|

市场调查报告书

商品编码

1851446

社群媒体分析:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Social Media Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

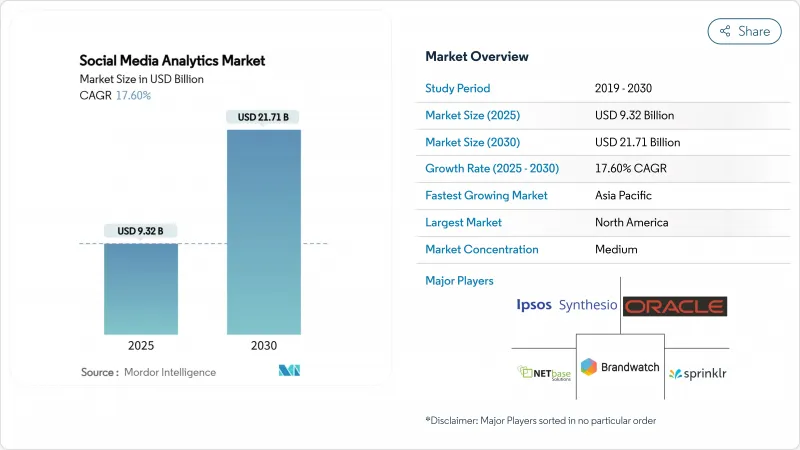

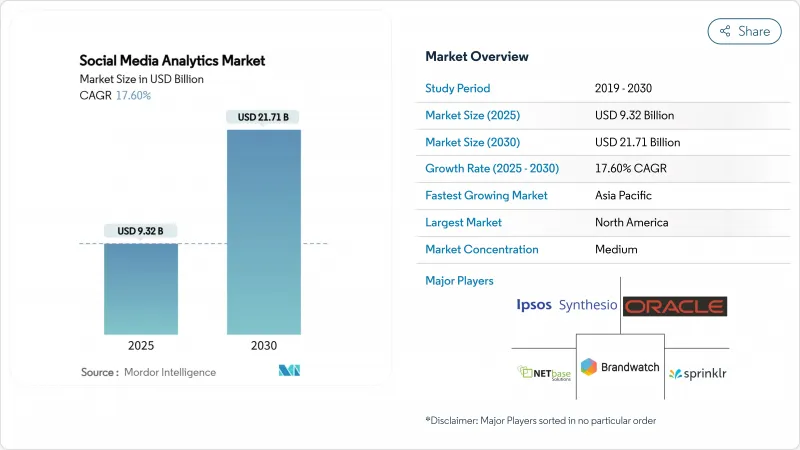

预计到 2025 年,社群媒体分析市场规模将达到 93.2 亿美元,到 2030 年将达到 217.1 亿美元,年复合成长率为 17.6%。

此次扩张的驱动力在于企业对即时情绪侦测、预测行为建模和宣传活动报酬率衡量的需求激增。成长也反映出市场正从独立的品牌监测转向整合式、人工智慧主导引擎,这些引擎能够大规模地摄取文字、影像、音讯和影片。加速的云端迁移、社交电商的兴起以及新的资料隐私法规正在重塑解决方案的蓝图。能够将多模态处理、透明的模型管治和特定领域的资料连接器结合的供应商正在赢得市场份额,因为买家正在将各种独立工具整合到嵌入式的客户体验体系中。因此,产品蓝图的重点在于持续的模型重训练和内建的客户经验辅助功能,以保持差异化优势。

全球社群媒体分析市场趋势与洞察

社群媒体用户数量呈指数级增长

预计到2025年,将有超过52.4亿人参与社群媒体,不断增长的数据量将推动社群媒体分析市场向可扩展的云端架构发展,以分析每天数十亿次的互动。影片优先的互动模式日益普及——TikTok的平均互动率为2.50%,而Instagram仅为0.50%——迫使供应商整合图像和影片分类器,取代仅基于文字的情绪分析工具。医疗保健提供者正利用用户数量的激增来追踪公共卫生讯号,因为90%的美国成年人透过社交平臺获取健康资讯。资料多样性加剧了供应商的锁定效应,因为专有领域本体和语言模型会随着时间的推移而提高准确性。然而,去除重复的机器人和虚假互动会增加计算成本,并需要不断改进演算法。

