|

市场调查报告书

商品编码

1906987

印度纸包装市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)India Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

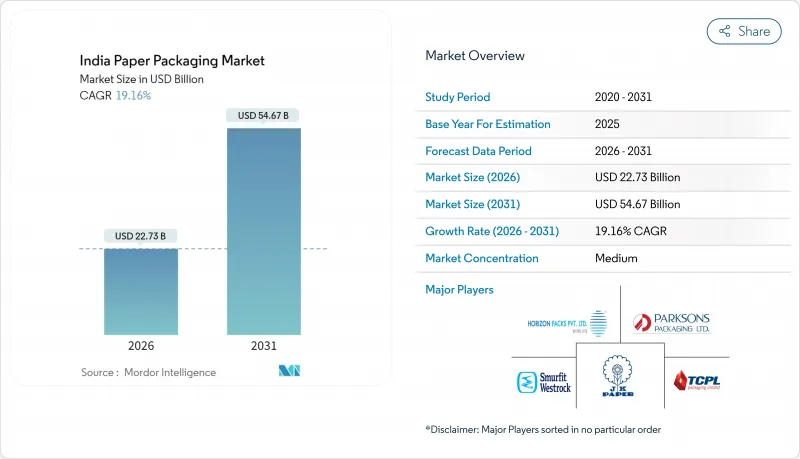

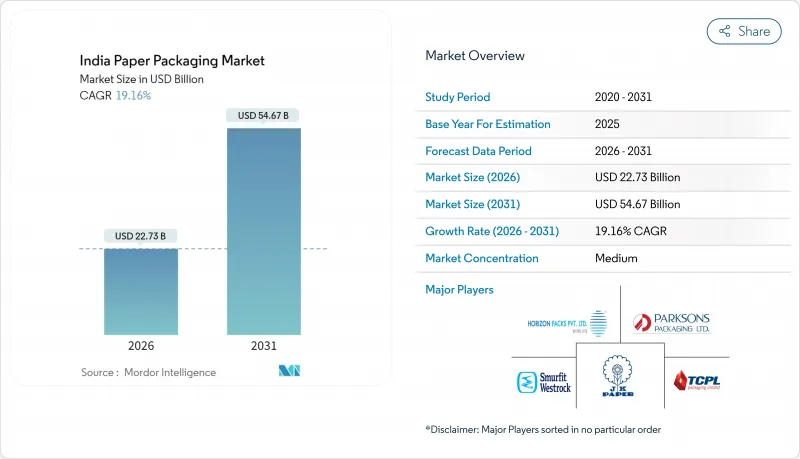

印度纸包装市场规模预计到 2026 年将达到 227.3 亿美元,高于 2025 年的 190.7 亿美元。

预计到 2031 年,该产业规模将达到 546.7 亿美元,2026 年至 2031 年的复合年增长率为 19.16%。

电子商务的蓬勃发展、塑胶使用限制以及快速消费品(FMCG)需求的不断增长,正推动着轻质、可回收基材在初级和二级包装领域的需求。印度所有28个邦/州对某些一次性塑胶的监管禁令加速了替代进程,同时,品牌所有者正投资于优质阻隔涂层纸板,以履行其永续性并满足消费者期望。数位印刷技术在标籤生产线上的渗透率已达18%,支援灵活生产、生产线末端客製化以及防伪。儘管市场成长,但牛皮纸价格波动带来的原材料风险以及来自具有成本竞争力的免税东盟进口产品的压力正在挤压利润空间,迫使国内造纸厂扩大规模、后向整合并保障再生纤维原料的供应。总体而言,印度纸包装市场的参与企业正在投资涂层、模塑纤维和智慧标籤技术,以增强产品完整性并获得价值链上的高价值应用。

印度纸包装市场趋势与洞察

电子商务物流需求加速成长

预计到2024年,印度线上订单量将达52亿件,高于上年的38亿件。这将推动对瓦楞纸箱的需求,并促使企业采用更轻、更坚固的瓦楞纸箱。各大电商平台已部署自动化包装线,以规范纸箱尺寸并减少空隙。快消业者则倾向于使用专为微型仓配中心设计的紧凑型纸箱。都市区的数位支付普及率已达87%,这使得货到付款的包装插页得以取消,并减少了材料消耗。订阅制电商模式提供了可预测的需求,使加工商能够获得专用生产线并签订原材料合同,从而稳定生产量。

快速消费品及包装食品销售成长

预计到2024年,包装食品产业将成长8.2%,这主要得益于全国12%的零售渗透率和大都会圈35%的零售渗透率。雀巢印度公司正投资260亿卢比(约29.28亿美元)扩大产能,显示其对消费持续成长充满信心。农村收入支持措施刺激了对小包装品牌产品的需求,从而促进了涂布纸板包装的发展。乳製品分销通路12%的年增长率主要由用于低温运输物流的保温瓦楞纸包装推动。这些变化正在加强食品巨头与包装供应商之间的多年期合同,稳定订单量,而订单量对印度纸包装市场至关重要。

牛皮纸原物料价格波动

受海运运费上涨和能源成本波动的影响,2024年牛皮纸现货价格波动幅度预计在15%至20%之间。这挤压了缺乏避险能力的中小型瓦楞纸生产商的利润空间。拥有自有纸浆厂的造纸企业则将影响降至最低,凸显了产业整合的价值。价格的不确定性正在减缓产能扩张,因为投资回报模式变得更加灵活,也阻碍了企业与期望成本曲线稳定的品牌所有者签订长期合约。

细分市场分析

预计到2025年,瓦楞纸板将维持其在印度纸包装市场53.65%的份额,这主要得益于电子商务对耐用性的要求以及工业承重需求。同时,预计到2031年,涂布纸的复合年增长率将达到20.95%,这主要受高端日常消费品(FMCG)和医药应用领域对防潮防油性能的需求不断增长的推动。印度纸板包装市场预计将从2025年的59亿美元成长到2031年的184.7亿美元。政府采购优先考虑可再生基材,尤其是在公共食品分销管道,这也促进了涂布纸需求的成长。反映这些结构性利多因素的投资包括ITC投资80亿印度卢比(约9.011亿美元)建设的阻隔涂布生产线。

先进的多层牛皮纸创新技术在减轻水泥袋重量的同时,保持了其抗破强度,从而帮助水泥袋从聚丙烯编织袋手中夺取市场份额。再生纤维含量的增加,以及FSC认证的广泛应用,正帮助品牌达成范围3碳减量目标。材料多样化使造纸厂免受牛皮纸价格波动的影响,并扩大了印度特种纸包装市场。

到2025年,软包装将占印度纸质包装市场53.74%的份额,主要得益于专为零食、糖果甜点和个人保健产品优化的包装袋、小袋和包装纸。由于阻隔涂层技术的应用,无塑胶复合材料得以普及,预计该细分市场将实现21.55%的复合年增长率。数位捲筒印刷机能够根据细分市场的偏好定製图形,从而推动销售成长。同时,随着全通路品牌协调商店和店内配送的设计,硬式折迭纸盒和瓦楞纸箱的市场份额也不断扩大。

由于微瓦楞纸板和胶印覆膜等创新技术的出现,硬质包装在化妆品和电子产品产业的渗透率不断提高。这些技术可减少8-10%的纤维用量,同时提升印刷精度。专为药品序列化设计的纸板生产线增加了防篡改功能,这对于符合监管要求至关重要,从而加速了硬包装的普及。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务物流需求加速履约

- 快速消费品(FMCG)和包装食品销售成长

- 政府禁止使用某些一次性塑胶製品

- 品牌拥有者转而使用优质轻质纸板

- 数位印刷和客製印刷的快速普及

- 供应链可追溯性与智慧标籤应用

- 市场限制

- 牛皮纸原料价格波动

- 东协免税进口商品对利润率带来压力

- 印度再生纤维的结构性短缺

- 国内瓦楞纸包装製造设施产能过剩及市场细分

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

- 价格分析——瓦楞纸箱和折迭纸箱

- 印度造纸业统计数据

- 目前纸张和纸板生产能力

- 生产量、销售量和运转率

- 书写纸和印刷纸的分解

- 纸板和包装纸的分解

- 特种纸和MG纸概述

第五章 市场规模与成长预测

- 依材料类型

- 牛皮纸

- 纸板

- 纸板

- 其他材料类型

- 依产品类型

- 软纸包装

- 小袋和包装袋

- 包装膜和薄膜

- 其他软纸包装

- 硬纸包装

- 折迭纸箱

- 瓦楞纸箱

- 其他硬纸包装

- 软纸包装

- 按包装类型

- 初级包装

- 二级包装

- 三级/运输包装

- 按最终用途行业划分

- 食物

- 饮料

- 医疗和药品

- 个人护理和化妆品

- 工业/电子设备

- 其他终端用户产业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Smurfit WestRock

- ITC Ltd.-Paperboards and Specialty Papers Div.

- JK Paper Ltd.

- Parksons Packaging Ltd.

- TCPL Packaging Ltd.

- Horizon Packs Pvt. Ltd.

- Oji Holdings Corp.(Oji India Packaging Pvt. Ltd.)

- Astron Paper and Board Mill Ltd.

