|

市场调查报告书

商品编码

1692552

西班牙公路货运:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Spain Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

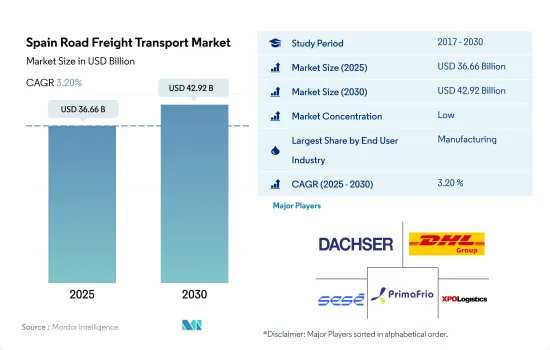

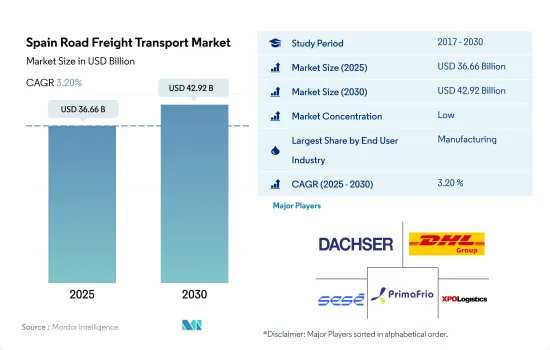

西班牙公路货运市场规模预计在 2025 年为 366.6 亿美元,预计到 2030 年将达到 429.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.20%。

预计2023年至2027年间电子商务产业的复合年增长率将达到10%,进而推动市场成长。

- 西班牙的製造业是该国经济的主要贡献者,为运输公司创造了需求。西班牙以汽车、机械和纺织等出口导向产业而闻名。这些行业严重依赖公路货运服务将货物运送到国内和国际市场。 2024 年 7 月,西班牙製造业产量增加 4.4%,主要得益于非耐用消费品(8.3%)、半成品(6.6%)和耐用消费品(2.8%)的成长。这标誌着从 6 月 4.3% 的跌幅中復苏。

- 预计到 2027 年,电子商务产业规模将达到 476.3 亿美元,2023 年至 2027 年期间的复合年增长率为 10%。电子商务的兴起预计将推动批发和零售终端用户领域的成长。此外,西班牙石油和天然气消费量的增加预计将为石油和天然气、采矿和采石终端用户领域提供支援。在消费量方面,石油仍是西班牙使用最广泛的能源,占总量的43.8%,其次是天然气,占21.8%。

西班牙公路货运市场趋势

西班牙政府加大基础建设投资,推动运输和仓储业发展

- 2024年5月,建设计画再次被提起。西班牙政府已聘请国有工程公司 Ineco 对该计划进行最新的可行性研究和成本估算。初步估计,建造该隧道的成本在 53.3 亿美元至 106.7 亿美元之间,预计将从欧洲和非洲的贷款机构资金筹措。西班牙与摩洛哥之间最短路线14公里,但海水深度约1,000米,施工难度高。正在考虑的替代方案长度约为 28 公里,但更易于管理,深度不到 300 公尺。目前的计画是建造一条隧道,未来可以选择增加第二条平行隧道。该隧道将供客运和货运列车使用。

- 西班牙于 2024 年 6 月拨款 24.7 亿美元用于加强西班牙北部的铁路基础设施,这是对阿斯图里亚斯地区 30.9 亿美元投资的一部分。其中,23.5亿美元将分配给预计2030年完工的欧盟计划。同时,由西班牙运输部监督的7.4495亿美元的开发案预计将于2050年完工。 2024年10月,西班牙核准了一项三方协议,将在巴塞隆纳港建造一个新的南部铁路入口,耗资超过8.0565亿美元。

为因应燃油价格上涨,西班牙政府已对2022年的零售价格实施每公升0.20美元的补贴折扣。

- 西班牙的燃料价格一直呈持续上涨趋势,到 2024 年 4 月,每公升汽油的平均价格上涨至 1.78 美元,连续第三个月上涨 0.96%,让人想起 10 月中旬的水平。同时,柴油价格为每公升 1.66 美元,第四週上涨近 0.6%。此外,自 2024 年初以来,汽油价格飙升了 9.25%,而柴油价格仅小幅上涨了近 4.5%。

- 燃料价格以及食品成本最近成为人们关注的焦点,对西班牙人的家庭预算产生了重大影响。到 2024 年底,每公升 95 辛烷值汽油的价格预计将达到 1.49 美元左右,柴油的价格预计将达到 1.38 美元左右。燃料价格预期下跌的主要原因是石油市场供应和需求都在下降。国际能源总署(IEA)预测,石油消费量将从2023年第三季的每天280万桶大幅下降至2024年的每天110万桶。

西班牙公路货运业概况

西班牙公路货运市场分为五大主要企业,分别为 DACHSER、DHL Group、Grupo Sese、Primafrio 和 XPO, Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 按经济活动分類的GDP分布

- 经济活动GDP成长

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输成本

- 卡车持有量(按类型)

