|

市场调查报告书

商品编码

1692557

印度公路货运:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

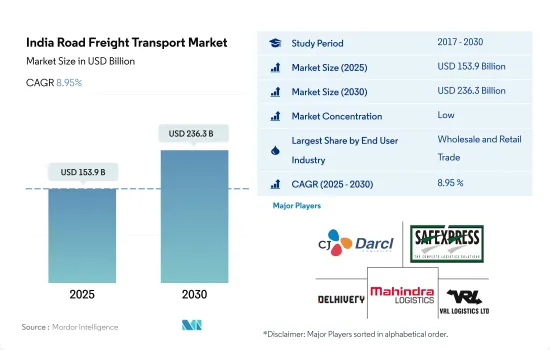

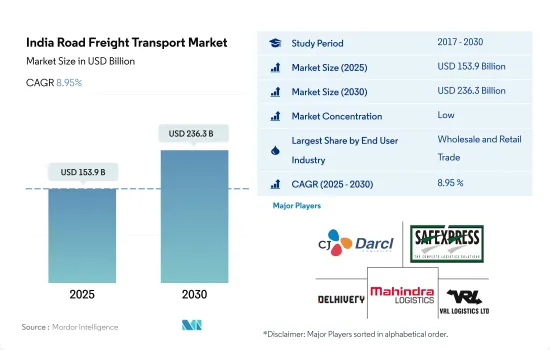

预计 2025 年印度公路货运市场规模将达到 1,539 亿美元,到 2030 年预计将达到 2,363 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.95%。

印度製造业预计到 2025 年将成长至 1 兆美元,推动市场成长

- 随着印度经济的成长,对製成品的需求不断增加,对运输原料和成品的公路货运服务的需求也日益增长。此外,製造业出口额创下4,474.6亿美元的历史新高,较去年4,220亿美元的历史最高纪录成长6.03%。 23财年(截至2022年9月)十大主要商品出口额为1,872亿美元。

- 批发和零售业的未来前景一片光明,因为印度零售业预计将在 2019 年至 2030 年间以 9% 的速度增长,从 2019 年的 7790 亿美元增至 2026 年的 14070 亿美元,到 2030 年将增加超过 18000 亿美元。在收入成长、人口结构有利、外国投资和都市化进程加快的支持下,该产业的长期前景一片光明。此外,预计产量和出口的增加将支持製造业的最终用户部分。印度是製造业领域外国投资的首选目的地。许多行动电话、奢侈品和汽车领域的知名品牌已在印度建立或计划建立製造工厂。预计2025年印度製造业规模将成长至1兆美元。

印度公路货运市场趋势

政府和私人投资、出口成长以及州际货物运输增加是运输业的主要驱动力。

- 到2024年,政府设定了将物流成本降低5-6%的目标。印度铁路正在努力提高货运能力、加快货运列车速度、降低货运票价、建立专用货运走廊并改善火车站、公路和港口之间最后一英里的连通性。我们正在与首席部长加蒂·沙克蒂合作,赋予物流行业地位,推广数位解决方案并发展物流基础设施。这些努力旨在降低成本并刺激物流领域的GDP成长。

- 预计该产业将持续成长,到 2027 年将增加 1,000 万个就业机会。印度渴望成为全球製造和物流中心,最近的政策吸引了约 100 亿美元的仓储和物流行业投资。印度 2024 年的基础设施计划,如孟买跨港口连接线 (MTHL)、新孟买国际机场、诺伊达国际机场和西部专用货运走廊,也有望加速印度成为全球物流领域重要参与者的进程。

由于多个邦政府削减增值税,柴油价格的涨幅没有汽油价格涨幅那么大。

- 9 月份,在沙乌地阿拉伯和俄罗斯将自愿减产和出口协议延长至 2023 年后,原油价格触及每桶 90 美元的 10 个月高点。由于印度 85% 的石油依赖进口,燃料价格受到了影响。代表 1,400 万名卡车驾驶人和车辆驾驶人的全印度汽车运输大会表示,不断上涨的燃油价格正在影响印度卡车司机,因为他们转嫁价格上涨的能力有限,而价格上涨占卡车运营成本的 70%。

- 印度政府正考虑在 2024 年将汽油和柴油价格每公升降低 4-6 印度卢比(0.04-0.07 美元),以赶上定于 2024 年上半年举行的人民院选举。目前,政府正在与石油行销公司进行讨论,以平等分担减价负担,这可能会导致每公升汽油和柴油价格大幅下降,最高可达 10 卢比(0.12 美元)。此举旨在减轻人们的经济负担,也可能导致零售通膨率下降,零售通膨率在2023年11月达到5.55%的高峰。

印度公路货运业概况

印度公路货运市场较为分散,该市场前五大参与者(按字母顺序排列)为 CJ Darcl、CJ Darcl Logistics Limited、Delhi Ltd.、Mahindra Logistics Ltd. 和 VRL Logistics Ltd.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 按经济活动分類的GDP分布

- 经济活动GDP成长

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输成本

- 卡车持有量(按类型)

- 主要卡车供应商

- 公路货运吨位趋势

- 公路货运价格趋势

- 模态共享

- 通货膨胀率

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 汇出目的地

- 国内货运

- 国际货运

- 卡车负载容量

- 整车装载 (FTL)

- 零担运输 (LTL)

- 货柜运输

- 货柜运输

- 没有容器

- 距离

- 远距

- 短途运输

- 产品成分

- 流体产品

- 固体货物

- 温度控制

- 非温控

- 温度控制

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- AP Moller-Maersk

- Allcargo Logistics Ltd.(including Gati Express)

- CJ Darcl

- CJ Darcl Logistics Limited

- Delhivery Ltd.

- DHL Group

- Expeditors International of Washington, Inc.

- GEODIS

- Mahindra Logistics Ltd.

- Nippon Express Holdings

- Transport Corporation of India Ltd.(TCI)

- V-TRANS

- Varuna Group

- VRL Logistics Ltd.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球物流市场概览

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

- 外汇

简介目录

Product Code: 92374

The India Road Freight Transport Market size is estimated at 153.9 billion USD in 2025, and is expected to reach 236.3 billion USD by 2030, growing at a CAGR of 8.95% during the forecast period (2025-2030).

India's manufacturing sector is expected to grow to USD 1 trillion by 2025 and drive the growth of the market

- As the Indian economy grows, there is an increase in the demand for manufactured goods, which leads to a higher need for road freight services to transport raw materials and finished goods. Moreover, manufacturing exports had their biggest year ever at USD 447.46 billion, growing 6.03% in FY23 over last year's record-breaking figure of USD 422 billion. In FY23 (until September 2022), exports of the top 10 major commodities stood at USD 187.2 billion.

- The future of the wholesale and retail trade segment is expected to be outstanding as India's retail industry is projected to grow at a pace of 9% over 2019-2030, from USD 779 billion in 2019 to USD 1,407 billion by 2026 and more than USD 1.8 trillion by 2030. The long-term future for the industry looks positive, supported by rising income, favorable demographics, entry of foreign players, and increasing urbanization. Moreover, rising production and exports are expected to support the manufacturing end-user segment. India is one of the top destinations for foreign investment in the manufacturing industry. Many leading brands in the mobile phone, luxury, and automotive sectors have established or are planning to set up their manufacturing plants in India. India's manufacturing sector is expected to grow to USD 1 trillion by 2025.

India Road Freight Transport Market Trends

Government and private investments, rising exports, and the increasing interstate movement of goods are the major drivers of the transportation industry

- In 2024, the government is dedicated to reducing logistics costs to 5-6%. Indian Railways is taking steps to boost freight capacity, increase the speed of freight trains, lower freight expenses, establish dedicated freight corridors, improve last-mile connectivity between railheads, roads, and ports. They're aligning with PM Gati Shakti, granting industry status to logistics, promoting digital solutions, and developing logistics infrastructure. These efforts aim to cut costs and spur GDP growth in logistics.

- The sector is expected to grow till 2027 and is expected to add 10 million jobs by 2027. India is aiming to become a global hub for manufacturing and logistics, with recent policies attracting around USD 10 billion USD in investments for the warehousing and logistics sector. Also India's infrastructure plans for 2024, such as the Mumbai Trans Harbour Link (MTHL), Navi Mumbai International Airport, Noida International Airport and Western Dedicated Freight Corridor etc, are expected to accelerate India's journey towards becoming a prominent player in the global logistics landscape.

The diesel price increase was less sharp than the increase in petrol prices due to VAT cuts offered by several state governments

- In September 2023, oil prices hit a 10-month high of USD 90 per barrel as Saudi Arabia and Russia extended their voluntary production and export cuts till 2023. As India imports 85% of its oil, the fuel prices were impacted. According to the All-India Motor Transport Congress, which represents 14 million truckers and vehicle operators, the soaring fuel prices are impacting India's truckers as they have limited ability to pass on the rising prices, which account for 70% of the cost of operating a truck.

- The Indian government is contemplating reducing petrol and diesel prices by INR 4 - INR 6 (USD 0.04 - USD 0.07) per litre in 2024, timed with the upcoming Lok Sabha elections in H1 2024. Discussion in ongoing with Oil Marketing Companies to share the burden of this reduction equally, and there's a possibility of a more substantial cut of up to Rs 10 (USD 0.12) per litre. This move aims to alleviate the financial strain on the public and could also help lower retail inflation, which peaked at 5.55% in November 2023.

India Road Freight Transport Industry Overview

The India Road Freight Transport Market is fragmented, with the major five players in this market being CJ Darcl, CJ Darcl Logistics Limited, Delhivery Ltd., Mahindra Logistics Ltd. and VRL Logistics Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 Allcargo Logistics Ltd. (including Gati Express)

- 6.4.3 CJ Darcl

- 6.4.4 CJ Darcl Logistics Limited

- 6.4.5 Delhivery Ltd.

- 6.4.6 DHL Group

- 6.4.7 Expeditors International of Washington, Inc.

- 6.4.8 GEODIS

- 6.4.9 Mahindra Logistics Ltd.

- 6.4.10 Nippon Express Holdings

- 6.4.11 Transport Corporation of India Ltd. (TCI)

- 6.4.12 V-TRANS

- 6.4.13 Varuna Group

- 6.4.14 VRL Logistics Ltd.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219