|

市场调查报告书

商品编码

1910947

义大利低温运输物流:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Italy Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

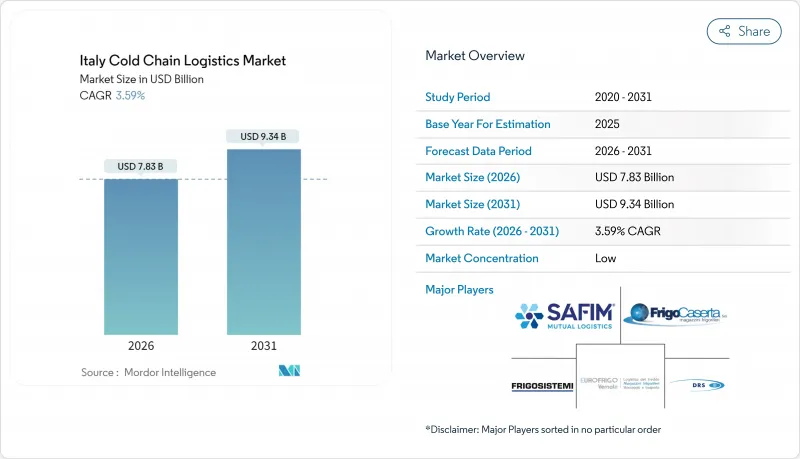

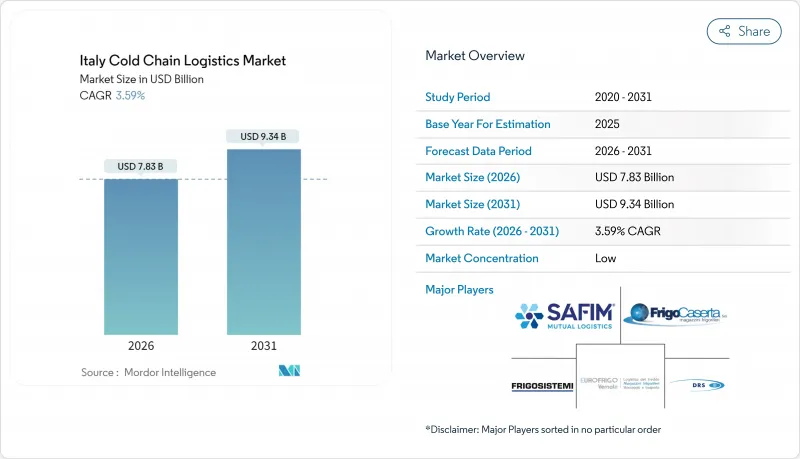

预计到 2026 年,义大利低温运输物流市场规模将达到 78.3 亿美元,高于 2025 年的 75.6 亿美元,预计到 2031 年将达到 93.4 亿美元,2026 年至 2031 年的复合年增长率为 3.59%。

随着市场日趋成熟,预计成长将趋于平稳而非指数级,但向生命科学分销、电商食品配送和碳中和运营的结构性转变将维持投资势头。盈利取决于能否透过可再生能源缓解能源价格上涨,以及能否透过采用自动化技术弥补劳动力短缺。随着国际供应商透过收购加强在义大利的市场份额,竞争日趋激烈,而本地专家则利用其区域网路争取利润丰厚的合约。技术主导的透明度已成为一项必要条件,即时物联网监控和人工智慧驱动的路线优化在义大利低温运输物流市场已变得司空见惯。

义大利低温运输物流市场趋势与洞察

电子商务食品配送

线上生鲜销售的快速普及迫使零售商建立末端配送冷藏能力,并推动了对可靠温控技术的高端需求。义大利邮政和DHL计画在2024年部署1万个宅配柜,其中许多旨在将生鲜食品保持在摄氏5度或以下,直至客户取走。包裹柜缩短了货物停留时间,降低了投递失败率,从而促进了网路的进一步密集化。 MD和Everli等零售商正在整合当日送达服务,并辅以低温运输保障。物流业者正透过附加价值服务获利,特别是预分拣和集中式微型枢纽转运点的建设。都市区交通壅塞限制有利于电动冷藏车的发展,并推动车队更新换代,转向零排放车型。

