|

市场调查报告书

商品编码

1693638

中国摩托车市场:市占率分析、产业趋势与统计、成长预测(2025-2030年)China Two Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

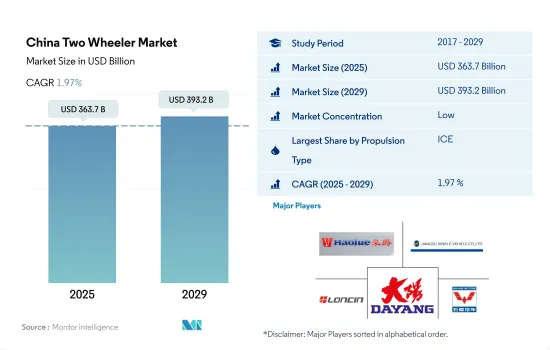

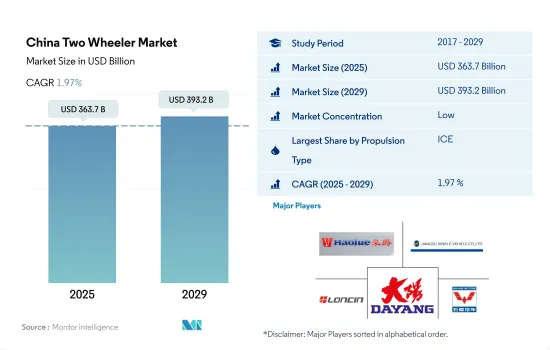

预计 2025 年中国摩托车市场规模为 3,637 亿美元,到 2029 年将达到 3,932 亿美元,预测期内(2025-2029 年)的复合年增长率为 1.97%。

在电动车进步和政府加强个人移动解决方案的支持政策的推动下,预计到 2030 年,中国摩托车市场将稳步成长。

- 2023年,中国摩托车整体销售量将达到1,980.5万辆,较上年的1913.16万辆有所成长,呈现持续成长的趋势。这一增长反映了都市化和个人移动解决方案需求不断增长的背景下,对两轮车(包括内燃机车和电动车)的需求不断增长。 2024 年的预测显示,这一数字预计将增长至 21,108,080 辆,这证实了人们对 PTW 作为一种重要交通方式的持续兴趣。

- 政府政策在塑造中国摩托车市场方面发挥关键作用,重点强调减少污染和推广电动车。这些努力,加上电动车技术和基础设施的进步,不仅为电动两轮车创造了良好的环境,而且还刺激了整个两轮车市场的成长。此外,疫情后的復苏正在重新激发对个人行动解决方案的需求,进一步推动市场扩张。

- 预计 2024 年至 2030 年期间,市场将温和成长,在 2029 年达到高峰 24,012,450 辆,然后在 2030 年略微下降至 23,737,600 辆。这一趋势表明市场日趋成熟,可能受到多种因素的影响,例如两轮车市场的饱和度、替代个人和公共运输方式的采用率可能增加,以及向电动车和永续移动解决方案的持续转变。技术创新、不断变化的消费者偏好以及政府对绿色交通的持续支持将在塑造中国摩托车市场未来发展轨迹方面发挥关键作用。

中国摩托车市场趋势

政府措施和OEM的大力投资推动中国电动车销售快速成长

- 政府减少汽车燃料排放的计画正在鼓励消费者转向更环保的汽车。 2020年11月,中国政府宣布2035年禁止使用石化燃料汽车,并承诺在新能源计画中销售100%的新能源汽车。这导致对电动车的需求增加。透过采取此类法规,中国近年来加强了电动车及其所用各种电池组的销售。

- 政府为消费者和製造商推出了各种计划和奖励,以促进和加强该国对电动车的需求。 2022年5月,政府宣布重新引入补贴计划,以增加电动车的销售量。此外,政府还将为购买电动车的客户提供1,500美元的补贴。这些因素正在鼓励消费者投资电动车,2022 年电动车销量将比 2021 年成长 2.90%。

- 电动车需求的不断增长迫使OEM计划扩大电动车类别的开发和生产。 2021年,通用汽车宣布计划在2025年将电动和自动驾驶汽车方面的支出增加到200亿美元。该公司计划在2023年推出20款新型电动车,并计划在中国每年销售超过100万辆电动车。因此,预计这些因素将在 2024 年至 2030 年期间推动中国电动车市场的发展。

中国摩托车产业概况

中国摩托车市场细分化,前五大企业占22.50%的市场。该市场的主要企业包括江门大长江集团、江苏新日电动车、隆鑫股份、洛阳北方企业集团、五羊本田摩托车(广州)等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 燃油价格

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 推进类型

- 混合动力汽车和电动车

- ICE

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Guangzhou Dayun Motorcycle Co. Ltd.

- Jiangmen Grand River Group Co. Ltd.(Jiangmen Dachangjiang Group Co. Ltd.)

- Jiangsu Xinri E-Vehicle Co. Ltd.

- JINYI Motor(China)Investment Co.Ltd.(Jinyi Vehicle Industry Co.Ltd.)

- Lifan Technology(Group)Co. Ltd.

- Loncin Motor Co. Ltd.

- Luoyang Northern Enterprises Group Co. Ltd.

- Sundiro Honda Motorcycle Co. Ltd.

- Wuyang-Honda Motors(Guangzhou)Co. Ltd.

- Zhejiang Luyuan Electric Vehicle Co. Ltd.

- Zongshen Industrial Group Co. Ltd.

第七章 CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

The China Two Wheeler Market size is estimated at 363.7 billion USD in 2025, and is expected to reach 393.2 billion USD by 2029, growing at a CAGR of 1.97% during the forecast period (2025-2029).

The Chinese two-wheeler market is set to grow steadily through 2030, driven by advancements in electric vehicles and supportive government policies enhancing personal mobility solutions

- In 2023, the overall sales for two-wheelers in China reached 19,800,500 units, indicating a consistent growth trend from the previous year's 19,131,600 units. This growth reflects the increasing demand for two-wheelers, encompassing both ICE and electric vehicles, amid urbanization and the growing need for personal mobility solutions. The forecast for 2024 projects an increase to 21,108,080 units, underscoring a sustained interest in two-wheelers as essential transport tools.

- Government policies have played a crucial role in shaping the two-wheeler market in China, with significant emphasis on reducing pollution and promoting EVs. These initiatives, coupled with advancements in EV technology and infrastructure, have not only fostered a favorable environment for electric two-wheelers but also stimulated the overall two-wheeler market growth. Additionally, the post-pandemic recovery has witnessed a resurgence in the demand for personal mobility solutions, further propelling market expansion.

- From the 2024 to 2030 period, the market is expected to witness gradual growth, with projections indicating a peak at 24,012,450 units in 2029 before a slight decline to 23,737,600 units in 2030. This trend indicates a maturing market that could be influenced by factors such as market saturation for two-wheelers, the potential for increased adoption of alternative personal and public transportation methods, and the ongoing shift toward electric and sustainable mobility solutions. Technological innovations, along with evolving consumer preferences and continued government support for green transportation, will play critical roles in shaping the future trajectory of the Chinese two-wheeler market.

China Two Wheeler Market Trends

Government initiatives and strong OEM investments drive rapid drowth in electric vehicle sales in China

- The programs launched by the government to reduce gas emissions caused by vehicle fuels are encouraging consumers to shift to green vehicles. In November 2020, the government of China announced a ban on fossil fuel vehicles by 2035, clearly stating the selling of 100% new energy vehicles under the new energy program. As a result, the demand for electric cars increased. Adopting such regulations enhanced the sales of electric cars and various types of battery packs used in them in China in recent years.

- The government is introducing various schemes and incentives for customers and manufacturers to promote and enhance the demand for electric vehicles in the country. In May 2022, the government announced the reintroduction of the subsidy program to increase the sales of electric vehicles. Moreover, the government will allocate a subsidy of USD 1500 to customers opting for an electric car. Such factors have encouraged customers to invest in electric mobility, which further has increased the sales of electric cars by 2.90% in 2022 over 2021 in China.

- The growing demand for electric vehicles has forced OEMs to plan to increase development and production in the electric vehicle category. In 2021, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company is expected to launch 20 new electric models by 2023 and aims to sell more than 1 million electric cars a year in China. As a result, these factors are expected to drive the electric vehicle market in China during the 2024-2030 period.

China Two Wheeler Industry Overview

The China Two Wheeler Market is fragmented, with the top five companies occupying 22.50%. The major players in this market are Jiangmen Grand River Group Co. Ltd.(Jiangmen Dachangjiang Group Co. Ltd.), Jiangsu Xinri E-Vehicle Co. Ltd., Loncin Motor Co. Ltd., Luoyang Northern Enterprises Group Co. Ltd. and Wuyang-Honda Motors (Guangzhou) Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.2 ICE

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Guangzhou Dayun Motorcycle Co. Ltd.

- 6.4.2 Jiangmen Grand River Group Co. Ltd.(Jiangmen Dachangjiang Group Co. Ltd.)

- 6.4.3 Jiangsu Xinri E-Vehicle Co. Ltd.

- 6.4.4 JINYI Motor (China) Investment Co.Ltd. (Jinyi Vehicle Industry Co.Ltd.)

- 6.4.5 Lifan Technology (Group) Co. Ltd.

- 6.4.6 Loncin Motor Co. Ltd.

- 6.4.7 Luoyang Northern Enterprises Group Co. Ltd.

- 6.4.8 Sundiro Honda Motorcycle Co. Ltd.

- 6.4.9 Wuyang-Honda Motors (Guangzhou) Co. Ltd.

- 6.4.10 Zhejiang Luyuan Electric Vehicle Co. Ltd.

- 6.4.11 Zongshen Industrial Group Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms