|

市场调查报告书

商品编码

1644998

真空瓦斯油-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Vacuum Gas Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

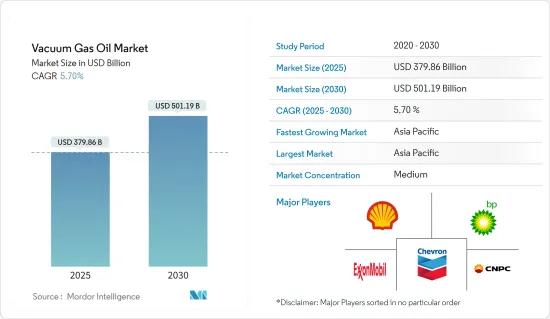

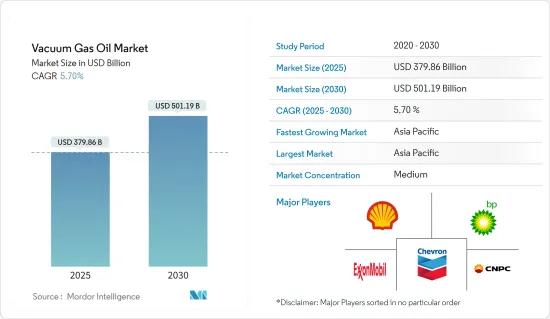

真空柴油市场规模预计在 2025 年为 3,798.6 亿美元,预计到 2030 年将达到 5,011.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.7%。

关键亮点

- 从中期来看,全球汽油需求的增加和汽车产业的快速扩张是推动市场发展的关键因素。

- 另一方面,国际组织对于VGO成分和排放气体含量的严格规定,对市场发展造成了重大限制。

- 预计海洋工业的成长将推动深海货船和其他船舶的船用燃料中真空瓦斯油(VGO)的需求激增,这将在预测期内为市场带来重大机会。

- 由于石油和天然气产量的增加,预计亚太地区将占据市场主导地位。

减压蜡油市场趋势

全球对汽油和柴油的需求不断增长,推动了市场

- 真空柴油主要用作炼油厂扩大汽油柴油生产的中间原料。 VGO 是在真空蒸馏塔中采用氢化和裂解等製程生产的。

- 柴油是运输、农业和各工业领域的主要燃料。然而,一些国家已经禁止使用柴油。由于经济发展和出行选择的增多,印度和中国等开发中国家的柴油消费量也大幅增加。预计在不久的将来,随着各种需求的增加,柴油消耗量将推动 VGO 的成长。

- 汽油是美国消耗的主要燃料之一,也是精製生产的主要产品。 2022 年,美国消耗了约 1,345.5 亿加仑成品汽油(平均每天约 3.69 亿加仑)。由于真空蜡油(VGA)是生产汽油的中间原料,汽油消费量的增加将推动市场成长。

- 此外,2022年全球整体石油消费量将达到约9,730万桶/日,高于2015年的9,270万桶/日。预计全部区域石油消费量的上升将支持 VGO 的成长,因为它被用作生产柴油和汽油的原料。

- 2022年3月,霍尼韦尔国际公司宣布,总部位于杜拜的油田设备供应商SPEC Energy DMCC将在其炼油厂中使用霍尼韦尔的一套製程技术,将低价值的真空蜡油(VGO)和真空残渣油转化为汽油和烷基化物等高价值产品。计划的第一阶段包括安装一个新的 UOP 渣油流化催化裂解装置,以提高汽油产量,以及安装一个 UOP/木材溶剂脱沥青製程装置 (SDA),以提高 RFCC 的供应品质。

- 由于上述情况和近期趋势,预测期内柴油和汽油生产中真空蜡油(VGO)的使用量增加将推动市场发展。

亚太地区预计将实现强劲成长

- 减压瓦斯油是石油蒸馏后剩下的重油,可以在裂解装置中进一步精製。它是一种中间原料,可以提高炼油厂的柴油和汽油产量。

- 中国、印度、日本和印尼等国家日益都市化和快速工业化,推动了石油需求,进而推动了该全部区域真空柴油(VGO)的成长。

- 此外,2022 年 12 月,雪佛龙公司 Lummus Global LLC 宣布山东玉龙石化已选择 CLG 许可的 EST 作为其位于中国山东省的油浆残渣加氢裂解装置的原料。该厂建成后将生产柴油减压瓦斯油 (VGO),产能达到 300 万吨/年,将成为世界上最大的工厂之一。

- 然而,2022年11月,印度政府宣布将增加向美国和加拿大等多个国家的真空柴油出口。因此,出口增加可能反过来推动整个全部区域真空瓦斯油市场的成长。

- 由于上述情况和近期趋势,预计预测期内亚太地区的真空瓦斯油市场将显着成长。

减压瓦斯油产业概况

真空柴油市场是半分割的。市场的主要企业(不分先后顺序)包括壳牌公司、英国石油公司、雪佛龙公司、埃克森美孚公司和中国石油天然气集团公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 全球对汽油和柴油的需求不断增加

- 汽车产业快速扩张

- 限制因素

- 全球组织对VGO成分有严格的规定

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 产品

- 低硫含量

- 硫含量高

- 类型

- 轻质减压瓦斯油

- 重型真空柴油机

- 按应用

- 汽油生产

- 柴油生产

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 卡达

- 科威特

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- BP PLC

- Chevron Corporation

- China National Petroleum Corporation

- Eni SpA

- Exxon Mobil Corporation

- Indian Oil Corp. Ltd.

- Kuwait Petroleum Corporation

- NK Rosneft'PAO

- Shell Plc

第七章 市场机会与未来趋势

- 海洋产业快速成长

简介目录

Product Code: 50000865

The Vacuum Gas Oil Market size is estimated at USD 379.86 billion in 2025, and is expected to reach USD 501.19 billion by 2030, at a CAGR of 5.7% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing demand for gasoline globally and the rapidly expanding automotive industry are the major factors driving the market.

- On the other note, the strict mandates by global organizations on VGO composition and emission content will be a major restraint for the market.

- Nevertheless, the growing marine industry is set to surge vacuum gas oil (VGO) requirement in bunker fuels for deep-sea cargo ships and other vessels, which will be a vital opportunity for the market during the forecast period.

- Asia-Pacific is expected to dominate the market, owing to the increasing oil and gas production across the region.

Vacuum Gas Oil Market Trends

Increasing Demand for Gasoline and Diesel Across the Globe to Drive the Market

- Vacuum gas oil is predominantly used as an intermediate feedstock to escalate gasoline and diesel production from refineries. VGO is produced through a vacuum distillation column using processes such as hydrogenation and cracking.

- Diesel has been a primary fuel for transportation, agriculture, and various industrial sectors. However, the use of diesel is banned in some countries. Developing nations, such as India and China, have also experienced significant growth in diesel consumption due to economic development and increased mobility. The growing diesel consumption for various needs will, in turn, drive VGO growth in the near future.

- Gasoline is one of the major fuels consumed in the United States and is the main product that oil refineries produce. In 2022, around 134.55 billion gallons of finished motor gasoline were consumed in the United States, an average of about 369 million gallons per day. Since vacuum gas oil (VGA) is the intermediate feedstock for producing gasoline, the growing consumption of gasoline will, in turn, drive the market's growth.

- Moreover, oil consumption across the globe was around 97.30 million barrels per day in the year 2022, which is comparatively higher than 92.70 million barrels per day in 2015. The growing oil consumption across the region will support the growth of VGO since it is used as a feedstock in the production of gasoil and gasoline.

- In March 2022, Honeywell International Inc. announced that SPEC Energy DMCC, an Oil field equipment supplier in Dubai, was to use a range of Honeywell's process technologies at its refinery to convert low-value vacuum gas oil (VGO) and vacuum residue into high-value products such as gasoline and alkylate. Phase one of the project included the installation of a new UOP Residue Fluidized Catalytic Cracking unit that is tailored to improve gasoline yield, a UOP/Wood Solvent Deasphalting process Unit (SDA) which was expected to improve the feed quality to the RFCC.

- Owing to the above points and the recent developments, the growing usage of Vacuum Gas Oil (VGO) in the production of diesel and gasoline drives the market during the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth

- Vacuum gas oil refers to heavy oil left over from petroleum distillation, which can be further refined in a cracking unit. It is an intermediate feedstock that can increase the output of diesel and gasoline from refineries.

- The increasing urbanization and rapid industrialization in countries like China, India, Japan, and Indonesia are pushing up oil demand, which will, in turn, favor the growth of vacuum gas oil (VGO) across the region; in addition, the rise in need for automobiles and development in expenditure in the petroleum zone are the major factors responsible for the growth in demand for VGO in this region.

- Moreover, in December 2022, Chevron Corporation Lummus Global LLC announced Shandong Yulong Petrochemical Co., Ltd. had selected EST, which CLG licenses, for a slurry residue hydrocracking unit in Shandong Province, China. The unit will produce diesel, naphtha, and vacuum gas oil (VGO) once it is complete, and with a capacity of 3.0 MMTA, it will be one of the largest in the world.

- Moroever, in November 2022, The Government of India announced they were stepping up vacuum gas oil exports to various countries such as the United States and Canada. Therefore the increasing exports will, in turn, facilitate the growth of the Vacuum Gas Oil Market across the region.

- Owing to the above points and the recent developments, the Asia-Pacific region is expected to witness significant growth in the vacuum gas oil market during the forecast period.

Vacuum Gas Oil Industry Overview

The vacuum gas oil market is semi fragmented. Some of the major players operating in the market (in no particular order) include Shell Plc, BP Plc, Chevron Corporation, Exxon Mobil Corporation, and China National Petroleum Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Gasoline and Diesel Across the Globe

- 4.5.1.2 Rapid Expansion of Automotive Industry

- 4.5.2 Restraints

- 4.5.2.1 Strict Mandates by the Global Organizations on VGO Composition

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Low Sulfur Content

- 5.1.2 High Sulfur Content

- 5.2 Type

- 5.2.1 Light Vacuum Gas Oil

- 5.2.2 Heavy Vacuum Gas Oil

- 5.3 By Application

- 5.3.1 Gasoline Production

- 5.3.2 Diesel Oil Production

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Asia-Pacific

- 5.4.2.1 China

- 5.4.2.2 India

- 5.4.2.3 Japan

- 5.4.2.4 Rest of Asia-Pacific

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Qatar

- 5.4.5.5 Kuwait

- 5.4.5.6 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BP PLC

- 6.3.2 Chevron Corporation

- 6.3.3 China National Petroleum Corporation

- 6.3.4 Eni SpA

- 6.3.5 Exxon Mobil Corporation

- 6.3.6 Indian Oil Corp. Ltd.

- 6.3.7 Kuwait Petroleum Corporation

- 6.3.8 NK Rosneft' PAO

- 6.3.9 Shell Plc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Growth in Marine Industry

02-2729-4219

+886-2-2729-4219