|

市场调查报告书

商品编码

1693968

广告科技-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Ad Tech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

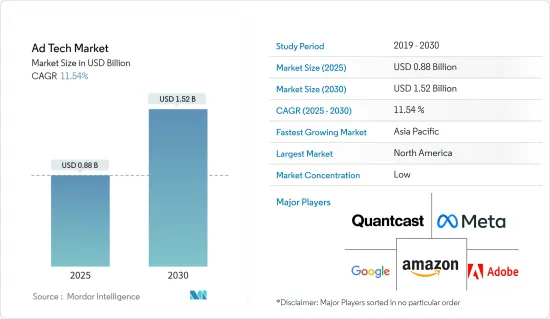

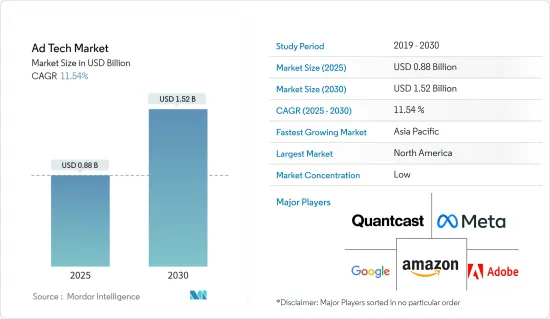

预计 2025 年广告科技市场规模为 8.8 亿美元,到 2030 年将达到 15.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.54%。

受数位设备和网路使用日益增多的推动,广告科技市场在过去几年中经历了显着增长。随着智慧型手机和社群媒体平台的兴起,数位广告已成为全球企业行销计画的重要组成部分。

关键亮点

- 从传统广告到网路广告的持续转变是市场成长的主要动力。随着网路的广泛普及和网路用户的增加,现在可以透过数位广告覆盖更广泛的受众。人们在网路上花费更多的时间在工作、娱乐和社交,广告商有能力在网路上接触到他们。

- 5G技术提供更低的延迟、更快的下载速度和更高的网路效率,预计将对广告科技需求的成长产生重大影响。这些进步为广告科技公司创造了新的机会,使其能够提供创新、有针对性、数据主导的广告解决方案,从而改善用户体验。

- 疫情期间,线上电子商务服务业也出现强劲成长。随着越来越多的人转向网路购物等数位服务,这些行业的公司增加了广告支出以接触潜在受众。这导致对线上广告的需求增加,尤其是在搜寻引擎和社交媒体平台上。

- 然而,大众对广告科技实践缺乏认识,导致监管问题日益严重。消费者保护机构越来越担心他们的资料被使用和收集用于广告目的的方式,这导致了更严格的监管,威胁到广告科技产业的发展。

- 新冠疫情为广告业带来了重大变化,其中一些变化预计将对该行业产生长期影响。由于消费者支出下降和经济不确定性,许多品牌选择削减广告预算,导致广告支出整体下降。这种下降趋势在广播、电视和印刷等传统媒体平台上尤其明显,这些平台的广告收入大幅下降。同时,随着人们在家中度过更多时间并转向数位媒体,数位广告支出大幅增加。随着越来越多的人熟悉电子商务和数位管道,预计即使在疫情消退后,这种上升趋势仍将持续下去。总体而言,这场疫情加速了该行业向数据主导方法和数位广告管道的转变,对该行业的未来产生了长期影响。

广告科技市场趋势

行动装置和智慧型手机将经历显着成长

- 行动装置上的广告是企业与目标受众建立联繫和互动的重要工具。商业领域的小型企业可以利用该领域的视觉方面在行动装置上创建引人注目的广告,突出其产品和独特的品牌身份验证。

- 此外,行动装置有多种形式的广告,包括图片文字广告、横幅广告、点击通话广告、点击讯息广告和点击下载广告。此外,由于其移动性和便利性,人们最终会选择智慧型手机设备而不是笔记型电脑和桌上型电脑。此外,由于行动平台能够处理类似的任务,预计其获利能力将越来越强。

- 赋予企业权力并使其能够加入第四次工业革命的最新行销策略包括数位广告和行动行销。鑑于我们将在不久的将来看到转向线上销售的小型企业数量大幅增加,智慧型手机使用率上升,以及缺乏现场活动和展览,这可能会提供一个重要的广告管道,并对线上广告市场产生积极影响。

- 爱立信表示,近年来全球智慧型手机行动网路用户总数已达到约64亿,预计预测期内将超过77亿人。行动网路智慧型手机用户数量最多的国家是中国、印度和美国。因此,随着全球智慧型手机行动网路用户数量的不断增加,预计该领域将迎来充足的成长机会。

- 因此,随着越来越多的顾客使用行动装置浏览和购买商品,行动广告对于时尚企业来说变得越来越重要。为了接触并吸引目标受众,企业正在大幅增加对行动广告的投资。

亚太地区:预计大幅成长

- 近年来,中国经济的不断增长和技术熟练的人口推动了网路消费和行动装置普及率的上升。随着社群媒体的普及,该国的广告科技产业正在快速发展。中国是百度、腾讯和阿里巴巴等科技巨头的所在地。基于影片的平台的日益增长的趋势也推动了该地区对各种广告形式的需求。

- 数位革命和网路普及率的提高正在推动印度广告科技市场的发展。网路购物和其他数位服务的兴起,以及对数位广告(主要来自搜寻引擎和社交媒体平台)日益增长的需求,迫使印度广告科技行业的公司增加广告支出。

- 由于对数据、自动化、人工智慧和程式化广告的投资增加,日本的广告科技市场预计将成长。新市场参与企业和创新的出现在日本的广告科技科技生态系统中发挥关键作用。随着日本行动应用生态系统的不断扩大,预计预测期内行动广告支出将会增加,为广告科技公司创造庞大的机会。此外,进入日本市场的影片广告分发平台数量也在增加。

- 澳洲日益增长的数位和网路普及率正在帮助推动该地区广告科技市场的成长。人工智慧 (AI)、机器学习 (ML)、虚拟实境 (VR) 和扩增实境(AR) 技术的日益普及预计将为广告科技公司提供丰厚的成长机会。社群媒体应用程式的日益普及和游戏产业的兴起也为澳洲广告科技市场的成长创造了许多选择。

- 在韩国,不断增加的投资、官民合作关係以及不断增长的数位游戏市场预计将为行销人员提供在高度互动的户外(OOH) 环境中吸引观众的绝佳机会。程序化数位户外广告为媒体所有者开闢了新的收益来源,带来了额外的收益。

- 创新创新、技术采用和对道德广告的奉献精神的结合将决定纽西兰在全球广告科技市场中的地位。随着市场预期扩张、重视在地化和法规合规,纽西兰完全有能力影响数位广告的变革。

广告科技产业概览

广告科技市场分散,大公司和小公司之间的竞争非常激烈。参与企业包括 Adobe、Google LLC、Amazon.com Inc.、Meta Platform Inc. 和 Quantcast。该市场的参与企业正在采取合作和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2023 年 10 月 - Meta 为广告主推出首个生成式 AI 功能,让他们可以使用 AI 创建背景、缩放图像并根据原始副本生成多个版本的广告文字。第一个新功能允许广告商透过产生多个不同的背景来客製化他们的创新资产,以改变他们的产品图像的外观。另一个功能「图像拉伸」允许广告商缩放其资产以适应各种产品(如供稿和捲轴)所需的不同长宽比。

- 2023 年 7 月—宏盟集团与Google合作,将Google的生成式人工智慧模型整合到其广告科技平台中。此次整合旨在增强宏盟广告科技平台的功能,同时提供更个人化和有效的广告机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 评估新冠疫情对各行业的影响

- 宏观经济趋势的影响

第五章市场动态

- 市场驱动因素

- 智慧型手机和社群媒体的普及率不断提高

- 数位广告:精准、有效、经济

- 市场限制

- 在认知度较低的情况下,点击机器人和安装劫持现象增多

- 广告数位化

- 出版商可以更多地存取客户数据

- 创造新的收益源

- 透过建议引擎个人化改善观看体验

- 基于位置的广告

- 顾客行为分析有助于形成消费模式

- 加强与科技公司的伙伴关係和合作

第六章市场区隔

- 按平台

- 供应端平台(SSP)

- 需求端平台(DSP)

- 广告交易平臺

- 资料管理

- 按广告格式

- 影片广告

- 社群媒体

- 搜寻广告

- 电子邮件

- 其他广告格式

- 按设备平台

- 桌面

- 行动智慧型手机

- 其他设备平台

- 按最终用户产业

- 零售与电子商务

- 医疗保健

- BFSI

- 服务业(旅馆业、观光业、法律服务)

- 通讯业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 纽西兰

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 其他拉丁美洲

- 北美洲

第七章竞争格局

- 公司简介

- Google LLC

- Amazon.com, Inc.

- Meta Platform, Inc.

- Quantcast

- Adobe

- Adform A/S

- MediaMath

- Microsoft Corporation

- Zeta Global Holdings Corp.

- Mediaocean

第八章投资分析

The Ad Tech Market size is estimated at USD 0.88 billion in 2025, and is expected to reach USD 1.52 billion by 2030, at a CAGR of 11.54% during the forecast period (2025-2030).

The ad tech market has witnessed considerable growth over the past few years, driven by the growing use of digital devices and the Internet. With the increasing adoption of smartphones and social media platforms, digital advertising has become essential to marketing plans for businesses worldwide.

Key Highlights

- The continuous shift from traditional to online advertising is the main driving force behind the market's growth. The proliferation of the Internet and the increase in the number of Internet users has made it possible to reach a larger audience through digital ads. People spend more time online for work, entertainment, and socializing, and advertisers can now reach them online.

- 5G technology is expected to significantly impact ad tech demand growth, offering lower latency, faster download speeds, and improved network efficiency. These advances introduce new opportunities for ad tech companies to provide targeted, innovative, data-driven advertising solutions to enhance user experience.

- The online and e-commerce services sector also significantly boosted during the pandemic. As more people turn to digital services such as online shopping, companies in these industries have increased their advertising spending to reach potential audiences. This has increased the demand for online advertising, especially on search engines and social media platforms.

- However, a lack of public awareness of ad tech practices has led to augmented regulatory concerns. Consumer protection agencies are becoming increasingly concerned about data being used and collected for advertising efforts, leading to strict regulations that threaten the growth of the ad tech industry.

- The COVID-19 pandemic has brought about significant transformations in the advertising industry, and several of these changes are expected to have a long-lasting impact on the sector. With reduced consumer spending and economic uncertainty, many brands have opted to decrease their advertising budgets, leading to an overall decrease in ad spending. This decline has been particularly noticeable in traditional media platforms such as radio, television, and print media, which have experienced a sharp decrease in advertising revenues. On the other hand, as people spend more time at home and engage with digital media, there has been a substantial increase in digital ad spending. This upward trend is predicted to persist even after the pandemic subsides as more individuals become acquainted with e-commerce and digital channels. Overall, the pandemic has augmented the industry's shift to a more data-driven approach and digital advertising channels, with long-term effects for the sector's future.

Ad Tech Market Trends

Mobile Devices and Smartphones to Witness Significant Growth

- Advertising on mobile devices acts as a significant tool for firms to connect with and interact with their target audience. Small firms in the business sector may make use of the visual aspect of the sector to create engaging advertising on mobile devices that highlights their offerings and distinctive brand identities.

- Furthermore, there are several forms of advertising for mobile devices, such as image text and banner ads, click-to-call ads, click-to-message ads, and click-to-download ads. Additionally, due to their mobility and ease, people ultimately choose smartphone devices over laptops or desktops. Also, due to the former's ability to undertake similar tasks, mobile platforms are predicted to become increasingly profitable.

- Modern marketing strategies that would empower firms and bring them into the fourth industrial revolution include digital advertising and mobile marketing. In due course, it would supply the essential advertising channels and prove to produce a good influence on the online advertising market, given the significant number of SMEs transitioning to online sales, rising smartphone usage, and the lack of on-ground events or exhibits in the near future.

- According to Ericsson, the total number of smartphone mobile network subscriptions worldwide reached around 6.4 billion in the recent years and is forecasted to surpass 7.7 billion during the forecast period. China, India, and the United States are the countries with the most significant number of smartphone mobile network subscriptions. Hence, with the rise in the overall number of smartphone mobile network subscriptions worldwide, the market is expected to witness ample opportunities to grow within the market sector.

- Therefore, as more customers use their mobile devices to explore and buy things, mobile advertising is becoming more crucial for the fashion business. In order to reach and interact with their target audience, firms are increasing their investment in mobile advertising significantly.

Asia-Pacific Expected to Witness Major Growth

- China's economic growth and a rising tech-savvy population have resulted in higher penetration of internet consumption and mobile device penetration in recent years. Due to the increased proliferation of social media, the ad tech industry is growing rapidly in the country. China hosts several tech giants such as Baidu, Tencent, and Alibaba. The rising inclination toward video-based platforms has also increased the demand for various advertising formats in the region.

- The digital revolution and growing internet penetration are driving the ad tech market in India. The rise of online shopping and other digital services, as well as increasing demand for digital advertising, especially on search engines and social media platforms, have compelled businesses in the Indian ad tech industry to increase their advertisement spending.

- The ad tech market in Japan is anticipated to grow due to increasing investment in data, automation, artificial intelligence, and programmatic advertising. The emergence of new market players and innovation plays a critical role in the ad tech ecosystem in Japan. Mobile ad spending is projected to increase in Japan during the forecast period, attributed to the country's expanding mobile app ecosystem, representing a massive opportunity for ad tech companies. Japan also has an increased influx of video advertising serving platforms entering the Japanese market.