- 主要卡车供应商

- 公路货运吨位趋势

- 公路货运价格趋势

- 模态共享

- 通货膨胀率

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 汇出目的地

- 国内的

- 国际货运

- 卡车负载容量

- 整车装载 (FTL)

- 零担运输 (LTL)

- 货柜运输

- 货柜运输

- 没有容器

- 运输距离

- 远距

- 短途运输

- 产品成分

- 流体产品

- 固体货物

- 温度控制

- 非温控

- 温度控制

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- AP Moller-Maersk

- DACHSER

- 德国铁路公司(包括德铁信可)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Grupo Sese

- 国际分销服务(包括 GLS)

- 法国邮政集团(包括 Seur Geopost SL)

- Marcotran

- Primafrio

- XPO, Inc.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球物流市场概览

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

- 外汇

简介目录

Product Code: 92369

The Spain Road Freight Transport Market size is estimated at 36.66 billion USD in 2025, and is expected to reach 42.92 billion USD by 2030, growing at a CAGR of 3.20% during the forecast period (2025-2030).

The e-commerce industry is projected to expand at a CAGR of 10% from 2023-2027, driving the market's growth

- The manufacturing sector in Spain is one of the major contributors to the country's economy and generates demand for freight operators. Spain is known for its export-oriented industries, such as automotive, machinery, and textiles. These industries rely heavily on road freight services to transport their goods to domestic and international markets. In July 2024, Spain's manufacturing production grew by 4.4%, driven by increases in non-durable consumer goods (8.3%), intermediate goods (6.6%), and durable consumer goods (2.8%). This marks a recovery after a 4.3% decline in June.

- The e-commerce industry is projected to register a CAGR of 10% during the period 2023-2027 and reach USD 47.63 billion by 2027. The rise in e-commerce is expected to drive the growth of the wholesale and retail trade end-user segment. Moreover, rising oil and gas consumption in Spain is expected to support the oil and gas, mining, and quarrying end-user segment. In terms of consumption, oil remains the most widely used fuel in Spain, accounting for 43.8% of the total, followed by natural gas at 21.8%.

Spain Road Freight Transport Market Trends

Developing transport and storage sector fueled by growing infrastructure investments by Spanish Government

- In May 2024, plans to build a rail tunnel under the Strait of Gibraltar to connect Spain and Morocco were revived. The Spanish government hired state-owned engineering firm Ineco to update the feasibility study and cost estimates for the project. Initial estimates suggest the tunnel could cost between USD 5.33 billion and USD 10.67 billion, with funding expected from European and African lending institutions. The shortest route between Spain and Morocco is 14 km, but the sea is about 1000 m deep there, making construction difficult. Alternatives being considered are around 28 km long but at a more manageable depth of less than 300 meters. The current plan is for a single-bore tunnel, with the option to add a second parallel tunnel in the future. This tunnel would be used by both passenger and freight trains.

- In June 2024, Spain allocated USD 2.47 billion to enhance rail infrastructure in northern Spain, part of a broader USD 3.09 billion investment in Asturias. Out of this total, USD 2.35 billion is earmarked for EU projects slated for completion by 2030. Meanwhile, developments overseen by Spain's Ministry of Transport, with a budget of USD 744.95 million, are targeted for a 2050 finish. In October 2024, Spain greenlit a tripartite agreement to construct a new southern rail entrance to the Port of Barcelona, with expenses exceeding USD 805.65 million.

Owing to high fuel prices, a discount of USD 0.2 per liter was applied to the retail price as a subsidy by the Spanish government in 2022

- Spain has witnessed a consistent uptrend in fuel prices, with the average cost of a liter of petrol climbing to USD 1.78 by April 2024, marking a 0.96% increase for three consecutive months, reminiscent of mid-October levels. Diesel prices, on the other hand, stood at USD 1.66 per liter, reflecting an uptick of nearly 0.6% in the fourth week of the month. Moreover, gasoline prices have surged by 9.25% since the start of 2024, while diesel has seen a more modest increase of close to 4.5%.

- Fuel prices have been a major concern recently, along with food costs, significantly impacting Spaniards' budgets. By the end of 2024, the price of a liter of 95-octane gasoline is expected to be around USD 1.49, and diesel around USD 1.38. The main reason for this expected drop in fuel prices is the oil market, which is seeing a decline in both supply and demand. The International Energy Agency predicts that oil consumption will fall sharply, from 2.8 million barrels per day in the third quarter of 2023 to 1.1 million in 2024.

Spain Road Freight Transport Industry Overview

The Spain Road Freight Transport Market is fragmented, with the major five players in this market being DACHSER, DHL Group, Grupo Sese, Primafrio and XPO, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 DACHSER

- 6.4.3 Deutsche Bahn AG (including DB Schenker)

- 6.4.4 DHL Group

- 6.4.5 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.6 Grupo Sese

- 6.4.7 International Distributions Services (including GLS)

- 6.4.8 La Poste Group (including Seur Geopost SL)

- 6.4.9 Marcotran

- 6.4.10 Primafrio

- 6.4.11 XPO, Inc.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219