|

市场调查报告书

商品编码

1693767

印度生物肥料:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)India Biofertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

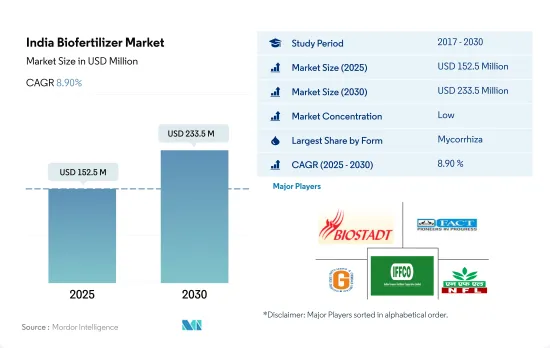

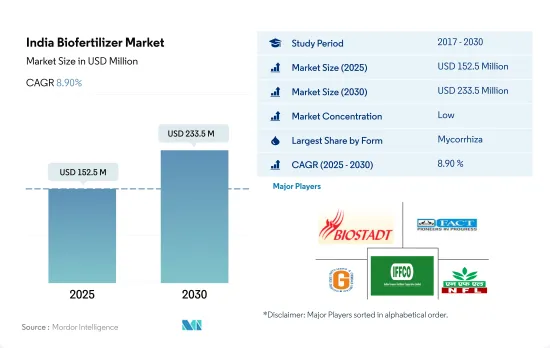

印度生物肥料市场规模预计在 2025 年为 1.525 亿美元,预计到 2030 年将达到 2.335 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.90%。

- 生物肥料是含有促进植物生长的活微生物的有机物质。 2017 年至 2021 年期间,印度生物肥料市值增长了约 11.0%,这可以归因于多种原因,例如农民意识的提高、印度註册有机农场总数的增加以及对有机或可持续种植产品的需求转变。截至 2021 年,印度在有机农业用地面积方面排名世界第五,在生产者总数方面排名第一。

- 基于菌根真菌的生物肥料将占据市场主导地位,2022 年的市场规模将达到 5,750 万美元。这主要是因为菌根真菌保留了增强从土壤中吸收磷、其他营养物质和水的能力,支持植物的生长并提高产量。它还可以帮助植物抵抗不利的土壤条件。然而,与其他生物肥料相比,基于根瘤菌和固氮螺菌的生物肥料的市场规模预计将以更快的速度成长。

- 生物肥料消费以连续作物为主,约占2022年市场价值的88.5%。连续作物的主导地位主要归因于该国的种植面积较大,约占同年有机作物总面积的59.8%。

- 国内和国际市场对有机产品的需求都很高。过度使用化学肥料是印度面临的主要挑战之一。印度政府正在透过各种计划和方案推动永续有机农业,为生物肥料提供奖励,预计这将在 2023 年至 2029 年期间推动市场发展。

印度生物肥料市场趋势

有机种植者的增加推动了有机种植面积的增加,主要用于连续作物。

- 印度是世界上经过认证的有机生产者总数最多的国家,2019年拥有130万名有机生产者。儘管有机生产者数量众多,但该国有机种植面积仅占全国农业总面积的2.0%左右。 2021年,该国有机种植面积为711,094.0公顷,比2017年增加约3.4%。该国的有机农业集中在几个邦。全国排名前 10 名的有机作物州约占有机作物总面积的 80.0%。中央邦、拉贾斯坦邦和马哈拉斯特拉邦等几个邦在扩大有机农业覆盖率方面处于领先地位。光是中央邦一地,2019 年有机种植面积就占印度全国的 27.0%。

- 该国以连续作物有机种植为主,2021 年有机作物连续种植面积约占全国有机作物种植总面积的 59.7%。粮食生产以稻米、小麦、小米和玉米为主。大多数谷类作物在雨季(六月至九月)种植。这段时期种植的作物主要依赖雨水或需要大量的水,例如水稻、玉米、棉花和大豆。

- 有机经济作物的总种植面积将从 2017 年的 27 万公顷增加到 2021 年的 28 万公顷。该国主要生产的经济作物为棉花、甘蔗、茶叶和香辛料。目前,该国有机园艺作物的生长有限。由于对有机产品的需求不断增长以及印度政府的有机农业计划,预计2023-2029年期间有机作物面积将会增加。

透过电子商务管道不断增长的需求和供应将推动人均有机食品支出的成长

- 印度人均有机产品支出为0.23美元,与亚太地区人均有机产品支出平均值相比相对较低。然而,近年来,消费者需求正在转向有机产品,因为越来越多的消费者认为有机产品具有更强的免疫力、更好的品质并且更容易透过电子商务管道获得。印度是有机食品和饮料的一个有前景的市场。预计到 2024 年,印度有机食品和饮料产业规模将达到 1.38 亿美元,2019 年至 2024 年期间的复合年增长率为 13%。

- 2022 年该国消费的有机食品和饮料总合为 1.08 亿美元。该国有机产品消费额从 2016 年的 4,500 万美元成长至 2021 年的 9,600 万美元。有机食品销售趋势呈上升趋势,主要原因是消费者意识不断增强,高所得消费者鼓励消费有机食品和饮料。需求最大的类别包括有机鸡蛋、乳製品、水果和蔬菜等必需食品。

- 有机饮料消费占据市场主导地位,占 2022 年有机食品和有机饮料总合市场价值的约 85.2%。有机饮料部分包括经核准认证机构认证的有机包装食品和饮料产品。 2020 年至 2022 年,有机饮料消费量的复合年增长率为 14%。有机产品的价格溢价限制了低收入消费者的购买能力,是有机食品消费的主要限制因素。然而,积极的促销和有机产品的优势将在预测期内推动有机食品市场的发展。

印度生物肥料产业概况

印度生物肥料市场细分,前五大公司占6.19%。市场的主要企业有 Biostadt India Limited、Fertilizers、Chemicals Travancore Limited、Gujarat State Fertilizers & Chemicals Ltd、Indian Farmers Fertiliser Cooperative Limited、National Fertilizers Limited 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 有机种植区

- 有机产品人均支出

- 法律规范

- 印度

- 价值炼和通路分析

第五章市场区隔

- 形式

- 固氮螺菌

- 固氮菌

- 菌根真菌

- 解磷细菌

- 根瘤菌

- 其他生物肥料

- 作物类型

- 经济作物

- 园艺作物

- 田间作物

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介

- Biostadt India Limited

- Fertilizers and Chemicals Travancore Limited

- GrowTech Agri Science Private Limited

- Gujarat State Fertilizers & Chemicals Ltd

- Indian Farmers Fertiliser Cooperative Limited

- IPL Biologicals Limited

- Madras Fertilizers Limited

- National Fertilizers Limited

- Samriddhi Crops India Pvt. Ltd

- T.Stanes and Company Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

The India Biofertilizer Market size is estimated at 152.5 million USD in 2025, and is expected to reach 233.5 million USD by 2030, growing at a CAGR of 8.90% during the forecast period (2025-2030).

- Biofertilizers are organic substances with living microorganisms that promote plant growth. The Indian biofertilizer market value increased by about 11.0% between 2017 to 2021, which can be attributed to various reasons like the increasing awareness among farmers, the increasing overall registered organic farms in India, and a shift in demand for organically or sustainably grown commodities. India ranks fifth in terms of world organic agriculture land and first in terms of the total number of producers as of 2021.

- Mycorrhizal-based biofertilizers dominated the market, which was valued at USD 57.5 million in 2022. This is mainly due to the mycorrhizal association holding the ability to boost phosphorus, other nutrients, and water absorption from the soil, supporting plant growth and development and increasing yield. It also helps the plant fight against adverse soil conditions. However, Rhizobium and Azospirillum-based biofertilizer market values are anticipated to grow at faster rates compared to other biofertilizers.

- The consumption of biofertilizers is dominant in row crops, and it accounted for about 88.5% of the market value in 2022. The dominance of row crops is mainly due to their large cultivation area in the country, which accounted for about 59.8% of the total organic crop area in the same year.

- There is a huge demand for organic products both in domestic and international markets. The overuse of chemical fertilizers is one of the major challenges in the country. The Indian government is promoting sustainable or organic cultivation practices through various schemes or programs by providing incentives for biofertilizers, which would drive the market between 2023 and 2029.

India Biofertilizer Market Trends

Growing number of organic producers helping the increase in area under organic cultivation, primarily in row crops

- India is the largest country, in terms of the total number of certified organic producers in the world, with 1.3 million organic producers in 2019. Despite having a large number of organic producers, organic cultivation areas in the country account for around 2.0% of the total agriculture area in the country. In 2021, the organic area in the country was recorded as 711,094.0 hectares, which increased by about 3.4% compared to 2017. Organic farming in the country is concentrated in only a few states. The top ten organic farming states in the country account for about 80.0% of the total organic crop area. A few states have taken the lead in improving organic farming coverage, like Madhya Pradesh, Rajasthan, and Maharashtra, which are the top three organic farming states in the country. Madhya Pradesh alone accounted for about 27.0% of India's total organic cultivation area in 2019.

- Organic cultivation of row crops is dominant in the country, which accounted for about 59.7% of the total organic crop area in 2021. Cereal crop production is dominant rice, wheat, millet, and maize are the major cereals produced. Most cereal crops are grown in the kharif season (June - September). The crops grown in this season are mainly rain dependent or require more water, like rice, maize, cotton, and soybean.

- The overall organic cash crop cultivation area increased from 0.27 million hectares in 2017 to 0.28 million hectares in 2021. The major cash crops produced in the country are cotton, sugarcane, tea, and spices. There is a limited growth of organic horticultural crops currently in the country. The increasing demand for organic products and Indian government initiatives to go organic are anticipated to increase organic crop area between 2023 and 2029.

Growing demand and their easy accessibility through e-commerce channels, rising the per capita spending on organic food

- India's per capita spending on organic products is relatively low at USD 0.23 compared to the average per capita spending on organic products in Asia-Pacific. However, in recent years, shifting consumer demand has increased toward organic products as more customers perceive these items offer better immunity, higher quality, and more accessibility through e-commerce channels. India is a promising and developing market for organic foods and beverages. India's domestic organic food and beverage industry is expected to be worth USD 138.0 million by 2024, rising at a compound annual growth rate of 13% between 2019 to 2024.

- In 2022, the total combined organic food and beverages worth USD 108.0 million consumed in the country. The consumption value of organic products in the country increased from USD 45 million in 2016 to USD 96.0 million in 2021. Organic food sales have seen an increasing trend mainly due to increasing consumer awareness, and high-income consumers are propelling organic food and beverage consumption. Categories that gained the most demand included essential foods, such as organic eggs, dairy, and fruits and vegetables.

- Organic beverage consumption dominated the market and accounted for about 85.2% of the total combined organic food and beverages market value in 2022. The organic beverages segment includes organic packaged food and beverages that are certified by the approved certification body. Organic beverage consumption value increased at a CAGR of 14% between 2020 to 2022. The price premium associated with organic products hampers lower-income consumer access and is the major limiting factor for organic food consumption. However, organic products' active promotion and advantages drive the organic food market during the forecast period.

India Biofertilizer Industry Overview

The India Biofertilizer Market is fragmented, with the top five companies occupying 6.19%. The major players in this market are Biostadt India Limited, Fertilizers and Chemicals Travancore Limited, Gujarat State Fertilizers & Chemicals Ltd, Indian Farmers Fertiliser Cooperative Limited and National Fertilizers Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Azospirillum

- 5.1.2 Azotobacter

- 5.1.3 Mycorrhiza

- 5.1.4 Phosphate Solubilizing Bacteria

- 5.1.5 Rhizobium

- 5.1.6 Other Biofertilizers

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Biostadt India Limited

- 6.4.2 Fertilizers and Chemicals Travancore Limited

- 6.4.3 GrowTech Agri Science Private Limited

- 6.4.4 Gujarat State Fertilizers & Chemicals Ltd

- 6.4.5 Indian Farmers Fertiliser Cooperative Limited

- 6.4.6 IPL Biologicals Limited

- 6.4.7 Madras Fertilizers Limited

- 6.4.8 National Fertilizers Limited

- 6.4.9 Samriddhi Crops India Pvt. Ltd

- 6.4.10 T.Stanes and Company Limited

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms