|

市场调查报告书

商品编码

1850351

新加坡海运:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Singapore Sea Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

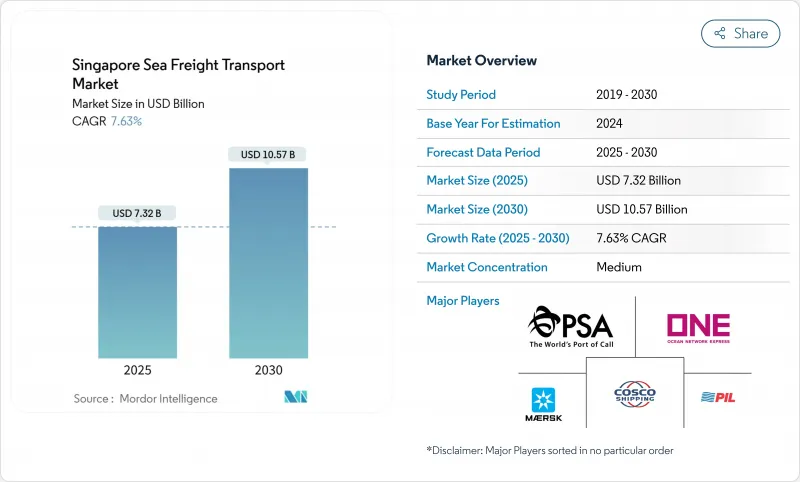

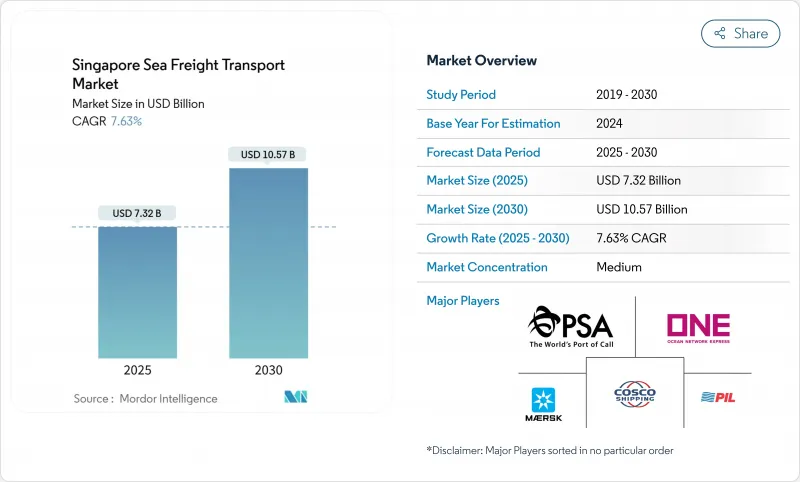

新加坡海运市场规模预计在 2025 年达到 73.2 亿美元,预计到 2030 年将达到 105.7 亿美元,预测期(2025-2030 年)复合年增长率为 7.63%。

这一成长动能主要得益于所有货柜业务逐步转移至大士港,此举释放了泊位容量,并缩短了船舶週转时间。以电子载货证券和统一港口社区系统为代表的数位化工具正在减少纸本工作,并为承运商将新加坡置于其航线网路核心提供了新的理由。优惠贸易协定正在扩大出口腹地,加之製造业向东南亚转移,共同推动了出口货柜数量(TEU)的成长。与清洁能源相关的液体散货运输量的增长以及温控药品运输方式向海运的转变,正在进一步推动增长。燃油成本上涨以及与马来西亚邻国的价格竞争仍然是主要观点,但新增船舶运力和贸易航线多元化相结合,确保了成长前景稳步推进。

新加坡海运市场趋势与洞察

大士港的整合提高了吞吐量

大士港计划将莱格西城码头整合为大士超级港,预计到2040年代吞吐能力将达到6500万标准箱,几乎是2021年3750万标准箱吞吐能力的两倍。第一期工程计画于2022年投入使用,目前已配备200多辆自动导引车和一个事件驱动型数位骨干网,可即时指挥堆场作业。由于该设施位于一条连续的海岸线上,内部转运次数显着减少,从而提高了起重机的运转率和船舶週转速度。由此带来的更高可预测性使航运公司能够合理安排同一航线的两次靠泊,并将运力保留给额外的航次。透过缩短港口停留时间,航运公司既能节省成本,也能减少温室气体排放,进一步巩固了新加坡作为枢纽港的地位。

东协製造业转型推动出口货柜数量成长

电子产品、精密工程和耐用消费品生产从北亚向东协转移,正推动新加坡成为出口大户。联华电子投资50亿美元的半导体晶圆厂以及其他类似投资项目,将吸引晶圆设备、化学品和成品晶片透过出口转运服务运往深水港。越南的工业扩张也遵循类似的模式,利用新加坡作为货运中心门户,并透过YCH集团和越南邮政正在建造的数位贸易走廊进行运输。供应商布局的扩大分散了地缘政治风险,提高了网路密度,并确保即使在全球经济疲软时期,东协内部的需求也能支撑泊位利用率。

燃油价格波动导致运费上涨

到2024年下半年,部分远距航线的货柜即期运价翻了一番以上。在新加坡,2023年生质燃料燃料库量增加了两倍,为航运公司的燃料成本基础增加了一个新的价格点。替代燃料有助于实现脱碳目标,但其尚不成熟的供应链导致与指数挂钩的燃料额外费用波动。因此,托运人优先选择港内延误较少的港口,以确保燃料消费量的可预测性。新加坡的效率提升将缓解但无法消除这种波动。

细分市场分析

预计到2024年,货柜货物将占新加坡海运市场份额的61%,随着冷藏货柜的普及,其主导地位预计将持续到2030年。疫苗和生技药品对温控箱的需求日益增长,促使PSA公司增设插电点和空气控制监控系统,使货柜运输成为生命科学出口商的策略推动力。液体散货将以8.1%的复合年增长率实现最快增长,这主要得益于生质燃料掺混和新兴绿色氨计划在裕廊岛的专用泊位需求。干散货量将受到区域建筑需求的推动而实现温和增长,而普通货物和滚装货物将保持稳定的市场份额。自动化、数位双胞胎和区块链技术在这些领域的应用将提高可预测性,使码头营运商能够针对每种商品类别优化堆场作业。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 透过将城市码头整合到大士大型港口来提高吞吐量

- 东协製造业转移推动新加坡出口货柜数量增加

- 透过优惠贸易协定(RCEP、CPTPP)降低海运成本

- 透过引入DigitalPORT@SG和电子载货证券,缩短了货物停留时间。

- 扩大药品和生鲜食品低温运输货柜运输量

- 绿色与数位化航运走廊倡议

- 市场限制

- 燃油价格波动会导致综合运费上涨。

- 来自巴生港和丹戎帕拉帕斯港支线关税的竞争压力

- 旺季期间40英尺高箱冷藏车短缺

- 裕廊岛的「最后一公里」/「首公里」货车运输能力紧张。

- 价值/供应链分析

- 监理与技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按货物类型

- 货柜货物

- 干燥

- 冷藏

- 干散货

- 液体散货

- 普通货物

- 滚装/滚卸货物

- 货柜货物

- 按最终用户行业划分

- 电子和半导体

- 化工/石油化工产品

- 饮食

- 製药和医疗保健

- 零售与电子商务

- 其他的

- 贸易通道

- 亚洲内部

- 北美洲

- 欧洲

- 中东

- 非洲

- 南美洲

- 大洋洲

- 按区域/连接埠丛集

- 西部地区(大士和裕廊)

- 中部地区(巴西班让和吉宝)

- 北部地区(三巴旺)

- 东部地区(樟宜和洛阳)

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- PSA International

- Ocean Network Express(ONE)

- Pacific International Lines(PIL)

- AP Moller-Maersk Singapore

- CMA CGM & ANL(Singapore)

- Evergreen Marine(Singapore)

- Hapag-Lloyd(Singapore)

- Cosco Shipping Lines(Singapore)

- Yang Ming(Singapore)

- X-Press Feeders(Sea Consortium)

- DHL Global Forwarding Singapore

- Kuehne+Nagel Singapore

- NYK Line(Yusen Logistics)

- DSV Air & Sea Singapore

- Sinotrans Singapore

- Agility Logistics Singapore

- Toll Group Singapore

- OOCL(Singapore)

- FedEx Logistics Singapore

- CEVA Logistics Singapore*

第七章 市场机会与未来展望

The Singapore Sea Freight Transport Market size is estimated at USD 7.32 billion in 2025, and is expected to reach USD 10.57 billion by 2030, at a CAGR of 7.63% during the forecast period (2025-2030).

This momentum rests on the phased shift of all container activity to Tuas Mega-Port, a move that frees berth capacity while cutting vessel turnaround times. Digital tools-most notably electronic bills of lading and a unified port community system-are trimming paperwork and giving carriers fresh reasons to keep Singapore at the centre of their networks. Preferential trade pacts widen the export hinterland and, together with a manufacturing tilt toward Southeast Asia, are lifting outbound TEU counts. A growing stream of liquid bulk linked to cleaner energy and a modal swing toward sea freight for temperature-controlled pharmaceuticals add further lift. Rising bunker costs and price competition from Malaysian neighbours remain watch points, yet the combination of new capacity and more diversified trade lanes keeps the growth outlook firmly on course.

Singapore Sea Freight Transport Market Trends and Insights

Tuas Mega-Port Consolidation Elevating Throughput

The consolidation of legacy city terminals into Tuas Mega-Port is transforming Singapore's competitiveness by pushing planned capacity toward 65 million TEUs in the 2040s-almost double the 37.5 million TEUs handled in 2021 . Phase 1, opened in 2022, already deploys more than 200 Automated Guided Vehicles, while an event-driven digital backbone orchestrates yard moves in real time. Because the facility sits on a single contiguous coastline, internal trans-shifts fall sharply, improving crane utilisation and vessel turnaround. The resulting predictability lets carriers rationalise dual calls on the same loop, freeing vessel days for extra sailings. An immediate inference is that shipping lines gain both cost savings and greenhouse-gas reductions through shorter port dwell, tightening Singapore's hold on hub status.

ASEAN Manufacturing Shift Driving Export TEUs

Relocation of electronics, precision-engineering and consumer-durables production from North Asia into ASEAN is pumping new export volumes through Singapore. United Microelectronics Corp.'s USD 5 billion semiconductor fab and similar investments pull in wafer tools, chemicals and finished chips that ride outbound feeder services before transhipment onto deep-sea loops. Vietnam's industrial expansion follows an identical pattern, using Singapore as its load-centre gateway via digital trade corridors being built by YCH Group and Vietnam Post. The widened supplier footprint spreads geopolitical risk and deepens network density, indicating that intra-ASEAN demand will support berth utilisation even when global cycles soften.

Volatile Bunker Prices Translating into Higher Freight Rates

Container spot rates on several long-haul trades more than doubled through late 2024, propelled by a 256 % spike on the Shanghai-Europe route tied to Red Sea diversions. In Singapore, biofuel bunkering volumes tripled in 2023, adding a fresh price reference to carriers' fuel cost base. Although alternative grades help with decarbonisation targets, their nascent supply chains inject volatility into index-linked fuel surcharges. Shippers therefore prioritise ports with minimal in-harbour delay so that bunker burn remains predictable; Singapore's efficiency gains cushion, but do not eliminate, that volatility.

Other drivers and restraints analyzed in the detailed report include:

- Preferential Trade Agreements Cutting Sea-Freight Costs

- DigitalPORT@SG & Electronic Bill-of-Lading Adoption

- Competitive Pressure from Port Klang & Tanjung Pelepas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Containerised cargo commands a 61% Singapore Sea Freight market share in 2024, and its prominence is expected to persist through 2030 as reefer adoption widens. Higher uptake of temperature-controlled boxes for vaccines and biologics is pushing PSA to add plug points and controlled-atmosphere monitoring, making container operations a strategic enabler for life-science exporters. Liquid bulk shows the fastest forecast growth at 8.1% CAGR, propelled by biofuel blending and nascent green-ammonia projects that need dedicated berths on Jurong Island. Dry bulk volumes grow modestly on the back of regional construction demand, while general cargo and roll-on/roll-off remain stable niches. The interplay of automation, digital twins, and blockchain within these segments boosts predictability, allowing terminal operators to fine-tune yard staging for each commodity class.

The Singapore Sea Freight Transport Market Report Segments the Industry Into by Cargo Type (Containerized Cargo, Dry Bulk Cargo and More), by End User Industry (Electronics & Semiconductors, Chemicals & Petrochemicals, Food & Beverage and More), by Trade Lane (Intra-Asia, North America, Europe and More) and by Region/Port Cluster(West Region, Central Region and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PSA International

- Ocean Network Express (ONE)

- Pacific International Lines (PIL)

- A.P. Moller-Maersk Singapore

- CMA CGM & ANL (Singapore)

- Evergreen Marine (Singapore)

- Hapag-Lloyd (Singapore)

- Cosco Shipping Lines (Singapore)

- Yang Ming (Singapore)

- X-Press Feeders (Sea Consortium)

- DHL Global Forwarding Singapore

- Kuehne + Nagel Singapore

- NYK Line (Yusen Logistics)

- DSV Air & Sea Singapore

- Sinotrans Singapore

- Agility Logistics Singapore

- Toll Group Singapore

- OOCL (Singapore)

- FedEx Logistics Singapore

- CEVA Logistics Singapore*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Consolidation of City Terminals into Tuas Mega-Port Elevating Throughput

- 4.2.2 ASEAN Manufacturing Shift Driving Export TEUs from Singapore

- 4.2.3 Preferential Trade Agreements (RCEP, CPTPP) Cutting Sea-Freight Costs

- 4.2.4 DigitalPORT@SG & Electronic Bill-of-Lading Adoption Shortening Dwell-Time

- 4.2.5 Expansion of Cold-Chain TEUs for Pharma & Perishables

- 4.2.6 Green & Digital Shipping-Corridor Initiatives

- 4.3 Market Restraints

- 4.3.1 Volatile Bunker Prices Translating into Higher All-in Freight Rates

- 4.3.2 Competitive Pressure from Port Klang & Tanjung Pelepas Feeder Rates

- 4.3.3 Shortage of 40-ft High-Cube Reefers During Peak Season

- 4.3.4 Tight Trucking Capacity for First/Last-Mile on Jurong Island

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Cargo Type

- 5.1.1 Containerized Cargo

- 5.1.1.1 Dry

- 5.1.1.2 Reefer

- 5.1.2 Dry Bulk Cargo

- 5.1.3 Liquid Bulk Cargo

- 5.1.4 General Cargo

- 5.1.5 Roll-On/Roll-Off Cargo

- 5.1.1 Containerized Cargo

- 5.2 By End-User Industry

- 5.2.1 Electronics & Semiconductors

- 5.2.2 Chemicals & Petrochemicals

- 5.2.3 Food & Beverage

- 5.2.4 Pharmaceuticals & Healthcare

- 5.2.5 Retail & E-commerce

- 5.2.6 Others

- 5.3 By Trade Lane

- 5.3.1 Intra-Asia

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 Middle East

- 5.3.5 Africa

- 5.3.6 South America

- 5.3.7 Oceania

- 5.4 By Region / Port Cluster

- 5.4.1 West Region (Tuas & Jurong)

- 5.4.2 Central Region (Pasir Panjang & Keppel)

- 5.4.3 North Region (Sembawang)

- 5.4.4 East Region (Changi & Loyang)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)}

- 6.4.1 PSA International

- 6.4.2 Ocean Network Express (ONE)

- 6.4.3 Pacific International Lines (PIL)

- 6.4.4 A.P. Moller-Maersk Singapore

- 6.4.5 CMA CGM & ANL (Singapore)

- 6.4.6 Evergreen Marine (Singapore)

- 6.4.7 Hapag-Lloyd (Singapore)

- 6.4.8 Cosco Shipping Lines (Singapore)

- 6.4.9 Yang Ming (Singapore)

- 6.4.10 X-Press Feeders (Sea Consortium)

- 6.4.11 DHL Global Forwarding Singapore

- 6.4.12 Kuehne + Nagel Singapore

- 6.4.13 NYK Line (Yusen Logistics)

- 6.4.14 DSV Air & Sea Singapore

- 6.4.15 Sinotrans Singapore

- 6.4.16 Agility Logistics Singapore

- 6.4.17 Toll Group Singapore

- 6.4.18 OOCL (Singapore)

- 6.4.19 FedEx Logistics Singapore

- 6.4.20 CEVA Logistics Singapore*