|

市场调查报告书

商品编码

1684107

欧洲摩托车市场:市场占有率分析、产业趋势与统计、成长预测(2025-2029)Europe Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

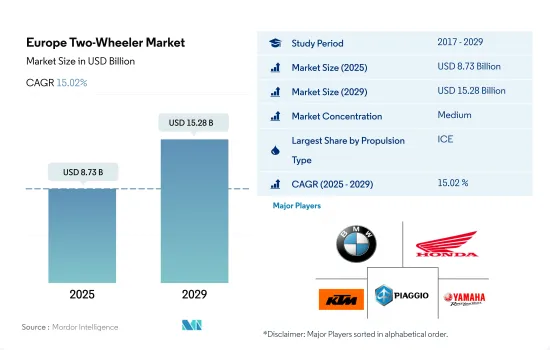

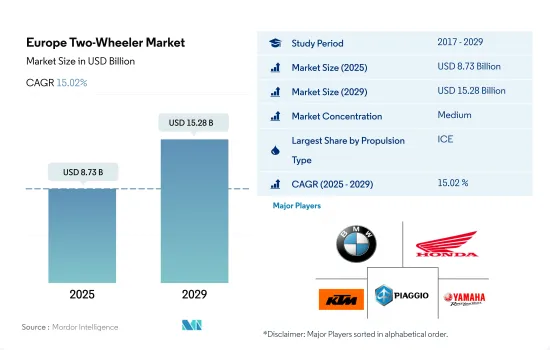

预计 2025 年欧洲摩托车市场规模将达到 87.3 亿美元,到 2029 年将达到 152.8 亿美元,预测期内(2025-2029 年)的复合年增长率为 15.02%。

欧洲摩托车市场的稳定成长标誌着在技术进步、政策和消费者偏好变化的推动下,摩托车市场向电气化和永续性转变。

- 2023年,欧洲摩托车市场呈现成长格局,销售量将达到1,256,184辆,高于前一年的1,188,468辆。这种增长反映了人们对摩托车作为主要和次要交通途径的兴趣日益增长,其驱动力都市化、寻求更永续的通勤方式以及摩托车对休閒活动的吸引力不断增加。

- 欧洲市场的扩张很大程度上受到混合动力汽车和电动两轮车的快速普及的推动。这项变革受到多种因素的推动,包括更严格的环境法规、旨在推广更清洁的交通途径的政府奖励以及消费者减少碳排放意识的增强。这些因素,加上电动两轮车技术的进步,例如电池寿命的延长、充电时间的缩短和性能的提升,使得电动两轮车成为越来越可行、越来越有吸引力的选择,适合更广泛的消费者。

- 2024年至2030年的预测资料显示,欧洲摩托车销量将稳定成长,2030年将达到1,730,220辆。这种持续的成长轨迹凸显了两轮车作为一种灵活、高效和永续的交通途径的持久吸引力。预计电动两轮车销量的持续成长将对这一成长做出重大贡献,反映出交通运输产业电气化的大趋势。

製造商正在投资研发,以推出更有效率、更安全、更智慧的两轮车,并在电池技术、自动驾驶能力和连接性方面取得进展。

- 在技术进步、消费者偏好变化和日益增长的环境问题等因素的推动下,欧洲摩托车市场正在经历显着的成长和转型。该市场包括各种机动车辆,包括摩托车、Scooter、轻型机踏车和电动两轮车。需求激增,尤其是对电动两轮车的需求,反映了该地区对永续交通解决方案的日益重视。政府奖励、更严格的排放法规以及不断扩大的电动车基础设施进一步推动了这种转变,使电动两轮车成为消费者越来越有吸引力的选择。

- 欧洲的消费趋势正在发生变化,明显的趋势是寻求便利、实惠且对环境影响较小的城市交通解决方案。两轮车,尤其是Scooter和轻型机踏车,正在成为一种流行的城市交通选择,因为它们比汽车更能有效地穿越交通,运作成本更低,而且更容易停放。这一趋势与摩托车共享平台和租赁服务的日益普及相辅相成,它们提供了灵活且经济高效的行动解决方案,而无需拥有摩托车。此外,两轮车上出现的智慧连接功能(如 GPS 导航、防盗系统和智慧型手机整合)增强了骑乘体验,并使其对精通技术的消费者俱有吸引力。

欧洲摩托车市场趋势

环境问题、政府支持和脱碳目标刺激了欧洲电动车的需求和销售

- 近年来,欧洲国家对电动车的需求和销售量大幅成长。德国 2022 年电动车销量与 2021 年相比成长了 22%,其次是英国,2022 年电动车销量与 2021 年相比成长了 18.40%。日益增长的环境问题、严格的政府规范、电动车的优势(例如更好的燃油经济性、更低的服务成本、更少的碳排放)以及政府补贴是推动欧洲国家电动车成长的一些因素。

- 欧洲国家对电动商用车,特别是轻型卡车的需求逐渐增加。此外,世界各国政府也支持电动车的普及。 2021年11月,英国政府宣布承诺在2040年实现所有重型车辆零排放。这些因素将使2022年英国电动商用车销量较2021年成长23.17%,不同国家的类似做法将推动整个欧洲对电动商用车的需求。

- 预计未来几年欧洲国家的汽车电气化将呈指数级增长。预计政府在脱碳方面的努力将推动欧洲电动商用车市场的发展。例如,2022年1月,德国交通部长宣布了2030年道路上电动车保有量达到1,500万辆的目标。受这些因素影响,预计2024年至2030年间欧洲国家的电动车销量将会成长。

欧洲摩托车产业概况

欧洲摩托车市场适度整合,前五大企业占41.80%的市占率。市场的主要企业有:宝马摩托车、本田摩托车、KTM 摩托车、比亚乔公司和雅马哈摩托车有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 燃油价格

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 推进类型

- 混合动力汽车和电动车

- 内燃机(电动车)

- 国家

- 奥地利

- 比利时

- 捷克共和国

- 丹麦

- 爱沙尼亚

- 法国

- 德国

- 爱尔兰

- 义大利

- 拉脱维亚

- 立陶宛

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 瑞典

- 英国

- 其他欧洲国家

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- BMW Motorrad

- Ducati Motor Holding SpA

- Harley-Davidson

- Honda Motor Co.,Ltd.

- KTM Motorcycles

- Piaggio & C. SpA

- Royal Enfield

- Suzuki Motor Corporation

- Triumph Motorcycles Ltd

- Yamaha Motor Company Limited

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50002259

The Europe Two-Wheeler Market size is estimated at 8.73 billion USD in 2025, and is expected to reach 15.28 billion USD by 2029, growing at a CAGR of 15.02% during the forecast period (2025-2029).

The European two-wheeler market's steady growth signifies an electrification and sustainability shift driven by tech advancements, policies, and changing consumer preferences

- In 2023, the European market for two-wheelers exhibited a growth pattern, with sales totaling 1,256,184 units, indicating an increase from the previous year's 1,188,468 units. This growth reflected an expanding interest in two-wheelers as both a primary and secondary mode of transportation, fueled by urbanization, the search for more sustainable commuting options, and the increased appeal of two-wheelers for leisure activities.

- The European market's progression is significantly influenced by the surge in hybrid and electric two-wheeler adoption. This shift is supported by a combination of factors, including stringent environmental regulations, government incentives aimed at promoting cleaner modes of transportation, and growing consumer consciousness towards reducing carbon footprints. These elements, coupled with advancements in electric two-wheeler technology-such as improved battery life, shorter charging times, and enhanced performance-are making electric options increasingly viable and attractive to a broader segment of consumers.

- From 2024 to 2030, the forecasted data indicated a steady increase in two-wheeler sales across Europe, with projections showing that sales could reach 1,730,220 units by 2030. This sustained growth trajectory underscores the enduring appeal of two-wheelers as a flexible, efficient, and sustainable mode of transportation. The continued rise in electric two-wheeler sales is expected to significantly contribute to this growth, reflecting a broader trend towards electrification in the transportation sector.

Manufacturers are investing in R&D to introduce more efficient, safer, and smarter two-wheelers with advancements in battery technology, autonomous driving features, and connectivity

- The European two-wheeler market has been witnessing significant growth and transformation, driven by a combination of technological advancements, changing consumer preferences, and increasing environmental concerns. The market encompasses a wide range of vehicles, including motorcycles, scooters, mopeds, and electrically powered two-wheelers. The surge in demand for electric two-wheelers, in particular, reflects the region's growing commitment to sustainable transportation solutions. This shift is further supported by government incentives, stricter emission regulations, and an expanding infrastructure for electric vehicles, making electric two-wheelers an increasingly attractive option for consumers.

- Consumer preferences in Europe have been evolving, with a noticeable trend toward urban mobility solutions that offer convenience, affordability, and reduced environmental impact. Two-wheelers, especially scooters and mopeds, have become popular urban transport options due to their ability to navigate through traffic more efficiently than cars, lower operating costs, and ease of parking. This trend is complemented by the growing popularity of ride-sharing platforms and rental services for two-wheelers, which offer flexible and cost-effective mobility solutions without the need for ownership. Additionally, the advent of smart connectivity features in two-wheelers, such as GPS navigation, anti-theft systems, and smartphone integration, has enhanced the riding experience, making them more appealing to tech-savvy consumers.

Europe Two-Wheeler Market Trends

Environmental concerns, government support, and decarbonization goals fuel European electric vehicle demand and sales

- The demand and sales of electric vehicles in European countries have grown significantly over the past few years. Germany witnessed a growth in the sales of electric cars by 22% in 2022 over 2021, followed by the United Kingdom with an 18.40% increase in 2022 over 2021. Growing environmental concerns, stringent governmental norms, advantages of electric vehicles such as fuel efficiency, low service cost, no carbon emissions, and subsidies by the government are some of the factors contributing to the growth of electric vehicles in European countries.

- The demand for electric commercial vehicles, especially light trucks, is growing gradually in European countries. Moreover, the governments of various countries are also supporting the adoption of electric vehicles. In November 2021, the government of the United Kingdom announced a pledge that all heavy-duty vehicles would be zero-emission by the year 2040. Such factors have increased the sales of electric commercial vehicles in the United Kingdom by 23.17% in 2022 over 2021, and similar practices in various countries are enhancing the demand for electric commercial vehicles across Europe.

- It is projected that the electrification of vehicles in European countries is expected to grow tremendously in the next few years. The efforts of the governments in the regions for decarbonization are expected to drive the electric commercial vehicle market in Europe. For instance, in January 2022, the transport minister of Germany announced a goal to put 15 million electric vehicles on the road by 2030. Such factors are expected to increase the sales of electric vehicles during the 2024-2030 period in European countries.

Europe Two-Wheeler Industry Overview

The Europe Two-Wheeler Market is moderately consolidated, with the top five companies occupying 41.80%. The major players in this market are BMW Motorrad, Honda Motor Co.,Ltd., KTM Motorcycles, Piaggio & C. SpA and Yamaha Motor Company Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.2 ICE

- 5.2 Country

- 5.2.1 Austria

- 5.2.2 Belgium

- 5.2.3 Czech Republic

- 5.2.4 Denmark

- 5.2.5 Estonia

- 5.2.6 France

- 5.2.7 Germany

- 5.2.8 Ireland

- 5.2.9 Italy

- 5.2.10 Latvia

- 5.2.11 Lithuania

- 5.2.12 Norway

- 5.2.13 Poland

- 5.2.14 Russia

- 5.2.15 Spain

- 5.2.16 Sweden

- 5.2.17 UK

- 5.2.18 Rest-of-Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BMW Motorrad

- 6.4.2 Ducati Motor Holding S.p.A.

- 6.4.3 Harley-Davidson

- 6.4.4 Honda Motor Co.,Ltd.

- 6.4.5 KTM Motorcycles

- 6.4.6 Piaggio & C. SpA

- 6.4.7 Royal Enfield

- 6.4.8 Suzuki Motor Corporation

- 6.4.9 Triumph Motorcycles Ltd

- 6.4.10 Yamaha Motor Company Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219