|

市场调查报告书

商品编码

1692560

马来西亚公路货运:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Malaysia Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

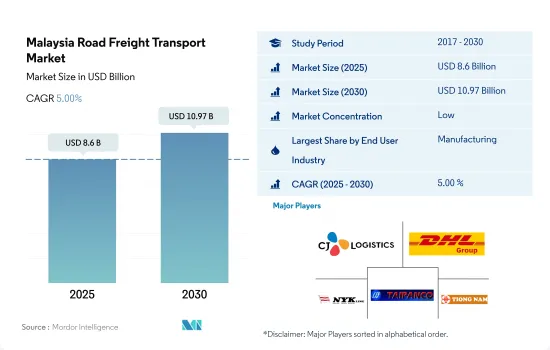

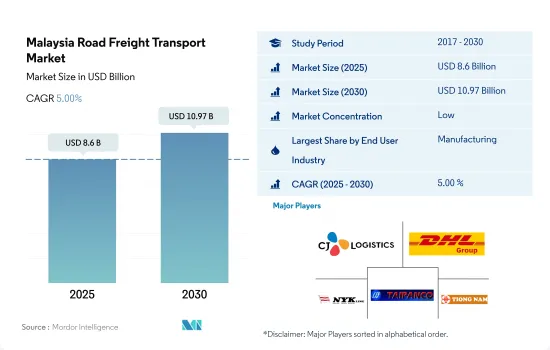

马来西亚公路货运市场规模预计在 2025 年为 86 亿美元,预计到 2030 年将达到 109.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.00%。

2022年马来西亚电子商务产业与前一年同期比较去年同期成长2.98%,推动市场成长。

- 2022年,占製造业69.2%的出口导向产业将成长7.1%,而内销导向产业将成长10.3%。 2022年,製成品出口与前一年同期比较增22%,其中电气和电子产品出口成长30%。受所有子部门扩张的推动,预计2023年国内製造业将成长3.9%。出口导向产业预计将稳步成长,其中电子电气行业将继续引领该行业的成长。

- 未来几年,马来西亚旨在利用物联网 (IoT) 和精密农业等技术来提高国内产量并减少进口依赖。未来两到七年内,马来西亚的目标是将水产养殖的鱼类产量从总产量的 26% 提高到 60%,预计这将促进农业、渔业和林业终端用户领域的发展。此外,预计探勘和生产活动的增加将推动石油和天然气、采矿和采石最终用户领域的发展。

马来西亚公路货运市场趋势

儘管外国直接投资亏损达 725 万美元,马来西亚运输和仓储产业 2022 年仍将与前一年同期比较增 33.42%

- 「一带一路」倡议正在推动马来西亚的基础设施发展。东海岸铁路线(ECRL)旨在改善东海岸的吉兰丹、登嘉楼和彭亨与西海岸的森美兰、雪兰莪和布城之间的连通性。这些地区目前缺乏完整的铁路连接。预计东海岸铁路将推动马来西亚经济成长高达 2.7%。预计建成20年后,马来西亚经济成长率将达4.6%。 ECRL计划预计于2026年12月完工,并于2027年1月开始营运。

- 捷运3号线是吉隆坡城市轨道运输网的最后一条主要线路,全长50.8公里,贯穿吉隆坡郊区。预计建设将于 2023 年初开始,并于 2030 年全面竣工,第一阶段将于 2028 年开始营运。透过酵母铁路 (ECRL),双轨铁路连接基础设施计划于 2017 年启动,其中包括 20 个车站:14 个客运站、5 个客运/货运站和 1 个货运站。

正在讨论取消柴油补贴,使零售燃油价格与市场价格保持一致

- 马来西亚计划自2024年6月起取消柴油补贴,并将零售价格与每公升3.35马来西亚林吉特(0.75美元)的市场价格保持一致,比之前的2.15马来西亚林吉特(0.48美元)上涨55%。儘管可能产生政治影响,但预计这项变化对通膨的影响较小。 2023 年的柴油补贴预计将达到 145 亿马来西亚林吉特(32.8 亿美元),政府预计补贴合理化每年可节省约 40 亿马来西亚林吉特(9 亿美元)。该国每月的柴油补贴高达 10 亿马来西亚林吉特(2.2 亿美元),而每天因洩漏造成的损失高达 450 万马来西亚林吉特(102 万美元)。

- 作为马来西亚总理安瓦尔·易卜拉欣 (Anwar Ibrahim) 长期努力改革国家燃油补贴制度的一部分,2024 年 6 月马来西亚柴油价格上涨了 50% 以上。改革旨在透过取消普遍能源补贴并将援助重点放在最需要的人身上来缓解公共财政压力。此举也旨在解决补贴柴油被走私到邻国并以高价交易的问题。

马来西亚公路货运业概况

马来西亚的公路货运市场较为分散,前五大参与者分别是 CJ 物流、DHL Group、Nippon Yusen、Taipanco Sdn Bhd 和 Tiong Nam Logistics Holdings Bhd(按字母顺序排列)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 按经济活动分類的GDP分布

- 按经济活动分類的GDP成长

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输成本

- 卡车持有量(按类型)

- 主要卡车供应商

- 公路货运吨位趋势

- 公路货运价格趋势

- 模态共享

- 通货膨胀率

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 汇出目的地

- 国内货运

- 国际货运

- 卡车负载容量

- 整车装载 (FTL)

- 零担运输 (LTL)

- 货柜运输

- 货柜运输

- 没有容器

- 距离

- 远距

- 短途运输

- 产品成分

- 流体产品

- 固体货物

- 温度控制

- 非温控

- 温度控制

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- CJ Logistics Corporation

- DHL Group

- FM Global Logistics Holdings Bhd

- Gulf Agency Company(GAC)

- NYK(Nippon Yusen Kaisha)Line

- Taipanco Sdn Bhd

- Tiong Nam Logistics Holdings Bhd

- Transocean Holdings Bhd

- Xin Hwa Holdings Bhd

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球物流市场概览

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

- 外汇

简介目录

Product Code: 92377

The Malaysia Road Freight Transport Market size is estimated at 8.6 billion USD in 2025, and is expected to reach 10.97 billion USD by 2030, growing at a CAGR of 5.00% during the forecast period (2025-2030).

The e-commerce sector in Malaysia experienced a YoY growth of 2.98% in 2022, which drove the growth of the market

- In 2022, the export-oriented industries, which comprised 69.2% of the manufacturing sector, grew by 7.1%, while the domestic-oriented industries increased by 10.3%. Exports of manufactured goods rose by 22% YoY in 2022, boosted by exports of electrical and electronic products, which rose by 30%. In 2023, the domestic manufacturing sector is estimated to grow by 3.9% on account of expansion in all sub-sectors. Export-centric industries were expected to grow steadily, with the electronics and electrical segment continuing to drive growth in the sector.

- In the coming years, the country aims to increase domestic production using technologies such as the Internet of Things (IoT) and precision farming to reduce import dependency. Over the next 2-7 years, Malaysia aims to raise fish production from aquaculture from 26% of total fish production to 60%, which is expected to boost the agriculture, fishing, and forestry end-user segment. Moreover, an increase in exploration and production activities is expected to drive the oil and gas, mining, and quarrying end-user segment.

Malaysia Road Freight Transport Market Trends

Malaysia's transportation and storage sector experienced 33.42% YoY growth in 2022, despite USD 7.25 million FDI deficit

- The Belt and Road Initiative is driving Malaysia's infrastructure growth. The East Coast Rail Link (ECRL) seeks to improve connectivity between Kelantan, Terengganu, and Pahang in the East Coast with Negeri Sembilan, Selangor, and Putrajaya in the West Coast. These areas currently lack complete railway connections. The ECRL is forecasted to boost Malaysia's economic growth by up to 2.7%. Furthermore, two decades after its construction, Malaysia's economic growth is expected to reach 4.6%. The ECRL project is set to finish by December 2026 and is expected to start operating in January 2027.

- The MRT3 is the last critical route to complete the Kuala Lumpur urban rail network; the line is 50.8 km long and runs around Kuala Lumpur's outskirts. Its construction began in early 2023 and is slated for full completion by 2030, while operations for the first phase are anticipated to commence in 2028. Through East Coast Rail Link (ECRL), a double-track railway linking infrastructure project, which includes 20 stations, began in 2017, with 14 passenger stations, five combined passenger and freight stations, and one freight station.

Elimination of Diesel subsidies under discussions, in order to align retail fuel prices to align with market rates

- Starting in June 2024, Malaysia plans to eliminate diesel subsidies, allowing retail prices to align with the market rate of MYR 3.35 (USD 0.75) per litre, marking a 55% increase from MYR 2.15 (USD 0.48). Despite potential political consequences, this change is projected to have minimal impact on the country's inflation rate. In 2023, diesel subsidies amounted to MYR 14.5 billion (USD 3.28 billion), and the government anticipates saving approximately MYR 4 billion (USD 0.90 billion) annually through this Subsidy Rationalization. Diesel subsidies in the country amount to MYR 1 billion (USD 0.22 billion) monthly, with daily losses from leaks totaling MYR 4.5 million (USD 1.02 million).

- Diesel prices in Malaysia surged by over 50% in June 2024 as part of Prime Minister Anwar Ibrahim's efforts to reform the country's long-standing fuel subsidy system. The restructuring aimed to alleviate pressure on national finances by eliminating universal energy subsidies and focusing assistance on those most in need. This move also aims to address issues like the smuggling of subsidized diesel to neighboring countries, where it fetches higher prices.

Malaysia Road Freight Transport Industry Overview

The Malaysia Road Freight Transport Market is fragmented, with the major five players in this market being CJ Logistics Corporation, DHL Group, NYK (Nippon Yusen Kaisha) Line, Taipanco Sdn Bhd and Tiong Nam Logistics Holdings Bhd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 CJ Logistics Corporation

- 6.4.2 DHL Group

- 6.4.3 FM Global Logistics Holdings Bhd

- 6.4.4 Gulf Agency Company (GAC)

- 6.4.5 NYK (Nippon Yusen Kaisha) Line

- 6.4.6 Taipanco Sdn Bhd

- 6.4.7 Tiong Nam Logistics Holdings Bhd

- 6.4.8 Transocean Holdings Bhd

- 6.4.9 Xin Hwa Holdings Bhd

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219