|

市场调查报告书

商品编码

1683118

法国作物保护化学品市场:市场占有率分析、行业趋势和成长预测(2025-2030 年)France Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

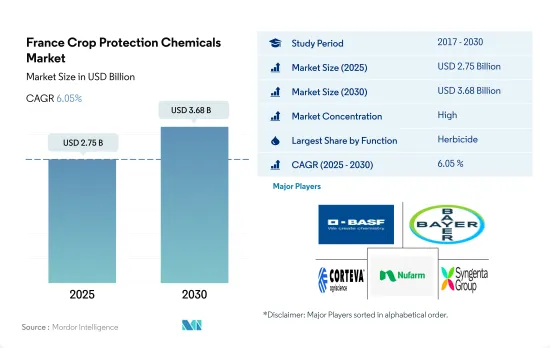

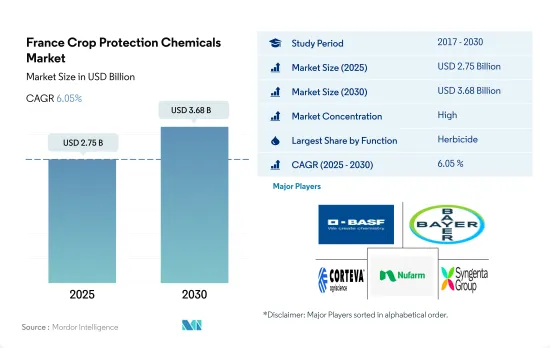

法国作物保护化学品市场规模预计在 2025 年为 27.5 亿美元,预计到 2030 年将达到 36.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.05%。

法国除草剂使用量的增加是由于多种社会和经济因素造成的。

- 法国是欧洲重要农业国,是多种农产品的生产大国和出口国。生产和出口小麦、黑麦、大麦、玉米、甜菜、燕麦、水果和蔬菜(苹果、甜瓜、桃子、油桃、番茄、花椰菜、胡萝卜、洋葱、沙拉蔬菜等)。杂草、真菌疾病和害虫给农业部门造成了巨大的损失。农民依靠化学农药保护化学产品来应对这些挑战并提高产量。从作物保护化学产品整体消费量来看,欧洲占第二大市场占有率,为16.4%,市场规模为23.2亿美元。

- 2022年,除草剂在作物保护化学品消费量中占据最大的市场占有率,占总量的50.7%。这项优势源自于法国及其海外领土共生产约 250 种不同的作物。根据农业部统计,法国平均每年使用超过29,300吨除草剂。社会和经济原因可能是导致化学除草剂使用增加的其他因素。Glyphosate是日本广泛使用的除草剂。

- 杀菌剂和杀虫剂也占除草剂之后的第二大份额,分别为 28.5% 和 20.7%。许多真菌疾病影响主要作物,而蚜虫等害虫将这些疾病从作物传播作物另一种作物,对作物造成广泛破坏。

- 作物病虫害的增加和提高生产力的需求可能会推动法国农药保护化学品市场在预测期内以 5.8% 的复合年增长率成长。

法国农药保护化学产品市场趋势

国际需求及其控制杂草的能力正在推高每公顷除草剂的消费量。

- 法国农业在国民经济中占有重要地位。然而,它们面临着杂草、害虫和真菌感染等巨大挑战,导致作物产量每年大幅下降。为了解决这些问题,2022 年法国每公顷农地平均使用 4,800 克农药保护化学品。

- 除草剂已成为主要的化学农药保护化学品类别,并在农业领域的广泛应用。 2022年每公顷农地平均除草剂消费量为2.2公斤。然而,包括基因改造品种在内的耐除草剂作物的采用,以及控制杂草生长和减少产量损失的需要,导致了除草剂施用量的增加和多种除草剂的使用。

- 杀菌剂在农业中已广泛应用,因此在农药保护化学品的消费量中排名第二。 2022年全国每公顷农业用地杀菌剂平均消费量为2公斤。气候条件变化等因素正在增加对杀菌剂的依赖。真菌疾病的传播对多种作物构成重大威胁,造成大量产量损失和作物品质下降。因此,农民严重依赖杀菌剂来控制这些疾病。

- 害虫侵扰的增加和抗性昆虫族群的出现推动了对杀虫剂的需求,以对抗日益严重的害虫挑战。 2022年,法国平均施药量为每公顷0.2公斤。

Glyphosate是法国使用最广泛的农药保护化学品,2022 年的价格为每吨 1,150 美元。

- 法国是欧洲最大的农药保护化学品消费国之一,也是世界第三大农药出口国。该国大部分农药出口到比利时、荷兰和巴西。

- 近期法国农药有效成分价格大幅上涨,尤其是杀虫剂。 2022 年Cypermethrin和甲氨基阿维菌素苯甲酸酯的价格分别为每吨 21,200 美元和 17,400 美元。这些杀虫剂的价格在2019年至2022年间大幅上涨了21.5%。

- 截至2022年,Metalaxyl的价格为每吨4,500美元。Metalaxyl是抗真菌最有效的系统性杀菌剂之一。它被广泛用作土壤和种子处理,以控制由腐霉菌和疫霉菌引起的种子腐烂和水分损害。它也可用作土壤处理剂,以控制一年生和多年生草本植物的疫霉菌茎腐病和溃疡病,对某些霜霉病也有效。

- Glyphosate是法国使用最广泛的农药保护化学物质。 2023年,瑞士化学集团先正达生产的两种含Glyphosate的除草剂将被禁止贩售。这是因为该公司未能提交对蜜蜂和其他昆虫、土壤和水生生物影响的必要风险评估,因此对可能对野生动物造成的危害的分析不足。

- 二甲戊灵是一种选择性除草剂,在谷类、玉米和水稻抽穗前以浅吸法施用,在豆类、棉花、大豆和花生播种前以浅吸法施用。对于蔬菜作物,在抽穗或移植前喷洒。值得注意的是,2022年该除草剂的价格与2019年相比大幅上涨了37.8%,达到每吨3,300美元。

法国农药和防护化学品产业概况

法国作物保护化学品市场相当集中,前五大公司占70.03%。市场的主要企业包括BASF公司、拜耳公司、科迪华农业科技、Nufarm Ltd 和先正达集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药保护化学品消费量

- 有效成分价格分析

- 法律规范

- 法国

- 价值链与通路分析

第 5 章。市场细分,包括市场规模(美元和数量)、2030 年预测和成长前景分析

- 功能

- 杀菌剂

- 除草剂

- 杀虫剂

- 灭螺剂

- 杀线虫剂

- 执行模式

- 化学喷涂

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50670

The France Crop Protection Chemicals Market size is estimated at 2.75 billion USD in 2025, and is expected to reach 3.68 billion USD by 2030, growing at a CAGR of 6.05% during the forecast period (2025-2030).

Various social and economic factors are reasons for the increased use of herbicides in the country

- France is an important agricultural country in Europe and a major producer and exporter of various agricultural products. Wheat, rye, barley, corn, sugar beets, oats, fruits, and vegetables, including apples, melons, peaches, nectarines, tomatoes, cauliflowers, carrots, onions, and salad vegetables, are produced and exported. Weeds, fungal diseases, and insect pests pose significant losses to the agricultural sector. Farmers depend on chemical pesticide products to combat these challenges and enhance production quantities. The overall consumption of crop protection chemicals occupied the second-largest market share of 16.4% in Europe, with a market value of USD 2.32 billion.

- In 2022, herbicides held the largest market share in terms of pesticide consumption, accounting for 50.7% of the total volume. This dominance can be attributed to France and its overseas territories together producing around 250 varieties of crops. According to the Ministere de l'Agriculture et de l'Alimentation, every year, on average, the country utilizes more than 29,300 metric ton of herbicides. Social and economic reasons could be other factors for the increased use of chemical herbicide products. Glyphosate is a widely used herbicide in the country.

