|

市场调查报告书

商品编码

1687177

德国货运与物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Germany Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

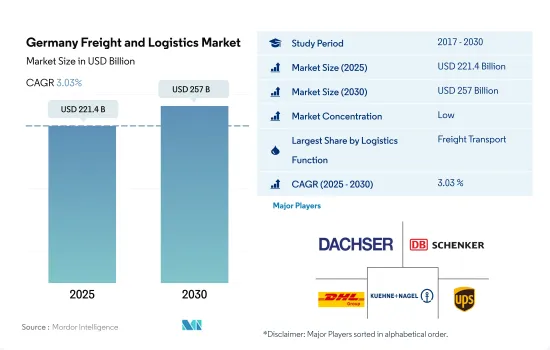

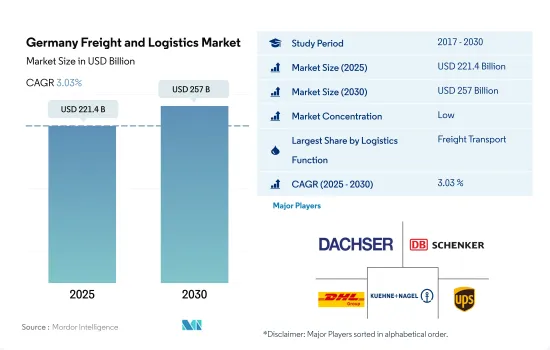

预计 2025 年德国货运代理和物流市场规模为 2,214 亿美元,到 2030 年将达到 2,570 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.03%。

我们看到电动卡车的推出和所有交通方式的新基础设施的建设正在增加。

- 德国正在积极推行永续交通,目前有几家私人公司推出了电动卡车。例如,2023年,知名公司马士基在德国采购了25辆最先进的沃尔沃FH电动卡车,用于当地运输。这些卡车计划于 2023 年第四季至 2024 年第一季交付。此外,德国正在推动数位化城市交通系统,目标是到 2030 年在汉堡街道上实现自动驾驶卡车运输。 2023 年,依维柯将与自动驾驶技术的全球领导者 Plus 合作开始测试自动驾驶卡车。

- 2024 年 2 月,DHL 和拥有并营运法兰克福机场 (FRA) 的 Fraport 集团破土动工建造新的航空货运设备。扩建工程将在法兰克福机场南货运城进行,毗邻机场 31 号登机口。该设施面积约 55,000平方公尺,预计耗时约 12 个月建成。 DHL 计划在 2025 年中期开设该航空货运中心。

德国货运及物流市场的趋势

德国是欧洲物流和运输领域的领导者,对环保运输方式的投资措施不断增加。

- 2024年7月,德国政府启动全国建置重型车辆快速充电网路的计划。该倡议符合柏林到 2045 年实现碳中和交通部门的雄心勃勃的目标。儘管温室气体排放将在 2023 年大幅下降,达到欧洲最大经济体 70 年来的最低水平,但交通运输部门仍在努力达到环境基准。德国的目标是到2030年,大约三分之一的重型道路运输将实现电动化或使用合成甲烷或氢气等电动燃料。

- 德国政府有意投资铁路而不是公路,以促进环境保护、永续性和高效的交通运输。 2022 年,德国铁路、联邦政府和地方政府在铁路基础设施上投资约 136 亿欧元(145.1 亿美元)。下萨克森州、汉堡州、不来梅州、梅克伦堡-前波美拉尼亚州和石勒苏益格-荷尔斯泰因州与德国铁路公司共同投资,将在2030年前对其铁路网络进行现代化升级。

欧洲维修季结束,德国 E5 汽油价格暴跌

- 2024年5月底,E5汽油价格较4月大幅下跌,最后一週下跌了4.91美元/100公升。下降的原因是欧洲维护季节的结束,炼油厂产量增加以及进口量增加。德国从阿姆斯特丹、鹿特丹和安特卫普进口的汽油一直在稳步增长,5 月份德国港口接收汽油量为 8,500 桶/天,而出口量则下降至 3,700 桶/天。供应过剩和维护季的结束导致德国 E5 汽油价格下跌。同时,柴油价格正在引发南部和东部市场动盪。

- 德国消费者面临物价上涨最快的国家,年通膨率居高不下主要是因为俄乌战争以来能源和食品价格极高。德国是世界上最大的天然气进口国之一。约95%的天然气消费量依赖进口。 2022年,55%的天然气进口将来自俄罗斯,30%来自挪威,13%来自荷兰。德国也预计,受欧盟排放权交易影响,2027年燃料价格将出现上涨。与2026年相比,2027年初,汽油价格将每公升上涨38美分,天然气价格将每度电上涨约3美分。

德国货运及物流业概况

德国货运代理和物流市场较为分散,市场上主要企业(按字母顺序排列):DACHSER、德国铁路股份公司(包括 DB Schenker)、DHL 集团、Kuehne+Nagel 和美国联合包裹服务公司 (UPS)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的 GDP 分布

- 经济活动带来的 GDP 成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业生产毛额

- 出口趋势

- 进口趋势

- 燃油价格

- 卡车运输成本

- 卡车持有量(依类型)

- 物流绩效

- 主要卡车供应商

- 模态共享

- 海运能力

- 班轮连结性

- 停靠港和演出

- 货运趋势

- 货物吨位趋势

- 基础设施

- 法律规范(公路和铁路)

- 德国

- 法律规范(海运和空运)

- 德国

- 价值链与通路分析

第五章 市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 物流功能

- 快递、快递和包裹 (CEP)

- 目的地

- 国内的

- 国际的

- 货物

- 按运输方式

- 航空

- 海上和内陆水道

- 其他的

- 货物

- 交通方式

- 航空

- 管道

- 铁路

- 路

- 海上和内陆水道

- 仓库存放

- 透过温度控制

- 无温度控制

- 温度管理

- 其他服务

- 快递、快递和包裹 (CEP)

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介.

