|

市场调查报告书

商品编码

1851754

IT服务管理(ITSM):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030年)ITSM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

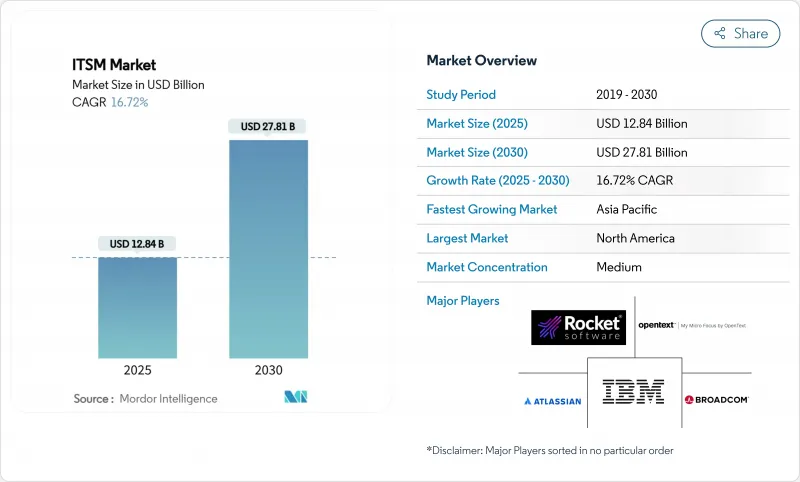

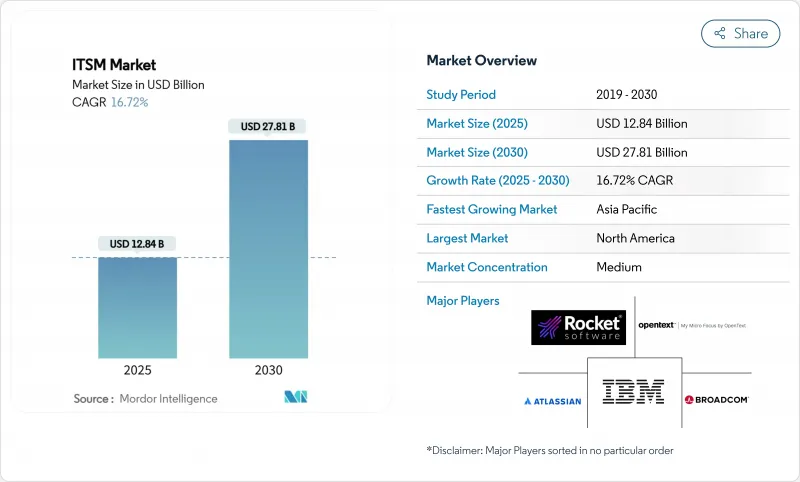

预计到 2025 年,IT 服务管理 (ITSM) 市场规模将达到 128.4 亿美元,到 2030 年将成长至 278.1 亿美元,复合年增长率为 16.72%。

这种加速发展源自于三大驱动力:企业快速采用人工智慧驱动的自动化技术、向云端原生架构转型以及对混合云端云和多重云端整合管理的需求。企业也正在采用低程式码编配来弥补技能短缺,同时,FinOps 和 GreenOps 报告正将永续性和成本控制指标直接纳入 IT 工作流程。随着分散式设备需要即时支援,边缘运算和 5G 的普及将进一步扩大 IT 服务管理市场的规模。

全球IT服务管理市场趋势与洞察

向云端原生IT服务管理平台的转变

采用云端原生技术消除了旧有系统每年高达 4 万美元的维护成本,从而释放了创新预算。与超大规模资料中心业者营运商建立策略合作伙伴关係,为人工智慧功能提供了弹性运算能力,推动 2025 年第一季季订阅量年增 19%。迁移到云端原生技术的製造商将支援时间从 30 分钟缩短至 6 分钟,显着提高了生产效率。早期采用者获得了成本和速度优势,使得云端原生功能成为整个 IT 服务管理市场的基本要求。

AI主导的服务自动化与AIOps集成

ServiceNow 的人工智慧交易量较上一季成长了 150%,预计到 2025 年,其人工智慧客户数量将超过 1000 家。 AIOps 可将平均问题解决时间缩短高达 60%,并减少工单积压。 IBM 的生成式人工智慧收入预计到 2025 年将达到 60 亿美元,凸显了企业对自主营运的强劲需求。采用对话式介面的供应商正在进一步普及人工智慧技术,改变买家的预期,并使自身与竞争对手形成鲜明对比。

传统系统迁移的复杂性和高昂的转换成本

虽然安全漏洞会增加风险,但分阶段迁移并保护数据,迁移后可带来高达 277% 的投资报酬率。儘管成本是一个障碍,且现有供应商仍将继续留任,但现代化改造后的组织将获得显着的效率提升。

细分市场分析

预计到2024年,云端采用将占IT服务管理市场的64.8%,并在2030年之前以18.3%的复合年增长率成长。企业选择云端是为了获取人工智慧功能并管理全球运营,而无需资本支出。在国防等资料密集型环境中,本地部署仍然至关重要。例如,微软将其内部ServiceNow实例迁移到Azure,就体现了云端在扩展创新规模方面所扮演的角色。

云端运算透过提供预先建置的集成,也契合了多重云端的现实。 ServiceNow 和 AWS 之间的策略合作,涵盖了跨多个产业的 AI 应用,展现了强劲的发展势头。因此,云端运算正迅速成为实现现代 IT 服务管理市场能力的预设途径。

作为IT支援的基础门户,服务台和事件管理在2024年将维持35.3%的市场份额。配置和资产管理将以17.9%的复合年增长率成长,这主要受资产发现需求的驱动。整合发现、依赖关係映射和事件工作流程的平台化方法将改变预算优先顺序。预计2025年至2030年间,配置和资产管理的IT服务管理市场规模将增加一倍。

人工智慧正在让所有应用程式变得更加强大,ServiceNow 的 AI 代理编排器展示了多个自主代理如何协作解决工单,从而减少人工操作。随着 DevOps 和混合架构对整合可见性的需求日益增长,变更管理、发布管理、网路管理和资料库管理也呈现出强劲的成长动能。

区域分析

北美地区将继续保持领先地位,预计到2024年将占全球收入的37.2%,这主要得益于其在企业和公共部门的稳固装置量。近期联邦政府签订的合约金额均超过100万美元,凸显了平台持续升级的需求。该地区的重点正从初始部署转向高阶人工智慧和跨域可观测性。

亚太地区是成长最快的地区。随着企业将IT服务管理(ITSM)外包以保持敏捷性,预计到2025年,託管服务的需求将激增32%。中国製造商和银行正在经历大规模的数位化,而日本三菱日联银行(MUFG Bank)透过实施ServiceNow,预计到2025年每年可节省2200小时。印度的国内需求与其在全球外包领域的领导地位相辅相成。

欧洲、南美洲以及中东和非洲蕴藏着多元化的商业机会。欧洲企业需要符合严格资料保护法律和即将推出的人工智慧管治架构的IT服务管理(ITSM)解决方案。永续性报告的出现为财务营运(FinOps)和绿色营运(GreenOps)模组带来了更广阔的发展前景。拉丁美洲的云端运算应用正在加速,海湾合作委员会(GCC)国家也加大了对ITSM的投资,以支持智慧城市建设。非洲的通讯业者和政府部门是经济实惠的云端基础平台应用的新兴领域,但前景看好。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 向云端原生IT服务管理平台的转变

- AI驱动的服务自动化与AIOps集成

- 混合/多重云端环境的整合管理

- 低代码/无代码编配支援公民IT服务管理

- ITSM 中内建了 FinOps 和 GreenOps 报告

- 将边缘运算和 5G 营运纳入 ITSM

- 市场限制

- 传统系统迁移的复杂性和高昂的转换成本

- ITSM和ITOM专业人员短缺

- 新的人工智慧管治和资料居住法规

- 可观测资料成本的上升推动了工具的激增。

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过部署

- 云

- 本地部署

- 透过使用

- 服务台和事件管理

- 配置和资产管理

- 变更和发布管理

- 网路和资料库管理

- 其他的

- 按最终用户行业划分

- BFSI

- 製造业

- 政府与教育

- 资讯科技/通讯

- 零售与电子商务

- 卫生保健

- 旅游与饭店

- 其他行业

- 按公司规模

- 大公司

- 中小企业

- 按服务类型

- 解决方案(平台/软体)

- 服务(实施、管理、训练)

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ServiceNow Inc.

- IBM Corporation

- BMC Software Inc.

- Atlassian Corporation PLC

- Broadcom Inc.(CA Technologies)

- Micro Focus International PLC

- Ivanti Inc.

- Freshworks Inc.

- ASG Technologies Group Inc.

- Axios Systems

- ManageEngine(Zoho Corp.)

- SolarWinds Corp.

- EasyVista SA

- USU Software AG

- SysAid Technologies Ltd.

- Cherwell(Ivanti)

- TOPdesk BV

- Hornbill Service Management Ltd.

- SymphonyAI Summit

- 4me Inc.

第七章 市场机会与未来展望

The IT service management market was valued at USD 12.84 billion in 2025 and is forecast to grow to USD 27.81 billion by 2030, reflecting a 16.72% CAGR.

The acceleration stems from three forces: rapid enterprise adoption of AI-driven automation, the migration to cloud-native architectures, and the need for unified management across hybrid and multicloud estates. Enterprises are also embracing low-code orchestration to offset skills shortages, while FinOps and GreenOps reporting embed sustainability and cost-control metrics directly into IT workflows. Edge-computing and 5G onboarding further expands the scope of the IT service management market as distributed devices require real-time support.

Global ITSM Market Trends and Insights

Shift to Cloud-Native ITSM Platforms

Cloud-native adoption removes the USD 40,000 annual maintenance burden linked to legacy systems, freeing budgets for innovation. Strategic alliances with hyperscalers enable elastic compute for AI features, driving 19% year-over-year subscription growth in Q1 2025. Migrating manufacturers cut support times from 30 minutes to 6 minutes, highlighting productivity gains. Early adopters gain cost and speed advantages, making cloud-native capability a baseline requirement across the IT service management market.

AI-Driven Service Automation and AIOps Integration

ServiceNow recorded 150% quarter-over-quarter growth in AI deals and surpassed 1,000 AI customers in 2025 ServiceNow. AIOps shortens mean time to resolution by up to 60%, reducing ticket backlogs. IBM's generative AI revenue reached USD 6 billion in 2025, underscoring enterprise appetite for autonomous operations.Vendors embedding conversational interfaces further democratize access, altering buyer expectations and sharpening competitive differentiation.

Legacy Migration Complexity and High Switching Cost

Enterprises devote USD 40,000 annually per legacy system and lose 17 hours a week to maintenance tasks.Security vulnerabilities heighten risk, yet phased migrations that safeguard data deliver up to 277% ROI post-transition. The expense forms a barrier, preserving incumbent vendor positions, but organizations that modernize enjoy significant efficiency gains.

Other drivers and restraints analyzed in the detailed report include:

- Unified Management for Hybrid/Multicloud Estates

- Low-Code/No-Code Orchestration Enabling Citizen ITSM

- Shortage of Skilled ITSM and ITOM Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments accounted for 64.8% of the IT service management market in 2024 and are projected to grow at 18.3% CAGR to 2030. Organizations select cloud to access AI functions and manage global operations without capital outlays. On-premise remains essential for data-sovereign environments such as defense. Real-world cases such as Microsoft migrating internal ServiceNow instances to Azure show cloud's role in scaling innovation.

Cloud also aligns with multicloud realities because it offers pre-built integrations. ServiceNow's strategic collaboration with AWS covers AI-powered applications across diverse industries and illustrates the momentum. Consequently, cloud is becoming the default path to modern IT service management market capabilities.

Service Desk and Incident Management retained 35.3% share in 2024 as the foundational gateway to IT support. Configuration and Asset Management, fueled by asset discovery needs, will expand at 17.9% CAGR. A combined platform approach that unifies discovery, dependency mapping, and incident workflows changes budget priorities. The IT service management market size for Configuration and Asset Management is forecast to double between 2025 and 2030.

AI further elevates every application. ServiceNow's AI Agent Orchestrator demonstrates multiple autonomous agents collaborating on ticket resolution to cut manual toil. Change, Release, Network, and Database Management segments climb steadily because DevOps and hybrid architectures demand integrated visibility.

IT Service Management Market Report is Segmented by Deployment (Cloud, On-Premises), Application (Service Desk and Incident Management, Configuration and Asset Management, and More), End-User Industry (BFSI, Manufacturing, IT and Telecommunications, and More), Enterprise Size (Large Enterprises, Smes), Service Type (Solutions, Services), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains leadership with 37.2% of 2024 revenue and an entrenched install base among enterprises and the public sector. Recent federal contracts surpass USD 1 million each, underscoring continued platform upgrades. Regional focus is shifting from first-time deployments toward advanced AI and cross-domain observability.

Asia-Pacific is the fastest-growing region. Managed services demand surged 32% in 2025 as companies outsource ITSM to stay agile. Chinese manufacturers and banks digitize operations at scale, while Japan's Mitsubishi UFJ Bank recorded 2,200 hours saved annually through its 2025 ServiceNow rollout. India's domestic demand strengthens alongside its global outsourcing leadership.

Europe, South America, Middle East, and Africa illustrate diverse opportunities. European enterprises need ITSM solutions that respect stringent data-protection laws and upcoming AI governance frameworks. Sustainability reporting brightens prospects for FinOps and GreenOps modules. Latin American adoption accelerates through cloud uptake, whereas GCC states invest in ITSM for smart-city initiatives. African telco and government segments form an early-stage but promising arena for affordable, cloud-based platforms.

- ServiceNow Inc.

- IBM Corporation

- BMC Software Inc.

- Atlassian Corporation PLC

- Broadcom Inc. (CA Technologies)

- Micro Focus International PLC

- Ivanti Inc.

- Freshworks Inc.

- ASG Technologies Group Inc.

- Axios Systems

- ManageEngine (Zoho Corp.)

- SolarWinds Corp.

- EasyVista SA

- USU Software AG

- SysAid Technologies Ltd.

- Cherwell (Ivanti)

- TOPdesk BV

- Hornbill Service Management Ltd.

- SymphonyAI Summit

- 4me Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to cloud-native ITSM platforms

- 4.2.2 AI-driven service automation and AIOps integration

- 4.2.3 Unified management for hybrid / multicloud estates

- 4.2.4 Low-code / no-code orchestration enabling citizen ITSM

- 4.2.5 FinOps and GreenOps reporting embedded in ITSM

- 4.2.6 Edge-computing and 5G operations onboarding to ITSM

- 4.3 Market Restraints

- 4.3.1 Legacy migration complexity and high switching cost

- 4.3.2 Shortage of skilled ITSM and ITOM professionals

- 4.3.3 Emerging AI-governance and data-residency regulations

- 4.3.4 Rising observability-data costs causing tool sprawl

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Application

- 5.2.1 Service Desk and Incident Management

- 5.2.2 Configuration and Asset Management

- 5.2.3 Change and Release Management

- 5.2.4 Network and Database Management

- 5.2.5 Others

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Manufacturing

- 5.3.3 Government and Education

- 5.3.4 IT and Telecommunications

- 5.3.5 Retail and E-commerce

- 5.3.6 Healthcare

- 5.3.7 Travel and Hospitality

- 5.3.8 Other Industries

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Mid-size Enterprises (SME)

- 5.5 By Service Type

- 5.5.1 Solutions (Platform/Software)

- 5.5.2 Services (Implementation, Managed, Training)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Southeast Asia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.5.2.5 Egypt

- 5.6.5.2.6 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ServiceNow Inc.

- 6.4.2 IBM Corporation

- 6.4.3 BMC Software Inc.

- 6.4.4 Atlassian Corporation PLC

- 6.4.5 Broadcom Inc. (CA Technologies)

- 6.4.6 Micro Focus International PLC

- 6.4.7 Ivanti Inc.

- 6.4.8 Freshworks Inc.

- 6.4.9 ASG Technologies Group Inc.

- 6.4.10 Axios Systems

- 6.4.11 ManageEngine (Zoho Corp.)

- 6.4.12 SolarWinds Corp.

- 6.4.13 EasyVista SA

- 6.4.14 USU Software AG

- 6.4.15 SysAid Technologies Ltd.

- 6.4.16 Cherwell (Ivanti)

- 6.4.17 TOPdesk BV

- 6.4.18 Hornbill Service Management Ltd.

- 6.4.19 SymphonyAI Summit

- 6.4.20 4me Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment