|

市场调查报告书

商品编码

1692551

法国公路货运:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)France Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

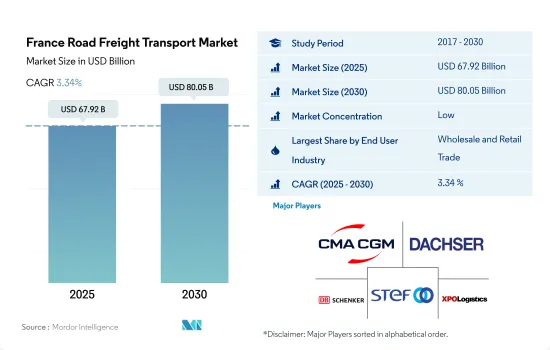

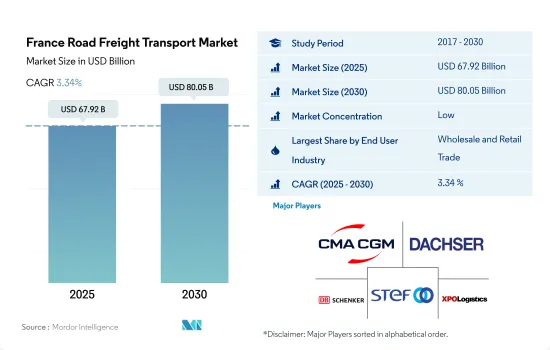

预计 2025 年法国公路货运市场规模为 679.2 亿美元,到 2030 年将达到 800.5 亿美元,预测期间(2025-2030 年)的复合年增长率为 3.34%。

法国电子商务市场激增推动市场成长

- 2023年,法国电子商务产业预计将实现与前一年同期比较增7%以上,到2024年底将成长11%以上。蓬勃发展的电子商务格局正在刺激对公路货运服务的需求成长。这一增长证实了法国充满活力的数位市场在经济挑战面前具有韧性。法国数位基础设施的不断加强正在简化线上交易并改善用户体验。值得注意的是,到2023年,将有近4,000万法国消费者进行网路购物,平均每月下单约5次。

- 未来几年,法国计画每年招募2万名年轻人进入农业领域,较目前的1.2万至1.4万人大幅增加。此外,作为雄心勃勃的「法国2030」计画的一部分,法国政府正在向农业领域投入超过20亿美元。这些投资大部分流向了法国农业技术公司和新兴企业。这些努力有望推动最终用户市场向前发展。

法国公路货运市场趋势

法国正在投资 10.6 亿美元用于道路现代化建设,投资 1,060 亿美元用于铁路基础建设,以促进其物流业的发展。

- 2023年,法国宣布了一项1,067.4亿美元的投资策略,预计将于2040年完成。这项由政府主导的计划重点是加强和现代化该国的铁路基础设施。该计画的核心是引进通往各大城市的高速通勤列车,以巴黎着名的 RER 系统为蓝本。该项目涉及法国国家铁路公司 SNCF、欧盟和地方当局的合作。

- 2024 年 7 月,Solaris订单。这些公车预计将于 2025 年初交付,并将加强 Artois Mobility 减少二氧化碳排放的努力,特别是在兰斯和贝苏纳地区。 Solaris Urbino 12 氢气公车的车顶配备了 70 kW 燃料电池,并配有 Solaris 高功率牵引电池,可在电力需求高峰时提供额外支援。

俄罗斯将增加对法国的液化天然气供应,以因应俄乌战争造成的燃料短缺

- 截至 2024 年 7 月 12 日的一周,法国柴油和超级无铅燃料的价格略有上涨。柴油价格为每公升 1.84 美元(含税)。 2024年前三个月,俄罗斯向法国供应的液化天然气比2023年同期成长超过欧盟其他国家。 2024年迄今,巴黎已向俄罗斯支付了超过6.4049亿美元的天然气供应,并敦促法国减少购买量。俄罗斯入侵乌克兰两年后,乌克兰与俄罗斯的天然气贸易不断增长,而马克宏也试图采取更强硬的立场来支持基辅。

- 2027年,欧盟将引进新的碳定价体系-排放交易体系2(ETS2)。欧盟立法者最初同意在 2023 年将二氧化碳排放量限制在每吨 48.03 美元,并对每公升柴油和汽油附加税。

法国公路货运业概况

法国公路货运市场较为分散,其中最大的五家公司(按字母顺序排列)分别是法国达飞集团(CMA CGM Group,包括 CEVA Logistics)、德莎集团(Dachser)、德国铁路股份公司(Deutsche Bahn AG,包括 DB Schenker)、STEF 集团和 XPO, Inc.

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 按经济活动分類的GDP分布

- 经济活动GDP成长

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输成本

- 卡车持有量(按类型)

- 主要卡车供应商

- 公路货运吨位趋势

- 公路货运价格趋势

- 模态共享

- 通货膨胀率

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 汇出目的地

- 国内的

- 国际货运

- 卡车负载容量

- 整车装载 (FTL)

- 零担运输 (LTL)

- 货柜运输

- 货柜运输

- 没有容器

- 运输距离

- 远距

- 短途运输

- 产品成分

- 流体产品

- 固体货物

- 温度控制

- 非温控

- 温度控制

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- CMA CGM Group(including CEVA Logistics)

- Dachser

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Expeditors International of Washington, Inc.

- FM Logistics

- Lactalis Group(including Lactalis Logistique & Transports)

- Reyes Holdings(including Martin Brower)

- STEF Group

- XPO, Inc.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球物流市场概览

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

- 外汇

简介目录

Product Code: 92368

The France Road Freight Transport Market size is estimated at 67.92 billion USD in 2025, and is expected to reach 80.05 billion USD by 2030, growing at a CAGR of 3.34% during the forecast period (2025-2030).

Surge in French e-commerce market propels the growth of the market

- In 2023, France's e-commerce sector witnessed a YoY growth exceeding 7%, with projections suggesting an uptick of over 11% by the end of 2024. This burgeoning e-commerce landscape is fueling an increased demand for road freight services. Such growth underscores a dynamic digital marketplace in France, resilient even amidst economic challenges. Continuous enhancements to France's digital infrastructure are streamlining online transactions and elevating user experiences. Notably, in 2023, close to 40 million French consumers engaged in online shopping, averaging about five orders each month.

- In the coming years, France aims to recruit 20,000 young individuals annually into its agricultural sector, marking a notable rise from the current intake of 12,000-14,000, all in a bid to enhance the industry's output. Furthermore, as part of its ambitious France 2030 program, the French government is channeling over USD 2 billion into the agricultural sector. A significant chunk of this investment is directed towards French agritech firms and startups. Such initiatives are poised to propel the end-user market forward.

France Road Freight Transport Market Trends

France is boosting its logistics industry with USD 1.06 billion investments toward road modernization and USD 106 billion towards rail infrastructure

- In 2023, France unveiled a USD 106.74 billion investment strategy slated for completion by 2040, aligning with its commitment to slash carbon emissions. The initiative, spearheaded by the government, focuses on bolstering and modernizing the nation's rail infrastructure. Central to the plan is the introduction of high-speed commuter trains, mirroring Paris's renowned RER system, in key urban centers. Collaborating on this endeavor are France's national rail entity, SNCF, alongside the European Union and regional administrations.

- In July 2024, Solaris secured an order from Artois Mobilites, part of the TADAO transport network in northern France, for four 12-meter Urbino hydrogen buses. These buses, slated for delivery in early 2025, will bolster Artois Mobilites' efforts to reduce carbon emissions, particularly in the Lens and Bethune regions. The Solaris Urbino 12 hydrogen buses will boast 70 kW fuel cells on their roofs and will be complemented by Solaris High Power traction batteries, providing additional support during peak electricity demand.

Increase in Russian LNG deliveries to France catering to fuel shortages caused by Russia-Ukraine war

- For the week ending July 12, 2024, diesel and super unleaded motor fuel prices in France saw a modest uptick. Diesel was priced at USD 1.84 per liter, inclusive of all taxes. In the first three months of 2024, Russian LNG deliveries to France increased more than to any other EU country compared to 2023. Paris has paid over USD 640.49 million to Russia for gas supplies since the start of 2024, prompting calls for France to reduce its purchases. This growing gas trade with Russia occurs as Macron aims to take a tougher stance in support of Kyiv, two years after Russia's full-scale invasion of Ukraine.

- In 2027, the EU is set to implement a new carbon pricing scheme, the Emissions Trading System 2 (ETS2), targeting CO2 emissions from buildings and road transport. Initially agreed upon in 2023, EU legislators assured that the pricing would cap at USD 48.03 per tonne of CO2, translating to an estimated 10-cent surcharge on each liter of diesel or petrol.

France Road Freight Transport Industry Overview

The France Road Freight Transport Market is fragmented, with the major five players in this market being CMA CGM Group (including CEVA Logistics), Dachser, Deutsche Bahn AG (including DB Schenker), STEF Group and XPO, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 CMA CGM Group (including CEVA Logistics)

- 6.4.2 Dachser

- 6.4.3 Deutsche Bahn AG (including DB Schenker)

- 6.4.4 DHL Group

- 6.4.5 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.6 Expeditors International of Washington, Inc.

- 6.4.7 FM Logistics

- 6.4.8 Lactalis Group (including Lactalis Logistique & Transports)

- 6.4.9 Reyes Holdings (including Martin Brower)

- 6.4.10 STEF Group

- 6.4.11 XPO, Inc.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219