简便食品需求

生活方式的改变推动了家庭已调理食品和冷冻零食消费的成长,这需要端到端的冷藏管理。 2024年,生鲜和冷冻产品的促销活动占食品杂货销售额的24.3%。德迅集团义大利分公司收购了Muller Fresh Food Logistics,以确保在旺季的运力。零售商Esselunga在2024年投资2.52亿美元升级其物流设施,以在促销期间维持服务水准。便利商店业态的扩张导致订单规模分散,加剧了配送密度的挑战。交叉转运自动化可以在几分钟内完成混合温度托盘的分拣,从而延长保质期并减少拣货错误。

能源和燃料价格高涨且波动剧烈

预计2025年,企业平均电费将上涨24%,天然气价格将上涨27%,冷冻设备将成为成本重点。拥有24小时运作的运作冷冻库的业者受到的影响尤其严重,固定价格合约的利润率因此承压。一些业者正透过对冲期货或安装屋顶太阳能板来应对,这些板可满足15%至25%的负载需求;其他业者则在试用氢燃料电池冷库,但资本投入仍居高不下。价格的不确定性阻碍了中小型运输业者的车队更新计划,引发了人们对高峰时段运力短缺的担忧。

细分市场分析

截至2025年,冷藏仓库将占义大利低温运输物流市场50.55%的份额,凸显了现有企业面临的资本障碍。营运商正在米兰和罗马附近扩建仓库,以满足食品和药品托运人的整合需求。成长趋势有利于整合交叉转运区、拣货指示灯模组和医药级无尘室的多温控设施。套件组装、贴标和GDP文件等附加价值服务正以3.78%的复合年增长率成长,超过了基础运输业务的成长速度。随着欧盟GDP修正案于2025年生效,审核力度加大,更多业者正在利用其监管的专业知识获利。预计冷藏运输量将保持稳定,而脱碳法规要求低排放区内的车队必须更新为电动货车。由于铁路轨道升级改造,铁路运输在2025年之前将受到影响,部分货物将转向公路运输,这将暂时提高卡车运输的盈利,但也会加剧二氧化碳排放排放。海空联运解决方案正在满足小众的医药市场需求,这种需求需要时间控制和温度控制的运输方式,排放完全空运少。

一波併购浪潮预示着产业整合的到来:Lineage 物流正在收购区域性仓储连锁企业,而MARR则在Lazio和普利亚大区建设新的仓储平台,以服务酒店餐饮业走廊。随着投资人寻求稳定的租金回报,房地产投资信託基金(REITs)也纷纷进军冷藏仓库市场。自动化投资持续成长,包括托盘穿梭车、自动化立体仓库(AS/RS)起重机以及用于能源建模的数位双胞胎。将人工智慧(AI)应用于库存规划的供应商,透过减少废弃物和确保5-7%的额外可用空间,在电费上涨的情况下仍能维持利润率。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电商在温控食品领域的成长

- 对新鲜和冷冻简便食品的需求不断增长

- 扩大生物製药低温运输(疫苗和生物製药)

- 出口导引型园艺及水产品产量

- 线上药局和直接送药上门服务的激增

- 推出碳中和冷冻解决方案

- 市场限制

- 能源和燃料价格波动

- 合格司机和仓库工人短缺

- 复杂的欧盟/义大利食品安全标准和GDP合规性

- 都市区缺乏用于微型仓配的冷藏中心

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 排放标准和欧盟绿色交易目标的影响

- 新冠疫情与地缘政治事件的影响

第五章 市场规模与成长预测

- 按服务类型

- 冷藏保管

- 公共仓库

- 私人仓库

- 冷藏运输

- 道路运输

- 铁路

- 海上运输

- 航空邮件

- 附加价值服务

- 冷藏保管

- 按温度类型

- 冷藏(0-5°C)

- 冷冻(-18 至 0°C)

- 环境的

- 超低温冷冻(低于-20°C)

- 透过使用

- 水果和蔬菜

- 肉类/家禽

- 鱼贝类

- 乳製品和冷冻甜点

- 麵包糖果甜点

- 蒸馏食品

- 药品和生技药品

- 疫苗和临床试验用品

- 化学品/特殊材料

- 其他生鲜产品

- 义大利各地区

- 义大利北部

- 义大利中部

- 义大利南部

- 岛屿(西西里岛和撒丁岛)

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Safim Logistics

- Frigocaserta Srl

- Eurofrigo Vernate Srl

- Frigoscandia SpA

- DRS Depositi Regionali Surgelati Srl

- Frigogel Srl

- Soluzioni Logistiche Freddo Srl

- Sodele Magazzini Generali Frigoriferi Srl

- Horigel Srl

- Fridocks General Warehouses & Frigoriferi Srl

- Lineage Logistics

- Mazzocco Srl

- Stef Italia

- DHL Supply Chain

- Kuehne+Nagel CoolCare Ital

- DSV

- CEVA Logistics

- Gruppo Marconi Logistica Integrata

- Trans Isole Srl

- Linofrigo Trasporti Srl

第七章 市场机会与未来展望

Italy Cold Chain Logistics Market size in 2026 is estimated at USD 7.83 billion, growing from 2025 value of USD 7.56 billion with 2031 projections showing USD 9.34 billion, growing at 3.59% CAGR over 2026-2031.

Maturation creates steady rather than spectacular gains, yet structural shifts toward life-science distribution, e-commerce grocery fulfillment, and carbon-neutral operations sustain investment momentum. Profitability hinges on the ability to blunt energy inflation through renewable power and to deploy automation that counters labor shortages. Competitive intensity is rising as international providers deepen Italian footprints through acquisitions, while domestic specialists leverage local relationships to retain high-margin contracts. Technology-led transparency has become table stakes, with real-time IoT monitoring and AI-guided routing now common across the Italy cold chain logistics market.

Italy Cold Chain Logistics Market Trends and Insights

E-commerce Grocery Fulfillment

Rapid penetration of online grocery has pushed retailers to build last-mile refrigerated capacity, raising premium demand for reliable temperature integrity. Poste Italiane and DHL rolled out 10,000 parcel lockers in 2024, many equipped to keep fresh food below 5 °C until customer pickup. Lockers shorten dwell times and cut failed-delivery costs, encouraging further network densification. Retailers such as MD and Everli integrate same-day delivery promises tied to cold chain guarantees. Logistics providers monetize value-added services, notably pre-sorting and consolidated micro-hub staging. Urban congestion rules now favor electric refrigerated vans, nudging fleet renewal toward zero-emission models.

Convenience Food Demand

Changing lifestyles have lifted household spending on ready-to-eat meals and frozen snacks, which depend on end-to-end cold integrity. Promotional activity in grocery reached 24.3% of sales in 2024, with fresh and frozen ranges leading the uplift. DACHSER's Italian unit scaled throughput by acquiring Muller Fresh Food Logistics, ensuring peak-season capacity. Retailer Esselunga allocated USD 252 million for logistics upgrades in 2024 to keep service levels high during promotional cycles. As convenience formats broaden, order sizes fragment, intensifying drop density challenges. Automation at cross-docks now sorts mixed-temperature pallets in minutes, extending shelf life while trimming picking errors.

High Energy & Fuel Price Volatility

Average business electricity bills climbed 24% and gas 27% in 2025, making refrigeration a cost flashpoint. Operators with 24/7 blast freezers suffer amplified exposure, eroding margins on fixed-price contracts. Some mitigate by hedging futures and installing rooftop photovoltaics that cover 15-25% of load. Others pilot hydrogen-ready chillers, although capex remains high. Price uncertainty stalls smaller carriers' fleet-renewal plans, potentially tightening capacity during peak seasons.

Other drivers and restraints analyzed in the detailed report include:

- Biopharma Cold Chain Expansion

- Horticulture & Seafood Exports

- Driver & Warehouse Labor Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage represented 50.55% of the Italy cold chain logistics market size in 2025, underscoring the capital barrier that shelters incumbents. Operators enlarge capacity near Milan and Rome to exploit consolidation demand from grocery and pharma shippers. Growth favors multi-temperature campuses integrating cross-dock zones, pick-to-light modules, and pharma-grade clean rooms. Value-added services, including kitting, labeling, and GDP documentation, are advancing at a 3.78% CAGR, outpacing basic transport. Providers monetize regulatory expertise as audits tighten under EU GDP updates effective 2025. Refrigerated transportation keeps stable volume, yet decarbonization rules mandate fleet turnover toward electric vans inside low-emission zones. Rail disruptions caused by line upgrades through 2025 redirect some freight to road, temporarily boosting trucking yields while elevating CO2 intensity. Sea-air multimodal solutions capture niche pharma demand seeking time-temperature integrity with lower emissions than full airfreight.

A wave of mergers signals consolidation. Lineage Logistics absorbed local warehouse chains, while MARR builds new platforms in Lazio and Puglia to serve hospitality corridors. Investors chase steady rent yields, prompting REIT entry into cold storage. Automation spend rises, covering pallet shuttles, AS/RS cranes, and digital twins for energy modeling. Providers embedding AI in inventory planning lower spoilage and free up 5-7% more usable space, defending margins despite rising electricity tariffs.

The Italy Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, Bakery & Confectionery, and More), and Geography (Italy). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Safim Logistics

- Frigocaserta Srl

- Eurofrigo Vernate Srl

- Frigoscandia SpA

- DRS Depositi Regionali Surgelati Srl

- Frigogel Srl

- Soluzioni Logistiche Freddo Srl

- Sodele Magazzini Generali Frigoriferi Srl

- Horigel Srl

- Fridocks General Warehouses & Frigoriferi Srl

- Lineage Logistics

- Mazzocco Srl

- Stef Italia

- DHL Supply Chain

- Kuehne + Nagel CoolCare Ital

- DSV

- CEVA Logistics

- Gruppo Marconi Logistica Integrata

- Trans Isole S.r.l.

- Linofrigo Trasporti Srl

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce growth in temperature-sensitive grocery

- 4.2.2 Rising demand for fresh and frozen convenience foods

- 4.2.3 Expansion of biopharma cold chain (vaccines & biologics)

- 4.2.4 Export-oriented horticulture and seafood volumes

- 4.2.5 Online pharmacy and direct-to-patient delivery surge

- 4.2.6 Adoption of carbon-neutral refrigeration solutions

- 4.3 Market Restraints

- 4.3.1 High energy and fuel price volatility

- 4.3.2 Shortage of qualified drivers and warehouse labour

- 4.3.3 Complex EU/Italian food-safety and GDP compliance

- 4.3.4 Scarcity of urban micro-fulfilment cold hubs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Emission Standards & EU Green Deal Targets

- 4.9 Impact of COVID-19 and Geo-Political Events

5 Market Size & Growth Forecasts

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5°C)

- 5.2.2 Frozen (-18-0°C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20°C)

- 5.3 By Application

- 5.3.1 Fruits & Vegetables

- 5.3.2 Meat & Poultry

- 5.3.3 Fish & Seafood

- 5.3.4 Dairy & Frozen Desserts

- 5.3.5 Bakery & Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals & Biologics

- 5.3.8 Vaccines & Clinical Trial Materials

- 5.3.9 Chemicals & Specialty Materials

- 5.3.10 Other Perishables

- 5.4 By Italian Region (Value)

- 5.4.1 Northern Italy

- 5.4.2 Central Italy

- 5.4.3 Southern Italy

- 5.4.4 Islands (Sicily & Sardinia)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Safim Logistics

- 6.4.2 Frigocaserta Srl

- 6.4.3 Eurofrigo Vernate Srl

- 6.4.4 Frigoscandia SpA

- 6.4.5 DRS Depositi Regionali Surgelati Srl

- 6.4.6 Frigogel Srl

- 6.4.7 Soluzioni Logistiche Freddo Srl

- 6.4.8 Sodele Magazzini Generali Frigoriferi Srl

- 6.4.9 Horigel Srl

- 6.4.10 Fridocks General Warehouses & Frigoriferi Srl

- 6.4.11 Lineage Logistics

- 6.4.12 Mazzocco Srl

- 6.4.13 Stef Italia

- 6.4.14 DHL Supply Chain

- 6.4.15 Kuehne + Nagel CoolCare Ital

- 6.4.16 DSV

- 6.4.17 CEVA Logistics

- 6.4.18 Gruppo Marconi Logistica Integrata

- 6.4.19 Trans Isole S.r.l.

- 6.4.20 Linofrigo Trasporti Srl

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment