|

市场调查报告书

商品编码

1645123

非洲低温运输物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Africa Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

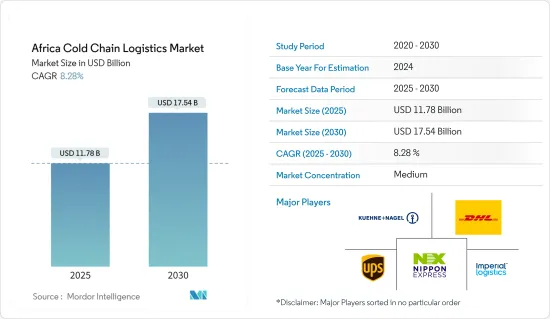

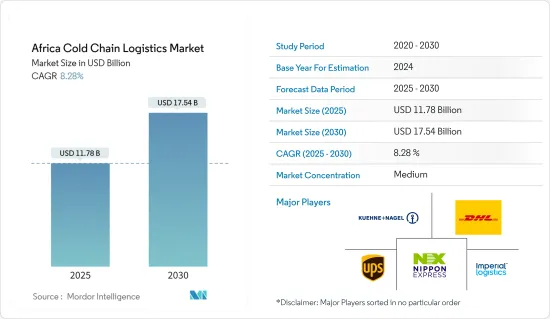

2025 年非洲低温运输物流市场规模预估为 117.8 亿美元,预计到 2030 年将达到 175.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.28%。

非洲对高效低温运输包装解决方案的需求显着增加。这种日益增长的兴趣是由非洲大陆的经济成长以及对温度敏感产品品质和安全日益增长的需求所推动的。预计,随着非洲大陆对温控商品的需求不断增加、许多新参与者的进入以及政府的倡议和计划,低温运输产业将得到推动。为了满足国家长期的交通需求,该国正在製定一项名为「2050国家交通总体规划」的计划,该计划将监督多式联运系统的建设。

随着出口商、进口商和物流业者数量的不断增长,南非正呈现新兴经济体的形象。维持高效的低温运输对于推动这些产业的成长和维持其长久性至关重要。

AP Moller Capital宣布将于2023年3月初收购Vector 物流。 AP Moller Capital 表示,此次收购为 Vector 物流提供了绝佳的机会,以加速其在供应链专业知识和物流服务方面实现独立的使命。此外,为了满足非洲日益增长的需求,我们将扩大目标区域,拓展活动范围,在更广泛的地区提供服务。

非洲低温运输物流市场趋势

包装和冷冻食品的需求不断增加

非洲对包装冷藏保存食品的需求正在上升。都市化、生活方式的改变和高所得族群的崛起都是促成这项发展的因素。这些产品的需求不断增长,是由多种因素推动的,包括经济发展、现代零售店的普及以及煤炭链基础设施的改善。

2024 年 2 月,在柏林举行的 2024 年蔬果展览会结束时,政府宣布将兴建一条连接义大利Liguria地区拉斯佩齐亚港和北非的增强型物流走廊。此次合作涉及港口系统管理局和塔洛斯集团,重点是加强义大利马里纳迪卡拉拉港和拉斯佩齐亚港与非洲沿海几个目的地之间的农产品运输。该倡议旨在加强物流联繫,特别是在农产品食品领域。

非洲联盟将该地区的粮食安全列为优先事项,并正在推动农业价值链中的政策、资金和多方相关利益者干预。为了提高粮食安全和农业效率,干预措施着重于对农场采取直接行动和支持系统,以促进粮食从一个地方运输到另一个地方。

埃及水产品出口成长

埃及的海鲜产业正在成长,与低温运输物流有很大关係。该行业正在不断扩大,低温运输技术和物流的进步促进了其发展。高效的低温运输系统确保水产品从捕捞到出售都保持新鲜。这些物流增强对于延长产品保质期、减少废弃物和满足国际品质标准发挥关键作用。煤炭链物流与埃及水务产业的整合是推动其上升趋势的关键因素。

埃及农业和垦务部报告称,埃及的鱼类产量预计在 2023 年 7 月达到 200 万吨,自给率达 85%。报告称,埃及的鱼类产量居非洲第一、世界第六位,吴郭鱼产量居第三位,随着国家计划达到运作,出口率预计将上升。

为了支持渔业部门,该部还成立了湖泊保护和鱼类资源发展局来管理和促进渔业发展。政府还为渔船配备追踪设备,每艘船需支付 3 万英镑(970 美元)的费用。因此,鑑于可能实现大批量生产,该地区的低温运输物流具有发展机会。

非洲低温运输物流行业概况

在非洲建立煤炭链物流业务需要专门的基础设施,包括温控仓储设施和运输。现有企业已经与主要供应商和客户建立了关係,因此可以设定市场进入障碍。然而,该行业不断发展的性质和潜在的政府倡议可能会吸引新的进入者。非洲的低温运输物流市场已经成熟并且与国内外现有的参与者竞争激烈。每家公司的服务品质、可靠性、地理覆盖范围和技术力都是关键的竞争因素。该行业正在不断发展,各公司也不断创新以保持竞争优势。东南亚邮政服务市场的领导者是日本通运、UPS 和 DHL。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 低温运输设施的技术趋势与自动化

- 政府法规和倡议

- 聚焦气候控制储存

- 运输和仓储成本

- 排放标准和法规对低温运输产业的影响

- 地缘政治与疫情将如何影响市场

第五章 市场动态

- 市场驱动因素

- 生鲜产品需求不断增加

- 增强健康意识

- 市场限制

- 高成本

- 缺乏适当的基础设施

- 市场机会

- 政府措施和投资

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/购买者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链/供应链分析

第六章 市场细分

- 按服务

- 贮存

- 运输

- 附加价值服务(冷冻、标籤、库存管理等)

- 按温度

- 常温

- 冷藏

- 冷冻

- 按应用

- 园艺(新鲜水果和蔬菜)

- 乳製品(牛奶、冰淇淋、奶油等)

- 肉类、鱼类、家禽

- 加工食品

- 製药、生命科学、化学

- 其他用途

- 按国家

- 埃及

- 摩洛哥

- 奈及利亚

- 南非

- 非洲其他地区

第七章 竞争格局

- 公司简介

- Imperial Logistics LTD

- Cold Solutions East Africa

- ARCH Emerging Markets Partners Limited

- Nippon Express Co. Ltd

- Zenith Carex International Limited

- Ayoba Cold Storage

- Kennie-o Cold Chain Logistics(KCCL)

- Trans-nationwide Express PLC(TRANEX)

- Kuehne+Nagel

- Cool World Rentals

- DP World

- Lineage Logistics

- CCS Logistics

- AfriAg

- 其他公司

第 8 章:市场的未来

第 9 章 附录

- 资本流动洞察

- 对外贸易统计-出口及进口,依产品、依国家

- 交通运输及仓储业对经济的贡献

The Africa Cold Chain Logistics Market size is estimated at USD 11.78 billion in 2025, and is expected to reach USD 17.54 billion by 2030, at a CAGR of 8.28% during the forecast period (2025-2030).

The demand for efficient cold chain packaging solutions in Africa has increased significantly. This increase in interest is due to the continent's growing economy, as well as increasing demand for quality and security of temperature-sensitive products. The cold chain industry is expected to be boosted by the increasing demand for temperature-controlled goods in the continent, the entry of many new businesses, and the government's efforts and programs. To meet the country's long-term transport needs, South Africa has an ongoing plan, namely the National Transport Master Plan 2050, to oversee the construction of multimodal transport systems.

With growing exporters, importers, and logistics operators, South Africa is experiencing an emerging economy. Maintaining an efficient cold chain is essential to facilitate these sectors' growth and maintain their longevity.

A.P. Moller Capital announced that it would acquire Vector Logistics at the beginning of March 2023. According to A.P. Moller Capital, the acquisition provides Vector Logistics a great opportunity to accelerate its mission of going independent in supply chain expertise and logistics services. In this context, it will also expand its coverage to meet growing demand in Africa and broaden its activities to serve the wider geographic area.

Africa Cold Chain Logistics Market Trends

Demand for Packaged and Frozen Food is Rising

In Africa, the demand for packaged, cold-stored foods is increasing. Urbanization, changes in lifestyles, and the growth of a higher class are some of the factors that contribute to this development. The growth in demand for these products is being driven by several factors, including economic development, the proliferation of modern retail outlets, and improvements to cold chain infrastructure.

In February 2024, the strengthened logistics corridor between the Ligurian port of La Spezia in Italy and North Africa was unveiled at the end of Fruit Logistica 2024 in Berlin. The collaboration involves the Harbour System Authority and the Tarros Group, with a focus on enhancing the transportation of agricultural goods between the ports of Marina di Carrara and La Spezia in Italy and several African coastal destinations. The initiative aims to bolster logistical ties, particularly in the agri-food sector.

The African Union prioritizes food security in the region and promotes policy, funding, and multistakeholder interventions in the agricultural value chain. To increase food security and agricultural efficiency, the intervention focuses on direct farm action and support systems facilitating the movement of food from one place to another.

Egyptian Export of Seafood is on the Rise

Egypt's fishing industry is experiencing growth, with a significant connection to cold chain logistics. The sector is expanding as advancements in cold chain technology and logistics contribute to its development. Efficient cold chain systems ensure the preservation of fresh seafood from catch to market. This enhancement in logistics plays a crucial role in extending the shelf life of products, reducing waste, and meeting international quality standards. The integration of cold chain logistics in Egypt's fishing industry is a key factor driving its upward trajectory.

The Ministry of Agriculture and Land Reclamation in Egypt reported that Egyptian fish production hit 2 million tons, marking a rate of 85% self-sufficiency, in July 2023. According to the report, Egypt has the highest fish production in Africa, sixth in the world, and third in tilapia production, and is expected to increase export rates with national projects operating at full capacity.

The Ministry also founded the Lake Protection and Fish Wealth Development Authority to regulate and facilitate the fishing industry to support the fishing sector. For EGP 30,000 (USD 970) per vessel, the government is also equipping fishing vessels with tracking devices. Therefore, with massive production, there is an opportunity for cold chain logistics in the area.

Africa Cold Chain Logistics Industry Overview

Specialized infrastructure, including temperature-controlled storage facilities and transport, is required for the establishment of an African cold chain logistics operation. Existing companies have established relationships with key suppliers and customers, which could create obstacles to entry into the market. However, new entrants can be attracted by the evolving nature of this sector and potential government initiatives. The presence of established companies, both local and international, in the African cold chain logistics market exerts a competitive influence. The quality of the service, reliability, geographic coverage, and technical capabilities of the companies are important factors for competition. The sector is evolving, and companies are constantly innovative to stay ahead of the competition. The leaders in the Southeast Asian postal services market are Nippon Express, UPS, and DHL.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends and Automation in Cold Chain Facilities

- 4.3 Government Regulations and Initiatives

- 4.4 Spotlight on Ambient/Temperature-controlled Storage

- 4.5 Spotlight on Transportation Costs and Storage Costs

- 4.6 Impact of Emission Standards and Regulations on the Cold Chain Industry

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Perishable Goods

- 5.1.2 Increasing Health Awareness

- 5.2 Market Restraints

- 5.2.1 High Cost Associated

- 5.2.2 Lack of adequate infrastructure

- 5.3 Market Opportunities

- 5.3.1 Government Initiatives and Investments

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

- 5.5 Industry Value Chain/Supply Chain Analysis

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Storage

- 6.1.2 Transportation

- 6.1.3 Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.)

- 6.2 By Temperature

- 6.2.1 Ambient

- 6.2.2 Chilled

- 6.2.3 Frozen

- 6.3 By Application

- 6.3.1 Horticulture (Fresh Fruits and Vegetables)

- 6.3.2 Dairy Products (Milk, Ice-cream, Butter, etc.)

- 6.3.3 Meat, Fish, Poultry

- 6.3.4 Processed Food Products

- 6.3.5 Pharma, Life Sciences, and Chemicals

- 6.3.6 Other Applications

- 6.4 By Country

- 6.4.1 Egypt

- 6.4.2 Morocco

- 6.4.3 Nigeria

- 6.4.4 South Africa

- 6.4.5 Rest of Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Imperial Logistics LTD

- 7.2.2 Cold Solutions East Africa

- 7.2.3 ARCH Emerging Markets Partners Limited

- 7.2.4 Nippon Express Co. Ltd

- 7.2.5 Zenith Carex International Limited

- 7.2.6 Ayoba Cold Storage

- 7.2.7 Kennie-o Cold Chain Logistics (KCCL)

- 7.2.8 Trans-nationwide Express PLC (TRANEX)

- 7.2.9 Kuehne+Nagel

- 7.2.10 Cool World Rentals

- 7.2.11 DP World

- 7.2.12 Lineage Logistics

- 7.2.13 CCS Logistics

- 7.2.14 AfriAg*

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 Insights into Capital Flows

- 9.2 External Trade Statistics - Export and Import, by Product and by Country

- 9.3 Transport and Storage Sector Contribution to the Economy