|

市场调查报告书

商品编码

1683090

电子产品中的聚氨酯 (PU) 黏合剂:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Polyurethane (PU) Adhesives in Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

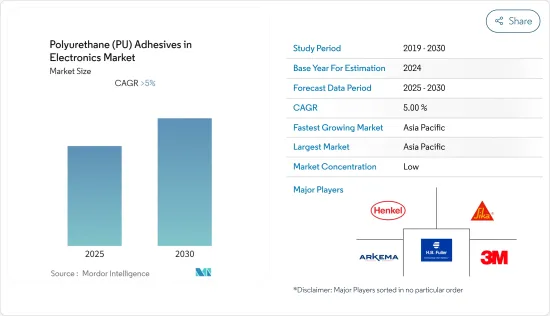

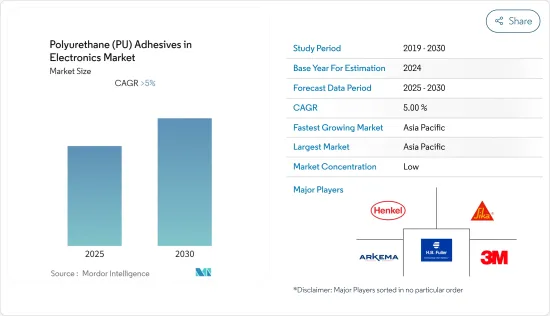

预测期内,电子产品聚氨酯 (PU) 黏合剂市场预计将以超过 5% 的复合年增长率成长

主要亮点

- 在产品类型中,导电胶预计将占据市场主导地位。这是因为它们优异的固有特性(例如散热能力)使其适用于许多应用。

- 全球范围内不断创新和发展先进技术可能会为电子市场的聚氨酯胶粘剂提供机会。

- 由于电子产品的生产、需求和出口,亚太地区是所研究市场中规模最大且成长最快的地区,这对电子应用领域中 PU 胶合剂的消费产生了重大影响。

聚氨酯 (PU) 胶合剂在电子产品的市场趋势

导电胶黏剂占市场主导地位

- 导电胶合剂用于电子工业,需要将各个零件固定在一起,以便电流在它们之间流动。

- PUR 双组分黏合剂广泛用于此目的,必须像快速固化环氧树脂一样混合或预先混合并冷冻。

- PUR 黏合剂还具有高剥离强度和柔韧性,使其适用于广泛的电子应用。这些特性使其在全球电子市场上广泛应用。

- 电子产业不断对现有产品进行先进功能的革新,同时新电子设备和技术的发展推动了电子产业的生产和成长。

- 例如,目前推动电子产业生产的技术创新包括支援 5G 的智慧型手机、Chromecast 和智慧型扬声器。

- 因此,预计上述因素将在预测期内推动全球电子应用领域 PUR 胶合剂的消费。

亚太地区占市场主导地位

- 由于中国、日本、韩国等主要国家从事电子产品的生产和出口,亚太地区在电子市场的 PU 胶合剂消费中占据主导地位。

- 无论从生产、出口或消费来看,中国都是该地区(甚至全球整体)最大的家电市场。中国是世界上最大的行动电话、电视机和电脑生产国。

- 此外,越南、韩国等国家受惠于相对较低的生产成本,推动了这些国家国内电子产品生产大幅成长。

- 因此,此类终端用户产业拥有强大的生产基础,且建设投资不断增加,正在推动该国电子产品对聚氨酯(PU)胶合剂的消费。

电子产业聚氨酯 (PU) 胶黏剂概述

全球电子聚氨酯(PU)黏合剂市场本质上是分散的。市场的一些主要企业包括 3M、阿科玛集团、HB Fuller、Sika AG 和 Henkel AG &Co.KGaA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 汽车工业的应用日益增多

- 提高技术优势

- 限制因素

- 有关 VOC排放的环境法规

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 依产品类型

- 导电胶

- 导热胶

- 紫外线固化胶合剂

- 其他产品类型

- 按应用

- 表面黏着技术

- 三防胶

- 电线定位

- 盆栽

- 封装

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东和非洲

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- 3M

- Arkema Group

- Ashland

- Avery Dennison Corporation

- Beardow Adams

- Dow

- Dymax Corporation

- Franklin International

- HB Fuller

- Henkel AG & Co. KGaA

- Huntsman International LLC

- ITW Performance Polymers(Illinois Tool Works Inc.)

- Jowat AG

- Mapei Inc.

- Pidilite Industries Ltd.

- Sika AG

- Wacker Chemie AG

第七章 市场机会与未来趋势

- 不断创新和开发前沿技术

简介目录

Product Code: 46752

The Polyurethane Adhesives in Electronics Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- Among product types, the electrically conductive adhesives are expected to dominate the market, owing to their superior intrinsic properties, like thermal dissipation functionality, making them suitable for numerous applications.

- The continuous innovation and development of advanced technologies across the globe is likely to offer opportunities for the PU adhesives in electronics market.

- Asia-Pacific stands to be the largest and fastest growing region in the studied market, where electronics production, demand and exports have been significantly influencing the consumption of PU adhesives for electronic applications.

Polyurethane Adhesive in Electronics Market Trends

Electrically Conductive Adhesives Segment Dominating the Market

- Electrically conductive adhesives are used in the electronics industry on components which are required to be held in place to pass electrical current between them.

- PUR two-part adhesives is widely used for this purpose, which either needs to be mixed or supplied pre-mixed and frozen like the snap-cure epoxies.

- PUR adhesives also offer high peel strength and flexibility which makes it widely suitable for electronic applications. Such properties make it widely popular for use in global electronics market.

- The electronics industry has been continuously innovating existing products with advanced features, along with development of new electronic devices and technologies which has been driving production and growth in electronics industry.

- For instance, some of the current innovation which have been driving the production in electronics industry includes 5G supporting smartphones, chromecast, smart speakers, etc.

- Thus, the aforementioned factors are projected to drive the global consumption of PUR adhesives for electronic applications over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominates the consumption of PU adhesives in electronics market, owing to the presence of some major countries, such as China, Japan and South Korea, which are engaged in the production and export of electronic products.

- In terms of production, exports and consumption, China stands to be the largest market for consumer electronics in the region (as well as globally). China's production of mobile phones, televisions and computers is the largest in the world.

- Besides, countries such as Vietnam, South Korea, etc., have been benefited due to comparatively lower cost of production, which is considerably driving the domestic electronic production in such countries.

- Hence, presence of the strong production base of such end-user industries and growing construction investments have been driving the consumption of polyurethane (PU) adhesives in electronics in the country.

Polyurethane Adhesive in Electronics Industry Overview

The global polyurethane (PU) adhesives in electronics market is fragmented in nature. Some of the keyplayers in the market includes 3M, Arkema Group, H.B. Fuller, Sika AG, and Henkel AG & Co. KGaA, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Application in Automotive Industry

- 4.1.2 Growing Technological Dominance

- 4.2 Restraints

- 4.2.1 Environmental Regulations Regarding VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Electrically Conductive Adhesive

- 5.1.2 Thermally Conductive Adhesive

- 5.1.3 UV Curing Adhesive

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Surface Mounting

- 5.2.2 Conformal Coatings

- 5.2.3 Wire Tacking

- 5.2.4 Potting

- 5.2.5 Encapsulation

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Beardow Adams

- 6.4.6 Dow

- 6.4.7 Dymax Corporation

- 6.4.8 Franklin International

- 6.4.9 H.B. Fuller

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 Huntsman International LLC

- 6.4.12 ITW Performance Polymers (Illinois Tool Works Inc.)

- 6.4.13 Jowat AG

- 6.4.14 Mapei Inc.

- 6.4.15 Pidilite Industries Ltd.

- 6.4.16 Sika AG

- 6.4.17 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Continuous Innovation and Development of Advanced Technologies

02-2729-4219

+886-2-2729-4219