- Fungicides and insecticides also occupy the largest market shares after herbicides, i.e., 28.5% and 20.7%, respectively. Numerous fungal diseases are affecting major crops, and insect pests such as aphids are spreading these diseases from one crop to another, resulting in significant crop damage.

- The increasing crop infestations and the need for higher productivity may drive the French crop protection chemicals market at a CAGR of 5.8% during the forecast period.

France Crop Protection Chemicals Market Trends

The consumption of herbicides per hectare is increasing due to their international demand and their ability to control weeds

- The agricultural sector in France holds great importance within the nation's economy. However, it faces considerable challenges in the form of weeds, insect pests, and fungal infections, resulting in considerable annual reductions in crop yield. To address these issues, France used an average of 4.8 thousand g of crop protection chemicals per hectare of agricultural land in 2022.

- Herbicides emerged as the primary chemical pesticide category, experiencing widespread use in the agricultural sector. The average herbicide consumption per hectare of agricultural land stood at 2.2 kg in 2022. However, the application rates and the employment of multiple herbicides increased due to the adoption of herbicide-resistant crops, including genetically modified varieties, and the need to manage weed growth and reduce yield losses.

- Fungicides hold the second position in terms of pesticide consumption, as they are extensively used in the agricultural industry. The average consumption of fungicides per hectare of agricultural land in the country was 2 kg in 2022. Factors such as changing climatic circumstances have contributed to an escalated dependence on fungicides. The prevalence of fungal diseases presents a significant threat to diverse crop types, causing a substantial decline in yield and the compromised quality of harvested produce. As a result, farmers heavily depend on fungicides to control these diseases.

- The increasing prevalence of insect infestations and the emergence of insect populations displaying resistance have spurred the need for insecticides to counter these escalating pest challenges. In 2022, the mean application rate in France stood at 0.2 kg per hectare.

Glyphosate is the most used pesticide in France, and it was priced at USD 1.15 thousand per metric ton in 2022

- France is one of the highest pesticide-consuming countries in Europe and the third-largest exporter of insecticides globally. The country exports most of its insecticides to Belgium, the Netherlands, and Brazil.

- Recently, France witnessed an escalation in the prices of active ingredients, particularly in the case of insecticides. Cypermethrin and emamectin benzoate were valued at USD 21.2 thousand per metric ton and USD 17.4 thousand per metric ton in 2022, respectively. These insecticides experienced a significant price increase of 21.5% between 2019 and 2022.

- As of 2022, metalaxyl was priced at USD 4.5 thousand per metric ton. It is one of the most effective systemic fungicides against oomycetes. It is widely used as a soil or seed treatment to control Pythium and Phytophthora seed rot and damping-off. It also serves as a soil treatment for controlling Phytophthora stem rots and cankers in annuals and perennials and offers efficacy against certain downy mildews.

- Glyphosate retains its position as the most extensively used pesticide in France. In 2023, the country banned the sale of two weedkillers containing glyphosate produced by Swiss chemical group Syngenta due to a lack of analysis on the chemical's potential harm to wildlife, as the company did not submit the mandatory risk assessment on the impacts on bees, other insects, soil, and water life.

- Pendimethalin, a selective herbicide, is applied before emergence in cereals, maize, and rice and with shallow soil incorporation before seeding beans, cotton, soybeans, and groundnuts. In vegetable crops, it is applied before emergence or transplanting. Notably, the price of this herbicide saw a substantial increase of 37.8% to USD 3.3 thousand per metric ton in 2022 compared to 2019.

France Crop Protection Chemicals Industry Overview

The France Crop Protection Chemicals Market is fairly consolidated, with the top five companies occupying 70.03%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Nufarm Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219