- The rising digital and internet penetration in Australia is bolstering the growth of the regional ad tech market. The rising adoption of artificial intelligence (AI), machine learning (ML), Virtual reality (VR), and augmented reality (AR) technologies is expected to provide lucrative growth opportunities for advertising technology players. The growing use of social media apps and the rising gaming industry also create numerous options for the ad tech market growth in Australia.

- Increased investments, public-private partnerships, and the ever-growing digital gaming market are projected to provide tremendous opportunities for marketers to attract audiences in highly interactive out-of-home (OOH) environments in South Korea. Programmatic Digital out-of-home advertising is opening up new revenue streams for media owners to drive additional revenues.

- A combination of creative innovation, technical adoption, and a dedication to ethical advertising define New Zealand's position in the global ad tech market. Because of the market's projected expansion and emphasis on regional specifics and legal compliance, New Zealand is positioned to have a significant impact on the changing face of digital advertising.

Ad Tech Industry Overview

The Ad tech market is fragmented, with high competition among large and small companies. Some of the players include Adobe, Google LLC, Amazon.com Inc., Meta Platform Inc., and Quantcast. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023 - Meta launched its first generative AI features for advertisers, allowing them to use AI to create backgrounds, expand images, and generate multiple versions of ad text based on their original copy. The first among the trio of new features allows an advertiser to customize their creative assets by generating multiple different backgrounds to change the look of their product images. Another feature, image expansion, allows advertisers to adjust their assets to fit different aspect ratios required across various products, like Feed or Reels.

- July 2023 - Omnicom has partnered with Google to integrate the latter's generative AI models into its Adtech platform. The integration aims to improve the capabilities of Omnicom's Adtech platform while providing personalized and effective advertising opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 An Assessment of the Impact of COVID-19 on the Industry

- 4.3 Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in the Adoption of Smartphones and Social Media

- 5.1.2 High Precision, Effectiveness, and Cost Efficiency of Digital Advertising

- 5.2 Market Restraint

- 5.2.1 Rise of Click Bots and Install Hijacks Amid Low Public Awareness

- 5.3 Digital Transformation in Advertising

- 5.3.1 Increased Access of Customer Data for Publishers

- 5.3.2 Generation of New Revenue Streams

- 5.3.3 Better Viewer Experience Through Personalization Through Recommendation Engines

- 5.3.4 Location-Based Advertising

- 5.3.5 Customer Behavior Analytics Helping with Spending Pattern

- 5.3.6 Increasing Partnerships and Collaboration with Technology Companies

6 MARKET SEGMENTATION

- 6.1 By Platform

- 6.1.1 Supply Side Platform (SSP)

- 6.1.2 Demand Side Platform (DSP)

- 6.1.3 Ad Exchange

- 6.1.4 Data Management

- 6.2 By Ad Format

- 6.2.1 Video Advertising

- 6.2.2 Social Media

- 6.2.3 Search Advertising

- 6.2.4 Email

- 6.2.5 Other Ad Formats

- 6.3 By Device Platforms

- 6.3.1 Desktop

- 6.3.2 Mobile Devices and Smartphones

- 6.3.3 Other Device Platforms

- 6.4 By End-user Industry

- 6.4.1 Retail and E-Commerce

- 6.4.2 Healthcare

- 6.4.3 BFSI

- 6.4.4 Services (Hospitality, Tourism, Legal Services)

- 6.4.5 Telecommunications

- 6.4.6 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Spain

- 6.5.2.5 Italy

- 6.5.2.6 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Australia

- 6.5.3.5 South Korea

- 6.5.3.6 New Zealand

- 6.5.3.7 Rest of Asia-Pacific

- 6.5.4 Middle-East and Africa

- 6.5.4.1 Saudi Arabia

- 6.5.4.2 United Arab Emirates

- 6.5.4.3 South Africa

- 6.5.4.4 Nigeria

- 6.5.4.5 Egypt

- 6.5.4.6 Rest of Middle East and Africa

- 6.5.5 Latin America

- 6.5.5.1 Brazil

- 6.5.5.2 Mexico

- 6.5.5.3 Argentina

- 6.5.5.4 Colombia

- 6.5.5.5 Rest of Latin America

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC

- 7.1.2 Amazon.com, Inc.

- 7.1.3 Meta Platform, Inc.

- 7.1.4 Quantcast

- 7.1.5 Adobe

- 7.1.6 Adform A/S

- 7.1.7 MediaMath

- 7.1.8 Microsoft Corporation

- 7.1.9 Zeta Global Holdings Corp.

- 7.1.10 Mediaocean