- A. Hartrodt

- BLG Logistics Group AG & Co. KG

- DACHSER

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Emons

- FedEx

- Hellmann Worldwide Logistics

- Kuehne+Nagel

- Rhenus Logistics

- Rohlig Logistics GmbH & Co. KG

- United Parcel Service of America, Inc.(UPS)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 技术进步

- 资讯来源和进一步阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

- 外汇

简介目录

Product Code: 56072

The Germany Freight and Logistics Market size is estimated at 221.4 billion USD in 2025, and is expected to reach 257 billion USD by 2030, growing at a CAGR of 3.03% during the forecast period (2025-2030).

The launches of electric trucks and the construction of new infrastructure for all modes of transport are increasing

- Germany is actively pursuing sustainable transportation, with several private trucking companies now introducing electric trucks. For instance, in 2023, Maersk, a prominent player, procured 25 cutting-edge Volvo FH electric trucks in Germany for local deliveries. These trucks are set to be delivered between Q4 2023 and Q1 2024. Furthermore, Germany is pushing for a digitized urban mobility system, with a target of enabling autonomous trucking on Hamburg's streets by 2030. In 2023, road trials for autonomous trucks commenced through a collaboration between Iveco and Plus, a global leader in autonomous driving technology.

- In February 2024, DHL and Fraport AG, the owner and operator of Frankfurt Airport (FRA), broke ground on a new air freight facility. This expansion is taking place at Fraport's CargoCity South, adjacent to Airport Gate 31. The construction of this facility, spanning approximately 55,000 square meters, is expected to take around twelve months. DHL plans to inaugurate the air cargo center by mid-2025.

Germany Freight and Logistics Market Trends

Germany leads European logistics and transportation, with rising investment initiatives focused on Eco-friendly mode of transport

- In July 2024, the German government initiated a nationwide project to establish a fast-charging network tailored for heavy-duty vehicles. This initiative aligns with Berlin's ambitious goal to achieve a carbon-neutral transport sector by 2045. Despite a notable drop in greenhouse gas emissions in 2023, marking a 70-year low for Europe's largest economy, the transport segment has struggled to hit its environmental benchmarks. Germany is targeting that roughly one-third of its heavy road haulage will be electrically powered or utilize electrically produced fuels like synthetic methane or hydrogen by 2030.

- The German government intends to invest more in rail than roads to promote environmental protection, sustainability, and effective transportation. In 2022, Deutsche Bahn, the federal government, and the local and regional governments invested roughly EUR 13.6 billion (USD 14.51 billion) in rail infrastructure. Lower Saxony, Hamburg, Bremen, Mecklenburg-Western Pomerania, and Schleswig-Holstein, together with DB, invested in modernizing their rail networks by 2030.

E5 gasoline prices in Germany dropped sharply due to end of maintenance season in Europe

- At the end of May 2024, E5 gasoline prices dropped significantly compared to April, with prices USD 4.91/100L lower in the last week. This decline is due to the end of the maintenance season in Europe, leading to increased refinery production and rising imports. Gasoline imports from Amsterdam-Rotterdam-Antwerp to Germany have steadily risen, with German seaports receiving 8,500 b/d in May, while exports fell to 3,700 b/d. The oversupply and end of maintenance season are driving down E5 gasoline prices in Germany. Meanwhile, diesel prices in the south and east are causing market disruptions.

- German consumers faced the fastest price rise, and the high annual inflation rate was primarily driven by extreme price increases for energy and groceries since the Russia-Ukraine War. Germany is among the world's biggest natural gas importers. Around 95% of its gas consumption is met by imports. In 2022, 55% of gas imports came from Russia, 30% from Norway, and 13% from the Netherlands. Moreover, Germany anticipates a fuel price jump from 2027 EU emissions trading. An increase of 38 cents per liter of petrol and around 3 cents per kilowatt hour of natural gas at the beginning of 2027 compared to 2026.

Germany Freight and Logistics Industry Overview

The Germany Freight and Logistics Market is fragmented, with the major five players in this market being DACHSER, Deutsche Bahn AG (including DB Schenker), DHL Group, Kuehne+Nagel and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Germany

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Germany

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 A. Hartrodt

- 6.4.2 BLG Logistics Group AG & Co. KG

- 6.4.3 DACHSER

- 6.4.4 Deutsche Bahn AG (including DB Schenker)

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 Emons

- 6.4.8 FedEx

- 6.4.9 Hellmann Worldwide Logistics

- 6.4.10 Kuehne+Nagel

- 6.4.11 Rhenus Logistics

- 6.4.12 Rohlig Logistics GmbH & Co. KG

- 6.4.13 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219