|

市场调查报告书

商品编码

1850963

贸易管理软体:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Trade Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

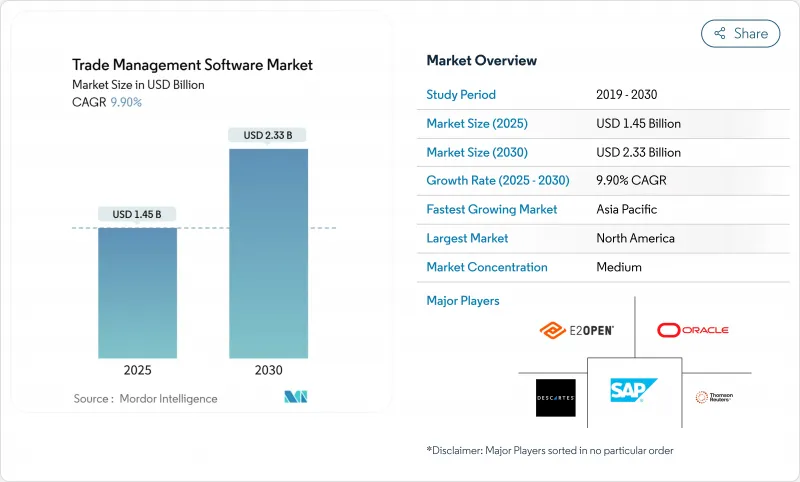

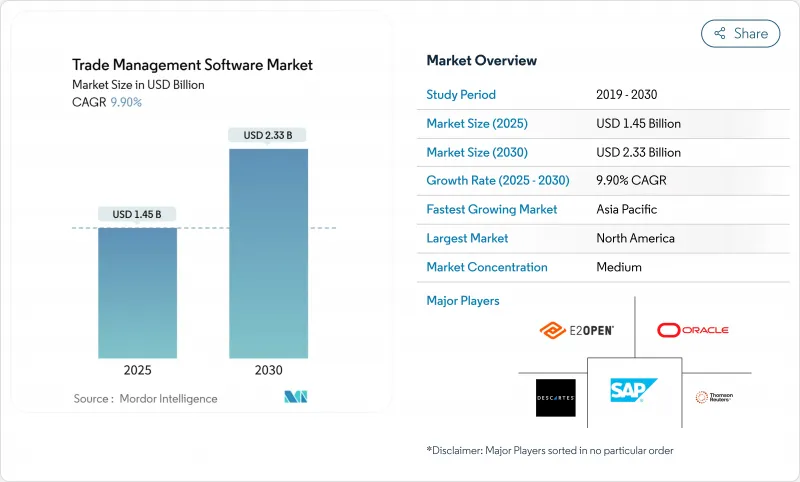

预计到 2025 年,贸易管理软体市场规模将达到 14.5 亿美元,到 2030 年将达到 23.3 亿美元,年复合成长率为 9.9%。

市场成长的驱动力来自日益完善的国际贸易规则、数位双胞胎在海关规划中的广泛应用,以及为缩短合规週期而向云端优先架构的明显转变。监管变化,例如美国更新的先进计算产品出口管制条例和欧盟的碳边境调节机制,正迫使企业对其合规工具进行现代化改造。同时,人工智慧驱动的情境规划引擎正在推动对整合筛检、文件处理和海关优化功能的平台的需求。供应商强调即时分析,以减少罚款、缩短港口停留时间并保持端到端的货物可视性。大型企业收购细分领域的专业公司也推动了产业整合,例如WiseTech Global于2025年收购E2open,旨在创建一个将海关、物流、库存和永续性彙报整合在一起的单一平台系统。

全球贸易管理软体市场趋势与洞察

采用云端优先策略可降低合规成本

云端平台消除了本地硬体及其相关的维护费用,将整体拥有成本降低了 30% 至 40%,同时为各种规模的企业提供先进的合规功能。自动内容更新可确保规则集始终保持最新状态,使用户能够以快 45% 的速度回应监管变化,并将罚款减少 35%。这一模式与 86% 的资讯长 (CIO) 计划在 2025 年前重新平衡其公共云端工作负载的目标相符,显示市场对灵活的託管模式的需求。供应商提供与 ERP 和 TMS 套件的快速 API 连接器,从而缩短整合时间并加快投资回报率。这些综合优势正促使进出口企业将云端采用视为一种策略槓桿,而不仅仅是简单的技术替换。

更严格的出口管制刺激投资

美国于2025年1月生效的《高级计算项目和人工智慧模型权重条例》扩大了许可义务并增加了审核风险。欧洲正在讨论的类似措施进一步加重了合规负担。如今,企业需要即时进行有限方筛检、采用动态许可筛检并建立防篡改的审核追踪。 2024年违规的创纪录处罚促使董事会加快系统升级,尤其是在半导体、航太和两用物项领域。集筛选、关税分类和自动生成文件于一体的平台正日益普及,因为它们减少了人工检查,并能加快货物运输速度。

贸易合规资料科学家短缺

对兼具分析和出口管理专业知识的人才需求远超供给。新兴市场正面临人才外流,迫使当地企业转向外部顾问,并因此承受巨大压力。人才短缺延长了预测性关税引擎的模型建置週期,限制了早期部署阶段的全面应用。为应对这项挑战,供应商正在引入引导式工作流程和低程式码工具,但劳动力市场的不平衡阻碍了其快速扩展。

细分市场分析

到2024年,解决方案业务将占总营收的65.09%,这反映出市场对自动化受限方筛检、原产地管理和关税优化工具的强劲需求。预计到2024年,解决方案贸易管理软体市场规模将达到9.4亿美元,随着出口商寻求能够减少错误并加快海关工作流程的单一控制面板,该市场将持续扩张。 Oracle、SAP和Descartes等Oracle正在将课税、ESG和安全工作流程整合到其核心贸易资料集中。

服务伙伴负责配置、变更管理和使用者培训,预计2025年至2030年间的复合年增长率将达到12.5%。购买软体加服务组合的企业能够更快地获得投资回报,因为服务提供者会维护HS编码库并随着规则的演变调整文件。咨询附加附加元件有助于绘製CBAM排放揭露讯息,订阅支援涵盖全天候监控、入口网站维护和审核协助。这使得小型进口商也能获得以往只有大型合规团队才能提供的专业知识。

预计到2024年,云端采用将占总支出的68.53%,到2030年将以15.3%的复合年增长率成长,并持续维持贸易管理软体市场的最大份额。 SaaS订阅可降低资本成本,并实现所有节点的自动监管更新。在寻求资料主权的银行和国防相关企业中,混合模式正在兴起,其中受管理的资料保留在本地,而不太敏感的功能则透过可扩展的云端进行路由。

根据一项产业调查,到2025年,86%的资讯长(CIO)计画将部分工作负载迁移到私有云端,以优化延迟和降低成本。供应商正积极回应,推出容器化。在港口配置,透过在海关查核点附近处理文件,可以降低延迟和停留时间。这种多模态架构使企业能够在不同部署环境中同步合规内容,同时微调风险接受度,进而扩大贸易管理软体市场的潜在规模。

贸易管理软体市场按组件(解决方案和服务)、部署类型(云端和本地部署)、组织规模(中小企业和大型企业)、最终用户行业(运输和物流、消费品和零售、製药和生命科学等)以及地区进行细分。市场预测以美元计价。

区域分析

2024年,北美将维持40%的贸易管理软体市场收入份额,这主要得益于世界一流的IT基础设施和持续推进的出口管制改革。 2025年美国对人工智慧模型权重的限制将促使科技、航太和半导体出口商采用能够即时审核许可证覆盖范围的仪錶板。零售商将部署数位双胞胎来测试采购方案和关税情景,而新的供应链安全协议将增加额外的报告层级,从而强化对综合合规引擎的需求。

预计亚太地区将实现最快成长,到2030年复合年增长率将达到14.8%。区域全面经济伙伴关係协定(RCEP)的深化、跨境电子商务的蓬勃发展以及政府对数位贸易的补贴正在推动投资。中小企业(SME)占出口商的大多数,但往往缺乏训练有素的合规负责人。此外,在新加坡和越南等经济体,单一窗口海关入口网站直接连接到供应商应用程式介面(API),从而缩短了合规货物的清关时间。

欧洲正围绕碳排放交易体系(CBAM)重组贸易流程,该体系将于2026年全面实施。钢铁、水泥和铝的进口商将被要求追踪隐含排放併购买碳排放证书,这将促使企业投资建造能够将供应商碳排放数据与海关申报资讯关联的系统。数位孪生技术使负责人能够测试可最大限度减少碳排放的采购变更方案,而企业则致力于将CBAM资料集与欧盟内部贸易统计局(Intrastat)和进口控制系统(ICS)的申报资讯整合到一个统一的介面中,从而减少重复工作和资料输入错误。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 采用云端优先策略可降低合规成本

- 更严格的出口管制措施会刺激支出。

- 全通路物流与第三方物流整合的兴起

- 用于情境定价的数位双胞胎

- 与环境、社会及公司治理(ESG)挂钩的关税激励措施和碳边境税

- 跨境贸易活动增加

- 市场限制

- 碎片化的传统IT系统减缓了系统整合速度。

- 贸易合规资料科学家短缺

- 中小企业初始成本高

- 地缘政治软体製裁可能导致供应商被排除在外

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 影响市场的宏观经济因素

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 供应商管理

- 进出口管理

- 发票和税务管理

- 合规与风险分析

- 服务

- 咨询

- 实施与集成

- 支援与维护

- 解决方案

- 按部署模式

- 云

- 本地部署

- 按组织规模

- 小型企业

- 大公司

- 按最终用户行业划分

- 运输/物流

- 消费品和零售

- 製药和生命科学

- 能源与公共产业

- 国防/航太

- 电子与高科技

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 西班牙

- 瑞士

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 新加坡

- 越南

- 印尼

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 奈及利亚

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SAP SE

- Oracle Corporation

- Thomson Reuters(ONESOURCE)

- Descartes Systems Group

- E2open LLC

- WiseTech Global

- Infor Nexus

- AEB SE

- Bamboo Rose LLC

- MIC Customs Solutions

- Livingston International

- Expeditors International

- Accuity

- 3rdwave

- Blume Global

- CargoSmart Ltd.

- Customs4trade

- Freightgate Inc.

- Aptean TradeBeam

- BluJay Solutions(K'rber)

第七章 市场机会与未来展望

The trade management software market is valued at USD 1.45 billion in 2025 and is expected to reach USD 2.33 billion by 2030, translating into a 9.9% CAGR.

The market's growth stems from tighter international trade rules, widespread deployment of digital twins for tariff planning, and a distinct move toward cloud-first architectures that trim compliance cycles. Regulatory changes such as the U.S. export-control update on advanced computing items and the European Union's Carbon Border Adjustment Mechanism are compelling firms to modernize compliance tools. At the same time, AI-enabled scenario-planning engines are pushing demand for unified platforms that consolidate screening, document generation, and duty optimization. Vendors are stressing real-time analytics to lower penalties, minimize dwell time at ports, and sustain end-to-end shipment visibility. Industry consolidation is also quickening as larger players acquire niche specialists which is exemplified by WiseTech Global's 2025 takeover of E2open to build single-stack systems that interlink customs, logistics, inventory, and sustainability reporting.

Global Trade Management Software Market Trends and Insights

Cloud-first deployments cut compliance cost

Cloud platforms remove on-premise hardware and related maintenance outlays, lowering total ownership costs by 30-40% and extending advanced compliance functionality to firms of all sizes.Automatic content updates keep rule sets current, allowing users to react 45% faster to regulatory changes and cut penalties by 35%. The model aligns with plans by 86% of CIOs to rebalance public-cloud workloads by 2025, signaling demand for flexible hosting patterns. Vendors include rapid API connectors to ERP and TMS suites, shrinking integration timelines and speeding returns on investment. Together, these benefits push importers and exporters to treat cloud deployment as a strategic lever rather than a simple technology swap.

Tightening export-control regimes spur spending

The January 2025 U.S. regulations on advanced computing items and AI model weights broaden license obligations and heighten audit risk. Similar measures under discussion in Europe further enlarge the compliance burden. Firms now require real-time restricted-party screening, dynamic license workflows, and tamper-proof audit trails. Record penalties for non-compliance in 2024 convinced boards to fast-track upgrades, especially in semiconductor, aerospace, and dual-use sectors. Platforms that blend screening, tariff classification, and auto-generated documents gain traction because they cut manual checks and move cargo faster.

Shortage of trade-compliance data scientists

Demand for professionals who blend analytics with export-control expertise is outrunning supply. Emerging markets feel the pinch as talent migrates, leaving local firms to lean on external consultants. The scarcity lengthens model-building cycles for predictive duty engines and limits full-feature adoption in early deployment years. To counter, suppliers embed guided workflows and low-code tools, but labor gaps remain a brake on rapid scaling world.

Other drivers and restraints analyzed in the detailed report include:

- Rise of omni-channel logistics and 3PL integration

- Customs-duty digital twins for scenario pricing

- Fragmented legacy IT slows system integration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Solutions segment held 65.09% of revenue in 2024, reflecting intense demand for tools that automate restricted-party screening, origin management, and duty optimization. The trade management software market size for Solutions stood at USD 0.94 billion in 2024 and continues to expand as exporters seek single dashboards that cut errors and speed clearance workflows. Oracle, SAP, and Descartes are layering taxation, ESG, and security workflows onto core trade data sets.

Service partners manage configuration, change control, and user training. The Services slice is projected at a 12.5% CAGR from 2025-2030. Enterprises buying software-plus-service bundles secure quicker ROI because providers maintain HS code libraries and adapt documents as rules evolve. Advisory add-ons help customers map CBAM emission disclosures, while subscription support covers 24X7 monitoring, portal upkeep, and audit assistance. Collectively, this structure allows smaller importers to access expertise that once sat only in large compliance teams.

Cloud deployments captured 68.53% of 2024 spending and are forecast to grow at a 15.3% CAGR through 2030, sustaining the largest slice of the trade management software market. SaaS subscriptions cut capital cost and deliver automatic regulatory updates across every node. Hybrid models emerge among banks and defense contractors seeking data sovereignty, keeping controlled data on-premise while routing less-sensitive functions through scalable clouds.

An industry survey shows 86% of CIOs will repatriate select workloads to private cloud by 2025, aiming for optimized latency and cost. Vendors counter by shipping containerized microservices that run seamlessly on public, private, or edge nodes. Edge deployments at ports process documentation close to customs checkpoints, lowering latency and shrinking dwell time. This multi-modal architecture lets companies fine-tune risk tolerance while holding compliance content in sync across installations, thereby enlarging the addressable trade management software market.

Trade Management Software Market is Segmented by Component (Solution and Service), Deployment (On-Cloud and On-Premise), Organization Size (Small and Medium Enterprises and Large Enterprises), End-User Industry (Transportation and Logistics, Consumer Goods and Retail, Pharmaceuticals and Life-Sciences, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 40% of trade management software market revenue in 2024, helped by world-class IT infrastructure and ongoing export-control reforms. The 2025 U.S. controls on AI model weights spur technology, aerospace, and semiconductor exporters to install dashboards that audit license coverage in real time. Retailers deploy customs digital twins to test sourcing alternatives and tariff scenarios, while new supply-chain security pacts impose extra reporting layers that strengthen demand for comprehensive compliance engines.

The Asia-Pacific region is projected to grow the fastest, with a 14.8% CAGR through 2030. Deeper RCEP ties, booming cross-border e-commerce, and government subsidies for digital trade are driving investment. SMEs dominate exporter counts yet often lack trained compliance officers. Low-cost, multilingual cloud suites offering wizard-driven classification and instant certificates of origin fill the gap, and single-window customs portals in economies like Singapore and Vietnam link directly to vendor APIs, cutting clearance times for compliant shipments.

Europe is restructuring trade processes around the CBAM, fully enforced from 2026. Importers of steel, cement, and aluminum must track embedded emissions and purchase carbon certificates, prompting investment in systems that link supplier carbon data with customs entries. Digital twins allow planners to test sourcing changes that minimize carbon outlays, while enterprises aim to merge CBAM datasets with Intrastat and Import Control System filings inside a single interface, reducing duplicate effort and data-entry errors.

- SAP SE

- Oracle Corporation

- Thomson Reuters (ONESOURCE)

- Descartes Systems Group

- E2open LLC

- WiseTech Global

- Infor Nexus

- AEB SE

- Bamboo Rose LLC

- MIC Customs Solutions

- Livingston International

- Expeditors International

- Accuity

- 3rdwave

- Blume Global

- CargoSmart Ltd.

- Customs4trade

- Freightgate Inc.

- Aptean TradeBeam

- BluJay Solutions (K'rber)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first deployments cut compliance cost

- 4.2.2 Tightening export-control regimes spur spending

- 4.2.3 Rise of omni-channel logistics and 3PL integration

- 4.2.4 Customs-duty digital twins for scenario pricing

- 4.2.5 ESG-linked tariff incentives and carbon border taxes

- 4.2.6 Growth in cross-border trade activities

- 4.3 Market Restraints

- 4.3.1 Fragmented legacy IT slows system integration

- 4.3.2 Shortage of trade-compliance data scientists

- 4.3.3 High upfront cost for SME adoption

- 4.3.4 Geopolitical software-sanctions risk vendor lock-out

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Vendor Management

- 5.1.1.2 Import/Export Management

- 5.1.1.3 Invoice and Duty Management

- 5.1.1.4 Compliance and Risk Analytics

- 5.1.2 Services

- 5.1.2.1 Consulting

- 5.1.2.2 Implementation and Integration

- 5.1.2.3 Support and Maintenance

- 5.1.1 Solutions

- 5.2 By Deployment Model

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 Transportation and Logistics

- 5.4.2 Consumer Goods and Retail

- 5.4.3 Pharmaceuticals and Life-Sciences

- 5.4.4 Energy and Utilities

- 5.4.5 Defense and Aerospace

- 5.4.6 Electronics and High-Tech

- 5.4.7 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Spain

- 5.5.3.7 Switzerland

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Malaysia

- 5.5.4.6 Singapore

- 5.5.4.7 Vietnam

- 5.5.4.8 Indonesia

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 Oracle Corporation

- 6.4.3 Thomson Reuters (ONESOURCE)

- 6.4.4 Descartes Systems Group

- 6.4.5 E2open LLC

- 6.4.6 WiseTech Global

- 6.4.7 Infor Nexus

- 6.4.8 AEB SE

- 6.4.9 Bamboo Rose LLC

- 6.4.10 MIC Customs Solutions

- 6.4.11 Livingston International

- 6.4.12 Expeditors International

- 6.4.13 Accuity

- 6.4.14 3rdwave

- 6.4.15 Blume Global

- 6.4.16 CargoSmart Ltd.

- 6.4.17 Customs4trade

- 6.4.18 Freightgate Inc.

- 6.4.19 Aptean TradeBeam

- 6.4.20 BluJay Solutions (K'rber)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment