|

市场调查报告书

商品编码

1684109

南美洲摩托车市场占有率分析、产业趋势和成长预测(2025-2029)South America Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

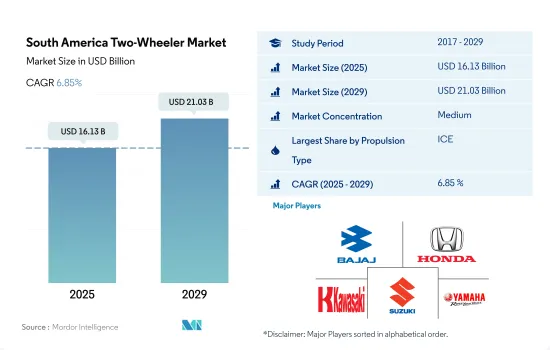

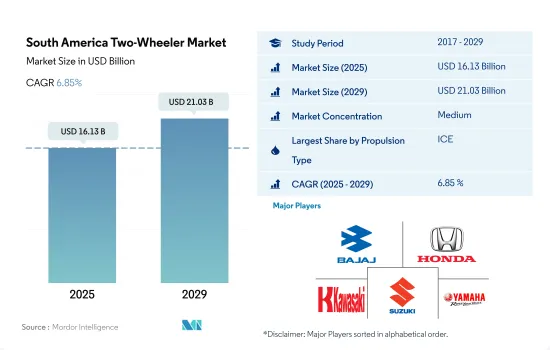

南美摩托车市场规模预计在 2025 年达到 161.3 亿美元,预计到 2029 年将达到 210.3 亿美元,预测期内(2025-2029 年)的复合年增长率为 6.85%。

在技术、政策和永续性的推动下,随着传统和偏好的偏好,南美洲摩托车市场将实现成长

- 2023年,南美洲摩托车市场将出现温和成长,销售量将从2022年的298万辆增加至301万辆。这一增长反映了经济復苏、都市化趋势以及对经济实惠的出行解决方案日益增长的需求,表明两轮车作为该地区必不可少的交通途径,需求稳定。传统内燃机车型以及人们对混合动力汽车和电动车日益增长的兴趣推动了摩托车的持续需求。

- 儘管与全球标准相比,电动两轮车的转变仍处于起步阶段,但随着电动车基础设施的改善、政府旨在减少碳排放的奖励以及消费者对环境永续性意识的不断提高,电动两轮车的转变正在获得发展动力。根据预测资料,南美洲摩托车市场持续成长,预计2030年销售量将达到422万辆。这项预测的成长轨迹不仅凸显了两轮车作为一种便捷且经济的交通途径的持久吸引力,也显示市场动态向电气化的重大转变。

- 随着技术进步使电动两轮车更容易获得,以及政府加强支持政策,市场有望向永续出行转型。这段时期,电动车型将越来越多地融入主流两轮车市场,反映出全球对环境责任和交通创新的趋势。

价格实惠的摩托车在南美洲的城市交通中很受欢迎,但各国的采用率各不相同。

- 南美洲摩托车市场对摩托车和Scooter有着强烈的偏好,认为它们是经济实用的交通途径。儘管经济挑战和安全问题普遍存在,但成长机会,特别是电动两轮车领域的成长机会,为製造商和政策制定者提供了满足不断变化的消费者需求和永续性目标的机会。

- 南美洲摩托车市场受到都市化、经济状况和交通基础设施等因素的影响,反映了各国不同的偏好和使用模式。巴西是南美洲最大的摩托车市场,摩托车是大部分人口的首选交通途径。对经济高效的交通途径,特别是在都市区和半都市区,正在推动市场的发展。巴西的本土製造业蓬勃发展,主要的全球和本土品牌提供各种各样的摩托车。

- 多样化的地形也引起了人们对越野摩托车的极大兴趣。阿根廷摩托车市场由寻求经济实惠的交通途径的通勤者和喜欢骑摩托车休閒的爱好者组成。经济波动影响了市场,但摩托车由于拥有和营运成本低,仍然是受欢迎的选择。儘管市场仍处于起步阶段,但人们对电动车款的兴趣正在增长。

南美洲摩托车市场的趋势

需求激增和政府奖励推动南美洲电动车市场发展

- 巴西、阿根廷等南美国家汽车市场潜力巨大。近年来,南美汽车工业经历了显着增长。该地区对电动车(EV)的需求不断增长,尤其是在乘用车领域。这种激增可以归因于人们意识的提高、对环境问题的日益关注以及政府鼓励采用电动车的倡议等因素。事实上,该地区的电动车销量已呈现显着成长,2022 年比 2021 年成长了 17.95%。

- 南美市场多元化,预计电动车将快速成长。巴西尤其重视可再生能源发电,并正在考虑转向电动公车,因为巴西拥有丰富的铌和锂蕴藏量,这对于电动车电池的发展至关重要。 2022年12月,圣保罗宣布计画禁止购买柴油公车,并在2024年底年终引进2,600辆电动公车。预计其他南美国家也将出现类似的趋势,预计2024年至2030年间汽车电气化程度将会提高。

- 南美国家的政府政策和奖励计画将成为该地区汽车电气化的主要驱动力。例如,税收优惠政策发挥着至关重要的作用。例如,哥伦比亚政府设定了一个雄心勃勃的目标,即到 2030 年让 60 万辆电动车上路,并正在利用奖励和补贴来减少碳排放。由于其他南美国家也有望采取类似倡议,电动车销量预计将在 2024 年至 2030 年间激增。

南美洲摩托车产业概况

南美洲摩托车市场适度整合,前五大公司占据61.02%的市占率。市场的主要企业有:巴贾杰汽车有限公司、本田汽车、川崎重工业有限公司、铃木汽车公司和雅马哈摩托车有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 燃油价格

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 推进类型

- 混合动力汽车和电动车

- 内燃机(电动车)

- 国家

- 阿根廷

- 巴西

- 南美洲其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Bajaj Auto Ltd.

- Harley-Davidson

- Hero MotoCorp Ltd.

- Honda Motor Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- KTM Motorcycles

- Royal Enfield

- Suzuki Motor Corporation

- TVS Motor Company Limited

- Yamaha Motor Company Limited

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50002261

The South America Two-Wheeler Market size is estimated at 16.13 billion USD in 2025, and is expected to reach 21.03 billion USD by 2029, growing at a CAGR of 6.85% during the forecast period (2025-2029).

The South American two-wheeler market is growing by blending traditional and electric preferences, driven by tech, policy, and sustainability

- In 2023, the South American market for two-wheelers saw a modest increase, with sales reaching 3,010,000 units from 2,980,000 units in 2022. This growth indicates a steady demand for two-wheelers as essential transportation tools in the region, reflecting the economic recovery, urbanization trends, and the increasing need for affordable mobility solutions. The ongoing demand for two-wheelers is supported by a mix of traditional ICE models and a growing interest in hybrid and EVs.

- The shift toward electric two-wheelers, although still in its early stages compared to global standards, is gaining momentum, fueled by improvements in EV infrastructure, governmental incentives aimed at reducing carbon emissions, and a growing consumer consciousness toward environmental sustainability. The forecasted data indicate continued growth in the two-wheeler market across South America, with sales projected to reach 4,220,000 units by 2030. This expected growth trajectory highlights not only the enduring appeal of two-wheelers as a convenient and cost-effective mode of transportation but also a significant shift in market dynamics toward electrification.

- As technological advancements make electric two-wheelers more accessible and governments enhance supportive policies, the market is poised for a transformative shift toward sustainable mobility. This period will likely witness an increasing integration of electric models into the mainstream two-wheeler market, reflecting broader global trends toward environmental responsibility and innovation in transportation.

Two-wheelers are preferred in South America for urban mobility due to affordability, with varying adoption rates across countries

- The two-wheeler market in South America has a very strong preference for motorcycles and scooters as economical and practical transportation options. While economic challenges and safety concerns are prevalent, the potential for growth, especially in the electric two-wheeler segment, presents opportunities for manufacturers and policymakers to cater to evolving consumer needs and sustainability goals.

- The two-wheeler market in South America reflects diverse preferences and usage patterns across different countries, influenced by factors such as urbanization, economic conditions, and transportation infrastructure. Brazil is the largest two-wheeler market in South America, with motorcycles being the preferred mode of transportation for a significant portion of the population. The market is driven by the need for affordable and efficient transportation solutions, especially in urban and semi-urban areas. Brazil has a robust local manufacturing industry, with major global and local brands offering a wide range of two-wheelers.

- The country also sees significant interest in off-road motorcycles due to its diverse terrain. The two-wheeler market in Argentina caters to a mix of commuters looking for cost-effective transport solutions and enthusiasts who prefer motorcycles for leisure. Economic fluctuations have impacted the market, but two-wheelers remain a popular choice due to their low cost of ownership and operation. There is a growing interest in electric models, although the market is still in its early stages.

South America Two-Wheeler Market Trends

Surging demand and government incentives propel South America's electric vehicle market

- Countries like Brazil and Argentina in South America show significant potential in the automobile market. The South American vehicle industry has witnessed notable growth in recent years. Notably, the region has seen a rising demand for electric vehicles (EVs), especially in the passenger car segment. This surge can be attributed to factors like heightened awareness, growing environmental concerns, and governmental initiatives promoting EV adoption. In fact, EV sales in the region saw a notable increase, growing by 17.95% in 2022 compared to 2021.

- South America, with its diverse markets, is poised for a surge in electric vehicles. Brazil, in particular, is eyeing a shift toward electric buses, driven by its focus on renewable power generation and its abundant reserves of niobium and lithium, crucial for EV battery development. A significant move in this direction came in December 2022 when Sao Paulo banned diesel bus purchases and announced plans to deploy 2600 electric buses by 2024-end. Similar trends in other South American nations are expected to drive vehicle electrification from 2024 to 2030.

- Government policies and incentive programs across South American nations are set to be key drivers for vehicle electrification in the region. Tax benefits, for instance, are playing a pivotal role. Colombia's government, for instance, is leveraging incentives and subsidies with an ambitious target of putting 600,000 EVs on its roads by 2030, aiming to tackle carbon emissions. With similar initiatives anticipated in other South American countries, the sales of EVs are expected to witness a surge from 2024 to 2030.

South America Two-Wheeler Industry Overview

The South America Two-Wheeler Market is moderately consolidated, with the top five companies occupying 61.02%. The major players in this market are Bajaj Auto Ltd., Honda Motor Co. Ltd., Kawasaki Heavy Industries Ltd., Suzuki Motor Corporation and Yamaha Motor Company Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.2 ICE

- 5.2 Country

- 5.2.1 Argentina

- 5.2.2 Brazil

- 5.2.3 Rest-of-South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Bajaj Auto Ltd.

- 6.4.2 Harley-Davidson

- 6.4.3 Hero MotoCorp Ltd.

- 6.4.4 Honda Motor Co. Ltd.

- 6.4.5 Kawasaki Heavy Industries Ltd.

- 6.4.6 KTM Motorcycles

- 6.4.7 Royal Enfield

- 6.4.8 Suzuki Motor Corporation

- 6.4.9 TVS Motor Company Limited

- 6.4.10 Yamaha Motor Company Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219