|

市场调查报告书

商品编码

1906259

印尼低温运输物流:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Indonesia Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

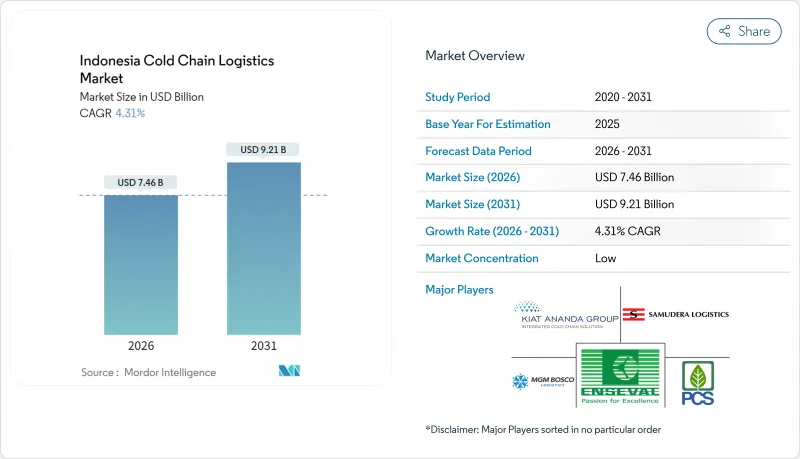

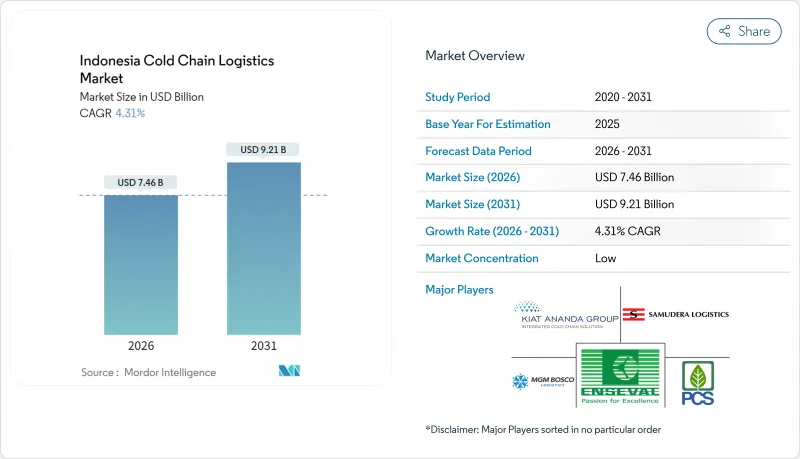

2025年,印尼低温运输物流市场价值为71.5亿美元,预计从2026年的74.6亿美元成长到2031年的92.1亿美元,在预测期(2026-2031年)内复合年增长率为4.31%。

此次市场回暖反映了印尼致力于物流基础设施现代化、降低全国配送成本以及开发高价值生鲜食品新出口管道的努力。政府的「印尼物流」(SiNasLog)计画进一步推动了成长势头,该计画旨在到2024年将物流成本占GDP的比重降至14.29%,并力争到2045年降至8%。生鲜电商的快速普及、水产品出口的激增以及全国范围内的疫苗分发,都推动了对温控仓储设施和附加价值服务的需求。企业正投资物联网感测器、区块链溯源技术和太阳能微型冷藏仓库,以提高可靠性、符合清真认证标准,并将服务扩展到偏远岛屿。港口数位化和船队升级以适应冷藏船的需求,将进一步巩固印尼作为区域冷藏物流枢纽的地位。

印尼低温运输物流市场趋势与洞察

冷冻水产品和肉类出口快速成长

印尼是世界第二大渔业生产国,海洋事务和渔业部正致力于提升水产养殖标准,以满足高端出口市场的需求。苏门答腊岛和苏拉威西岛新建的冷藏保管缩短了出口前置作业时间,并帮助加工商满足美国和欧盟的温度控制通讯协定。近期一份每月向美国出口160万枚鸡蛋的合同,印证了需要经认证的冷藏设施的蛋白质出口量不断增长。一个整合的品质保证平台结合了物联网感测器和区块链技术,确保监管链数据的安全,从而增强了买家的信心和定价权。随着海湾市场对经认证的清真水产品需求不断增长,以出口为导向的加工商正在增建符合政府第42/2024号法规的专用清真冷库。这些投资吸引了国际航空公司增加冷藏航班,从而扩大了印尼的低温运输物流市场。

生鲜电商和最后一公里冷藏配送业务快速成长

印尼电子商务市场预计将从2024年的587亿美元快速成长至2028年的868.1亿美元,其中生鲜食品类别成长尤为显着。网购消费者期望生鲜和冷冻食品在24小时内送达,这迫使平台业者在人口密集的都市区地区部署暗店、转运微型枢纽和冷藏摩托车配送网路。根据第31/2023号部长级条例简化的许可程序,Start-Ups得以快速部署冷藏配送服务。大型小包裹整合商,例如NCS,目前营运160个配备自主研发的仓库管理系统(WMS)的多功能仓库,可在拣货过程中维持±1°C的温度精度。先进的温度探头可向配送员的手持终端机发送即时警报,防止产品劣化,增强消费者信心。这些发展为印尼低温运输物流市场注入了新的资金,并推动了使用电池驱动的冷藏摩托车进行零排放城市配送的试验。

电力和柴油燃料成本上涨

冷库耗电量庞大,2024年电力和柴油价格的上涨将对营运商的利润率造成压力。虽然卡车生物柴油计画已推进至B35混合燃料,但固定式冷库仍依赖石化燃料发电。普拉博沃总统提出的「15年内逐步淘汰燃煤发电厂」的目标需要新增75吉瓦可再生能源,但程序上的延误阻碍了产能扩张。太阳能冷冻系统前景广阔:本地设计的太阳能冷冻机组单价为2,682美元,能源效率比(COP)为0.69,适用于疫苗储存。然而,资金筹措障碍和复杂的土地租赁条款限制了其推广应用。因此,在低碳电力更广泛应用之前,高昂的能源成本将阻碍印尼低温运输物流市场的扩张。

细分市场分析

至2025年,冷藏仓储将占印尼低温运输物流市场53.40%的份额,并继续作为该国国家粮食安全储备的基石。政府的大米、鸡蛋和水产品储备需要在雅加达、泗水和棉兰附近建造大型冷库,以确保战略储备能够出口并抵御通货膨胀。营运商正在对其设施维修,使其采用氨或二氧化碳製冷系统,以符合《基加利协议》的标准。利用数位双胞胎技术优化气流模式,已使能源消耗年减了8%。区块链技术的整合检验清真出口货物的真伪,并缩短目的港的清关程序。

随着製造商将先前内部完成的标籤、包装和品质保证工作外包,附加价值服务正以4.73%的复合年增长率快速成长。 42/2024号法规强制要求清真产品和非清真产品分开存放,这推动了对隔离式仓库和认证检验员的需求激增。这为第三方物流(3PL)营运商带来了机会。在运输领域,道路运输主导采用保温硬箱和GPS定位感测器,实现了98.35%的温度记录即时上传。市占率依然可观,但较为分散。海运需求不断成长,主要得益于印尼Samudera公司斥资2.8亿美元扩充船队,加强了从望加锡到中国的支线运输服务。 DHL开设香港至雅加达的直航服务,缩短了高价值生技药品的交付时间,进一步巩固了高端空运市场。这些服务创新正在重塑印尼低温运输物流市场的竞争格局。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 冷冻水产品和肉类出口快速成长

- 生鲜电商和最后一公里冷藏配送业务快速成长

- 政府推动「SiNasLog」物流基础设施的发展

- 扩大药品低温运输(疫苗/生物製药)

- 出口对清真认证低温运输的需求

- 适用于离网岛屿的太阳能微型冷藏仓库

- 市场限制

- 电力和柴油燃料成本上涨

- 爪哇走廊以外的产能缺口

- 持有资格的冷藏车驾驶人短缺

- 逐步减少基加利冷媒相关的改造成本

- 价值/供应链分析

- 监管环境

- 政府法规和政策

- 清真标准和认证的影响

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链/供应链分析

第五章 市场规模与成长预测

- 按服务类型

- 冷藏保管

- 公共仓库

- 私人仓库

- 冷藏运输

- 道路运输

- 铁路

- 海上运输

- 航空邮件

- 附加价值服务

- 冷藏保管

- 按温度类型

- 冷藏(0-5°C)

- 冷冻(-18 至 0°C)

- 环境的

- 超低温冷冻(低于-20°C)

- 透过使用

- 水果和蔬菜

- 肉类/家禽

- 鱼贝类

- 乳製品和冷冻甜点

- 麵包糖果甜点

- 蒸馏食品

- 药品和生技药品

- 疫苗和临床试验材料

- 化学品/特殊材料

- 其他生鲜产品

- 按地区(印尼)

- 爪哇岛(雅加达和博多)

- 苏门答腊

- 加里曼丹

- 苏拉威西

- 努沙登加拉,峇里岛

- 其他的

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Kiat Ananda Group

- Enseval Putera Megatrading Tbk

- MGM Bosco Logistics

- Samudera Logistics

- Pluit Cold Storage

- PT International Mega Sejahtera

- PT YCH Indonesia

- PT Wira Logitama Saksama

- DHL Supply Chain Indonesia

- PT BGR Logistik Indonesia

- PT Wahana Cold Storage

- Yusen Logistics

- Ninja Xpress

- Nippon Express

- PT Tira Cipta Logistik(TCL)

- CKL Indonesia Raya(CKL Cargo)

- PT Perishable Logistics Indonesia(PLI)

- PT Mitsubishi Logistics Indonesia

- JAS Worldwide

- Coolkas

第七章 市场机会与未来展望

第八章附录

- 冷藏仓储设施年度统计数据

- 冷冻食品进出口贸易数据

- 食品运输和储存的法规结构

- 食品饮料产业指标

The Indonesia Cold Chain Logistics Market was valued at USD 7.15 billion in 2025 and estimated to grow from USD 7.46 billion in 2026 to reach USD 9.21 billion by 2031, at a CAGR of 4.31% during the forecast period (2026-2031).

The market's upward trajectory reflects Indonesia's efforts to modernize logistics infrastructure, lower nationwide distribution costs, and unlock new export channels for high-value perishable goods. Growth momentum is reinforced by the government's SiNasLog program, which reduced logistics costs to 14.29% of GDP in 2024 and is targeting 8% by 2045. Rapid e-grocery adoption, surging seafood exports, and nationwide vaccine distribution have pushed up demand for temperature-controlled storage and value-added services. Companies are investing in IoT sensors, blockchain traceability, and solar-powered micro cold stores to improve reliability, meet halal certification rules, and extend reach to off-grid islands. Digitalization of ports and reefer-friendly vessel upgrades further strengthen Indonesia's role as a regional refrigeration hub.

Indonesia Cold Chain Logistics Market Trends and Insights

Surge in Frozen Seafood & Meat Exports

Indonesia remains the world's second-largest fisheries producer, and the Ministry of Marine Affairs and Fisheries is upgrading aquaculture standards to satisfy premium export markets. New cold storage nodes on Sumatra and Sulawesi shorten export lead times, helping processors meet U.S. and EU temperature protocols. A recent deal to ship 1.6 million eggs monthly to the United States underlines rising protein export volumes that need certified refrigerated handling. Integrated quality-assurance platforms combine IoT sensors and blockchain to secure chain-of-custody data, boosting buyer confidence and pricing power. As demand for verified halal seafood rises in Gulf markets, export-oriented processors are adding dedicated halal-only cold rooms compliant with Government Regulation 42/2024. These investments broaden the Indonesian cold chain logistics market by attracting international carriers to schedule additional reefer-equipped sailings.

E-grocery & Last-mile Refrigerated Delivery Boom

Indonesia's e-commerce value is forecast to jump from USD 58.7 billion in 2024 to USD 86.81 billion in 2028, with groceries as a standout growth category. Online shoppers expect fresh and frozen items to arrive within 24 hours, forcing platforms to deploy dark stores, cross-dock micro hubs, and refrigerated two-wheeler fleets in dense urban corridors. Ministerial Regulation 31/2023 simplified licensing, enabling start-ups to roll out chilled delivery services faster. Large parcel integrators such as NCS now operate 160 multipurpose warehouses equipped with proprietary WMS that maintain +-1 °C precision during order picking. Advanced temperature probes dispatch real-time alerts to riders' handhelds, preventing spoilage and reinforcing consumer trust. These dynamics inject fresh capital into the Indonesia cold chain logistics market and foster experimentation with battery-powered refrigerated bikes for zero-emission urban fulfillment.

High Electricity & Diesel Costs

Cold rooms draw heavy power, yet grid tariffs and generator diesel prices climbed in 2024, squeezing operators' margins. While the biodiesel program advanced to a B35 blend for trucks, stationary warehouses still rely on fossil-based electricity. President Prabowo's pledge to retire coal plants within 15 years requires 75 GW of new renewables, but procedural delays slow capacity additions. Solar chillers show promise: locally engineered units cost USD 2,682 each and deliver a 0.69 coefficient of performance suitable for vaccines. Yet financing hurdles and land-lease complexities limit widespread deployment. High energy costs, therefore, temper the Indonesia cold chain logistics market expansion until low-carbon electricity becomes more accessible.

Other drivers and restraints analyzed in the detailed report include:

- Government "SiNasLog" Logistics-Infrastructure Push

- Pharmaceutical Cold-Chain Expansion (Vaccines/Biologics)

- Capacity Gap Outside Java Corridor

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage contributed 53.40% to the Indonesia cold chain logistics market in 2025 and continues to anchor national food security reserves. Government rice, egg, and seafood buffers require bulk cold depots near Jakarta, Surabaya, and Medan, ensuring strategic stockpiles remain export-ready and inflation-proof. Operators retrofit facilities with ammonia or CO2 systems to comply with Kigali standards, while digital twins optimize airflow patterns and cut energy use 8% year-on-year. Blockchain integration verifies product authenticity for halal export consignments, shortening clearance at destination ports.

Value-added services are expanding at a 4.73% CAGR as manufacturers outsource labelling, portioning, and quality-assurance workflows that once occurred in-house. Regulation 42/2024 compels separate halal and non-halal lines, spurring demand for segregated rooms and certified inspectors, a boon for third-party logistics (3PLs). Transportation retains a large but fragmented share, led by road carriers deploying insulation-grade rigid boxes and GPS-linked sensors that upload 98.35% of temperature logs in real time. Maritime traffic gains from Samudera Indonesia's USD 280 million vessel expansion, bolstering feeder links from Makassar to China. Airfreight's premium niche is reinforced by DHL's direct Hong Kong-Jakarta rotation, shaving delivery times for high-value biologics. Collectively, service innovation is reshaping competitive boundaries within the Indonesia cold chain logistics market.

The Indonesia Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, and Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, and Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, and More), Region (Java, Sumatra, Kalimantan, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kiat Ananda Group

- Enseval Putera Megatrading Tbk

- MGM Bosco Logistics

- Samudera Logistics

- Pluit Cold Storage

- PT International Mega Sejahtera

- PT YCH Indonesia

- PT Wira Logitama Saksama

- DHL Supply Chain Indonesia

- PT BGR Logistik Indonesia

- PT Wahana Cold Storage

- Yusen Logistics

- Ninja Xpress

- Nippon Express

- PT Tira Cipta Logistik (TCL)

- CKL Indonesia Raya (CKL Cargo)

- PT Perishable Logistics Indonesia (PLI)

- PT Mitsubishi Logistics Indonesia

- JAS Worldwide

- Coolkas

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in frozen seafood & meat exports

- 4.2.2 E-grocery & last-mile refrigerated delivery boom

- 4.2.3 Government "SiNasLog" logistics-infrastructure push

- 4.2.4 Pharmaceutical cold-chain expansion (vaccines/biologics)

- 4.2.5 Halal-certified cold-chain demand for exports

- 4.2.6 Solar-powered micro cold-stores in off-grid islands

- 4.3 Market Restraints

- 4.3.1 High electricity & diesel costs

- 4.3.2 Capacity gap outside Java corridor

- 4.3.3 Shortage of certified reefer-truck drivers

- 4.3.4 Kigali refrigerant phase-down retrofit costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.5.1 Government regulations & initiatives

- 4.5.2 Halal standards & certification impacts

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Value-Chain / Supply-Chain Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5 °C)

- 5.2.2 Frozen (-18-0 °C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20 °C)

- 5.3 By Application

- 5.3.1 Fruits & Vegetables

- 5.3.2 Meat & Poultry

- 5.3.3 Fish & Seafood

- 5.3.4 Dairy & Frozen Desserts

- 5.3.5 Bakery & Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals & Biologics

- 5.3.8 Vaccines & Clinical Trial Materials

- 5.3.9 Chemicals & Specialty Materials

- 5.3.10 Other Perishables

- 5.4 By Region (Indonesia)

- 5.4.1 Java (Jakarta & BOD)

- 5.4.2 Sumatra

- 5.4.3 Kalimantan

- 5.4.4 Sulawesi

- 5.4.5 Bali & Nusa Tenggara

- 5.4.6 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Kiat Ananda Group

- 6.4.2 Enseval Putera Megatrading Tbk

- 6.4.3 MGM Bosco Logistics

- 6.4.4 Samudera Logistics

- 6.4.5 Pluit Cold Storage

- 6.4.6 PT International Mega Sejahtera

- 6.4.7 PT YCH Indonesia

- 6.4.8 PT Wira Logitama Saksama

- 6.4.9 DHL Supply Chain Indonesia

- 6.4.10 PT BGR Logistik Indonesia

- 6.4.11 PT Wahana Cold Storage

- 6.4.12 Yusen Logistics

- 6.4.13 Ninja Xpress

- 6.4.14 Nippon Express

- 6.4.15 PT Tira Cipta Logistik (TCL)

- 6.4.16 CKL Indonesia Raya (CKL Cargo)

- 6.4.17 PT Perishable Logistics Indonesia (PLI)

- 6.4.18 PT Mitsubishi Logistics Indonesia

- 6.4.19 JAS Worldwide

- 6.4.20 Coolkas

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment

8 Appendix

- 8.1 Annual Statistics on Refrigerated Storage Facilities

- 8.2 Import-Export Trade Data of Frozen Food Products

- 8.3 Regulatory Framework on Food Transport & Storage

- 8.4 Food & Beverage Sector Indicators