- Kapco Packaging Ltd.

- Chaitanya Packaging Pvt. Ltd.

- Trident Paper Box Industries Pvt. Ltd.

- TGI Packaging Pvt. Ltd.

- Packman Packaging Pvt. Ltd.

- Emami Paper Mills Ltd.

- Andhra Paper Ltd.

- Pakka Ltd.

- PR Packagings Ltd.

- Total Pack Ltd.

第七章 市场机会与未来展望

India paper packaging market size in 2026 is estimated at USD 22.73 billion, growing from 2025 value of USD 19.07 billion with 2031 projections showing USD 54.67 billion, growing at 19.16% CAGR over 2026-2031.

Expansive e-commerce operations, plastic-use restrictions, and rising fast-moving consumer goods (FMCG) volumes combine to lift demand for lightweight, recyclable substrates across primary and secondary formats. Regulatory bans on selected single-use plastics in all 28 states accelerate substitution, while brand owners invest in premium barrier-coated paperboard to meet sustainability pledges and consumer expectations. Digital printing adoption, already at 18% penetration in label lines, supports agile production, late-stage customization, and counterfeit deterrence. Amid growth, raw-material exposure to kraft-paper price swings and cost-competitive zero-duty ASEAN imports pressure margins, prompting domestic mills to scale, backward-integrate, and secure recovered-fiber feedstock. Overall, India paper packaging market participants deploy capital toward coating, molded-fiber, and smart-label technologies that strengthen product stewardship credentials and capture higher-value applications along the supply chain.

India Paper Packaging Market Trends and Insights

Accelerating E-commerce Fulfillment Demand

India processed 5.2 billion online shipments in 2024 compared with 3.8 billion a year earlier, boosting corrugated-box volumes and encouraging adoption of lightweight high-strength grades. Large platforms added automated packing lines that standardize dimensions and reduce empty space. Quick-commerce operators favor compact corrugated formats designed for micro-fulfillment centers. Digital payment penetration reached 87% in urban areas, allowing removal of cash-on-delivery inserts and lowering material usage. Subscription-commerce models provide predictable demand, enabling converters to dedicate lines and secure raw-material contracts, thereby stabilizing throughput.

FMCG and Packaged-Food Volume Expansion

The packaged-food sector grew 8.2% in 2024, supported by organized retail penetration of 12% nationally and 35% in metros. Nestle India allocated INR 2,600 crore (USD 29.28 crore ) for capacity upgrades, underscoring confidence in sustained consumption growth. Rural-income support schemes stimulated demand for branded goods sold in small pack sizes that favor coated paperboard. Growth in the organized dairy channel at 12% annually requires insulated corrugated containers for cold-chain logistics. These shifts reinforce multiyear contracting between food majors and packaging suppliers, anchoring baseline order volumes for the India paper packaging market.

Kraft-paper input-price volatility

Spot kraft prices fluctuated 15-20% in 2024 due to ocean-freight spikes and energy-cost swings, eroding SME corrugator margins that lack hedging capacity. Mills with captive pulping muted exposure, underscoring integration's value. Price uncertainty delays capacity upgrades as payback models become fluid, and it hampers long-term contracts with brand owners expecting stable cost curves.

Other drivers and restraints analyzed in the detailed report include:

- Government Ban on Select Single-Use Plastics

- Rapid Adoption of Digital and On-Demand Printing

- Zero-duty ASEAN imports squeezing margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corrugated board maintained 53.65% India paper packaging market share in 2025, driven by e-commerce durability requirements and industrial stacking needs. Yet coated paperboard registers a 20.95% CAGR to 2031, propelled by premium FMCG and pharmaceutical applications that demand moisture and grease barriers. India paper packaging market size for paperboard is projected to reach USD 18.47 billion by 2031, up from USD 5.9 billion in 2025. Coated variants also leverage government procurement favoring recyclable substrates, particularly in public food-distribution channels. Investments such as ITC's INR 800 crore (USD 9.011 crore) barrier-coating line reflect this structural tailwind.

Advanced multiwall kraft innovations cut weight in cement sacks without sacrificing burst strength, winning share from woven polypropylene. Recovered-fiber content rises alongside FSC certification uptake, helping brands achieve Scope-3 carbon reductions. Material diversification cushions mills against kraft price cycles and broadens the India paper packaging market addressable for specialized grades.

Flexible structures secured 53.74% India paper packaging market share during 2025 thanks to pouches, sachets, and wraps optimized for snack, confectionery, and personal-care items. The sub-category posts a 21.55% CAGR as barrier coatings allow plastic-free laminates. Digital web presses tune graphics to micro-market preferences, reinforcing volume gains. Meanwhile, rigid folding cartons and corrugated cases expand as omnichannel brands harmonize shelf-ready and ship-in-own-container designs.

