|

市场调查报告书

商品编码

1693658

摩托车 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

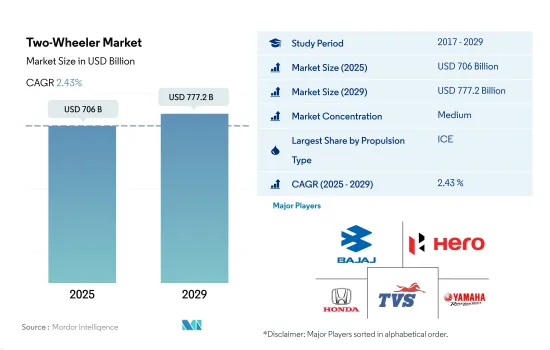

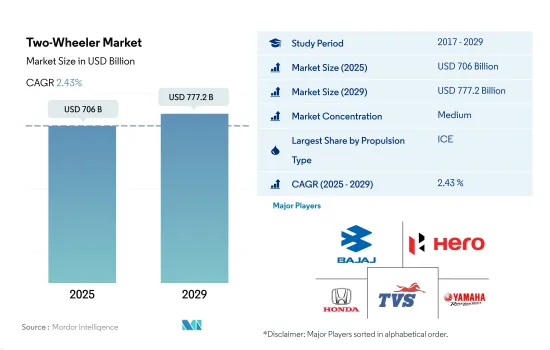

预计 2025 年摩托车市场规模将达到 7,060 亿美元,到 2029 年将达到 7,772 亿美元,预测期内(2025-2029 年)的复合年增长率为 2.43%。

开发中国家GDP 和人均收入的成长将推动全球摩托车需求

- 电子商务和共用微型行动服务的快速成长,尤其是在中国和印度等新兴经济体,正在刺激都市区采用两轮车。凭藉实惠的价格和基于应用程式的便利性,两轮车吸引了越来越多的客户群。

- 此外,开发中国家GDP 和人均收入的提高也推动了全球对摩托车的需求。收入的激增催生了庞大的消费阶层,并推动了整体消费。尤其是印度、泰国、印尼等国家的农村人均可支配所得预计将快速成长。

- 人们对汽车排放的担忧日益加剧,促使世界各国政府加强监管。汽车製造商越来越重视减轻重量以提高燃油效率。作为一种减少排放气体的方式,电动车(EV)在许多新兴经济体中越来越受欢迎。世界各国政府都在透过补贴和免税政策来奖励人们采用电动车。例如,在印度,混合动力汽车和电动车快速采用和製造 (FAME) 计划为电动两轮车购买者提供每千瓦时电池容量 10,000 印度卢比(约 200 万美元)的补贴。 FAME倡议已拨款 200 亿印度卢比,用于支持 2022 年 3 月销售约 100 万辆电动两轮车。

世界各地的摩托车趋势差异很大。亚洲销售领先,欧美追求奢华,新兴地区成长参差不齐

- 亚太摩托车市场非常活跃。它是世界上最大的,特别是印度、中国和东南亚等国家,由于人口密度高。摩托车和Scooter因其价格便宜、燃油效率高以及在拥挤的都市区行驶的便利性而广受欢迎。该地区拥有强大的本地製造业基础、强大的供应链以及鼓励使用两轮车的政府支持政策。此外,人们对环境问题的认识不断提高、政府对电动车的激励措施以及电池技术的进步,正在帮助电动两轮车在这个市场上获得发展动力。

- 相较之下,在北美和欧洲,摩托车市场通常被视为爱好者市场,而不是必需品市场。在这些地区,人们更倾向于选择高功率的两轮车,而不是Scooter和轻型机踏车。该市场的特点是消费者对高端运动型摩托车的需求,哈雷戴维森、宝马和杜卡迪等公司拥有较高的品牌忠诚度。环境问题和城市交通解决方案正在重塑市场,推动向电动和混合模式的转变。欧洲城市尤其透过严格的排放法规和购买电动车的奖励来鼓励这种转变。

- 在南美洲、非洲和中东等其他地区,则呈现出不同的模式。在南美,市场规模较小,但与亚太地区一样,摩托车对于都市区和农村的交通至关重要。随着都市化加快和道路基础设施改善,对经济实惠的交通工具的需求推动了非洲摩托车市场的成长。

全球摩托车市场趋势

全球需求成长和政府支持将推动电动车市场成长

- 电动车(EV)因其具有提高能源效率、减少温室气体和污染排放的潜力,已成为汽车产业的重要组成部分。这种快速成长背后的主要因素是日益增长的环境问题和政府的支持政策。其中,电动车全球销售呈现强劲成长势头,2022年较2021年成长10.82%。据预测,2025年底,电动乘用车年销量将超过500万辆,约占汽车总销量的15%。

- 领先的製造商和组织(例如伦敦警察厅和消防队)正在积极推行电动车策略。例如,该公司设定了在 2025 年实现零排放汽车、在 2030 年实现 40% 货车电气化、到 2040 年实现全电动化的目标。预计全球也将出现类似的趋势,2024 年至 2030 年间电动车的需求和销售量将急剧成长。

- 在电池技术和汽车电气化进步的推动下,亚太地区和欧洲有望主导电动车生产。 2020年5月,起亚汽车欧洲公司公布“S计划”,宣布转向电动化策略。这项决定是在起亚电动车在欧洲创下销售纪录之际做出的。起亚雄心勃勃地计划在 2025 年之前在全球推出 11 款电动车,涵盖轿车、SUV 和 MPV 等各个领域。该公司的目标是到 2026 年实现全球电动车年销量达到 50 万辆。

机车业概况

摩托车市场适度整合,前五大企业占52.50%的市场。该市场的主要企业有 Bajaj Auto Ltd.、Hero MotoCorp Ltd.、本田汽车、TVS Motor Company Limited、雅马哈摩托车公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 人均GDP

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 消费者汽车购买支出(cvp)

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 通货膨胀率

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 新款 Xev 车型发布

- 燃油价格

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 推进类型

- 电动车

- 混合动力汽车和电动车

- ICE

- 地区

- 非洲

- 南非

- 非洲以外

- 亚太地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 韩国

- 泰国

- 其他亚太地区

- 欧洲

- 奥地利

- 比利时

- 捷克共和国

- 丹麦

- 爱沙尼亚

- 法国

- 德国

- 爱尔兰

- 义大利

- 拉脱维亚

- 立陶宛

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 瑞典

- 英国

- 其他欧洲国家

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地区

- 非洲

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Aima Technology Group Co. Ltd.

- Ather Energy Pvt. Ltd.

- Bajaj Auto Ltd.

- Harley-Davidson

- Hero MotoCorp Ltd.

- Honda Motor Co. Ltd.

- KTM Motorcycles

- Piaggio & C. SpA

- TVS Motor Company Limited

- Yadea Technology Group Co. Ltd.

- Yamaha Motor Company Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93051

The Two-Wheeler Market size is estimated at 706 billion USD in 2025, and is expected to reach 777.2 billion USD by 2029, growing at a CAGR of 2.43% during the forecast period (2025-2029).

The rising GDP and per capita income in developing nations bolsters the global demand for two-wheelers

- The surge in e-commerce and shared micro-mobility services, particularly in emerging economies like China and India, is fueling the adoption of two-wheelers in urban areas. With their pocket-friendly prices and app-based convenience, two-wheelers are attracting a growing customer base.

- Moreover, the rising GDP and per capita income in developing nations are bolstering the global demand for two-wheelers. This surge in income has created a substantial consumer class, driving overall consumption. Notably, the per capita disposable income in rural areas of countries like India, Thailand, and Indonesia is expected to witness rapid growth.

- The mounting concerns over vehicular emissions have prompted governments worldwide to tighten regulations. Automotive manufacturers are increasingly prioritizing weight reduction to enhance fuel efficiency. Electric vehicles (EVs) are gaining traction in many developing economies as a means to curb emissions. Governments are incentivizing EV adoption through subsidies and tax exemptions. For instance, in India, the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles (FAME) program offers subsidies of INR 10,000 per kWh of battery capacity for electric two-wheeler buyers. The FAME initiative allocated INR 2,000 crore to support the sale of nearly 1 million electric two-wheelers by March 2022.

Global two-wheeler trends vary: Asia leads in volume, the West prefers luxury, and emerging regions show mixed growth

- In Asia-Pacific, the two-wheeler market is highly dynamic. It is the largest in the world due to the high population density, particularly in countries like India, China, and Southeast Asia. Motorcycles and scooters are popular due to their affordability, fuel efficiency, and convenience in navigating congested urban areas. This region has a robust local manufacturing base, strong supply chains, and supportive government policies encouraging two-wheeler use. Additionally, electric two-wheelers are gaining traction in this market, driven by increasing awareness of environmental issues, government incentives for electric vehicles, and advancements in battery technology.

- Contrastingly, in North America and Europe, the two-wheeler market is often seen as a segment for enthusiasts rather than a necessity. These regions exhibit a strong preference for higher-powered motorcycles over scooters or mopeds. The market is characterized by a demand for luxury and sports motorcycles, with companies like Harley-Davidson, BMW, and Ducati enjoying significant brand loyalty. Environmental considerations and urban mobility solutions are reshaping the market, with an increasing shift toward electric and hybrid models. European cities, particularly, are fostering this shift with stringent emission regulations and incentives for electric vehicle purchases.

- The Rest of the World, encompassing South America, Africa, and the Middle East, shows a mixed pattern. In South America, motorcycles are essential for urban and rural transportation, similar to Asia-Pacific, though the market is smaller. Africa's two-wheeler market is growing, driven by the need for affordable transportation amid expanding urbanization and improving road infrastructure.

Global Two-Wheeler Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Two-Wheeler Industry Overview

The Two-Wheeler Market is moderately consolidated, with the top five companies occupying 52.50%. The major players in this market are Bajaj Auto Ltd., Hero MotoCorp Ltd., Honda Motor Co. Ltd., TVS Motor Company Limited and Yamaha Motor Company Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.8.1 Africa

- 4.8.2 Asia-Pacific

- 4.8.3 Europe

- 4.8.4 Middle East

- 4.8.5 North America

- 4.8.6 South America

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Electric

- 5.1.2 Hybrid and Electric Vehicles

- 5.1.3 ICE

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 South Africa

- 5.2.1.2 Rest-of-Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 Australia

- 5.2.2.2 China

- 5.2.2.3 India

- 5.2.2.4 Indonesia

- 5.2.2.5 Japan

- 5.2.2.6 Malaysia

- 5.2.2.7 South Korea

- 5.2.2.8 Thailand

- 5.2.2.9 Rest-of-APAC

- 5.2.3 Europe

- 5.2.3.1 Austria

- 5.2.3.2 Belgium

- 5.2.3.3 Czech Republic

- 5.2.3.4 Denmark

- 5.2.3.5 Estonia

- 5.2.3.6 France

- 5.2.3.7 Germany

- 5.2.3.8 Ireland

- 5.2.3.9 Italy

- 5.2.3.10 Latvia

- 5.2.3.11 Lithuania

- 5.2.3.12 Norway

- 5.2.3.13 Poland

- 5.2.3.14 Russia

- 5.2.3.15 Spain

- 5.2.3.16 Sweden

- 5.2.3.17 UK

- 5.2.3.18 Rest-of-Europe

- 5.2.4 Middle East

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 UAE

- 5.2.4.3 Rest-of-Middle East

- 5.2.5 North America

- 5.2.5.1 Canada

- 5.2.5.2 Mexico

- 5.2.5.3 US

- 5.2.6 South America

- 5.2.6.1 Argentina

- 5.2.6.2 Brazil

- 5.2.6.3 Rest-of-South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aima Technology Group Co. Ltd.

- 6.4.2 Ather Energy Pvt. Ltd.

- 6.4.3 Bajaj Auto Ltd.

- 6.4.4 Harley-Davidson

- 6.4.5 Hero MotoCorp Ltd.

- 6.4.6 Honda Motor Co. Ltd.

- 6.4.7 KTM Motorcycles

- 6.4.8 Piaggio & C. SpA

- 6.4.9 TVS Motor Company Limited

- 6.4.10 Yadea Technology Group Co. Ltd.

- 6.4.11 Yamaha Motor Company Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219