|

市场调查报告书

商品编码

1693553

中东和非洲特种肥料:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Middle East & Africa Specialty Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

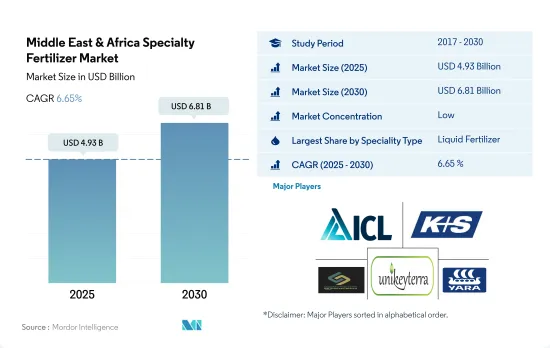

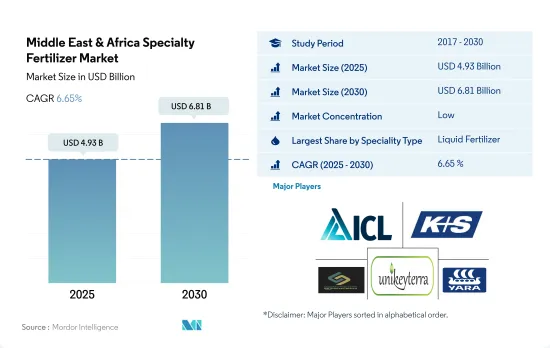

预计 2025 年中东和非洲特种肥料市场规模将达到 49.3 亿美元,到 2030 年将达到 68.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.65%。

营养供应意识和效率的提高可能会推动市场成长

- 预计到 2022 年,中东和非洲特殊肥料市场将占总市场份额的 7.6%,预测期内的复合年增长率为 6.4%。农民对专用肥料的采用率相对较低,而且与传统肥料相比成本较高,这是导致其市场占有率不大的原因。

- 2022年,南非、奈及利亚和土耳其成为主导国家,分别占11.4%、8.3%和4.9%的市占率。这些国家由于人口众多、土地充足且政府主导肥料测试,成为肥料製造商关注的重点。这些製造商正在客製化专门的产品以满足这些市场的特定要求,从而进一步刺激市场扩张。

- 2022 年,在中东和非洲特种肥料市场中,液体肥料将占 48.5% 的较大份额。该地区的种植者意识到液体肥料的好处,包括易于渗透到土壤中、植物更快吸收养分以及减少浪费。这些肥料既可以施在地面上,也叶面喷布面上。对于研究期间关注液体肥料领域的製造商来说,这是一个有利可图的机会。

- 2022 年,水溶性肥料在中东和非洲特种肥料市场占有 47.3% 的份额。水溶性肥料不受养分流失的影响,简化了养分管理。

- 近年来,农民对专用肥的认知度明显提高。除此之外,对液体、水溶性和控制释放肥料的需求不断增加,预计将推动市场成长。

在研究期间,营养供应意识和效率的提高可能会推动市场成长

- 预计中东和非洲的特种肥料市场在2022年将占到总市场份额的7.6%,预计在2023年至2030年期间的复合年增长率为6.4%。特种肥料市场占有率低主要是因为农民的认知度有限,而且与传统替代品相比成本相对较高。

- 2022 年,南非、奈及利亚和土耳其成为市场主导者,占比分别为 11.4%、8.3% 和 4.9%。这些国家对于肥料製造商来说具有很大的吸引力,因为它们人口众多、土地充足,而且政府支持肥料测试。这些製造商提供根据这些国家的特定要求量身定制的产品,进一步促进了市场成长。

- 液体肥料在中东和非洲特种肥料市场占有很大份额,2022 年占比为 48.5%。该地区的种植者正在意识到液体肥料的好处,例如改善土壤渗透、增强养分吸收和减少浪费。这些肥料既可以施用于地面,也可以叶面喷布面上,为该领域的製造商创造了巨大的成长机会。

- 水溶性肥料将占2022年特种肥料市场的47.0%,由于不受浸出的影响,简化了营养管理。

- 由于农民对特种肥料认识的急剧提高,推动了对液体、水溶性和控制释放肥料的需求,预计市场将出现强劲增长。

中东和非洲特种肥料市场趋势

该地区的农田遭受风蚀和水蚀,农作物种植面临挑战。

- 在中东和非洲,玉米、水稻、高粱和大豆等田间作物通常在4月至5月播种,9月至10月收穫。该地区的农业面临重大挑战,包括土地和水资源短缺。雨养灌溉土地因风蚀和水蚀劣化,且不可持续的耕作方式进一步加剧了这一情况。该地区以农田作物为主,覆盖了90%的农业用地。 2022年,该地区田间作物作物种植面积预计将达2.49亿公顷,比2017年增加3.9%。其中,玉米的种植面积较大,占田间作物总种植面积的17.8%。 2017年至2022年,小麦种植面积将增加4.6%。其中,2022年该地区玉米种植面积将达4,430万公顷。

- 在非洲,尼日利亚是高粱产量最高的国家,其次是衣索比亚。高粱是重要的作物,占尼日利亚谷物总产量的50%,种植面积约占全国谷物生产面积的45%。高粱是中东和非洲干旱地区的首选主要作物,因为它耐旱耐涝,适应各种土壤条件,确保粮食和收入安全。

- 过去十年来,该地区人口增加了23%以上。儘管生产能力有限,但预测显示粮食进口量将会增加。然而,农业部门一直在不断扩张,耕地面积也在增加。

干旱天气加速了土壤中氮的消耗,而氮是农业生产力的关键营养素。

- 氮、磷、钾是植物生长必需的关键营养素。氮和磷是蛋白质和核酸所必需的,而蛋白质和核酸是植物组织的主要成分。另一方面,钾对收穫作物的品质有显着的影响。田间作物平均每公顷获得174.4公斤主要养分。

- 其中,中东及非洲地区田间作物氮、磷、钾平均施用量分别为234.8公斤/公顷、127.4公斤/公顷、161.0公斤/公顷。中东和非洲主要种植小麦、高粱、水稻、玉米等田间作物。 2022年,这些作物主要养分平均施用量分别为144.5公斤/公顷、162.9公斤/公顷、152.6公斤/公顷和245.24公斤/公顷。

- 在主要营养元素中,氮将成为中东和非洲地区的主要消费量,到2022年将达到170万吨。氮是作物产量最重要的营养元素,由于该地区土壤普遍缺乏氮,氮是应用最广泛的肥料。这一优点是由于该地区耕作面积大,约占总耕作面积的 95.0%,因此对主要营养物质的需求很高。强调自给自足和减少对进口的依赖是该地区田间作物市场成长的基础。

中东和非洲特种肥料产业概况

中东和非洲的特种肥料市场较为分散,前五大公司占了16.78%的市场。该市场的主要企业有:ICL Group Ltd、K+S Aktiengesellschaft、Safsulphur、Unikeyterra Chemical 和 Yara International ASA(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 主要作物种植面积

- 田间作物

- 园艺作物

- 平均养分施用量

- 微量营养素

- 田间作物

- 园艺作物

- 主要营养素

- 田间作物

- 园艺作物

- 次要宏量营养素

- 田间作物

- 园艺作物

- 微量营养素

- 灌溉农田

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 专业类型

- CRF

- 聚合物涂层

- 聚合硫涂层

- 其他的

- 液体肥料

- SRF

- 水溶性

- CRF

- 施肥方式

- 受精

- 叶面喷布

- 土壤

- 作物类型

- 田间作物

- 园艺作物

- 草坪和观赏植物

- 原产地

- 奈及利亚

- 沙乌地阿拉伯

- 南非

- 土耳其

- 其他中东和非洲地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Azra Group AS

- Foskor

- Gavilon South Africa(MacroSource, LLC)

- ICL Group Ltd

- K+S Aktiengesellschaft

- Kynoch Fertilizer

- Safsulphur

- Unikeyterra Chemical

- Yara International ASA

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The Middle East & Africa Specialty Fertilizer Market size is estimated at 4.93 billion USD in 2025, and is expected to reach 6.81 billion USD by 2030, growing at a CAGR of 6.65% during the forecast period (2025-2030).

Growing awareness and efficiency in nutrient supply may drive market growth

- The Middle East & Africa's specialty fertilizers market held a 7.6% share of the total market value in 2022, with a projected CAGR of 6.4% during the forecast period. The relatively lower adoption of specialty fertilizers by farmers, coupled with their higher costs compared to conventional options, explains this modest market share.

- In 2022, South Africa, Nigeria, and Turkey emerged as dominant players, capturing 11.4%, 8.3%, and 4.9% of the market, respectively. These countries, with their sizable populations, ample land availability, and government-led fertilizer trials, have become focal points for fertilizer manufacturers. These manufacturers are tailoring specialty products to meet the specific requirements of these markets, fueling further market expansion.

- Liquid fertilizers held a significant share of 48.5% in the Middle East & Africa's specialty fertilizers market in 2022. Growers in this region have recognized the benefits of liquid fertilizers, including their easy soil penetration, fast nutrient absorption by plants, and reduced wastage. These fertilizers can be applied either to the ground or as a foliar spray. This presents a lucrative opportunity for manufacturers eyeing the liquid fertilizers segment over the study period.

- In 2022, water-soluble fertilizers commanded a 47.3% share in the Middle East & Africa's specialty fertilizers market. These fertilizers offer a simplified nutrition management approach as their nutrient levels remain unaffected by leaching.

- A notable uptick in farmers' awareness regarding specialized fertilizers has occurred in recent years. This, coupled with a growing demand for liquid, water-soluble, and controlled-release fertilizers, is expected to be the driving force behind the market's growth.

Growing awareness and efficiency in nutrient supply may drive market growth during the study period

- The Middle East & Africa's specialty fertilizers market held a 7.6% share of the total market value in 2022, with a projected CAGR of 6.4% from 2023 to 2030. Specialty fertilizers face a lower market share, primarily due to limited farmer awareness and their relatively higher cost compared to conventional alternatives.

- In 2022, South Africa, Nigeria, and Turkey emerged as the dominant players in the market, capturing shares of 11.4%, 8.3%, and 4.9%, respectively. These countries, with their sizable populations, ample land availability, and government-backed fertilizer trials, have become prime targets for fertilizer manufacturers. These manufacturers are tailoring their offerings to the specific requirements of these nations, further fueling market growth.

- Liquid fertilizers held the lion's share, accounting for 48.5% of the Middle East & Africa's specialty fertilizers market in 2022. Growers in the region have recognized the advantages of liquid fertilizers, such as better soil penetration, enhanced nutrient absorption, and reduced wastage. These fertilizers can be applied either to the ground or as foliar sprays, presenting a significant growth opportunity for manufacturers in this segment.

- Water-soluble fertilizers, capturing 47.0% of the specialty fertilizers' market value in 2022, offer simplified nutrition management as they are not affected by leaching.

- The market has witnessed a surge in farmer awareness about specialized fertilizers and a rising demand for liquid, water-soluble, and controlled-release fertilizers, setting the stage for robust market growth.

Middle East & Africa Specialty Fertilizer Market Trends

Deterioration of agricultural lands due to erosion caused by wind and water will pose a challenge in cultivating crops in the region.

- In countries in the Middle East & Africa, field crops such as corn, rice, sorghum, and soybeans are typically sown in April-May and harvested between September and October. Agriculture in the region faces significant challenges, including scarcity of land and water. Both rain-fed and irrigated lands are deteriorating due to erosion from wind and water, exacerbated by unsustainable farming practices. Field crops occupy a dominant position, accounting for 90% of the region's agricultural land. In 2022, the total area under field crop cultivation in the region reached 249 million hectares, marking a 3.9% increase from 2017. Corn alone commands a significant share, covering 17.8% of the total field crop area. Wheat cultivation area witnessed a 4.6% rise from 2017 to 2022. Specifically, the region's corn cultivation area was 44.3 million hectares in 2022.

- Nigeria leads in sorghum production, followed by Ethiopia in Africa. Sorghum, a vital cereal crop, constitutes 50% of Nigeria's total cereal output and occupies approximately 45% of the land dedicated to cereal production. Sorghum's resilience to drought and waterlogging, along with its adaptability to diverse soil conditions, makes it a preferred staple crop in the drier regions of the Middle East & Africa, ensuring food and income security.

- The region has witnessed a population growth of over 23% in the last decade. Despite limited production capacity, the forecast indicates a rise in food imports. However, the agricultural sector has consistently expanded, paralleled by an increase in cultivated land.

The arid climate leads to a faster depletion of nitrogen in the soil, making it a crucial nutrient for agricultural productivity.

- Nitrogen, phosphorous, and potassium are primary nutrients crucial for plant growth. Nitrogen and phosphorous are integral to proteins and nucleic acids, key components of plant tissue. Meanwhile, potassium significantly influences the quality of harvested crops. Field crops, on average, receive an application rate of 174.4 kg per hectare for these primary nutrients.

- Specifically, the average application rates for nitrogen, phosphorous, and potassium in field crops across the Middle East & Africa stood at 234.8 kg/hectare, 127.4 kg/hectare, and 161.0 kg/hectare, respectively. The Middle East & Africa predominantly cultivate major field crops like wheat, sorghum, rice, and corn. In 2022, the average application rates for primary nutrients in these crops were 144.5 kg/hectare, 162.9 kg/hectare, 152.6 kg/hectare, and 245.24 kg/hectare, respectively.

- Of the primary nutrients, nitrogen dominates consumption in the Middle East & Africa, reaching 1.7 million metric tons in 2022. Nitrogen is the most crucial nutrient for crop yields, and given the prevalent deficiency of nitrogen in regional soils, it has become the most widely applied fertilizer. This dominance is driven by the region's substantial field crop area, comprising around 95.0% of the total, and the resulting high demand for primary nutrients. This emphasis on self-sufficiency and reducing import reliance underscores the growing market for field crops in the region.

Middle East & Africa Specialty Fertilizer Industry Overview

The Middle East & Africa Specialty Fertilizer Market is fragmented, with the top five companies occupying 16.78%. The major players in this market are ICL Group Ltd, K+S Aktiengesellschaft, Safsulphur, Unikeyterra Chemical and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Speciality Type

- 5.1.1 CRF

- 5.1.1.1 Polymer Coated

- 5.1.1.2 Polymer-Sulfur Coated

- 5.1.1.3 Others

- 5.1.2 Liquid Fertilizer

- 5.1.3 SRF

- 5.1.4 Water Soluble

- 5.1.1 CRF

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Country

- 5.4.1 Nigeria

- 5.4.2 Saudi Arabia

- 5.4.3 South Africa

- 5.4.4 Turkey

- 5.4.5 Rest of Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Azra Group AS

- 6.4.2 Foskor

- 6.4.3 Gavilon South Africa (MacroSource, LLC)

- 6.4.4 ICL Group Ltd

- 6.4.5 K+S Aktiengesellschaft

- 6.4.6 Kynoch Fertilizer

- 6.4.7 Safsulphur

- 6.4.8 Unikeyterra Chemical

- 6.4.9 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms