|

市场调查报告书

商品编码

1683986

欧洲除草剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Herbicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

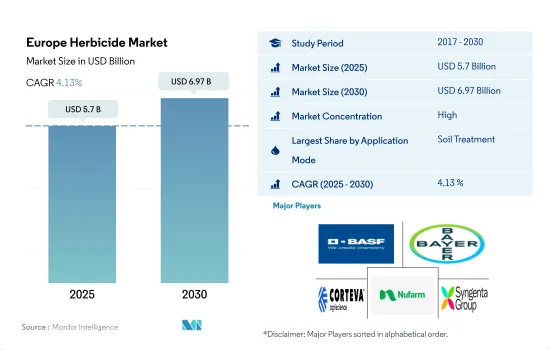

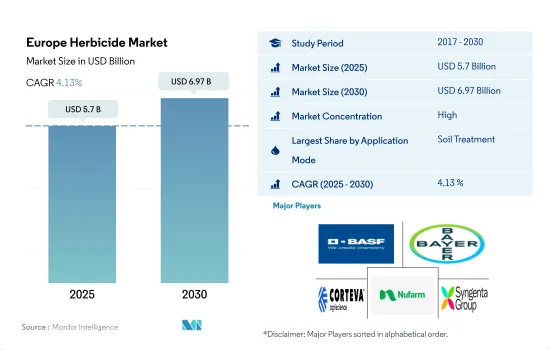

预计 2025 年欧洲除草剂市场规模为 57 亿美元,到 2030 年将达到 69.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.13%。

在欧洲,土壤处理是迄今为止除草剂施用最重要的主要手段。

- 在欧洲,农业中使用不同的除草剂施用方法来有效管理杂草。选择正确的施用方法可以帮助农民实现经济有效的解决方案,准确覆盖目标区域并最大限度地减少浪费。效率的提升将优化除草剂的使用,最终降低农民的投入成本。

- 在农业实务中,土壤施用是除草剂使用的主要方式,占2022年除草剂总施用量的48.2%。这种方法主要用于谷物和谷类的种植,占据最大的市场占有率,为62.0%。除草剂土壤处理是首选,因为它们有助于透过防止或减少杂草生长来保护作物和谷类的品质。这些除草剂可以在杂草出现之前或生长初期有效控制杂草。

- 此外,叶面喷布法占了第二大市场占有率, 2022 年占 30.6%。事实证明,这种施药技术对杂草控制非常有利,特别是在需要精确定位的作物,例如直接喷洒到目标植物的叶子上。这种方法对于控制抽穗后的杂草非常有效,并且通常用于许多作物。

- 在欧洲农业领域,除草剂的使用主要是为了优化作物生产力和提高整体盈利。美国除草剂市场占有率预计将以4.1%的复合年增长率成长,显示该市场预计将经历显着增长。

小麦、玉米和甜菜等主要作物中杂草的侵染日益严重,以及这些作物种植面积的不断扩大,可能会推动市场的发展。

- 除了真菌疾病和害虫外,杂草对欧洲农业部门的威胁也越来越大,对该地区的主要作物造成了广泛的破坏。该地区除草剂消费占了大部分市场占有率,占欧洲作物保护化学品市场的34.7%,2022年价值为49.3亿美元。

- 2022 年,谷物和谷类的市场占有率为 61.7%,占据欧洲除草剂市场的主导地位。这一优势是由于种植面积的增加和这些作物杂草的感染增加。有很多杂草会造成作物损失。在进行的实验中,研究人员发现法国小麦种植中存在 108 种杂草,欧洲五个国家(丹麦、芬兰、德国、拉脱维亚和瑞典)小麦种植中存在 197 种杂草。这些杂草种类的增加已经对小麦、玉米和甜菜等主要作物造成了危害。平均每年,未控制的杂草会导緻小麦作物损失 25-30%,玉米作物损失 60-85%,甜菜作物损失 90-95%。

- 在欧洲国家,土壤施用除草剂处理越来越受欢迎。这种施用模式在2022年占据了48.2%的领先市场占有率。这一优势很大程度上与早期生长阶段的杂草控制有效性有关,这使得作物出苗更快,并减少了后期对除草剂的需求。由于这些优势,这种应用模式预计将成长,预测期内复合年增长率估计为 4.1%。

- 受主要作物杂草侵染加剧的推动,预测期内欧洲除草剂市场预计将以 4.0% 的复合年增长率成长。

欧洲除草剂市场趋势

预计农民将更多地依赖除草剂作为应对杂草挑战的关键工具

- 欧洲除草剂消费量大幅增加,主要原因有很多。其中一个关键因素是,由于数百万人从农村迁移到都市区,手工除草劳动力短缺。因此,使用除草剂已成为提高作物产量和品质的有效且经济的方法。这一趋势在 2019 年至 2022 年尤为明显,该地区的除草剂消费量增加了 31.4%。

- 在欧洲国家中,德国和法国的除草剂使用率高于该地区的其他国家。 2022 年,德国的使用率为每公顷 3,100,紧随其后的是法国,为 2,800。这些国家严重依赖包括除草剂在内的化学农药的使用来确保农业生产的稳定性、数量和粮食安全。杂草的持久性和适应性使得这些地区必须增加除草剂的施用率。

- 此外,预计未来30年欧洲人口成长将导致粮食需求急剧增加。因此,为了满足日益增长的粮食生产需求,即提高产量并保护作物免受有害杂草的侵害,对除草剂的需求预计会增加。

- 因此,预计预测期内(2023-2029 年),粮食需求增加、劳动力短缺和气候变迁将推动除草剂的消费。未来几年,农民可能会更加依赖除草剂作为应对这些挑战、满足不断增长的粮食需求和确保永续农业生产力的重要工具。

在欧洲国家中,德国和法国的2022年Glyphosate价格最高,为每吨1,150美元。

- 2022 年,甲草胺的价格为每吨 16,700 美元。甲草胺是一种合成有机化合物,广泛用作选择性控制某些阔叶杂草和禾本科杂草的除草剂。甲草胺可用于蔬菜和田间作物、休閒区的草坪和非农业用地。剂型包括可湿性粉剂、乳油、水分散性颗粒剂(干流动剂)及流动浓缩剂。甲草胺可透过多种方法施用,包括空中施用、化学施用和地面施用。

- 苯二甲戊灵苯二甲戊灵是一种具有残留活性的出苗前除草剂,可广谱控制多种作物(包括园艺、草坪和林业)中的一年生杂草和阔叶杂草。其主要作用方式是抑制易感杂草的细胞分裂和伸长,阻止根和芽的生长。 2022年,这种除草剂的价格为每吨3,300美元。

- Glyphosate类除草剂仍是欧洲使用最广泛的除草剂,占欧盟除草剂市场的33%。 2022年Glyphosate除草剂的价格为每吨1,200美元。Glyphosate除草剂的使用量持续大幅成长,在欧洲,特别是在欧盟的农业大国,销售量仍然很大。来自农业会计数据网络(FADN)的资料显示,农业在农药上的支出整体正在增加。

- 在欧盟国家中,2022年德国和法国的Glyphosate价格最高,均为每吨1,150美元,其次是英国,每吨1,140美元。

欧洲除草剂产业概况

欧洲除草剂市场比较集中,前五大公司占了65.24%的市占率。市场的主要企业有:BASF公司、拜耳公司、科迪华农业科技、纽髮姆有限公司和先正达集团(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 价值链与通路分析

第五章 市场区隔

- 执行模式

- 化学灌溉

- 叶面喷布

- 熏蒸

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 欧洲其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001688

The Europe Herbicide Market size is estimated at 5.7 billion USD in 2025, and is expected to reach 6.97 billion USD by 2030, growing at a CAGR of 4.13% during the forecast period (2025-2030).

In Europe, soil treatment holds the utmost importance as the primary mode of herbicide application

- In Europe, various modes of herbicide application are employed to efficiently manage weeds in agriculture. By selecting appropriate application methods, farmers can achieve cost-effective solutions, ensuring precise coverage of targeted areas and minimizing wastage. This enhanced efficiency optimizes herbicide usage, ultimately leading to reduced input costs for farmers.

- In agricultural practices, soil application stands out as the predominant mode of herbicide usage, which represented 48.2% of the total herbicide application segment in 2022. This method is majorly employed in the cultivation of grains and cereals, which holds the largest market share at 62.0%. The preference for soil treatment of herbicides is driven by their efficacy in protecting the quality of grains and cereals by preventing or minimizing weed growth. They are effective in controlling weeds during their pre-emergent and early growth stages.

- Furthermore, the foliar application method secured the second-largest market share by value, which accounted for 30.6% in 2022. This application technique has proven to be advantageous for weed control, particularly in crops that require accurate targeting, for instance, when applied directly onto the leaves of target plants. This method is effective for controlling post-emergence weeds and is commonly used in many agricultural crops.

- In the European agricultural sector, herbicide usage is focused on optimizing crop productivity and enhancing overall profitability. The market is expected to witness significant growth, with a projected CAGR of 4.1% in terms of the US herbicide market share.

Growing weed infestations in major crops like wheat, maize, and sugar beet and extending cultivation area under this crops may drive the market

- Apart from fungal diseases and insect pests, weeds are becoming a threat to the European agriculture sector, causing huge damage to the major crops in the region. The consumption of herbicides in the region occupied a majority market share, which accounted for 34.7% of the European crop protection chemical market, with a market value of USD 4.93 billion in 2022.

- Grains and cereal crops dominated the European herbicide market with a 61.7% market share in 2022. This dominance was attributed to the higher cultivation area and increased weed infections in these crops. There are numerous weed species causing crop losses. According to an experiment conducted, researchers found 108 weed species in France's wheat crops, and 197 weed species were found in five European countries' wheat cultivations (Denmark, Finland, Germany, Latvia, and Sweden). These increased weed species caused damage to major crops such as wheat, maize, sugar beet, and other crops. On average, every year, uncontrolled weeds cause wheat crop loss of 25-30%, maize crop loss of 60-85%, and sugar beet crop loss of 90-95%.

- The application of herbicide products through soil treatment is gaining popularity in European countries. This application mode occupied a major market share of 48.2% in 2022. The dominance is majorly related to the effectiveness of controlling weeds in the early growth stage, which could give more strength to the crops for faster germination, reducing the herbicide's necessity in the later stages. Due to these benefits, the application mode is projected to grow, registering an estimated CAGR of 4.1% during the forecast period.

- The European herbicides market is anticipated to grow, registering a CAGR of 4.0% during the forecast, driven by increased weed infestations in major crops.

Europe Herbicide Market Trends

Farmers are expected to increasingly rely on herbicides as a key tool to manage weed challenges

- Europe has experienced substantial growth in the consumption of herbicides, primarily driven by various factors. One significant factor is the shortage of workers available for manual weeding, as millions of people have migrated from rural to urban areas. As a result, herbicide usage has emerged as an effective and cost-efficient method to enhance both the quality and quantity of crop yields. This trend was particularly notable from 2019 to 2022, with herbicide consumption in the region increasing by 31.4%.

- Among European countries, Germany and France have high herbicide usage rates compared to others in the region. In 2022, Germany recorded a usage rate of 3.1 thousand per hectare, while France followed closely with 2.8 thousand per hectare. These countries heavily rely on the application of chemical pesticides, including herbicides, to ensure the stability, quantity, and food security of their agricultural production. The persistence and adaptability of weeds have necessitated higher rates of herbicide application in these regions.

- Furthermore, the increasing European population has projected a rapid growth in food demand over the next three decades. Consequently, the demand for herbicides is also expected to rise to meet the increasing need for food production by increasing the yield and protecting crops from harmful weeds.

- Therefore, the rising demand for food, labor shortages, and climate change are expected to drive the consumption of herbicides during the forecast period (2023-2029). Farmers will increasingly rely on herbicides as a key tool over the coming years to address these challenges and meet the increasing food demand, ensuring sustainable agricultural productivity.

Among countries in Europe, the price of glyphosate in 2022 was highest in Germany and France, priced at USD 1.15 thousand per metric ton

- In 2022, Metribuzin was valued at USD 16.7 thousand per metric ton. It represents a synthetic organic compound widely utilized as a herbicide with selective control over specific broadleaf weeds and grassy weed species. The applications of Metribuzin are used in vegetable and field crops, turf grasses in recreational areas, and non-crop areas. Its available formulations include wettable powder, emulsifiable concentrate, water-dispersible granules (dry flowable), and flowable concentrate. Various methods, such as aerial, chemigation, and ground application, are employed for Metribuzin's application.

- Pendimethalin is a pre-emergence herbicide with residual activities that deliver broad-spectrum control against annual grasses and broadleaf weeds across different crops, including horticultural, turf, and forestry. Its primary mode of action involves inhibiting cell division and elongation in susceptible weeds, thus impeding root and shoot growth. In 2022, this herbicide was priced at USD 3.3 thousand per metric ton.

- Glyphosate-based herbicides maintain their position as the most widely used herbicide in Europe, which accounts for 33% of the EU herbicide market. In 2022, the price of glyphosate-based herbicides stood at USD 1.2 thousand per metric ton. The usage of glyphosate-based herbicides continues to witness significant growth, while sales in Europe, especially in larger agricultural member states of the European Union, remain substantial. Data from the Farm Accountancy Data Network (FADN) indicates a general increase in farmers' spending on pesticides.

- Among EU countries, the price of glyphosate in 2022 was highest in Germany and France, each priced at USD 1.15 thousand per metric ton, followed by the United Kingdom at USD 1.14 thousand per metric ton.

Europe Herbicide Industry Overview

The Europe Herbicide Market is fairly consolidated, with the top five companies occupying 65.24%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Nufarm Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219