|

市场调查报告书

商品编码

1687082

菲律宾货运和物流:市场占有率分析、行业趋势和成长预测(2025-2030 年)Philippines Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

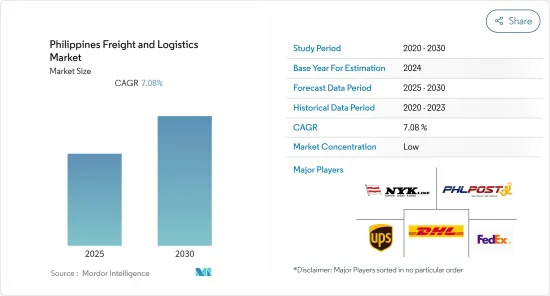

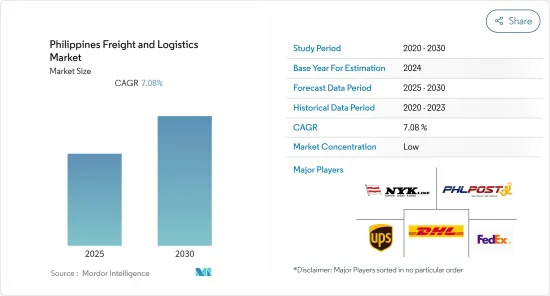

菲律宾货运和物流市场预计在预测期内实现 7.08% 的复合年增长率

关键亮点

- 疫情导致菲律宾电子商务成长。随着越来越多的人在网上购物以及该国网上零售商数量的增加,这种趋势可能会持续下去。根据菲律宾贸易和工业部(DTI)的数据,2020 年 3 月有 1,700 名线上经销商,2021 年 1 月有 93,318 名。

- 受电子商务业务兴起的推动,仓储业的需求依然旺盛,这预示着 2022 年工业和物流房地产行业将实现良好增长。高力菲律宾的一项调查显示,製造业、物流业和电子商务将在 2022 年继续成长。高力国际表示,甲米地-拉古纳-八打雁(CALABA)走廊的工业空置率从 2020 年的 5.7% 下降到 2021 年上半年的 5.6%。

- 高力国际将这一下降归因于随着线上零售市场的不断扩大,快速消费品(FMCG)公司对仓储和储存空间的需求增加。根据菲律宾贸工部的电子商务蓝图,预计到 2022 年,电子商务产业将贡献约 1.2 兆菲律宾比索(250 亿美元)。据高力菲律宾称,预计未来 12 至 36 个月内冷藏需求将成长,从而推动对工业资产的需求。投资委员会(BOI)预计,到 2023 年,菲律宾低温运输产业将创造 200 亿菲律宾比索(4.17 亿美元)的收入。

- 数位转型由 Lazada、Zalora 和 Shopee 等电子商务公司主导。他们与 Ninja Van 和 Lalamove 等科技主导的物流公司合作运输货物并允许客户即时追踪他们的订单。透过数位转型,您可以更透明地了解订单状态,缩短前置作业时间,并将清关流程加快 80% 至仅需 3-5 个工作天。

菲律宾货运和物流市场的趋势

电子商务成长推动菲律宾物流市场

Lazada集团表示,菲律宾电子商务市场预计将比其地区竞争对手成长更快。 Lazada 预计,儘管全球经济放缓且物价上涨,但随着菲律宾和其他东南亚国家从疫情中復苏,未来 5 到 10 年,这些国家的电子商务将实现「大幅」成长。

此外,根据美国农业部(USDA)的调查,到2022年,跨境电商销售额也将出现成长率,美国将有超过7,000万线上用户参与跨境电商(CBE),主要购买非食品类商品,成为电商销售市场的第四大贡献者。跨境电子商务销售额的空前成长在很大程度上是由于菲律宾消费者转向直接购买各种进口商品。

此外,菲律宾消费者对进口产品、食品和饮料的认识不断提高,进一步促进了 CBE 的销售,购买量从 2019 年的零增长到 2022 年的约 100 万美元。此外,跨境电子商务销售的发展将进一步推动对货运代理、仓储和其他附加价值服务的需求。同时,到2022年,电子产品将在电商平台上显示出显着的销售额,销售额将超过60亿美元,其次是个人护理、家居用品、家具、时尚等。因此,电商销售的扩大将为国内物流公司创造重大机会。

增加基础设施支出以促进菲律宾货运和物流市场

在交通、能源和水、卫生和个人卫生等常规领域,菲律宾宣布了2022年的新计画。计划已宣布。本土公司继续占据大部分市场占有率,但在某些情况下,本土公司在新兴产业(如资料中心的官民合作关係计画)与国际公司建立合作关係,而本土公司缺乏必要的技术专长。

美国资助的菲律宾低温运输计划(PCCP)等政府计画也正在帮助改善东南亚国家的低温运输物流基础设施。 PCCP 是由美国农业部 (USDA) 资助的为期四年的计划。透过提供改进的技术、扩大低温运输市场和加强中间商,我们正在组织生产者团体来提高农业生产力并满足国际食品安全标准。

菲律宾官民合作关係的肯农路维修计画已收到包括中国第一公路工程局有限公司和日本 JFE 工业公司(PPP)在内的竞标竞标者的意向。当地建筑公司 First Balfour 和 Riofil Corporation 也参与其中。菲律宾国家经济发展局(NEDA)是公共工程与公路部 (DPWH) 提交给肯农路计划最终核准的地方。这条33公里的道路将拓宽,18座桥樑将被改造,并且需要进行护坡。

菲律宾的铁路网络经过数十年的忽视和资金不足而处于破败状态,目前正在復兴。菲律宾政府的首要任务之一是马尼拉南北通勤铁路,这是菲律宾政府迄今为止最大的基础设施投资。 NSCR 计划建造一条 163 公里长的郊区铁路网,连接北部的克拉克和新克拉克区域增长中心与首都马尼拉市中心和南部拉古纳省的卡兰巴市。

不过,据公共工程和公路部称,截至 2022 年 1 月,菲律宾政府 119 个主要基础设施计划中已有 15 个完工,其中包括帕西格河沿岸剩余路段的开发。同时,有77个计划处于建设阶段,27个计划处于筹备阶段。因此,菲律宾各地不断增加的物流基础设施计划预计将促进货运和物流业务的发展。

菲律宾货运及物流业概况

菲律宾货运和物流市场分散,拥有许多国内外物流服务供应商。现有主要参与者包括联邦快递、UPS、DHL、Kuehne+Nagel、菲律宾邮政、日本通运和 2GO Express。

国际参与企业正在进行策略性投资,建立区域物流网络,包括开设新的物流中心和智慧仓库。电子商务的成长是推动宅配服务发展的重要因素。消费的成长和网路普及率正在推动菲律宾电子商务活动的发展。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场洞察与动态

- 当前市场状况

- 政府法规和倡议

- 市场动态

- 驱动程式

- 电子商务销售额增加

- 限制因素

- 运输成本高

- 机会

- 增加基础建设计划投资

- 驱动程式

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链/供应链分析

- 洞察技术趋势

- 洞察电子商务产业

- 菲律宾物流基础设施发展洞察

- 菲律宾宅配与快递小包裹(CEP)市场概况

- COVID-19对市场的影响

第五章市场区隔

- 按功能

- 货物

- 路

- 海洋和内陆水域

- 空运

- 铁路

- 货物

- 仓储业

- 附加价值服务等

- 货物

- 按最终用户

- 製造/汽车

- 石油和天然气、采矿和采石

- 农业、渔业和林业

- 建设业

- 分销和贸易

- 医疗和製药

- 其他的

第六章竞争格局

- 公司简介

- Deutsche Post DHL Group

- FedEx Corporation

- United Parcel Service(UPS)

- Nippon Yusen NYK(Yusen Logistics)

- PHL Post

- Nippon Express

- LBC Express

- 2GO Express

- JRS Express

- DB Schenker

- Kuehne+Nagel International AG

- CJ Logistics*

- 其他公司

第七章:市场的未来

第 8 章 附录

- 总体经济指标

- 资本流动洞察

The Philippines Freight and Logistics Market is expected to register a CAGR of 7.08% during the forecast period.

Key Highlights

- The pandemic increased e-commerce in the nation as cautious consumers stayed home to avoid coming into contact with disease vectors. As more people purchase online and there are more online retailers in the country, this tendency will likely continue. According to the Philippines' Department of Trade and Industry (DTI), there were 1,700 online sellers in March 2020 and 93,318 in January 2021.

- The warehouse industry was still in high demand, driven by the thriving e-commerce business, and this bode well for the industrial and logistics real estate sector's growth in 2022. According to a survey by Colliers Philippines, manufacturing, logistics, and e-commerce will continue to grow in 2022. According to Colliers, the industrial vacancy rate in the Cavite-Laguna-Batangas (CALABA) corridor decreased to 5.6% in the first half of 2021 from 5.7% in 2020.

- Colliers attributed the reduction to the increase in the demand for warehouse and storage space from fast-moving consumer goods (FMCG) companies as the country's online retail market continues to expand. The e-commerce sector is anticipated to contribute around PHP 1.2 trillion (USD 25 billion) by 2022, according to the DTI's e-commerce roadmap. According to Colliers Philippines, the increased need for cold storage facilities is anticipated to support demand for industrial assets over the next 12 to 36 months. By 2023, the Board of Investments (BOI) expects the country's cold chain sector to generate PHP 20 billion (USD 417 million) in income.

- The digital shift has been led by e-commerce firms like Lazada, Zalora, and Shopee, who work with tech-driven logistics firms like Ninja Van and Lalamove to transport items so that customers can track their orders in real-time. Switching to digital will increase order status transparency, reduce lead times, and speed up customs clearance processes by up to 80%, taking only 3-5 business days.

Philippines Freight & Logistics Market Trends

Growth in e-Commerce to Drive the Logistics Market in Philippines

According to Lazada Group, the Philippine e-commerce market is expected to grow faster than its regional competitors. In the next five to ten years, Lazada expects e-commerce in the Philippines and the rest of Southeast Asia to grow "a lot higher" as these countries recover from the pandemic despite the global economic slowdown and rising prices.

Moreover, in 2022, cross-border e-commerce sales also witnessed a growth rate, and as per a United States Department of Agriculture (USDA) study, more than 70 million online users in the Philippines participated in cross-border e-commerce (CBE), mostly purchased non-food items accounting for the fourth largest contribution to the e-commerce sales market. The unprecedented growth in border e-commerce sales is majorly driven by Filipino consumers' shift towards acquiring a variety of imported goods directly.

In addition, the growing awareness among Filipino consumers regarding imported products and food and beverages further bolstered the CBE sales, from zero in 2019 to almost USD 1 million in purchases in 2022. Also, the developments in cross-border e-commerce sales further drive demand for freight forwarders, warehouses, other value-added services, etc. Meanwhile, in 2022, electronic goods witnessed significant sales from e-commerce platforms, and the sales amounted to more than USD 6 billion, followed by personal and household care, furniture, fashion, etc. Thus, the growing e-commerce sales create huge opportunities for logistics providers in the country.

Increased Spending on Infrastructure to Propel the Freight and Logistics Market in the Philippines

In the customary areas of transportation, energy, and WASH, the Philippines has announced new projects for 2022. (water projects). The local firms continue to hold the majority of the market share, but some collaborations with international players are being formed in new or emerging industries (such as a planned public-private partnership for a data center) when the local players lack the necessary technological expertise.

Government programs, such as the Philippines Cold Chain Project (PCCP), funded by the United States, are also helping to improve the Southeast nation's cold chain logistics infrastructure. The PCCP is a four-year project funded by the US Department of Agriculture (USDA). It is attempting to organize producer groups to increase agricultural productivity and meet international food safety standards by providing improved technologies, expanding cold chain-related markets, and strengthening intermediate organizations.

The Philippines' PHP 11 Bn (USD 214 Million) public-private partnership to rehabilitate Kennon Road has received expressions of interest from possible bidders, including China First Highway Engineering and JFE Engineering Corporation of Japan (PPP). Local building firms First Balfour and Riofil Corporation were among the others. The National Economic and Development Authority (NEDA) of the Philippines is where the DPWH will present the Kennon Road project for final approval. The 33km road has to be widened, 18 bridges need to be upgraded, and slope protection needs to be built.

The Philippines' railway network is undergoing a rebirth after decades of neglect and underspending that has left it in a decrepit state. Among the government's top priorities is the flagship North-South Commuter Railway in Manila, its largest-ever individual infrastructure investment. NSCR is envisaged as a 163 route-km suburban railway network connecting the regional growth centers of Clark and New Clark City in the north with central Manila and Calamba City in Laguna province to the south of the capital.

However, in January 2022, according to the Department of Public Works and Highways, 15 out of 119 flagship infrastructure projects of the Philippine government had been completed, which includes the improvement of remaining sections along the Pasig River. Meanwhile, 77 projects remain at the construction stage, while 27 are in the pipeline. Thus, the increasing logistics and infrastructure projects across the country are expected to fuel the freight and logistics operations.

Philippines Freight & Logistics Industry Overview

The competition in the Philippines freight and logistics market is fragmented, with the presence of many local and international logistics service providers. Some of the existing major players in the market include FedEx, UPS, DHL, Kuehne + Nagel, PHL Post, Nippon Express, and 2GO Express.

The international players are making strategic investments to establish a regional logistics network, such as opening new distribution centers, smart warehouses, etc. The growth of e-commerce is an essential factor spurring the development of courier services. Increasing consumption and Internet penetration are boosting e-commerce activity in the Philippines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND MARKET DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Brief on Government Regulations and Initiatives

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.1.1 Growing E-commerce Sales

- 4.3.2 Restraints

- 4.3.2.1 High Shipping Costs

- 4.3.3 Opportunities

- 4.3.3.1 Increasing Investments in Infrastructure Projects

- 4.3.1 Drivers

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain/Supply Chain Analysis

- 4.6 Insights into Technological Trends

- 4.7 Insights into the E-commerce Industry

- 4.8 Insights into Logistics Infrastructure Development in the Philippines

- 4.9 Brief on the Courier, Express, and Parcel (CEP) market in Philippines (Market Size and Forecast)

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Function

- 5.1.1 Freight Transport

- 5.1.1.1 Road

- 5.1.1.2 Sea and Inland Water

- 5.1.1.3 Air

- 5.1.1.4 Rail

- 5.1.2 Freight Forwarding

- 5.1.3 Warehousing

- 5.1.4 Value-added Services and Others

- 5.1.1 Freight Transport

- 5.2 By End User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Oil and Gas, Mining, and Quarrying

- 5.2.3 Agriculture, Fishing, and Forestry

- 5.2.4 Construction

- 5.2.5 Distributive Trade

- 5.2.6 Healthcare and Pharmaceuticals

- 5.2.7 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 Deutsche Post DHL Group

- 6.2.2 FedEx Corporation

- 6.2.3 United Parcel Service (UPS)

- 6.2.4 Nippon Yusen NYK (Yusen Logistics)

- 6.2.5 PHL Post

- 6.2.6 Nippon Express

- 6.2.7 LBC Express

- 6.2.8 2GO Express

- 6.2.9 JRS Express

- 6.2.10 DB Schenker

- 6.2.11 Kuehne + Nagel International AG

- 6.2.12 CJ Logistics*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 Insights into Capital Flows