GenAI驱动的洞察引擎推动北美地区的提升销售

北美企业正大力投资基因人工智慧(GenAI),以期将被动监控转变为预测性指引。该地区69%的负责人认为基因人工智慧对内容个人化具有革命性意义。先进的变压器模型能够以99.68%的准确率检测虚假讯息,从而提高整体资料保真度。一项银行试点计画将长短期记忆网路(LSTM)应用于136,150条社交媒体帖子,实现了91%的客户情绪分类准确率,从而能够进行微细分宣传活动。然而,只有12%的企业报告了明确的基因人工智慧投资报酬率,这为能够填补技能缺口的供应商创造了咨询和管理服务的机会。部署低程式码模型训练介面和可解释性仪表板的供应商最有可能获得更高的收入。

严格的隐私法规限制了资料粒度。

GDPR的实施使欧盟出版商的第三方追踪能力降低了14.79%,迫使平台开发诸如联邦学习等保护隐私的分析解决方案。 《加州消费者隐私法案》在美国范围内也实施了类似的限制。 Meta的「付费或同意」政策表明,同意框架如何降低资料可用性并使跨平台用户资料拼接变得更加复杂。能够在保护个人隐私的同时提供汇总的、群体层面的洞察的供应商,将能够遵守法规并降低客户的风险敞口。

细分市场分析

到2024年,解决方案将占总收入的65%,凸显其作为社群媒体分析市场入门级产品的地位。虽然订阅许可可能提供可预测的净利率,但目前企业面临大量待实施项目,因此更倾向于选择服务合约。预计服务业务将以23.3%的复合年增长率成长,这需要进行模型校准、分类设计和监管映射。这一成长表明,社群媒体分析市场在实施和优化方面的规模将超过基础平台费用,尤其是在GenAI工作流程需要客製化提示工程的情况下。 Sprinklr 2025财年的营收为7.964亿美元,高于2023财年的6.182亿美元,这反映了其软体+咨询的双轨模式。

专业服务的发展势头也受到垂直行业合规性差异的驱动。医疗保健客户要求符合 HIPAA 标准,而银行客户则要求信用风险决策模型具有可解释性。与领域专家和资料科学家合作的服务提供者可以加快价值实现速度并提高市场份额。因此,咨询合作伙伴正在共同开发基于结果的定价模式,这种模式与更高的转换率和更低的客户流失率相关,从而奖励各方增加经常性收入。

预计到2024年,云端运算将占据社群媒体分析市场72%的份额,并在2030年之前维持21.8%的复合年增长率,这主要得益于自动扩展和託管安全技术的推动。弹性GPU丛集处理视讯串流和变压器模型的成本效益高于大多数本地部署方案。混合部署方案在受资料居住规则约束的产业仍然存在,但超大规模资料中心在区域资料中心的投资降低了资料主权障碍。因此,随着即时仪錶板成为董事会层级的营运工具,面向云端工作负载的社群媒体分析市场规模将会扩大。

云端原生供应商利用持续配置,每週推送功能更新,从而改善机器人侦测、语言覆盖范围和合规性范本。与 Snowflake 和 Databricks 等大型资料仓储生态系统的集成,实现了对行销、销售和服务的统一可视性。相反,传统的本地部署方案在模型升级和修补程式方面存在延迟,增加了营运风险。

区域分析

北美将引领社群媒体分析市场,预计到2024年营收成长率将达到38%,这主要得益于其成熟的数位广告生态系统和早期部署的人工智慧技术。美国超过75%的广告支出都发生在网路上,这推动了社群媒体监听工具在全通路编配宣传活动中的应用。由于各州隐私权法规的差异,企业面临日益增长的合规成本,也促使企业需要具备政策感知能力的分析架构。儘管社群媒体分析技术已经发展成熟,但随着品牌将其应用场景从行销扩展到风险管理、投资者关係和职场文化评估等领域,该技术仍保持成长动能。

亚太地区到2030年将以21.3%的复合年增长率领跑,主要得益于行动优先的消费群体大规模接受社交电商。到2024年,该地区的社群媒体广告支出将达到770亿美元,年增15%,这将推动跨语言情绪分析和网红诈欺侦测的投资。中国的生态系统创新,例如淘宝直播带货,正向东南亚蔓延,催生出待开发区的分析需求。印度的多语言多样性进一步要求建构适应性强的本体,并促进伙伴关係开发本地语言模型。

GDPR 和《数位服务法案》迫使企业探索合规的分析方案,而不是放弃洞察生成。提供用户许可管理、设备端处理和差分隐私报告等功能的供应商,正吸引越来越多谨慎的买家。同时,拉丁美洲和中东及非洲地区的网路普及率不断提高,将推动现成云端分析解决方案的采用。巴西和海湾地区的城市丛集体现了成熟的市场行为,在无需大量在地化成本的情况下,加速了社群媒体分析市场的普及。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 社群媒体用户数量呈指数级增长

- GenAI驱动的洞察引擎推动北美地区的提升销售

- 加速应用内社交电商的投资报酬率追踪

- 全球广告商(美国和欧盟)强制的品牌安全指标推动市场发展

- 市场限制

- 严格的隐私法规限制了资料粒度。

- 多模态资料解读分析技能的差距阻碍了市场发展

- 机器人和假流量会扭曲市场情绪指标,阻碍市场发展。

- 价值链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 服务

- 透过部署模式

- 云

- 本地部署

- 按模组

- 社群媒体监测与追踪

- 社群媒体衡量/聆听与分析

- 按最终用户行业划分

- 媒体与娱乐

- 资讯科技和电讯

- BFSI

- 零售与电子商务

- 旅游与饭店

- 医疗保健和生命科学

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- GCC

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Sprinklr

- Oracle Corporation

- Synthesio(Crimson Hexagon)

- Brandwatch

- NetBase Solutions Inc.

- Meltwater(Sysomos Inc.)

- Talkwalker

- Sprout Social

- Digimind Social

- Brand24

- Hootsuite Inc.

- Khoros, LLC

- Clarabridge(now Qualtrics)

- Cision Ltd.

- Socialbakers(now Emplifi)

- Mentionlytics

- YouScan

- Pulsar Platform

- Dataminr

- Unmetric

- Awario

- Nuvi

- Adobe Inc.

第七章 市场机会与未来展望

The social media analytics market size stands at USD 9.32 billion in 2025 and is forecast to reach USD 21.71 billion by 2030, advancing at a 17.6% CAGR.

Surging enterprise demand for real-time sentiment detection, predictive behavioral modeling, and campaign ROI measurement underpins this expansion. Growth also reflects a decisive pivot from stand-alone brand monitoring toward unified, AI-driven insight engines that ingest text, image, audio, and video at scale. Accelerated cloud migration, the proliferation of social commerce, and fresh data-privacy mandates are reshaping solution roadmaps. Vendors able to combine multimodal processing, transparent model governance, and domain-specific data connectors are capturing share as buyers consolidate point tools into integrated customer-experience stacks. Competitive intensity remains high because switching costs are modest and proof-of-value cycles are short; as a result, product roadmaps emphasize continuous model retraining and embedded GenAI co-pilots to sustain differentiation.

Global Social Media Analytics Market Trends and Insights

Exponential Growth of Number of Social Media Users

More than 5.24 billion individuals engage on social channels in 2025, expanding data volumes and pushing the social media analytics market toward scalable cloud architectures that parse billions of daily interactions. Rising video-first engagement on TikTok, with 2.50% average interaction rates versus 0.50% on Instagram, forces vendors to embed image and video classifiers, displacing text-only sentiment tools. Healthcare providers leverage this user surge to track public health signals, with 90% of US adults sourcing health information on social platforms. Data diversity strengthens vendor lock-in because proprietary domain ontologies and language models improve accuracy over time. However, the need to de-duplicate bots and fake interactions escalates compute costs and necessitates continual algorithmic refinement.

GenAI-Powered Insight Engines Driving Upsell in North America

North American enterprises invest heavily in GenAI to transform passive monitoring into predictive guidance. Sixty-nine percent of regional marketers call GenAI revolutionary for content personalization. Advanced transformer models now detect misinformation with 99.68% accuracy, lifting overall data fidelity. Banking pilots that applied Long Short-Term Memory networks across 136,150 social posts achieved 91% customer-sentiment classification accuracy, enabling micro-segmented campaign offers. Yet only 12% of firms report clear GenAI ROI, creating advisory and managed-service opportunities for providers that can bridge the skills gap. Vendors rolling out low-code model-training interfaces and explainability dashboards are best positioned to capture expansion revenue.

Stringent Privacy Regulations Limiting Data Granularity

GDPR enforcement cut third-party tracking capability by 14.79% for EU publishers, compelling platforms to devise privacy-preserving analytics such as federated learning. The California Consumer Privacy Act extends similar constraints across the United States. Meta's "Pay or Okay" policy illustrates how consent frameworks reduce data availability and complicate cross-platform user stitching. Vendors able to deliver aggregated, cohort-level insights while preserving individual privacy comply with regulation and reduce client risk exposure.

Other drivers and restraints analyzed in the detailed report include:

- Acceleration of In-App Social Commerce ROI Tracking

- Brand-Safety Metric Mandates by Global Advertisers

- Analytics Skill-Set Gap for Multimodal Data Interpretation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions contributed 65% of 2024 revenue, underlining their role as the entry point to the social media analytics market. Subscription licenses provide predictable margins, yet enterprises now confront implementation backlogs that favor service engagements. Services are forecast to rise at a 23.3% CAGR as firms seek model calibration, taxonomy design, and regulatory mapping. This uptick illustrates how the social media analytics market size for implementation and optimization eclipses basic platform fees, especially when GenAI workflows demand bespoke prompt engineering. Sprinklr's USD 796.4 million FY25 revenue, up from USD 618.2 million in FY23, showcases the dual-stream model of software plus advisory.

The momentum in professional services also stems from vertical compliance nuances. Healthcare clients require HIPAA alignment, while banking customers demand model explainability for credit-risk decisions. Providers that pool domain experts with data scientists reduce time-to-value and deepen wallet share. Consequently, advisory partners co-develop outcome-based pricing tied to conversion uplift or churn reduction, aligning incentives and boosting recurring revenue.

Cloud captured 72% of the social media analytics market share in 2024 and is projected to sustain a 21.8% CAGR through 2030 on the strength of auto-scaling and managed security. Elastic GPU clusters process video streams and transformer models more cost-effectively than most on-premise alternatives. Hybrid options persist in sectors bound by data-residency rules, yet hyperscaler investment in regional zones lowers sovereignty barriers. The social media analytics market size for cloud workloads will therefore expand as real-time dashboards become board-level operational tools.

Cloud-native providers leverage continuous deployment to push weekly feature releases that refine bot-detection, language coverage, and compliance templates. Integration with broader data-warehouse ecosystems such as Snowflake and Databricks enables unified marketing, sales, and service visibility. Conversely, legacy on-premise installations struggle with model-versioning and patch latency, increasing operational risk.

The Social Media Analytics Market Report is Segmented by Component (Solutions, Services), Deployment Mode (Cloud, On-Premise), Module (Social Media Monitoring and Tracking, Social Media Measurement/Listening and Analytics), End-User Industry (Media and Entertainment, IT and Telecom, BFSI, Retail and E-Commerce, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the social media analytics market with 38% revenue in 2024, buoyed by sophisticated digital-ad ecosystems and early GenAI rollouts. More than 75% of US ad expenditure is online, driving pervasive use of social listening tools within omnichannel campaign orchestration. Enterprises face rising compliance overhead due to state-level privacy statutes, prompting demand for policy-aware analytics frameworks. Despite maturity, growth continues as brands extend usage from marketing into risk, investor relations, and workplace culture assessment.

Asia-Pacific posts the highest regional CAGR at 21.3% through 2030 as mobile-first populations adopt social commerce at scale. The region's USD 77 billion social-media ad spend in 2024, up 15% year over year, anchors investment in cross-language sentiment and influencer fraud detection. China's ecosystem innovation-such as Taobao's live-stream selling-spills over to Southeast Asia, creating green-field analytics demand. India's multilingual diversity further necessitates adaptable ontologies, spurring local-language model development partnerships.

Europe records steady growth because GDPR and the Digital Services Act force enterprises to seek compliant analytics alternatives rather than abandon insight generation. Vendors that embed consent management, on-device processing, and differential-privacy reporting expand pipeline among cautious buyers. Meanwhile, Latin America, Middle East, and Africa begin adopting off-the-shelf cloud analytics as internet penetration rises. Urban clusters in Brazil and the Gulf states mirror advanced market behaviors, accelerating social media analytics market adoption without incurring heavy localization expenditure.

- Sprinklr

- Oracle Corporation

- Synthesio (Crimson Hexagon)

- Brandwatch

- NetBase Solutions Inc.

- Meltwater (Sysomos Inc.)

- Talkwalker

- Sprout Social

- Digimind Social

- Brand24

- Hootsuite Inc.

- Khoros, LLC

- Clarabridge (now Qualtrics)

- Cision Ltd.

- Socialbakers (now Emplifi)

- Mentionlytics

- YouScan

- Pulsar Platform

- Dataminr

- Unmetric

- Awario

- Nuvi

- Adobe Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential Growth of Number of Social Media Users

- 4.2.2 GenAI-powered Insight Engines Driving Upsell in North America

- 4.2.3 Acceleration of In-App Social Commerce ROI Tracking

- 4.2.4 Brand-safety Metric Mandates by Global Advertisers (US and EU) Drives the Market

- 4.3 Market Restraints

- 4.3.1 Stringent Privacy Regulations Limiting Data Granularity

- 4.3.2 Analytics Skill-set Gap for Multimodal Data Interpretation Hinders the Market

- 4.3.3 Bot and Fake-traffic Distortion of Sentiment Metrics Hinders the Market

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Module

- 5.3.1 Social Media Monitoring and Tracking

- 5.3.2 Social Media Measurement/Listening and Analytics

- 5.4 By End-user Industry

- 5.4.1 Media and Entertainment

- 5.4.2 IT and Telecom

- 5.4.3 BFSI

- 5.4.4 Retail and e-Commerce

- 5.4.5 Travel and Hospitality

- 5.4.6 Healthcare and Life-sciences

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sprinklr

- 6.4.2 Oracle Corporation

- 6.4.3 Synthesio (Crimson Hexagon)

- 6.4.4 Brandwatch

- 6.4.5 NetBase Solutions Inc.

- 6.4.6 Meltwater (Sysomos Inc.)

- 6.4.7 Talkwalker

- 6.4.8 Sprout Social

- 6.4.9 Digimind Social

- 6.4.10 Brand24

- 6.4.11 Hootsuite Inc.

- 6.4.12 Khoros, LLC

- 6.4.13 Clarabridge (now Qualtrics)

- 6.4.14 Cision Ltd.

- 6.4.15 Socialbakers (now Emplifi)

- 6.4.16 Mentionlytics

- 6.4.17 YouScan

- 6.4.18 Pulsar Platform

- 6.4.19 Dataminr

- 6.4.20 Unmetric

- 6.4.21 Awario

- 6.4.22 Nuvi

- 6.4.23 Adobe Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment