|

市场调查报告书

商品编码

1683131

非洲作物保护化学品市场 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Africa Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

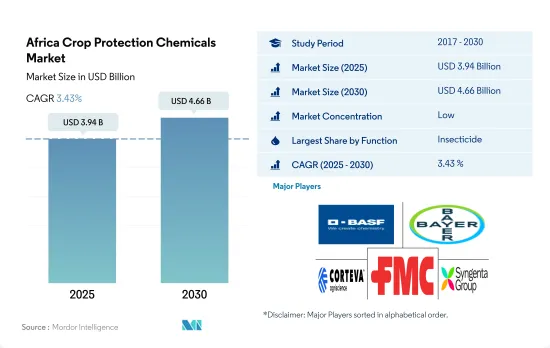

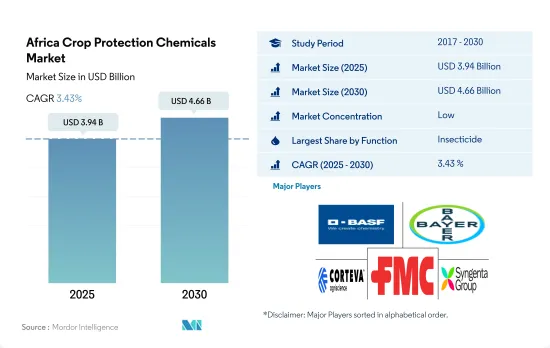

预计 2025 年非洲作物保护化学品市场规模为 39.4 亿美元,到 2030 年将达到 46.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.43%。

农药主导非洲作物保护化学品市场

- 农业是非洲的主要产业之一。该行业满足了不断增长的人口的粮食安全需求,并促进了该地区的经济成长。该地区多样的气候条件有利于种植小麦、玉米、水稻、大豆、向日葵、豆类、烟草、咖啡、可可和茶等多种作物。

- 杀虫剂在非洲作物保护化学品市场占据主导地位,2022 年占 41.7% 的份额。根据国际农业和生物科学中心的数据,非洲国家因昆虫造成的作物损失估计占每年预期作物产量的 49.0%。但由于气候变化,虫害预计会增加,农作物损失可能会更加严重。茎虫、食叶毛虫、豆叶潜蝇、蚜虫、蓟马、叶蝉、粉蝨和介壳虫是造成该地区经济产量损失的主要害虫。

- 除草剂是非洲使用第二多的作物保护剂,2022 年的市场占有率为 30.7%。该地区的杂草侵扰每年平均造成 25-100% 的作物损失。同时,该地区正在实施集约化农业实践以满足不断增长的人口的食物需求,这促进了各种杂草的传播。过去一段时间,除草剂消费量显着增长,2017 年至 2022 年期间使用量增加了 8,264 吨。

- 人口增加、可耕地面积减少和粮食安全的提高是推动该地区市场发展的因素,预计预测期内复合年增长率为 3.6%。

由于用于保护作物免受害虫和杂草侵害的农药消费量增加,市场正在成长

- 在非洲,对农药的需求日益增加,以保护作物免受害虫、疾病和杂草的侵害。该地区的农民严重依赖这些化学物质,因为病虫害的侵袭会对作物造成巨大的损害和损失。

- 秋季虫害可能导致1,600万吨玉米短缺,价值近50亿美元。国际农业和生物科学中心称,如果不加以控制,这种玉米蛾每年可能对非洲12个主要玉米生产国造成830万至2060万吨的损失。

- 在非洲,2,300万公顷土地上种植木薯、甘薯、马铃薯和山药等根茎类作物。 5 亿至 10 亿非洲人食用木薯,但木薯易受病虫害侵害。木薯花叶病毒和木薯褐条病是影响此作物最重要的疾病。东非和中非每年的经济损失估计在 19 亿美元至 27 亿美元之间。

- 该国最重要的作物是玉米、稻米、小麦和高粱。其中,玉米是种植最广泛的谷物。玉米极易受到二化螟(玉米螟科:玉米虫)等害虫的侵害,每年可造成 15% 至 100% 的严重产量损失。事实上,东非农民报告称,仅二化螟造成生产损失就高达 4.5 亿美元。这些因素正在推动农药的消费,预计作物保护化学品市场在预测期内的复合年增长率将达到 3.6%。

非洲作物保护化学品市场的趋势

采用病虫害综合治理策略和其他替代方案(如轮作)显着减少了每公顷农药的消费量

- 过去一段时间,非洲每公顷土地的农药消费量明显下降。 2017年农药消费量为每公顷1175公克。但随后的努力已成功将这一水准降低了每公顷 96 克,降至目前的每公顷 1,079 克。农药使用量的大幅减少是多种因素的结果,包括实施优先考虑永续和生态友善方法的改良农业实践。农民越来越多地采用综合病虫害管理、轮作和生物病虫害防治等创新技术,以尽量减少每公顷土地使用的化学农药量。

- 除草剂是该地区使用的主要农业化学产品,但近年来,每公顷除草剂消费量大幅下降,到 2022 年将与 2017 年相比下降至 34 克。除草剂消费量的大幅减少归功于综合杂草管理 (IWM) 方法的成功。在这种方法下,农民采用了各种创新策略,包括多样化种植系统、机械除草、轮作和使用覆盖作物。这些生态友善技术减少了对除草剂的依赖,促进了永续农业,改善了土壤健康并有助于保护生物多样性。

- 透过采用 IPM 策略、种植抗病作物、替代性病虫害控製手段以及提高对农药负面影响的认识,到 2022 年,农民将比 2017 年减少每公顷杀菌剂使用量 38 克,减少杀虫剂使用量 23 克。

需求增加和供应有限将导致活性成分价格大幅波动

- Cypermethrin是该地区用于控制水稻、棉花、大豆和蔬菜等作物害虫的主要杀虫剂。由于需求量大,2022 年Cypermethrin的价格与 2017 年相比每公吨上涨了 3,186.2 美元。这一上涨是由于当地产量有限,导致严重依赖进口来满足需求。

- Atrazine是南非和奈及利亚等玉米生产国使用的主要除草剂,这些国家 88% 的玉米种植面积都使用阿特拉津来除草。Atrazine的用途广泛,涉及多种陆地粮食作物和非作物、森林、住宅草坪、高尔夫球场、休閒区和牧场,并且是农场广泛使用的除草剂。由于Atrazine在各类作物中的应用不断扩大,其价格与前一年同期比较稳步上涨,2022 年与 2017 年相比每吨增长了 3,292.7 美元。

- Glyphosate是该地区第二常用的除草剂,并且由于其价格低廉而被广泛接受。许多农民选择Glyphosate作为主要的除草解决方案。 2022年,有效成分Glyphosate的价格为每吨1,143.2美元。

- 该地区农药活性成分的价格在过去一段时间内大幅上涨,每公吨上涨了 1,580.9 美元。价格高企主要原因是该地区生产能力有限。过去五年来,非洲农药进口量大幅增加,对进口产品的依赖加剧,导致该地区农药价格上涨。

非洲作物保护化学品产业概况

非洲作物保护化学品市场细分化,前五大公司占24.91%。该市场的主要企业包括BASF公司、拜耳公司、科迪华农业科技公司、富美实公司和先正达集团

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 南非

- 价值链与通路分析

第 5 章。市场细分,包括市场规模(美元和数量)、2030 年预测和成长前景分析

- 功能

- 杀菌剂

- 除草剂

- 杀虫剂

- 灭螺剂

- 杀线虫剂

- 执行模式

- 化学喷涂

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 南非

- 非洲其他地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 51595

The Africa Crop Protection Chemicals Market size is estimated at 3.94 billion USD in 2025, and is expected to reach 4.66 billion USD by 2030, growing at a CAGR of 3.43% during the forecast period (2025-2030).

Insecticides dominate the African crop protection chemicals market

- Agriculture is one of the major sectors in Africa. This sector fulfills the growing population's food security needs and helps the region to grow economically. The region's diverse climate conditions are favorable to the various crops, including wheat, maize, rice, soybeans, sunflower, beans, tobacco, coffee, cocoa, and tea.

- Insecticides dominated the African crop protection chemicals market, accounting for a share of 41.7% in 2022. Crop losses in African countries due to insects are estimated at 49.0% of the expected total crop yield each year, according to the Centre for Agriculture and Biosciences International. However, some crop losses may be even worse, and the effects of the changing climate are expected to increase the damage done by insects. Stem borers, leaf-eating caterpillars, bean flies, aphids, thrips, leafhoppers, whiteflies, and beetles are major pests that cause economic yield losses in the region.

- Herbicides are the second most used crop protection chemicals in Africa, accounting for a market share of 30.7% in 2022. On average, the region is losing up to 25-100% crop losses to weed infestations every year. At the same time, the region is implementing intensive agricultural practices to meet the food needs of a growing population, which favors the infestation of various weed species. During the historical period, the consumption of herbicides witnessed significant growth, and the usage increased by 8,264 metric tons between 2017 and 2022.

- Growing population, a decrease in arable land, and a rise in food security are some driving factors of the market in the region, and the market is anticipated to witness a CAGR of 3.6% during the forecast period.

The market is growing due to the rising consumption of pesticides to protect crops from pests and weeds

- The demand for pesticides in Africa is increasing to protect crops from pests, diseases, and weeds. Farmers in the region depend heavily on these chemicals as pest and disease infestations can result in substantial crop damage and loss.

- The fall armyworm infestation can lead to a shortage of 16 million metric tons of maize worth almost USD 5 billion. According to the Centre for Agriculture and Biosciences International, if this moth is not properly controlled, it has the potential to cause annual losses of 8.3 to 20.6 million tons in 12 of Africa's major maize-producing nations.

- Africa cultivates root and tuber crops such as cassava, sweet potato, potato, and yam on 23 million hectares of land. Cassava is consumed by 500 million to 1 billion Africans, but it is susceptible to insect pests and disease. The cassava mosaic virus and cassava brown streak disease are the most significant diseases affecting the crop. The annual economic losses in eastern Africa and central Africa are estimated to be between USD 1.90-2.70 billion.

- Maize, rice, wheat, and sorghum are the most important food crops grown in the country. Among these, maize is the most widely grown cereal crop. It is highly susceptible to pests, like Chilo partellus Swinhoe (Crambidae), which can cause significant yield losses ranging from 15% to 100% annually. In fact, farmers in eastern Africa have reported production losses of up to USD 450 million due to Chilo partellus alone. These factors are expected to drive the consumption of pesticides, and the crop protection chemicals market is expected to register a CAGR of 3.6% during the forecast period.

Africa Crop Protection Chemicals Market Trends

Adoption of IPM strategies and other alternative methods like crop rotations significantly reduces pesticide consumption per hectare

- During the historical period, there has been a remarkable decline in pesticide consumption per hectare within Africa. In 2017, the pesticide consumption rate stood at 1,175 g per ha. However, subsequent efforts have successfully reduced it by 96 g per ha, resulting in a current rate of 1,079 g per ha. This significant reduction in pesticide usage was due to a combination of various factors, which include the implementation of improved agricultural practices that prioritize sustainable and eco-friendly methods. Farmers have increasingly adopted innovative techniques such as integrated pest management, crop rotation, and biological pest control, which have minimized the need for chemical pesticide usage per hectare.

- Herbicides are majorly utilized pesticide products in the region, but in recent years, the herbicide consumption per hectare is significantly reduced by 34 g in 2022, as compared to 2017. This substantial decrease in herbicide consumption was due to the successful implementation of integrated weed management (IWM) practices. Under this approach, farmers have adopted a range of innovative strategies such as diversified cropping systems, mechanical weed control, crop rotation, and the use of cover crops. These environment-friendly techniques have contributed to reducing herbicide reliance and also promoted sustainable agriculture, enhancing soil health and conserving biodiversity.

- Farmers adopt IPM strategies, disease-resistant crops, and alternatives to control pests and diseases, raising awareness of pesticide's negative effects, thus reducing fungicide and insecticide use per hectare by 38 and 23 g per ha in 2022, compared to 2017.

Increasing demand and limited availability majorly fluctuate the active ingredient prices

- Cypermethrin is the predominant insecticide utilized in the region to control pests affecting crops such as rice, cotton, soybeans, and vegetables. Due to its high demand, the price of Cypermethrin rose by USD 3,186.2 per metric ton in 2022 compared to 2017. This increase was due to its limited production within the region, leading to a significant dependence on imports to meet the demand.

- Atrazine stands as the primary herbicide utilized in maize-producing countries like South Africa and Nigeria, with 88% of the maize area employed for weed control. Its usage extends to various terrestrial food crops, non-food crops, forests, residential turf, golf courses, recreational areas, and rangelands, making it a widely adopted weed control measure on farms. Due to its expanding application across various crops, the price of Atrazine has been steadily increasing Y-o-Y, with a growth recorded at USD 3,292.7 per metric ton in 2022 compared to 2017.

- Glyphosate is widely embraced as the second most used herbicide in the region, primarily due to its affordability. Many farmers opt for glyphosate as their primary weed control solution. In 2022, glyphosate's active ingredient was priced at USD 1,143.2 per metric ton.

- During the historical period, prices of pesticide-active ingredients in the region experienced a substantial increase, amounting to an increase of USD 1,580.9 per metric ton. This surge may be mainly attributed to the region's limited production capacity. Over the past five years, there has been a notable rise in pesticide imports into Africa, leading to heightened dependence on imported products and consequent price escalation in the region.

Africa Crop Protection Chemicals Industry Overview

The Africa Crop Protection Chemicals Market is fragmented, with the top five companies occupying 24.91%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 South Africa

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

- 5.4 Country

- 5.4.1 South Africa

- 5.4.2 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219