Rigid formats benefit from micro-flute and litho-lam innovations that reduce fiber by 8-10% yet elevate print fidelity, deepening penetration in cosmetics and electronics. Cartonboard lines tailored for pharmaceutical serialization add tamper evidence crucial to regulatory compliance, accelerating rigid adoption.

The India Paper Packaging Market Report is Segmented by Material Type (Kraft Paper, Paperboard, Corrugated Board, and More), Product Type (Flexible Paper Packaging, Rigid Paper Packaging), Packaging Format (Primary Packaging, Secondary Packaging, Tertiary/Transit Packaging), End-Use Industry (Food, Beverage, Healthcare and Pharmaceuticals, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Smurfit WestRock

- ITC Ltd. - Paperboards and Specialty Papers Div.

- JK Paper Ltd.

- Parksons Packaging Ltd.

- TCPL Packaging Ltd.

- Horizon Packs Pvt. Ltd.

- Oji Holdings Corp. (Oji India Packaging Pvt. Ltd.)

- Astron Paper and Board Mill Ltd.

- Kapco Packaging Ltd.

- Chaitanya Packaging Pvt. Ltd.

- Trident Paper Box Industries Pvt. Ltd.

- TGI Packaging Pvt. Ltd.

- Packman Packaging Pvt. Ltd.

- Emami Paper Mills Ltd.

- Andhra Paper Ltd.

- Pakka Ltd.

- P.R. Packagings Ltd.

- Total Pack Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating e-commerce fulfilment demand

- 4.2.2 FMCG and packaged-food volume expansion

- 4.2.3 Government ban on select single-use plastics

- 4.2.4 Brand-owner switch to premium, lightweight board

- 4.2.5 Rapid adoption of digital and on-demand printing

- 4.2.6 Supply-chain traceability and smart-label adoption

- 4.3 Market Restraints

- 4.3.1 Kraft-paper input-price volatility

- 4.3.2 Zero-duty ASEAN imports squeezing margins

- 4.3.3 Structural shortage of recovered fibre in India

- 4.3.4 Excess domestic corrugator capacity and fragmentation

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

- 4.9 Pricing Analysis - Corrugated and Folding Carton

- 4.10 India Paper Industry Statistics

- 4.10.1 Current Capacity of Paper and Paperboard

- 4.10.2 Production, Sales and Utilisation Rates

- 4.10.3 Writing and Printing Paper Breakdown

- 4.10.4 Paperboard and Packaging Paper Breakdown

- 4.10.5 Specialty and MG Paper Overview

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Kraft Paper

- 5.1.2 Paperboard

- 5.1.3 Corrugated Board

- 5.1.4 Other Material Types

- 5.2 By Product Type

- 5.2.1 Flexible Paper Packaging

- 5.2.1.1 Pouches and Bags

- 5.2.1.2 Wraps and Films

- 5.2.1.3 Other Flexible Paper Packaging

- 5.2.2 Rigid Paper Packaging

- 5.2.2.1 Folding Carton

- 5.2.2.2 Corrugated Boxes

- 5.2.2.3 Other Rigid Paper Packaging

- 5.2.1 Flexible Paper Packaging

- 5.3 By Packaging Format

- 5.3.1 Primary Packaging

- 5.3.2 Secondary Packaging

- 5.3.3 Tertiary / Transit Packaging

- 5.4 By End-Use Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Healthcare and Pharmaceuticals

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Industrial and Electronic

- 5.4.6 Other End-Use Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Smurfit WestRock

- 6.4.2 ITC Ltd. - Paperboards and Specialty Papers Div.

- 6.4.3 JK Paper Ltd.

- 6.4.4 Parksons Packaging Ltd.

- 6.4.5 TCPL Packaging Ltd.

- 6.4.6 Horizon Packs Pvt. Ltd.

- 6.4.7 Oji Holdings Corp. (Oji India Packaging Pvt. Ltd.)

- 6.4.8 Astron Paper and Board Mill Ltd.

- 6.4.9 Kapco Packaging Ltd.

- 6.4.10 Chaitanya Packaging Pvt. Ltd.

- 6.4.11 Trident Paper Box Industries Pvt. Ltd.

- 6.4.12 TGI Packaging Pvt. Ltd.

- 6.4.13 Packman Packaging Pvt. Ltd.

- 6.4.14 Emami Paper Mills Ltd.

- 6.4.15 Andhra Paper Ltd.

- 6.4.16 Pakka Ltd.

- 6.4.17 P.R. Packagings Ltd.

- 6.4.18 Total Pack Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment