|

市场调查报告书

商品编码

1684050

通讯用 MLCC -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Telecommunication MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

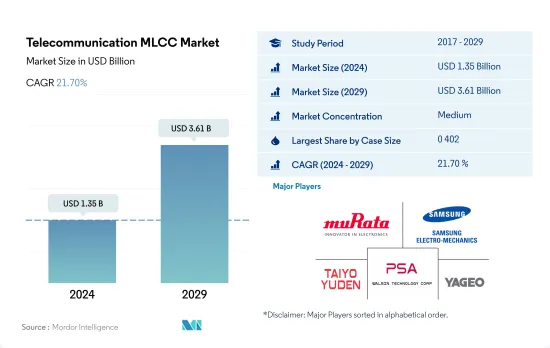

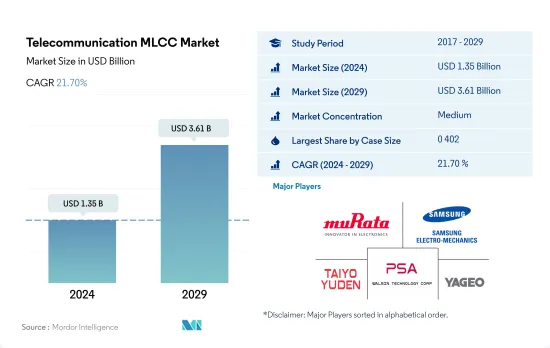

预计2024年通讯MLCC市场规模为13.5亿美元,到2029年将达到36.1亿美元,预测期内(2024-2029年)的复合年增长率为21.70%。

各种外壳尺寸推动通讯MLCC的演进

- 由于技术进步和对小型高效能电子元件的需求,通讯MLCC 市场正在经历重大变革时期期。在「按錶壳尺寸」部分,主要有五个类别:0 201、0 402、0 603、1 005 和 1 210。每种錶壳尺寸在塑造产业发展方面都发挥关键作用。

- 0201 錶壳尺寸对于满足产业不断变化的需求仍然至关重要。该细分市场累计强劲成长势头,2022 年销售额达 1.4529 亿美元。其紧凑的外形规格满足了机上盒 (STB) 等设备的空间优化需求,这对于实现 4K HDR 和杜比全景声 (Dolby Atmos) 支援等高级功能至关重要。

- 錶壳尺寸0603象征日益增长的合作和技术创新。其紧凑的外形规格与中国电信和中国联通的5G网路共用计划的战略合作相辅相成。 1005 机壳尺寸可适应这些创新,从而实现个人化服务和高效的频宽利用。 ADB 和 KAONMEDIA 等伙伴关係利用这种机壳尺寸来引入最尖端科技并提高设备性能。

- 1210型机箱在通讯基础设施中发挥着至关重要的作用。它能够实现基地台内的高效能讯号处理、功率转换和射频电路。 Ubiik 的 freeRANTM 和 Qualcomm 的紧凑型宏 5G RAN 平台等创新表明了对高效能元件的需求。

- 从先进机上盒的小型但功能强大的组件到基地台的高效讯号处理,我们为整个通讯市场提供了各种尺寸的产品,兼顾了尺寸限制和技术能力,从而推动了行业的发展。

全球通讯基础设施对MLCC的需求不断增长

- 由于 5G 网路的快速部署以及对高速连接和先进通讯服务的需求不断增长,全球通讯业正在经历动态成长。

- 亚太地区正处于通讯业快速成长的前沿,智慧型手机、资料通讯服务和数位内容的广泛应用就是明证。中国等国家正率先推出 5G 技术,目前已有数百万个 5G基地台运作。该地区对 MLCC 的需求很大,主要是因为需要能够承受高温并保持讯号完整性的高效通讯基地台。随着该地区在通讯不断创新和领先,对 MLCC 的需求依然强劲。

- 美国是全球通讯领域的重要参与者,在建立5G网路方面取得了长足进步。随着AT&T、Verizon、T-Mobile等科技巨头大力投资5G技术,通讯基地台对MLCC的需求不断上升。

- 欧洲行动应用和服务的快速成长推动了加强通讯基础设施的需求。英国、德国、法国和西班牙等国家推出5G网络,增加了对基地台的需求。 MLCC 在实现 5G 先进功能(例如更高的资料传输速度和更低的延迟)方面发挥关键作用。

- 随着5G网路的快速部署,中东和非洲正在经历重大变革时期。随着商用 5G 服务在全部区域推出,世界其他地区对 MLCC 的需求正在激增。

全球通讯用MLCC市场动向

5G网路部署不断增加推动MLCC需求

- 5G技术的到来为通讯业带来了重大进步,彻底改变了更快的无线连线。其中,5G/mmWave基地台已成为部署5G网路的必不可少的组成部分,尤其是在资料需求量大的都市区。这些基地台使用毫米波频率来发送和接收无线电讯号,从而实现 5G 技术的优势。 5G/mmWave 基地台中 MLCC 的整合在支援功能方面发挥着至关重要的作用,并对通讯MLCC 市场具有影响力。

- 5G/mmWave基地台旨在利用 24 GHz 至 100 GHz 范围内的 mmWave 频率的独特特性来提供超快速且可靠的无线连接。 5G/mmWave基地台的部署对于充分发挥自动驾驶汽车和物联网等新兴应用的潜力至关重要。

- 从过往分析来看,通讯MLCC市场5G/mmWave基地台的成长模式及预测已经显现。这些基地台的数量在早期非常少,随着时间的推移逐渐增长。 2018 年该数量将达到 9 万台,2019 年将增至 12 万台。儘管面临新冠疫情带来的挑战,5G/mmWave基地台部署仍保持韧性,2020 年将进一步成长至 13 万台,2022 年将增至 22 万台。预测显示该数量将继续扩大,到 2026 年将达到 50 万台。这一上升趋势反映出对利用 mmWave 频率来改善无线效能的 5G 网路的需求不断增长,尤其是在人口稠密的都市区。

引领通讯MLCC市场的成长

- 通讯市场正在经历 5G 固定无线存取 (FWA) 连线的大幅成长。预计从 2020 年到 2026 年,该市场将以 68% 的复合年增长率呈指数级增长。这一增长将导致销量大幅增加,预计 2020 年 5G FWA 连接数为 200 万,到 2026 年将达到 6,500 万。这对 MLCC 製造商来说是一个巨大的机会,因为 FWA 设备严重依赖 MLCC 来实现高效能。客户端设备 (CPE)、基地台和网路设备等 FWA 设备正在推动对 MLCC 的需求。随着 5G FWA 的采用不断扩大,对这些电容器的需求将会增加。为了满足5G FWA设备的特定要求和预期性能,对于MLCC製造商来说,持续的技术创新和生产供给能力的调整至关重要。

- 认识到 4G 和其他技术在通讯市场中持续的重要性至关重要。 MLCC 在智慧型手机、路由器和物联网设备等设备中发挥至关重要的作用,有助于电源管理、讯号滤波和杂讯抑制。随着 4G 和其他技术的连接数量的增加,这些设备对 MLCC 的需求也在增加。儘管如此,5G FWA连接的快速成长为MLCC製造商创造了诱人的市场机会。但同样重要的是要认识到对 4G 和其他技术的持续需求。透过创新和伙伴关係满足这两个行业的独特需求,MLCC 製造商可以推动成长并充分发挥通讯MLCC 市场的潜力。

通讯MLCC产业概况

通讯MLCC市场适度整合,前五大企业占比44.61%。市场的主要企业有:村田製作所、三星电机、太阳诱电、华新科技和国巨集团(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 基地台销售

- 5G/毫米波基地台

- 宏4G基地台

- 宏5G/Sub-6GHz基地台

- 小型4G基地台

- 紧凑型5G基地台

- 机上盒销售

- 全球机上盒销量

- FWA连接

- 全球范围内的 FWA 连接

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 设备类型

- 基地台

- 机上盒

- 其他的

- 錶壳尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他的

- 电压

- 50V~200V

- 小于50V

- 200V以上

- 电容

- 10μF至100μF

- 小于10μF

- 100μF 以上

- 介电类型

- 1级

- 2级

- 地区

- 亚太地区

- 欧洲

- 北美洲

- 世界其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001995

The Telecommunication MLCC Market size is estimated at 1.35 billion USD in 2024, and is expected to reach 3.61 billion USD by 2029, growing at a CAGR of 21.70% during the forecast period (2024-2029).

Different case sizes are fueling the evolution of telecommunication MLCCs

- The telecommunication MLCC market is undergoing a profound transformation, driven by technological advancements and the demand for compact yet high-performance electronic components. Within the "by case size" segment, five key categories stand out: 0 201, 0 402, 0 603, 1 005, and 1 210. Each case size plays a pivotal role in shaping the industry's evolution.

- The 0 201 case size is central to meeting evolving industry demands. Demonstrating strong growth, this segment generated USD 145.29 million in revenue in 2022. Its compact form factor aligns with the need for space optimization in devices like set-top boxes (STBs), which is crucial for enabling advanced features such as 4K HDR and Dolby Atmos support.

- The 0 603 case size represents collaborative progress and technological innovation. Its compact form factor complements strategic collaborations, exemplified by China Telecom and China Unicom's 5G network sharing initiative. Case Size 1 005 accommodates these innovations, allowing personalized services and efficient bandwidth utilization. Partnerships like ADB and KAONMEDIA leverage this case size to introduce cutting-edge technologies, enhancing device performance.

- The 1 210 case size plays a significant role in telecom infrastructure. It enables efficient signal processing, power conversion, and RF circuitry within base stations. Innovations like Ubiik's freeRANTM and Qualcomm's Compact Macro 5G RAN Platform exemplify the demand for high-performance components.

- Case sizes of all types in the telecommunication market with compact yet powerful components for advanced STBs to efficiently signal processing in base stations contribute to the industry's progress, offering a balance between size constraints and technological capabilities.

The demand for MLCCs is growing in the global telecommunication infrastructure

- The global telecommunication sector is experiencing dynamic growth, driven by the rapid deployment of 5G networks and the increasing demand for high-speed connectivity and advanced communication services.

- Asia-Pacific is at the forefront of the telecommunications industry's surge, marked by the widespread adoption of smartphones, data services, and digital content. Countries such as China are pioneering the deployment of 5G technology, with millions of operational 5G base stations. The demand for MLCCs in the region is substantial, driven by the need for efficient communication base stations that can withstand high temperatures and maintain signal integrity. As the region continues to innovate and lead in telecommunications, the demand for MLCCs remains strong.

- The United States is a key player in the global telecommunication sector, making significant strides in establishing the national 5G network. With tech giants like AT&T, Verizon, and T-Mobile investing heavily in 5G technology, the demand for MLCCs in communication base stations is on the rise.

- Europe has witnessed a surge in mobile applications and services, driving the need for enhanced telecommunications infrastructure. The deployment of 5G networks across countries like the United Kingdom, Germany, France, and Spain has led to an increased demand for base stations. MLCCs are playing a critical role in enabling the advanced functionalities of 5G, such as higher data rates and reduced latency.

- Middle East & Africa is undergoing a significant transformation with the rapid deployment of 5G networks. As commercial 5G services are introduced across the region, the demand for MLCCs in the Rest of the World has surged.

Global Telecommunication MLCC Market Trends

The rising adoption of 5G networks is propelling the MLCC demand

- The emergence of 5G technology has brought significant advancements to the telecommunications industry, revolutionizing wireless connectivity with faster speeds. In this context, 5G/mmWave base stations have become crucial components for deploying 5G networks, particularly in urban areas with high data demand. These base stations use mmWave frequencies to transmit and receive wireless signals, enabling the benefits of 5G technology. The integration of MLCCs within 5G/mmWave base stations plays a pivotal role in supporting functionality and presents implications for the telecom MLCC market.

- 5G/mmWave base stations are designed to deliver ultra-fast and reliable wireless connectivity by leveraging the unique characteristics of mmWave frequencies, ranging from 24 GHz to 100 GHz. The deployment of 5G/mmWave base stations is crucial for achieving the full potential of emerging applications such as autonomous vehicles and IoT.

- Upon historical analysis, a clear growth pattern and projections emerge for 5G/mmWave base stations within the telecom MLCC market. The volume of these base stations started from negligible figures in the early years and experienced gradual growth over time. In 2018, the volume reached 0.09 million units, increasing to 0.12 million units in 2019. Despite the challenges posed by the global COVID-19 pandemic, the deployment of 5G/mmWave base stations remained resilient, with a further increase to 0.13 million units in 2020 and 0.22 million units in 2022. The projected figures indicate a continued expansion, with the volume expected to reach 0.5 million units by 2026. This upward trend reflects the growing demand for 5G networks to leverage mmWave frequencies for enhanced wireless performance, particularly in densely populated urban areas.

Navigating growth in the telecommunications MLCC market

- The telecommunication market is witnessing a remarkable surge in 5G fixed wireless access (FWA) connections. It is projected to expand exponentially at a CAGR of 68% from 2020 to 2026. This growth translates to a substantial increase in volume, with 2 million 5G FWA connections in 2020, which is expected to reach 65 million by 2026. This presents a significant opportunity for MLCC manufacturers, as FWA devices heavily rely on MLCCs for efficient performance. FWA devices, including customer premises equipment (CPE), base stations, and network equipment, are driving the demand for MLCCs. As the adoption of 5G FWA continues to grow, the need for these capacitors will be amplified. To meet the specific requirements and performance expectations of 5G FWA devices, ongoing innovation and alignment of production and supply capabilities are paramount for MLCC manufacturers.

- It is crucial to recognize the continued significance of 4G and other technologies in the telecommunication market. MLCCs play a vital role in these devices, such as smartphones, routers, and IoT devices, facilitating power management, signal filtering, and noise suppression. As the number of 4G and other technology connections increases, so does the demand for MLCCs in these devices. Nevertheless, the rapid growth of 5G FWA connections presents a compelling market opportunity for MLCC manufacturers. However, it is essential to recognize the continued demand for 4G and other technologies. By addressing the unique needs of both segments through innovation and partnerships, MLCC manufacturers can drive growth and capture the full potential of the telecommunications MLCC market.

Telecommunication MLCC Industry Overview

The Telecommunication MLCC Market is moderately consolidated, with the top five companies occupying 44.61%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, Walsin Technology Corporation and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Base Station Sales

- 4.1.1 5G/mmWave Base Station

- 4.1.2 Macro 4G Base Station

- 4.1.3 Macro-5G/sub6GHz Base Station

- 4.1.4 Small 4G Base Station

- 4.1.5 Small 5G Base Station

- 4.2 Set Top Boxes Sales

- 4.2.1 Global Set Top Boxes Sales

- 4.3 Fwa Connections

- 4.3.1 Global FWA connections

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Device Type

- 5.1.1 Base Stations

- 5.1.2 Set Top Boxes

- 5.1.3 Others

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 50V to 200V

- 5.3.2 Less than 50V

- 5.3.3 More than 200V

- 5.4 Capacitance

- 5.4.1 10 μF to 100 μF

- 5.4.2 Less than 10 μF

- 5.4.3 More than 100 μF

- 5.5 Dielectric Type

- 5.5.1 Class 1

- 5.5.2 Class 2

- 5.6 Region

- 5.6.1 Asia-Pacific

- 5.6.2 Europe

- 5.6.3 North America

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219