|

市场调查报告书

商品编码

1692147

非洲两轮车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Africa Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

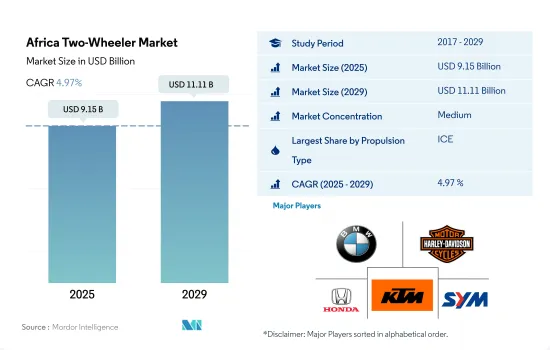

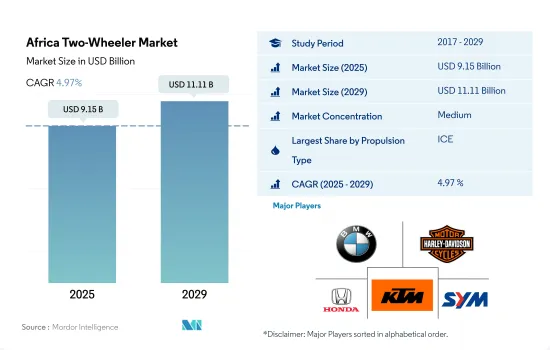

预计 2025 年非洲摩托车市场规模将达到 91.5 亿美元,到 2029 年预计将达到 111.1 亿美元,预测期内(2025-2029 年)的复合年增长率为 4.97%。

在都市化和永续交通解决方案需求的推动下,非洲摩托车市场有望经历显着成长。

- 2023 年,非洲摩托车市场将呈现復苏和成长态势,销量将达到 188 万辆,高于 2022 年的 185 万辆。这一增长凸显了整个非洲大陆对两轮车的依赖日益增加,推动因素包括两轮车价格实惠、可灵活应对不同地形,以及消费者对永续和高效出行解决方案(包括电动两轮车 ( E2W ))的兴趣日益浓厚。

- 预计 2024 年销量将显着增加至 199 万辆,反映出两轮车作为都市区和农村交通必需的交通工具,需求旺盛。非洲政府致力于改善道路安全、加强基础设施和推广环保型交通途径的措施对摩托车市场产生了积极影响。整个非洲大陆的E2W政策和奖励各不相同,但正逐步向永续流动性转变,以符合全球趋势和当地环境目标。

- 2024 年至 2030 年间,非洲摩托车市场可能会经历显着成长,预测期末销量将达到 232.5 万辆。这一预期成长是由都市化加快、经济发展和对便利交通途径的迫切需求所推动的。技术、可负担性、改善的基础设施和日益增强的环境永续意识都有可能推动E2W的广泛采用,为整个非洲两轮车市场的蓬勃发展奠定基础。

都市化、经济因素以及对经济实惠和永续的交通解决方案日益增长的需求的推动,亚洲摩托车市场正在经历强劲增长。

- 在都市化、经济发展和对经济高效运输解决方案的需求不断增长的推动下,非洲摩托车市场正在经历强劲增长。随着非洲大陆的城市不断扩张,两轮车逐渐成为私家车的实用、经济的替代品,为在拥挤的都市区出行提供了更大的机动性和便利性。

- 南非两轮车市场一直持续成长,在城市交通解决方案中发挥至关重要的作用。预计 2023 年销量将达到 15,620 辆,较 2022 年的 15,120 辆有显着成长。这一增长表明,全国范围内对两轮车的兴趣激增,因为价格低廉、能够灵活避开交通拥堵以及燃料成本上涨,使两轮车成为个人交通的有吸引力的替代品。

- 受经济成长和对永续交通途径日益增长的偏好的推动,非洲其他地区的摩托车市场正在崛起。 2023 年,该细分市场呈现扩张趋势,销量将从 2022 年的 1,836,980 辆小幅增长至 1,866,540 辆。这一增长证实了两轮车在该地区交通生态系统中发挥着不可或缺的作用,可在不同的地理和社会经济环境中提供经济实惠、便捷且高效的交通途径。

非洲摩托车市场的趋势

非洲交通电气化迅速扩张,各类车辆电气化大幅增加

- 非洲交通运输部门的电气化正在加速推进。乘用车的电气化率预计在 2022 年为 2%,到 2023 年将上升至 4%。轻型商用车 (LCV) 也将如此,其电气化率将从 2022 年的 0.20% 上升至 2023 年的 1.09%。公车是许多非洲国家公共交通的重要组成部分,其电气化率从 2022 年的 0.50% 跃升至 2023 年的 1.96%。两轮车是多个地区流行的交通途径,其电气化率也从 2022 年的 1.50% 跃升至 2023 年的 4.65%。

- 过去五年来,非洲对更绿色的交通方式的承诺变得显而易见。乘用车电气化率已从2017年的2%提升至2022年的5%。作为非洲大陆货运必不可少的轻型商用车的电气化率已从2017年的0.20%飙升至2022年的近2%。作为公共交通必不可少的公车取得了显着进展,已从2017年的0.50%提升至2022年的3.42%。同时,广泛用于日常通勤的两轮车的电气化率已从2017年的1.50%提升至2022年的7.81%。

- 展望 2024-2030 年,预计非洲所有车辆类别的电气化将持续成长。到2030年,12%的乘用车将配备电气化零件。预计到本世纪末,轻型商用车的电气化率将达到 6%,而对于永续城际旅行至关重要的公车的电气化率预计将达到 10%。以高效和经济着称的两轮车市场预计到 2030 年将实现 22% 的电气化率。

非洲摩托车产业概况

非洲摩托车市场中等集中,前五大厂商占据49.80%的市场。市场的主要企业是:宝马摩托车、哈雷戴维森、本田摩托车、KTM 摩托车和 Sym(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均国内生产毛额

- 消费者在汽车上的支出 (cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 燃油价格

- 法律规范

- 价值链与通路分析

第五章 市场区隔

- 推进类型

- 国家

- 南非

- 非洲

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- Bajaj Auto Ltd.

- BMW Motorrad

- Harley-Davidson

- Hero MotoCorp Ltd.

- Honda Motor Co. Ltd.

- KTM Motorcycles

- Lifan Technology(Group)Co. Ltd.

- Suzuki Motor Corporation

- Sym

- TVS Motor Company Limited

- Yamaha Motor Company Limited

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 90861

The Africa Two-Wheeler Market size is estimated at 9.15 billion USD in 2025, and is expected to reach 11.11 billion USD by 2029, growing at a CAGR of 4.97% during the forecast period (2025-2029).

Africa's two-wheeler market is gearing up for significant growth, driven by urbanization and the demand for sustainable transportation solutions

- In 2023, the African two-wheeler market showcased resilience and growth, with sales figures reaching 1,880,000 units, marking an improvement from 2022's 1,850,000 units. This growth highlights the increasing reliance on two-wheelers across the continent, driven by their affordability, flexibility in navigating diverse terrains, and growing consumer interest in sustainable and efficient mobility solutions, including electric two-wheelers (E2Ws).

- The forecast for 2024 anticipates a notable increase in sales to 1,990,000 units, reflecting the robust demand for two-wheelers as essential vehicles for both urban and rural transportation needs. Governmental initiatives across various African countries, focusing on improving road safety, enhancing infrastructure, and promoting environmentally friendly transportation options, have positively impacted the two-wheeler market. While policies and incentives for E2Ws vary across the continent, there is a gradual shift towards sustainable mobility, aligning with global trends and local environmental goals.

- From 2024 to 2030, the African two-wheeler market is poised for significant growth, with projections indicating sales could reach 2,325,000 units by the end of the forecast period. This expected growth is likely to be propelled by ongoing urbanization, economic development, and the critical need for accessible transportation solutions. The potential increase in E2W adoption, driven by improvements in technology, affordability, and infrastructure, alongside a heightened awareness of environmental sustainability, sets the stage for a dynamic expansion of the two-wheeler market across Africa.

The Asian two-wheeler market is experiencing robust growth driven by urbanization, economic factors, and the rising demand for affordable, sustainable transportation solutions

- The African two-wheeler market is experiencing significant growth, driven by urbanization, economic development, and the increasing demand for affordable and efficient transportation solutions. As cities across the continent continue to expand, two-wheelers have emerged as a practical and cost-effective alternative to private cars, offering greater mobility and convenience in navigating congested urban areas.

- South Africa's two-wheeler landscape is witnessing consistent growth, positioning itself as a pivotal player in the realm of urban mobility solutions. The year 2023 witnessed a surge in sales, with figures reaching 15,620 units, a notable uptick from the 15,120 units sold in 2022. This escalation signifies a burgeoning interest in two-wheelers within the nation, fueled by their affordability, agility in navigating traffic congestion, and the escalating cost of fuel, which renders two-wheelers an alluring alternative for personal transportation.

- The Rest of Africa's two-wheeler market finds itself on an upward trajectory, propelled by economic growth and a growing inclination towards sustainable transportation preferences. In 2023, this market segment witnessed an expansion, with sales reaching an impressive 1,866,540 units, a modest increment from the 1,836,980 units sold in 2022. This growth underscores the indispensable role two-wheelers play in the region's mobility ecosystem, offering affordable, accessible, and efficient transportation solutions across diverse geographic and socio-economic landscapes.

Africa Two-Wheeler Market Trends

Africa's transport electrification is expanding rapidly, with significant increases across all vehicle types

- Electrification in Africa's transport sector is gaining momentum. In 2022, the electrification rate for passenger cars was 2%, which climbed to 4% in 2023. Light commercial vehicles (LCVs) followed suit, with their electrification rate rising from 0.20% in 2022 to 1.09% in 2023. Buses, a crucial part of public transport in many African countries, saw their electrification rate surge from 0.50% in 2022 to 1.96% in 2023. Even two-wheelers, a popular mode of transport in several regions, witnessed a significant uptick, with their electrification rate leaping from 1.50% in 2022 to 4.65% in 2023.

- Over the past five years, Africa's commitment to greener transportation has been evident. The electrification rate for passenger cars rose from 2% in 2017 to 5% in 2022. LCVs, crucial for goods transport across the continent, saw their electrification rate surge from 0.20% in 2017 to nearly 2% by 2022. Buses, pivotal for mass transit, made notable progress, going from a 0.50% rate in 2017 to 3.42% by 2022. Meanwhile, the electrification percentage for two-wheelers, widely used for daily commutes, climbed from 1.50% in 2017 to 7.81% in 2022.

- Looking ahead to the period of 2024-2030, all vehicle categories in Africa are expected to witness consistent growth in electrification. By 2030, passenger cars with electric components are projected to account for 12% of the total. LCVs are anticipated to reach a 6% electrification rate, while buses, crucial for sustainable urban and inter-city travel, are forecasted to hit a 10% electrification rate by the end of the decade. The two-wheelers segment, known for its efficiency and affordability, is set to achieve a significant electrification rate of 22% by 2030.

Africa Two-Wheeler Industry Overview

The Africa Two-Wheeler Market is moderately consolidated, with the top five companies occupying 49.80%. The major players in this market are BMW Motorrad, Harley-Davidson, Honda Motor Co. Ltd., KTM Motorcycles and Sym (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.2 Country

- 5.2.1 South Africa

- 5.2.2 Rest-of-Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Bajaj Auto Ltd.

- 6.4.2 BMW Motorrad

- 6.4.3 Harley-Davidson

- 6.4.4 Hero MotoCorp Ltd.

- 6.4.5 Honda Motor Co. Ltd.

- 6.4.6 KTM Motorcycles

- 6.4.7 Lifan Technology (Group) Co. Ltd.

- 6.4.8 Suzuki Motor Corporation

- 6.4.9 Sym

- 6.4.10 TVS Motor Company Limited

- 6.4.11 Yamaha Motor Company Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219