|

市场调查报告书

商品编码

1683990

印度杀菌剂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)India Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

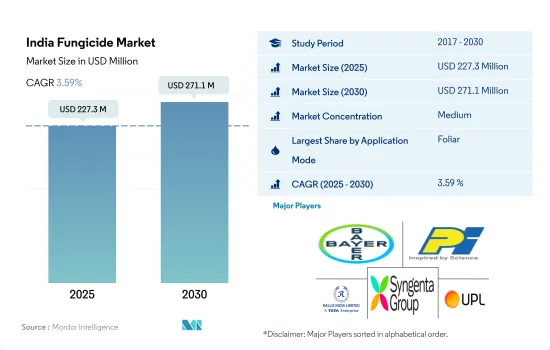

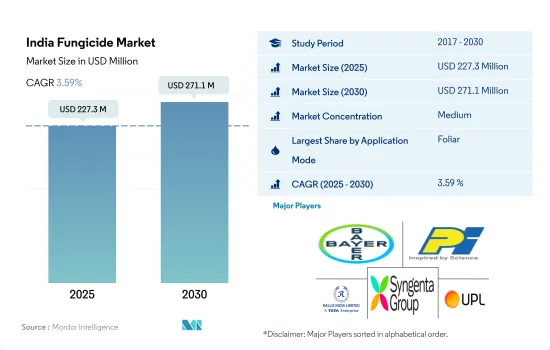

印度杀菌剂市场规模预计在 2025 年为 2.273 亿美元,预计到 2030 年将达到 2.711 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.59%。

真菌疾病的增加增加了对各种施用方法的杀菌剂的需求。

- 根据具体要求和疾病,杀菌剂可以以多种方式使用。这些方法包括化学喷雾、叶面喷布、熏蒸以及种子和土壤处理。这些不同的施用方法对于根据条件将杀菌剂有效地应用于不同作物起着重要作用。

- 2022年,叶面喷布在杀菌剂应用领域占据主导地位,占据最大的市场占有率,为60.9%。这种方法之所以受到高度青睐,是因为它透过直接针对叶子上的病原体,可以有效地预防叶面真菌疾病。叶面喷布可促进杀菌剂快速渗透和吸收到植物组织中,确保有效对抗真菌病原体。

- 杀菌剂种子处理被广泛用于在植物发育早期对抗真菌感染。这些处理方法为种子周围提供了保护屏障,有效地防止了种子腐烂、猝倒病、涝渍病和根腐病等多种疾病。在2022年的印度杀菌剂市场中,杀菌剂种子处理部分占了13.8%的市场占有率。

- 由于这些作物易受害虫侵害,谷物和谷类生产商会根据作物阶段和害虫侵染情况采用各种喷洒方法。对于这些作物,主要采用叶面喷洒杀虫剂的方法。

- 施用方法的选择受多种因素的影响,包括特定的目标疾病、作物类型、疾病阶段和设备的可用性。预计预测期内杀菌剂市场复合年增长率将达到 3.9%。

印度杀菌剂市场趋势

气候变迁和日益增加的疾病压力可能会推动杀菌剂的消费

- 印度是作物保护化学品(包括杀菌剂)的重要消费国。该国农业部门规模庞大,种植的作物种类繁多,因此对杀菌剂的需求很高。真菌病害严重降低农产品的产量和品质,造成很大的损失。杀菌剂对于预防和控制各种疾病,维持农业生产的健康和生产力至关重要。 2022年,印度每公顷杀菌剂消费量为101.5公克/公顷。

- 印度的作物种类繁多,从水稻和小麦等主食作物到棉花、水果和蔬菜等经济作物,因此引发的疾病种类繁多。銹病、枯萎病、霜霉病和腐烂病是真菌疾病对这些作物造成毁灭性影响的一些例子。为了减轻这些风险并保护作物,印度农民使用杀菌剂作为疾病管理策略的重要工具。

- 在印度,农业实践的改变和粮食需求的增加导致耕地面积的增加。农民正在更频繁地重复种植或逐年增加种植週期。作物集约化种植增加了疾病爆发的风险,包括真菌疾病,因此对杀菌剂的需求也增加了。 2017年至2022年期间,印度每公顷杀菌剂消费量增加了5.0%。

- 印度政府制定了多项计画和方案来鼓励使用杀菌剂等作物保护化学物质。各国政府透过补助、推广服务和培训计画鼓励农民使用杀菌剂进行病害防治。

气候变迁会改变真菌的生存、传染性和宿主的易感性,导致新疾病的出现。

- 真菌病害是重要作物的一大威胁。真菌病原体导致印度各种作物产量严重下降。在谷物中,它被认为是一个产量限制因素。印度因真菌感染造成的作物产量损失估计每年约 500 万吨。

- 代森锰锌是一种广谱接触性杀菌剂,用于防治玉米、稻米、小麦、蔬菜、水果、甘蔗、烟草等作物的冰斑病、环斑病、稻瘟病、疮痂病、叶霉病、白粉病、茎腐病、茎腐病、褐腐病、白茎腐病、黑茎腐病等真菌病害。 2022 年其价格为每吨 7,700 美元。

- 丙森锌是一种接触性杀菌剂,2022 年的价格为每吨 3,500 美元。它用于防治苹果、马铃薯、辣椒和番茄等作物的多种疾病,包括早晚疥疮、七叶树腐烂病、白粉病、果叶斑病和叶斑病。

- 福美锌是一种基本的接触性叶面杀菌剂,2022 年的价格为每吨 3,200 美元。主要防治马铃薯早疫病、晚疫病,攀缘植物和葫芦科植物的霜霉病、黑腐病,苹果的黑星病,香蕉的香蕉叶斑病,柑橘的黑腐病。

- 气候变迁会影响真菌的生存、传染性和宿主易感性,导致新疾病的出现。例如,印度半岛西海岸、中部、内陆半岛和东北部的气候变暖趋势为高粱霜霉病(SDM)和洋桔梗叶枯病(TLB)等玉米病害创造了有利条件。预计这些因素将影响杀菌剂的价格和需求。

印度杀菌剂产业概况

印度杀菌剂市场适度整合,前五大公司占53.11%的市占率。该市场的主要企业有:拜耳股份公司、PI Industries、Rallis India Ltd、先正达集团和UPL Limited(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 印度

- 价值炼和通路分析

第五章 市场区隔

- 执行模式

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- PI Industries

- Rallis India Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001692

The India Fungicide Market size is estimated at 227.3 million USD in 2025, and is expected to reach 271.1 million USD by 2030, growing at a CAGR of 3.59% during the forecast period (2025-2030).

The rising fungal diseases are driving the demand for fungicides in various application methods

- Fungicides can be applied using a variety of methods, depending on the specific requirements and diseases. These methods include chemigation, foliar application, fumigation, and seed and soil treatments. These diverse application methods play a crucial role in effectively applying fungicides to various crops, depending on the conditions.

- In 2022, foliar application dominated the fungicide application segment, which held the largest market share of 60.9%. This method was highly preferred as it provides efficient protection against foliar fungal diseases by directly targeting pathogens on leaves. The foliar application facilitates swift penetration and absorption of fungicides into the plant tissues, ensuring their effective action against fungal pathogens.

- Fungicide seed treatments are extensively employed to combat fungal infections in the early stages of plant development. These treatments provide a protective barrier around the seeds, effectively preventing a range of diseases such as seed rots, seedling blights, damping off, and root rots. The fungicide seed treatments segment held a market share of 13.8% in the Indian fungicide market in 2022.

- Grains and cereal crop growers are majorly adopting all the application methods in their cultivation based on the crop stage and insect pests as these crops are more susceptible to insect pests. Foliar insecticide application was majorly adopted by the farmers in these crops.

- The selection of the application mode is influenced by various factors, including the specific target disease, crop type, disease stage, and the availability of equipment. The fungicide market is expected to register a CAGR of 3.9% during the forecast period.

India Fungicide Market Trends

The changing climate and rising disease pressure are expected to drive the consumption of fungicides

- India is a significant consumer of crop protection chemicals, including fungicides. The country's agricultural sector is large, with diverse types of crops being cultivated, leading to a substantial demand for fungicides. Fungal diseases can significantly reduce agricultural output and quality, resulting in considerable crop losses. Fungicides are essential in the prevention and management of various diseases, maintaining the health and productivity of agricultural production. In 2022, the consumption of fungicides in India per hectare accounted for 101.5 g/ha.

- India has a high crop diversity, ranging from staple food crops like rice and wheat to cash crops like cotton, fruits, and vegetables, creating a varied disease spectrum. Rust, blight, mildew, and rot are a few examples of the devastating effects of fungal diseases on these crops. To mitigate the risks and protect their crops, farmers in India rely on fungicides as an important tool in their disease management strategies.

- Crop intensity is rising in India because of changing agricultural practices and increased food demand. Farmers frequently engage in repeated cropping or increase the number of crop cycles every year. This intensification leads to a higher risk of disease outbreaks, including fungal diseases, and, consequently, a greater need for fungicides. The consumption of fungicides in India per hectare increased by 5.0% from 2017 to 2022.

- The Indian government has developed several plans and programs to encourage the use of crop protection chemicals such as fungicides. The government has pushed farmers to utilize fungicides for disease management through subsidies, extension services, and training programs.

Climatic changes altering fungal survivability and infectivity as well as host susceptibility, leading to new disease outbreaks

- Fungal diseases are a major threat to important crops. Fungal pathogens cause large yield losses in different crops in India. They are known to be yield-limiting factors in cereals. The fungal infections-related decline in crop yield in India is believed to be approximately 5.0 million tons per year.

- Mancozeb is a broad-spectrum contact fungicide used to control fungal diseases like eyespot, ringspot, blast, scab, leaf mold, powdery mildew, stem bois, stem rot, brown rot, white stem rot, and black stem rot in corn, rice, wheat, vegetables, fruit, sugarcane, and tobacco crops. It was valued at USD 7.7 thousand per metric ton in 2022.

- Propineb is a contact fungicide valued at USD 3.5 thousand per metric ton in 2022. It is used to control various diseases like scab early & late blight dieback, buckeye rot, downy mildew, fruit spots, and brown, narrow leaf spot diseases in apple, potato, chili, and tomato crops.

- Ziram is a basic contact foliar fungicide priced at USD 3.2 thousand per metric ton in 2022. It mainly controls early & late blight of potatoes/tomatoes, downy mildew and black rot of vines and cucurbits, scab of apples, Sigatoka of bananas, and melanose of citrus.

- Climatic changes can affect fungal survivability, infectivity, and host susceptibility, resulting in new disease outbreaks. For instance, the warming trend in climate along the Indian subcontinent's west coast, central, interior peninsula, and northeast regions creates favorable conditions for maize diseases like sorghum downy mildew (SDM) and turcicum leaf blight (TLB). These factors are expected to influence the prices and demand for fungicides.

India Fungicide Industry Overview

The India Fungicide Market is moderately consolidated, with the top five companies occupying 53.11%. The major players in this market are Bayer AG, PI Industries, Rallis India Ltd, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 PI Industries

- 6.4.7 Rallis India Ltd

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219