|

市场调查报告书

商品编码

1939579

越南农作物保护化学品:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Vietnam Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

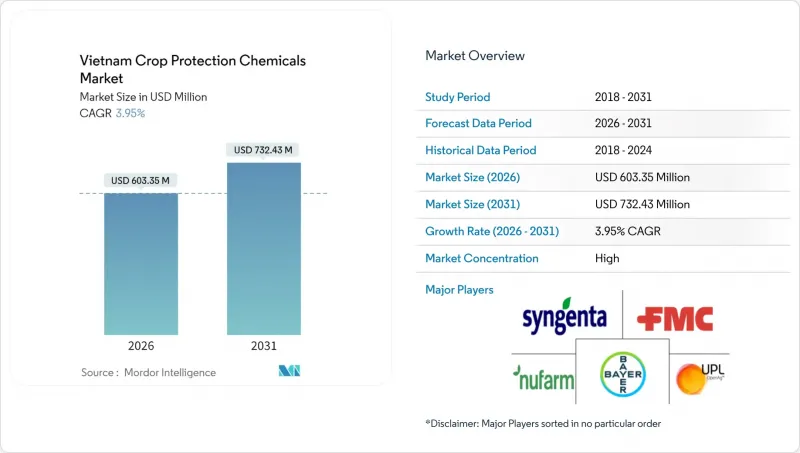

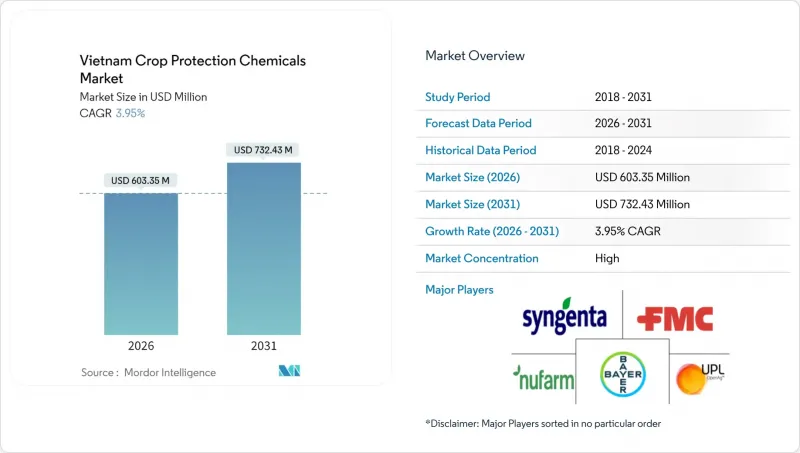

越南作物保护化学品市场预计将从 2025 年的 5.8042 亿美元成长到 2026 年的 6.0335 亿美元,预计到 2031 年将达到 7.3243 亿美元,2026 年至 2031 年的复合年增长率为 3.95%。

出口机会的增加、农业的快速现代化以及气候变迁导致的病虫害压力加剧,都在推动对传统农药和低残留製剂的需求。全国范围内向综合虫害管理(IPM)的转变,即合成农药与生物农药的结合,促使知名品牌拓展产品线,而本土企业也在扩大其非专利产品线。同时,数位化合约农业平台透过简化最后一公里配送、提高产品可追溯性以及将农民与品牌投入品连接起来,为越南农药市场提供支援。儘管政府对大米出口合规的补贴计划、特色果园的扩张以及耐除草剂谷物种子的推广都在扩大耕地面积,但假冒仿冒品产品贸易、更严格的残留标准以及农村劳动力短缺等问题却阻碍了市场增长。

越南农药市场趋势及分析

政府激励措施以达到大米出口品质标准

越南的农业出口策略正透过与品质挂钩的财政奖励推动农药需求结构性转变,这些措施奖励符合国际标准的农民。农业与农村发展部发布的第01/2024/TT-BNNPTNT号通知规定,采用经认证的作物保护通讯协定的农民可获得直接补贴,符合欧盟有机残留标准的稻米可获得高于市场价格15%的溢价。出口品质合规要求鼓励采用生物和化学相结合的综合虫害管理通讯协定,从而为提供全面产品系列而非单一活性成分解决方案的公司拓展市场机会。

特色水果出口农场的快速扩张

特色水果种植正崛起为高附加价值产业,推动越南农业转型。光是火龙果一项,预计到2024年出口额就将达28亿美元,年增23%。中部高地和南部省份果园的扩张,催生了对专为热带水果生产定制的杀菌剂和杀虫剂的需求。在热带水果种植区,一次虫害爆发就可能使价值数百万美元的收成颗粒无收。中国、日本和韩国等高端水果出口市场严格的残留标准要求精准把握喷洒时间和选择合适的产品,迫使农民选择价格更高、残留更少的配方。从自给自足的农业生产转向商业性果园管理的转变,促使农民采用专业的作物保护方法,并倾向于选择知名的国际品牌而非本地非专利。

假农药贸易迅速成长

假农药的涌入扼杀了合法市场的成长,它们以比正品低30%至50%的价格销售劣质产品,造成不公平竞争,挤压了整个产业的利润空间。仿冒品的涌入在与中国和柬埔寨接壤的边境地区尤为严重,跨境走私网络利用监管漏洞和执法资源匮乏牟利。仿冒品通常含有不准确的活性成分浓度或禁用物质,导致作物歉收,并削弱农民对化学农药的信心。仿冒品的氾滥迫使合法生产商投入大量资金用于打击仿冒品和农民教育项目,从而减少了可用于产品研发和市场拓展的资源。

细分市场分析

由于稻田持续潮湿,容易引发稻瘟病、纹枯病和叶斑病,预计2025年,杀菌剂将占越南农药市场价值的37.80%。儘管越南农药市场中杀菌剂仍以三唑类和甲氧基丙烯酸酯类为主,但市场需求正转向获得出口核准的低残留SDHI类复方製剂。受福寿螺引进越南15个新省份的推动,杀蜗牛剂将以6.48%的复合年增长率成长。为了在满足残留审核要求的同时保持药效,农民越来越多地将甲醛替代品与生物饵剂结合使用。

杀线虫剂虽然市占率不大,但成长迅速,尤其在蔬菜种植区需求强劲,因为气候变迁导致根结线虫的危害日益严重。这种功能性产品组合反映了越南的作物结构,越南以水稻和特种作物为主,这些作物需要密集的病虫害防治才能达到出口品质标准。由于根结线虫的发生率不断上升,小规模的细分市场,例如蔬菜种植区的杀线虫剂,也正在作为利基市场扩张。作用机制轮替和抗性管理标籤方面的进步,为高价值多效製剂带来了光明的前景。国际供应商主导取得专利的杀菌剂和杀虫剂市场,而国内企业则在单效非专利除草剂市场蓬勃发展。

越南农药市场报告按功能(杀菌剂、除草剂、杀虫剂、杀螺剂等)、应用方法(化学灌溉、叶面喷布、熏蒸、种子处理等)和作物类型(经济作物、水果和蔬菜、谷类、豆类和油籽等)进行细分。市场预测以价值(美元)和数量(公吨)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

- 调查方法

第二章 报告

第三章执行摘要主要发现

第四章 主要产业趋势

- 每公顷农药用量

- 活性成分价格分析

- 法律规范

- 越南

- 价值炼和通路分析

- 市场驱动因素

- 政府激励措施以达到大米出口品质标准

- 为出口特色水果而迅速扩大果园规模

- 引进抗除草剂杂交稻米与玉米种子

- 合约农业平台的发展推动了投入品包装的扩张

- 气候变迁引发湄公河三角洲的虫害压力

- 利用数位科技的农业零售商网络

- 市场限制

- 假农药贸易日益猖獗

- 欧盟和美国买家製定了严格的残留标准

- 由于劳动力外流增加,农业劳动人口减少。

- 消费者对有机农产品的偏好日益增长

第五章 市场规模和成长预测(价值和数量)

- 功能

- 消毒剂

- 除草剂

- 杀虫剂

- 杀软体动物剂

- 杀线虫剂

- 如何申请

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 谷物和谷类

- 豆类和油籽

- 草坪和观赏植物

第六章 竞争情势

- 关键策略倡议公司

- 市占率分析

- 公司概况

- 公司简介

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

- Sumitomo Chemical Co.

- Albaugh LLC

- Loc Troi Group

- Hailir Group

- Nippon Soda Co., Ltd.

- Vietnam National Chemical Group-Vinachem

- Takeda Pharmaceutical Co.

第七章:CEO们需要思考的关键策略问题

The Vietnam crop protection chemicals market is expected to grow from USD 580.42 million in 2025 to USD 603.35 million in 2026 and is forecast to reach USD 732.43 million by 2031 at 3.95% CAGR over 2026-2031.

Mounting export opportunities, fast-modernizing farms, and climate-induced pest loads combine to propel demand for both conventional and low-residue formulations. A nationwide pivot toward integrated pest management that blends synthetic and biological solutions is encouraging established brands to widen portfolios while domestic players scale generic lines. In parallel, digital contract-farming platforms streamline last-mile delivery, improving product traceability and locking farmers into branded input packages that underpin the Vietnam crop protection chemicals market. Government subsidy programs for rice-export compliance, specialty fruit orchard expansion, and herbicide-tolerant grain seed adoption collectively enlarge addressable acres, while counterfeit trade, residue-limit tightening, and rural labor scarcity temper the growth curve.

Vietnam Crop Protection Chemicals Market Trends and Insights

Government Incentives for Rice-Export Quality Compliance

Vietnam's agricultural export strategy fundamentally reshapes crop protection demand through quality-linked financial incentives that reward farmers for meeting international standards. The Ministry of Agriculture and Rural Development's Circular 01/2024/TT-BNNPTNT establishes direct subsidies for farmers adopting certified crop protection protocols, with premium payments reaching 15% above market rates for rice meeting EU organic residue standards. Export quality compliance requirements drive adoption of integrated pest management protocols that combine biological and chemical solutions, expanding market opportunities for companies offering comprehensive product portfolios rather than single-active ingredient solutions.

Rapid Expansion of Specialty Fruit Export Orchards

Specialty fruit cultivation emerges as a high-value driver transforming Vietnam's agricultural landscape, with dragon fruit exports alone reaching USD 2.8 billion in 2024, representing 23% growth from previous year levels. Orchard expansion in the Central Highlands and southern provinces creates demand for specialized fungicides and insecticides tailored to tropical fruit production, where single pest outbreaks can destroy entire seasonal harvests worth millions of dollars. Premium fruit export markets in China, Japan, and South Korea enforce strict maximum residue limits that require sophisticated application timing and product selection, driving farmers toward higher-priced, low-residue formulations. The shift from subsistence farming to commercial orchard management introduces professional crop protection practices that favor established international brands over local generic products.

Escalating Counterfeit Pesticide Trade

Counterfeit pesticide infiltration undermines legitimate market growth by offering substandard products at prices 30-50% below authentic formulations, creating unfair competition that pressures profit margins across the industry. Border provinces with China and Cambodia experience particularly acute counterfeit penetration, where cross-border smuggling networks exploit regulatory gaps and limited enforcement resources. Counterfeit products often contain incorrect active ingredient concentrations or banned substances, leading to crop failures that damage farmer confidence in chemical crop protection methods. The proliferation of fake products forces legitimate manufacturers to invest heavily in anti-counterfeiting measures and farmer education programs, reducing resources available for product development and market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Herbicide-Tolerant Hybrid Rice and Corn Seeds

- Growth of Contract-Farming Platforms Driving Input Packages

- Stringent Residue Limits from European Union/United States Buyers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fungicides captured 37.80% of the 2025 value as perennial humidity in paddies breeds blast, sheath blight, and brown spot. The Vietnam crop protection chemicals market size for fungicides remains anchored by triazoles and strobilurins, yet demand migrates toward low-residue SDHI blends that win export approvals. Molluscicides, propelled by golden apple snail incursions into 15 new provinces, headline growth at 6.48% CAGR. Farmers increasingly integrate metaldehyde alternatives with biological baits to satisfy residue audits while preserving efficacy.

Nematicides represent a smaller but growing segment, particularly in vegetable production areas where root-knot nematode pressure intensifies under climate change conditions. The functional mix reflects Vietnam's crop portfolio emphasis on rice and specialty crops that require intensive disease and pest management to meet export quality standards. Minor segments, namely nematicides for vegetable zones, enjoy niche expansion as root-knot outbreaks rise. Advances in mode-of-action rotation and resistance-management labeling bolster prospects for premium multi-active packs. International suppliers dominate patented fungicide and insecticide niches, while local firms thrive in single-active herbicide generics.

The Vietnam Crop Protection Chemicals Market Report is Segmented by Function (Fungicide, Herbicide, Insecticide, Molluscicide, and More), Application Mode (Chemigation, Foliar, Fumigation, Seed Treatment, and More), and Crop Type (Commercial Crops, Fruits and Vegetables, Grains and Cereals, Pulses and Oilseeds, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Syngenta Group

- UPL Limited

- Wynca Group (Wynca Chemicals)

- Sumitomo Chemical Co.

- Albaugh LLC

- Loc Troi Group

- Hailir Group

- Nippon Soda Co., Ltd.

- Vietnam National Chemical Group - Vinachem

- Takeda Pharmaceutical Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY & KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Government incentives for rice-export quality compliance

- 4.5.2 Rapid expansion of specialty fruit export orchards

- 4.5.3 Adoption of herbicide-tolerant hybrid rice and corn seeds

- 4.5.4 Growth of contract-farming platforms driving input packages

- 4.5.5 Climate-change-driven pest pressure in Mekong Delta

- 4.5.6 Digitally enabled last-mile agro-dealer networks

- 4.6 Market Restraints

- 4.6.1 Escalating counterfeit pesticide trade

- 4.6.2 Stringent residue limits from European Union/United States buyers

- 4.6.3 Rising labor migration shrinking farm labor pool

- 4.6.4 Increasing consumer preference for organic produce

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 FMC Corporation

- 6.4.5 Nufarm Ltd

- 6.4.6 Syngenta Group

- 6.4.7 UPL Limited

- 6.4.8 Wynca Group (Wynca Chemicals)

- 6.4.9 Sumitomo Chemical Co.

- 6.4.10 Albaugh LLC

- 6.4.11 Loc Troi Group

- 6.4.12 Hailir Group

- 6.4.13 Nippon Soda Co., Ltd.

- 6.4.14 Vietnam National Chemical Group - Vinachem

- 6.4.15 Takeda Pharmaceutical Co.