25% investment tax credit for semiconductor manufacturing investments in equipment or fabs.

- Furthermore, the United States is one of the largest markets for electric vehicles, and the country has also recorded rapid growth in EV sales in recent years. More than 377,000 EVs were sold in the country in Q4 2023, registering a 34% increase from Q4 2022, according to Alliance for Automotive Innovation.

- Many regulations have been implemented in recent years to promote the use of electric vehicles in the country. For instance, New York state lawmakers passed a bill that essentially mandates that all new passenger cars sold in the state run on electric power by 2035. Moreover, the United States has set a target to ensure half of the vehicles sold in the country are electric by 2030.

High-end Semiconductor Packaging Industry Overview

The high-end semiconductor packaging market is consolidated. Companies employ product innovation, expansions, and partnerships to stay ahead of the competition and widen their market reach.

- May 2024: Siliconware Precision Industries Co. Ltd (SPIL), a prominent player in semiconductor packaging and testing, recently marked the commencement of its Malaysia P1 plant at Bandar Cassia Technology Park, Pulau Pinang. Over the next 15 years, SPIL plans to roll out new technologies, including wafer bumping, and provide a holistic turnkey solution encompassing wafer bumping, wafer-level chip packaging, flip chip packaging, and testing.

- March 2024: Nepes Corporation in South Korea partnered with Siemens EDA to address complex thermal, mechanical, and IC packaging design challenges in advanced 3D-IC packages. Nepes specializes in wafer-level, fan-out wafer-level, and panel-level packaging designs. Expanding on its expertise, Nepes is driving packaging innovations using Siemens EDA's technologies, including the Calibre nmPlatform, HyperLynx, and Xpedition software. By integrating these Siemens solutions, Nepes has enhanced its design capabilities, enabling swift and dependable services in 2.5D/3D chiplet designs for its global IC clientele.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Consumption of Semiconductor Devices Across Industries

- 5.1.2 Growing Adoption of 3D Printing in Semiconductor Packaging

- 5.2 Market Restraints

- 5.2.1 High Initial Investment and Increasing Complexity of Semiconductor IC Designs

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 3D SoC

- 6.1.2 3D Stacked Memory

- 6.1.3 2.5D interposers

- 6.1.4 UHD FO

- 6.1.5 Embedded Si Bridge

- 6.2 By End User

- 6.2.1 Consumer Electronics

- 6.2.2 Aerospace and Defense

- 6.2.3 Medical Devices

- 6.2.4 Telecom and Communication

- 6.2.5 Automotive

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.3.5 South East Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Taiwan Semiconductor Manufacturing Company

- 7.1.3 Advanced Semiconductor Engineering Inc.

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 Amkor Technology Inc.

- 7.1.6 JCET Group Co. Ltd

- 7.1.7 TongFu Microelectronics Co. Ltd

- 7.1.8 Fujitsu Limited

- 7.1.9 Siliconware Precision Industries Co. Ltd

- 7.1.10 Powertech Technology Inc.