|

市场调查报告书

商品编码

1692556

中国公路货运:市场占有率分析、产业趋势与统计、成长预测(2025-2030年)China Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

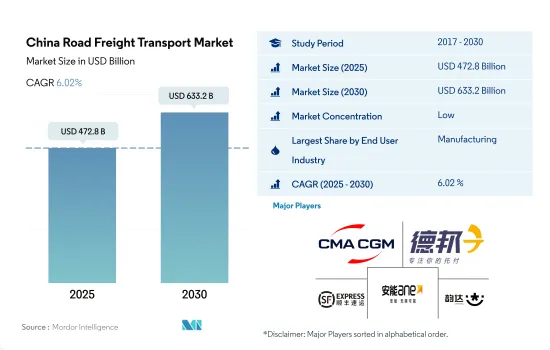

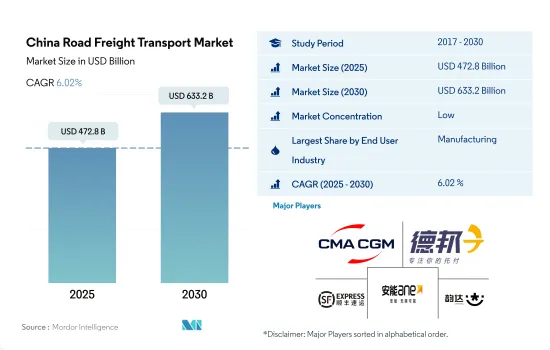

预计 2025 年中国公路货运市场规模为 4,728 亿美元,到 2030 年将达到 6,332 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.02%。

製造业产出成长和电子商务推动公路货运服务需求

- 由于卡车运输业在确保该国製成品的及时交付和分配方面发挥着至关重要的作用,製造业产量的增加正在推动对道路服务的需求。儘管面临全球地缘政治挑战和其他新兴经济体的竞争,中国製造业仍蓬勃发展。 2023年,中国製造业增加价值占GDP比重将达31.7%。此外,中国位居2024年新兴亚洲製造业指数榜首。受製造业復苏的支撑,中国2024年4月工业生产年增6.7%,高于2024年3月的4.5%。

- 道路、桥樑和机场等大型基础设施建设计划的发展正在推动建筑终端用户领域的发展。受「十四五」规划(2021-2025 年)中基础设施计划投资的支持,预计 2025 年至 2028 年期间建设产业的复合年增长率将达到 3.9%。政府计划在 2060 年投资 13.8 兆美元用于绿色能源转型,预计这也将支持成长。因此,预计未来几年建筑终端用户领域将会成长。

中国公路货运市场趋势

「十四五」规划重点发展清洁能源基础建设和交通运输投资,推动经济成长

- 2023年,中国清洁能源产业为国家经济成长做出了重大贡献。据中国能源与清洁空气机构(CREA)称,中国对可再生能源基础设施的投资达到了8,900亿美元,几乎相当于当年世界对石化燃料供应的投资。清洁能源,包括再生能源来源、核能、电网、能源储存、电动车和铁路,到2023年将占中国GDP的9.0%,与前一年同期比较7.2%。 2023年电动车产量与前一年同期比较成长36%。

- 中国在其「十四五」规划(2021-2025年)中公布了扩大交通网络的目标。到2025年,高铁里程将由2020年的3.8万公里增加到5万公里,覆盖95%的50万人口以上城市,线路长度达到250公里。到2025年,铁路营业里程达到16.5万公里,民用机场270个以上,都市区地铁营业里程达到1万公里,高速公路营业里程达到19万公里,高等级内河航道营业里程达到1.85万公里。 2025年,实现全面发展是首要目标,重点转变交通运输方式,提高交通运输对GDP的贡献率。

受俄乌战争影响,中国柴油零售价格飙升至历史高点。

- 预计2023年中国原油进口量将较2022年成长11%,达到5.6399亿吨,即1,128万桶/日。受俄乌战争影响,全球油价上涨,中国燃油价格创历史新高。 2024年1-2月原油进口量达8,831万吨,年增5.1%。这一增长是由于之前以较低价格购买了原油。布伦特期货在2023年9月达到高峰97.69美元,12月跌至72.29美元,2024年3月升至84.05美元。 2024年3月OPEC+集团决定将减产协议延长至6月底,进一步推高了油价。此举引发了人们对全球石油需求的担忧,因为该组织将减产近6%的全球需求。此外,近期原油价格上涨可能从2024年下半年开始抑制中国的进口。

- 中国计划根据近期国际原油价格波动调整汽油、柴油零售价格。价格上涨反映出全球供应紧张和需求前景改善。根据国发改委预测,2024年中国汽油和柴油价格将上涨28美元/吨。儘管预计燃料需求将下降,但到2035年,石油基燃料仍可能是主要选择。

中国道路货物运输产业概况

中国公路货运市场较分散,主要五大参与者为达飞集团(旗下有CEVA物流)、德邦物流、顺丰速运(KEX-SF)、上海安能聚创供应链管理及韵达控股(依字母顺序排列)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 按经济活动分類的GDP分布

- 按经济活动分類的GDP成长

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输成本

- 卡车持有量(按类型)

- 主要卡车供应商

- 公路货运吨位趋势

- 公路货运价格趋势

- 模态共享

- 通货膨胀率

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 汇出目的地

- 国内货运

- 国际货运

- 卡车负载容量

- 整车装载 (FTL)

- 零担运输 (LTL)

- 货柜运输

- 货柜运输

- 没有容器

- 运输距离

- 远距

- 短途运输

- 产品成分

- 流体产品

- 固体货物

- 温度控制

- 非温控

- 温度控制

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- AP Moller-Maersk

- Changjiu Logistics

- China Post

- CMA CGM Group(including CEVA Logistics)

- Deppon Logistics Co., Ltd.

