|

市场调查报告书

商品编码

1692126

2.5D 和 3D 半导体封装-市场占有率分析、产业趋势和统计、成长预测(2025-2030 年)2.5D & 3D Semiconductor Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

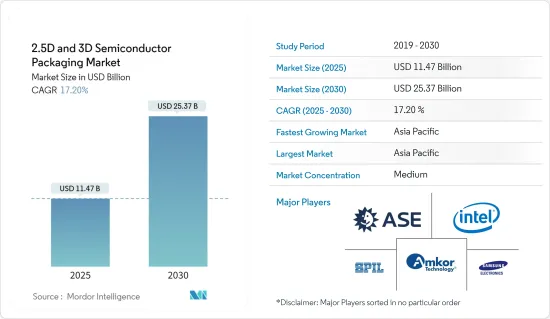

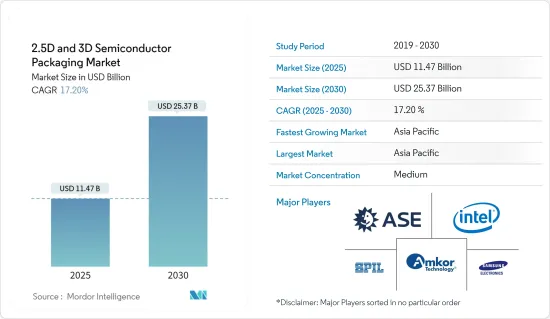

2.5D 和 3D 半导体封装市场规模预计在 2025 年达到 114.7 亿美元,预计到 2030 年将达到 253.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 17.2%。

2.5D 和 3D 是将多个 IC 整合在一个封装内的封装技术。在 2.5D 结构中,多个主动半导体晶片并排放置在硅中介层上,从而实现高晶粒间互连密度。在 3D 架构中,有源晶片采用晶粒堆迭进行集成,以实现最短的互连和最小的封装占用空间。近年来,2.5D和3D凭藉其极高的封装密度和能源效率等优势,逐渐成为理想的晶片组整合平台。

主要亮点

- 高效能运算、资料中心网路和自动驾驶汽车正在推动该市场的采用率并加速技术发展。趋势是在云端、边缘运算和设备层面拥有更多的运算资源。此外,通讯和基础设施行业高端性能应用和人工智慧(AI)的成长正在推动该市场的发展。

- 数位化的提高、远端工作和工作趋势的增加以及消费者对电子产品需求的不断增长,正在推动对能够实现各种新功能的先进半导体设备的需求。随着对半导体元件的需求不断增长,先进的封装技术提供了当今数位化世界所需的外形规格和处理能力。

- 资讯科技正在彻底改变现代消费者和产品消费模式。产品,尤其是电子产品,曾经仅由电气和机械部件组成,现在正成为以多种方式结合硬体、软体、感测器、微处理器、资料储存、微处理器和连接性的复杂系统,从而形成提供不断增加功能的电子设备。

- 2.5D/3D半导体封装单元的设计、开发和安装需要大量的前期投资,具体取决于各行业的要求。 3D 半导体封装的主要成本驱动因素包括硅通孔 (TSV) 形成产量比率损失、晶圆凸块、TSV 曝光、组装产量比率、FOEL 和 BOEL。

- 根据美国预算办公室的数据,预计到 2033 年,美国国防支出将逐年增加。 2023 年,美国国防支出将达到 7,460 亿美元。同一预测也显示,到 2033 年,美国国防开支将成长到 1.1 兆美元。全球国防预算的增加可能为所研究市场的成长提供有利机会。

2.5D/3D半导体封装市场趋势

通讯和电讯终端用户产业预计将占据较大的市场占有率

- 通讯和电讯是市场成长最快的领域之一。全球范围内产生的数据量正在快速增长。数据爆炸是由许多嵌入式设备推动的,这些设备在每次单独的交易中都会产生少量数据,而这些数据加在一起就形成了巨量资料。组织从各种来源收集数据,包括智慧(物联网)设备、商业交易、工业设备和社交媒体。

- 世界各地的组织都希望能够快速处理和处理资料并从中获益。高效能运算 (HPC) 使公司能够增加建立可以利用大量资料的深度学习演算法所需的运算规模。随着更多数据的出现,对更多运算资源的需求也随之出现,导致 HPC 的采用率增加,进而推动市场成长。高效能运算的兴起推动了对具有更高性能、更低延迟、更大频宽和更高功率效率的半导体装置的需求,从而对 2.5D 和 3D 封装技术产生了巨大的需求。

- 通讯基地台在确保行动电话和智慧型手机等行动装置的强大通讯生态系统方面发挥着至关重要的作用。由于高频率,5G技术有可能以惊人的速度有效地管理大量数据,因此需要更密集的基地台网路。与4G LTE相比,5G基地台将拥有更多的发射天线和元件,导致功耗和发热量增加。

- 根据GSMA预测,到2025年,5G行动连线预计将分别占韩国和日本总连线数的73%和68%。到 2030 年,海湾合作委员会国家约 95% 的行动连线将实现 5G 连接,而亚洲这一比例将达到 93%。 5G智慧型手机和网路的日益普及将创造新的市场机会。

- 在5G及其后续技术推动下,通讯业正不断提高资料传输速度。这些技术进步需要强大的基础设施来管理资料量的急剧成长。公司可能会使用 2.5D 和 3D 封装来开发高效能处理器和网路设备,以满足产业不断升级的需求。

中国:预计将实现显着成长

- 技术进步透过使用紧凑设计的半导体晶片,促进了各种家用电器、医疗设备、通讯和通讯设备以及汽车的复杂化和小型化,从而推动了中国市场的需求。

- 随着该国推出 5G 服务,对智慧型手机的需求正在增加,预计这将在预测期内推动市场成长。连网型设备的成长、支援 5G 的智慧型手机以及中国在生产家用电器方面的强大製造能力正在推动市场的成长。

- 工信部表示,中国的5G基础设施正在蓬勃发展,到2023年底将拥有338万个基地台。在大力投入和积极部署战略的支持下,中国已实现5G广泛覆盖。预计到2024年,基地台数量将超过600万个。该地区 5G 的不断普及预计将推动对 5G 设备的需求,从而增加中国对 2.5D 和 3D 半导体封装的需求。

- 政府投资和私营部门产品开发的成长,以提高半导体元件的效率并支持对节能电子设备日益增长的需求,可能会支持市场成长。

- 例如,2023年8月,中国国家自然科学基金委员会(NSFC)启动了一项新计划,资助数十个专注于小型晶片技术的计划。 NSFC是国内基础研究和前沿发展的主要资金来源。这将有助于推动半导体封装的进步,并为在中国2.5D和3D半导体封装市场营运的供应商创造机会。

- 中国市场庞大的製造能力、现有的工业基础设施以及对半导体装置製造的优先考虑可能会支持市场成长。

- 例如,2024年5月,中国成立了第三个也是最大的国有半导体投资基金,规模达475亿美元,以加倍努力打造国内晶片产业。预计这将支持该国对 2.5D 和 3D 半导体封装的需求,用于为半导体设备提供保护外壳。

- 因此,政府不断加强国内半导体生态系统的倡议以及该国作为汽车和家用电子电器领域的全球生产国的崛起可能会支持市场成长。

2.5D和3D半导体封装产业概况

2.5D和3D半导体市场已呈现半固体,既有全球性企业,也有中小型企业。市场的主要企业包括日月光集团、安靠科技公司、英特尔公司、三星电子和硅品精密工业公司 (SPIL)。市场上的公司正在采取收购和联盟等策略来加强其产品供应并获得永续的竞争优势。

- 2024年4月,三星AVP团队订单NVIDIA AI晶片先进封装合同,从而实现未来高频宽记忆体晶片的供应。三星电子的 AVP 团队可能负责为 Nvidia 的 AI 处理器提供内插器和 2.5D 封装技术。不过,这些处理器中使用的 HBM 和 GPU 晶片很可能来自其他供应商。 2.5D封装技术可以将CPU、GPU、HBM等晶片水平整合在内插器上。

- 2023年10月,日月光科技控股子公司日月光半导体製造股份有限公司(Advanced Semiconductor Engineering Inc.)发布了其整合设计生态系统(IDE)。此协同设计工具集旨在系统化增强 VIPack 平台上的先进封装架构。这种新方法可以实现从单晶粒SoC 到多晶片分解 IP 区块(如晶片和记忆体)的平稳过渡,从而利用 2.5D 或先进的扇出结构进行整合。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链分析

- 市场宏观经济走势分析

第五章市场动态

- 市场驱动因素

- 多个产业对半导体装置的消费不断增加

- 对紧凑、高功能电子设备的需求不断增长

- 市场限制

- 半导体IC设计初期投入高,复杂度不断增加

- 市场机会

- 高阶运算、伺服器和资料中心的采用率不断提高

第六章市场区隔

- 依封装技术

- 3D

- 2.5D

- 3D晶圆级晶片规模封装 (WLCSP) - 定性分析

- 按最终用户产业

- 消费性电子产品

- 医疗设备

- 通讯和电讯

- 车

- 其他最终用户产业

- 按地区

- 美国

- 中国

- 台湾

- 韩国

- 日本

- 欧洲

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- ASE Group

- Amkor Technology Inc.

- Intel Corporation

- Samsung Electronics Co. Ltd

- Siliconware Precision Industries Co. Ltd(SPIL)

- Powertech Technology Inc.

- Jiangsu Changjiang Electronics Technology Co. Ltd

- TSMC Limited

- GlobalFoundries Inc.

- Tezzaron Semiconductor Corporation.

第八章投资分析

第九章:未来市场展望

The 2.5D & 3D Semiconductor Packaging Market size is estimated at USD 11.47 billion in 2025, and is expected to reach USD 25.37 billion by 2030, at a CAGR of 17.2% during the forecast period (2025-2030).

2.5D and 3D are packaging methodologies that include multiple ICs inside the package. In a 2.5D structure, multiple active semiconductor chips are placed side-by-side on silicon interposers to achieve high die-to-die interconnect density. In a 3D structure, active chips are integrated by die stacking for the shortest interconnect and smallest package footprint. In recent years, 2.5D and 3D have gained momentum as ideal chipset integration platforms due to their merits in achieving extremely high packaging density and energy efficiency.

Key Highlights

- High-performance computing, data center networking, and autonomous vehicles are pushing the adoption rates for the market studied and accelerating its technological evolution. The trend is to have more enormous computing resources at the cloud, edge computing, and device levels. The advancements in the market studied are also possible due to the growth in high-end performance applications and artificial intelligence (AI) in the telecom and infrastructure industry.

- Rising digitization, increasing trends of remote work and remote operations, and increasing consumer demand for electronics have sparked the need for advanced semiconductor devices that enable various new capabilities. As the demands for semiconductor devices intensify consistently, advanced packaging techniques provide the form factor and processing power required for today's digitized world.

- Information technology is revolutionizing the consumption pattern of modern consumers and products. Once composed solely of electrical and mechanical parts, products, especially electronic ones, are increasingly becoming complex systems that combine hardware, software, sensors, microprocessors, data storage, microprocessors, and connectivity in myriad ways, providing more functionalities to the resulting electronic devices.

- Significantly high initial investment is required in the design, development, and setting up of 2.5D/3D semiconductor packaging units as per the requirements of different industries. The major cost-driving processes of 3D semiconductor packaging include Through Silicon Via (TSV) creation yield loss, Wafer bumping, TSV reveals, Assembly yield, FOEL, BOEL, etc.

- According to the US Congressional Budget Office, defense spending in the United States was predicted to increase yearly until 2033. Defense outlays in the United States amounted to USD 746 billion in 2023. The forecast predicted an increase to USD 1.1 trillion in 2033. The increasing defense budgets globally are likely to offer lucrative opportunities for the growth of the market studied.

2.5D and 3D Semiconductor Packaging Market Trends

Communications and Telecom End-user Industry is Expected to Hold Significant Market Share

- Communications and telecom represent one of the fastest-growing segments of the market. The amount of data generated worldwide is increasing at a rapid pace. The explosion of data is fueled by many embedded devices that produce a small amount of data for each discrete transaction and add up to big data when clubbed together. Organizations collect data from various sources, including smart (IoT) devices, business transactions, industrial equipment, social media, etc.

- Organizations worldwide are looking to benefit from processing and acting upon data quickly. High-performance computing (HPC) has enabled businesses to scale computationally to build deep-learning algorithms that may take advantage of high volumes of data. As more data emerges, the need for more significant amounts of computing resources emerges, leading to greater adoption of HPC, which drives the market's growth. With the proliferation of high-performance computing, there is an escalating demand for semiconductor devices that deliver enhanced performance, lower latency, increased bandwidth, and power efficiency, creating significant demand for 2.5D and 3D packaging technologies.

- Communication base stations play a pivotal role in ensuring a robust communication ecosystem for mobile devices, including phones and smartphones. Given its high frequencies, 5G technology may efficiently manage vast data volumes at remarkable speeds, requiring a denser network of base stations. In contrast to 4G LTE, 5G base stations feature more transmitting antennas and components, leading to increased power consumption and heat generation.

- According to the GSMA, in 2025, the share of 5G mobile connections of total connections in South Korea and Japan are anticipated to account for 73% and 68%, respectively. About 95% of mobile connections will be 5G by 2030 in GCC states and 93% in Asia. The increasing adoption of 5G smartphones and networks creates new market opportunities.

- The telecom industry continually advances data transmission speeds, driven by technologies such as 5G and its successors. These innovations demand robust infrastructure to manage the surge in data volumes. Companies may use 2.5D and 3D packaging to develop high-performance processors and network equipment, meeting the industry's escalating requirements.

China Expected to Witness Significant Growth

- Advancing technologies have contributed to the advancement and miniaturization of various consumer electronics, medical devices, telecom and communication devices, and automobiles by using compactly designed semiconductor chips, which would fuel the demand for the market in China.

- With the launch of 5G services in the country, smartphone demand has been increasing in China, which is likely to fuel the market's growth during the forecast period. The growth of connected devices, 5G-enabled smartphones, and the country's large manufacturing capabilities in the production of consumer electronic products are fueling the market's growth.

- According to MIIT, China's 5G infrastructure surged, boasting 3.38 million base stations by the close of 2023. Bolstered by substantial investments and aggressive deployment strategies, the nation achieved broad 5G coverage. Projections indicated a climb to over six million base stations by 2024. The rising execution of 5G in the region is also anticipated to boost the need for 5G-enabled devices, thereby increasing the demand for 2.5D and 3D semiconductor packaging in China.

- The growth of governmental investments and private players' product development to increase the efficiency of semiconductor components and support the increasing demand for energy-efficient electronic devices would support the market's growth.

- For instance, in August 2023, the National Natural Science Foundation of China (NSFC), a primary domestic funding source for basic research and frontier exploration, launched a new program to finance dozens of projects focused on chiplet technology. This would support the advancement in semiconductor packing and create an opportunity for market vendors operating in the country's 2.5D and 3D semiconductor packaging market.

- The Chinese market's large manufacturing capabilities, the existing industrial infrastructure, and the priority of the country's manufacturing of semiconductor devices would support the market's growth.

- For instance, in May 2024, China set up its third and largest state-backed semiconductor investment fund, worth USD 47.5 billion, as the country redoubled its efforts to build its domestic chip industry, which would support the demand for the 2.5D and 3D semiconductor packaging in the country due to its application in providing a protective enclosure for semiconductor devices.

- Therefore, the growth of governmental initiatives to strengthen the country's semiconductor ecosystem and the country's emergence as a global producer of the automotive and consumer electronic sectors would support the market's growth.

2.5D and 3D Semiconductor Packaging Industry Overview

The 2.5D & 3D Semiconductor market is semi-consolidated due to the presence of global players and small and medium-sized enterprises. Some major players in the market are ASE Group, Amkor Technology Inc., Intel Corporation, Samsung Electronics Co. Ltd, and Siliconware Precision Industries Co. Ltd (SPIL). Players in the market are adopting strategies such as acquisitions and partnerships to enhance their product offerings and gain sustainable competitive advantage.

- In April 2024, Samsung's AVP team received an order for advanced packaging for NVIDIA's AI chip, allowing for the future supply of high-bandwidth memory chips. The AVP team at Samsung Electronics may be responsible for providing interposer and 2.5D packaging technology for packaging NVIDIA's AI processors. However, the HBM and GPU chips used in these processors may come from other suppliers. 2.5D packaging technology allows for the horizontal integration of chips such as CPUs, GPUs, and HBMs on an interposer.

- In October 2023, Advanced Semiconductor Engineering Inc., a part of ASE Technology Holding Co. Ltd, introduced its Integrated Design Ecosystem (IDE). This collaborative design toolset aims to enhance advanced package architecture on its VIPack platform systematically. This new approach enables a smooth shift from a single-die SoC to multi-die disaggregated IP blocks like chiplets and memory for integration utilizing 2.5D or advanced fanout structures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Analysis of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Consumption of Semiconductor Devices Across Several Industries

- 5.1.2 Increasing Demand for Compact, High Functionality Electronic Devices

- 5.2 Market Restraints

- 5.2.1 High Initial Investment and Increasing Complexity of Semiconductor IC Designs

- 5.3 Market Opportunities

- 5.3.1 Growing Adoption of High-end Computing, Servers, and Data Centers

6 MARKET SEGMENTATION

- 6.1 By Packaging Technology

- 6.1.1 3D

- 6.1.2 2.5D

- 6.1.3 3D Wafer-level chip-scale packaging (WLCSP) - Qualitative Analysis

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Medical Devices

- 6.2.3 Communications and Telecom

- 6.2.4 Automotive

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 China

- 6.3.3 Taiwan

- 6.3.4 South Korea

- 6.3.5 Japan

- 6.3.6 Europe

- 6.3.7 Latin America

- 6.3.8 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASE Group

- 7.1.2 Amkor Technology Inc.

- 7.1.3 Intel Corporation

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 Siliconware Precision Industries Co. Ltd (SPIL)

- 7.1.6 Powertech Technology Inc.

- 7.1.7 Jiangsu Changjiang Electronics Technology Co. Ltd

- 7.1.8 TSMC Limited

- 7.1.9 GlobalFoundries Inc.

- 7.1.10 Tezzaron Semiconductor Corporation.