- DHL Group

- SF Express(KEX-SF)

- Shanghai Aneng Juchuang Supply Chain Management Co., Ltd.

- Shanghai YTO Express(Logistics)Co., Ltd.

- SINOTRANS

- STO Express Co., Ltd.(Shentong Express)

- Yunda Holding Co. Ltd

- ZTO Express

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球物流市场概览

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

- 外汇

简介目录

Product Code: 92373

The China Road Freight Transport Market size is estimated at 472.8 billion USD in 2025, and is expected to reach 633.2 billion USD by 2030, growing at a CAGR of 6.02% during the forecast period (2025-2030).

Rise in manufacturing sector's output and e-commerce driving the demand for road freight services

- The rise in manufacturing production is driving the demand for road services as the trucking industry plays a significant role in ensuring the timely delivery and distribution of manufactured goods domestically. China's manufacturing sector thrives despite facing challenges due to global geopolitics and competition from other emerging economies. In 2023, the value-added by China's manufacturing accounted for 31.7% of its GDP. Moreover, China is at the top of the Emerging Asia Manufacturing Index 2024. China's industrial output grew 6.7% YoY in April 2024, up from the 4.5% growth in March 2024, supported by the recovery in the manufacturing sector.

- Developing large-scale infrastructure construction projects such as roads, bridges, and airports is driving the construction end-user segment. The construction industry is expected to record an average annual growth rate of 3.9% between 2025 and 2028, supported by investment in infrastructure projects as part of the 14th Five-Year Plan (FYP) (2021-2025). The government's plan to invest USD 13.8 trillion by 2060 in green power transformation is also expected to support the growth. As a result, the construction end-user segment is expected to grow in the coming years.

China Road Freight Transport Market Trends

Rising focus on developing clean energy infrastructure and transport sector investment under 14th Five-Year Plan driving growth

- In 2023, China's clean energy sector significantly contributed to the country's economic expansion. According to Energy and Clean Air (CREA), China's investment in renewable energy infrastructure amounted to USD 890 billion, almost matching global investments in fossil fuel supply for the same year. Clean energy, including renewable energy sources, nuclear power, electricity grids, energy storage, electric vehicles (EVs), and railways, constituted 9.0% of China's GDP in 2023, up from 7.2% YoY. EV production grew by 36% YoY in 2023.

- In the 14th Five-Year Plan (2021-2025), China revealed goals for expanding its transportation network. By 2025, high-speed railways will extend to 50,000 kms, up from 38,000 kms in 2020, with 95% of cities with populations above 500,000 covered by 250-km lines. The country aims to increase its railway length to 165,000 kms, civil airports to over 270, subway lines in cities to 10,000 kms, expressways to 190,000 kms, and high-level inland waterways to 18,500 kms by 2025. The primary objective is to achieve integrated development by 2025, emphasizing advancements in the transformation of the transportation system and its contribution to GDP.

China's retail diesel and gasoline prices were soared to historically high levels amid the Russia-Ukraine War

- In 2023, China imported 11% more crude oil than in 2022, totaling 563.99 mn metric tons (MMT), or 11.28 mn barrels per day. This surge was due to increased global crude oil prices amid the Russia-Ukraine War, causing fuel prices in China to reach historic highs. In Jan-Feb 2024, crude oil imports rose by 5.1% YoY, reaching 88.31 MMT. This increase was driven by purchasing crude oil at lower prices earlier. Brent futures peaked at USD 97.69 in September 2023, fell to USD 72.29 in December, and rose to USD 84.05 by March 2024. The decision made by the OPEC+ group in March 2024 to extend output cuts until the end of June has further boosted crude prices. This move has raised concerns about global oil demand, as the group is reducing production by nearly 6% of world demand. The recent increase in crude prices may also dampen China's imports starting from H2 2024.

- China plans to adjust retail prices for gasoline and diesel to align with recent shifts in global crude oil prices. The price hike reflects a tightening of global supply and a positive forecast for demand. According to NDRC, gasoline and diesel prices in China will increase by USD 28 per ton in 2024. Although there's expectation of declining demand for fuels, oil-based fuels will remain the primary choice until 2035.

China Road Freight Transport Industry Overview

The China Road Freight Transport Market is fragmented, with the major five players in this market being CMA CGM Group (including CEVA Logistics), Deppon Logistics Co., Ltd., SF Express (KEX-SF), Shanghai Aneng Juchuang Supply Chain Management Co., Ltd. and Yunda Holding Co. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 Changjiu Logistics

- 6.4.3 China Post

- 6.4.4 CMA CGM Group (including CEVA Logistics)

- 6.4.5 Deppon Logistics Co., Ltd.

- 6.4.6 DHL Group

- 6.4.7 SF Express (KEX-SF)

- 6.4.8 Shanghai Aneng Juchuang Supply Chain Management Co., Ltd.

- 6.4.9 Shanghai YTO Express (Logistics) Co., Ltd.

- 6.4.10 SINOTRANS

- 6.4.11 STO Express Co., Ltd. (Shentong Express)

- 6.4.12 Yunda Holding Co. Ltd

- 6.4.13 ZTO Express

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219