|

市场调查报告书

商品编码

1910858

IT人员配备:市场占有率分析、产业趋势与统计资料、成长预测(2026-2031年)IT Staffing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

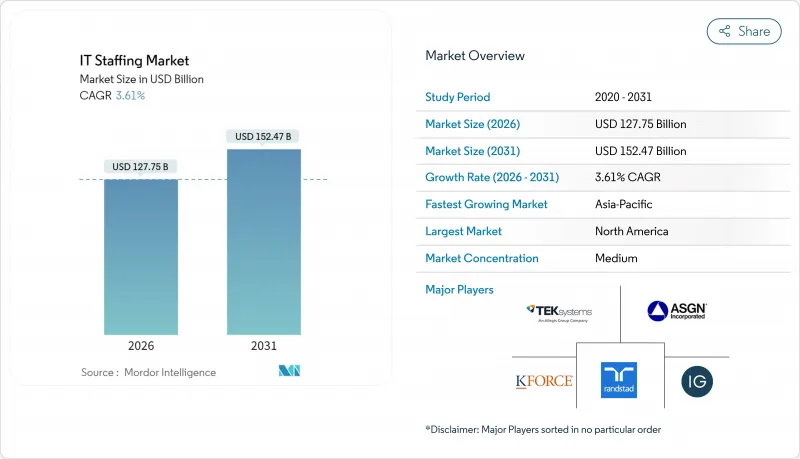

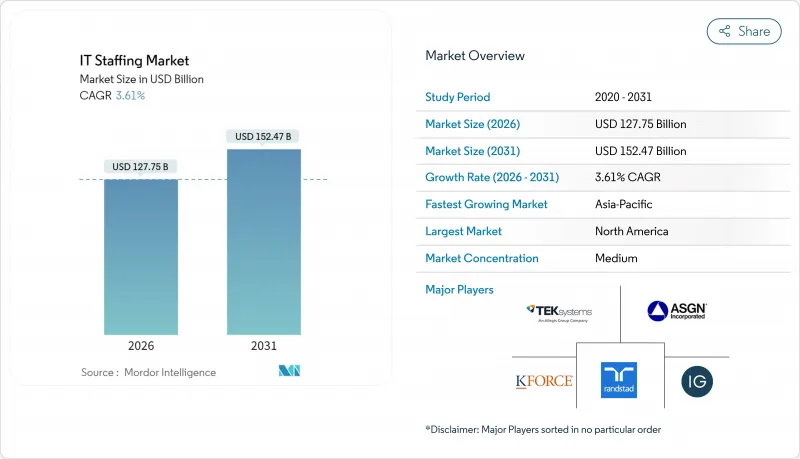

IT 人员配备市场预计将从 2025 年的 1,233 亿美元成长到 2026 年的 1,277.5 亿美元,预计到 2031 年将达到 1,524.7 亿美元,2026 年至 2031 年的复合年增长率为 3.61%。

这种稳定扩张反映出企业正在调整人才策略,从大规模招募转向专业技能获取,而云端运算、人工智慧和网路安全领域的支出重点进一步强化了这一转变。儘管临时工和合约工仍然占据主导地位,但成长正转向工作说明书(SOW)模式,将交货风险转移给服务提供者。对生成式人工智慧工程、边缘运算和网路弹性的需求正在重塑招聘要求,而持续的全球技能短缺则推高了工资水平。同时,全球2000强企业供应商整合的加剧正在挤压託管服务供应商的利润空间,同时又增加了他们在现有客户中的业务份额。

全球IT人才市场趋势与洞察

加快以人工智慧、云端运算和物联网为中心的数位转型计划的实施。

在全球科技职位招募中,需要人工智慧或机器学习技能的比例年增了9%至14%。云端迁移需要专业的DevOps工程师和安全架构师,而预计到2030年将达到1,395.8亿美元的边缘运算投资,则需要能够整合基础设施和物联网技术的人才。 NTT DATA计画培训20万名员工掌握生成式人工智慧技术,进一步显示了目前技能提升工作的规模。连接人工智慧演算法、云端资源和设备网路的跨学科企划团队正在推动IT人才市场的持续扩张。

不断扩展的远距和混合办公模式需要分散的员工。

戴尔科技公司65%的员工拥有正式的弹性工作安排,显示基于地理的招募模式将成为常态。虽然雇主可以接触到更广泛的人才库,但他们也必须应对跨国合规问题以及日益增长的薪资平等期望。根据万宝盛华集团发布的《2025年展望》,41%的公司计划增加员工,其中技术岗位的需求最为旺盛。竞标竞标正在全球蔓延,推高了薪资水平,并迫使招聘机构在薪资之外加强人才保留激励措施。

小众技术领域持续存在全球技能短缺

预计到2034年,数位技能短缺问题将对全球经济造成损失,凸显了量子技术、先进人工智慧和零信任安全等领域专业人才供应的结构性瓶颈。大学在课程更新方面进展缓慢,导致应届毕业生进入这些专业领域需要数年时间。人才短缺推高了薪资水平,延长了计划週期,迫使企业投入大量资金进行倡议再培训,从而削弱了短期投资收益率。

细分市场分析

到2025年,软体开发人员将占IT人才市场的37.05%,反映出应用现代化计划的持续推进。生成式人工智慧工程师预计到2031年将以11.75%的复合年增长率成长,显示市场对大型语言模型(LLM)的快速设计、模型审核和微调的需求日益增长。随着边缘云端管道的扩展,数据和人工智慧工程领域的IT人才市场规模预计将呈指数级增长。薪资水准表明,企业在提供混合人工智慧开发的专业知识时可以收取较高的溢价。

传统测试和品质保证人员的角色正面临自动化带来的挑战,许多专业人士正在转向使用人工智慧驱动的检验工具。系统分析师正在提升整合架构方面的技能,而网路专家则在提升人工智慧驱动的威胁监控方面的技能。新兴技能(量子开发、区块链架构、物联网设备安全)正成为IT人才市场中一个规模虽小但成长迅速的细分领域。

到2025年,银行、金融和保险(BFSI)产业仍将是最大的招募垂直产业,市占率达24.15%,这主要得益于开放银行计画和金融科技平台的升级。医疗保健产业预计将成为成长最快的垂直产业,复合年增长率(CAGR)将达到10.25%,这主要得益于电子健康记录的现代化和人工智慧辅助诊断技术的应用。远端医疗和病患资料互通性标准的采用预计将进一步扩大医疗保健计划IT人才的市场规模。

在製造业领域,智慧工厂部署是重中之重,需要物联网和预测性维护的人才。零售和电子商务持续建立全通路解决方案,而公共部门机构则为网路安全数位化公民服务拨出预算。能源、汽车和智慧城市计画属于「其他产业」类别,每个产业都需要专业技能,并为IT人才市场提供多元化的人才储备。

区域分析

北美地区预计到2025年将维持44.05%的市场份额,这得益于其先进的技术生态系统、大规模的数位化预算和严格的安全要求。签证政策的持续变化和工资的上涨导致人才短缺,进而促使更多业务转移到加拿大和拉丁美洲。美国主要依靠硅谷的软体计划和华尔街的云端运算革命,而加拿大则在多伦多和蒙特娄等地提供成本优势。

亚太地区将以8.15%的复合年增长率实现最快增长,主要得益于印度IT服务的扩张、日本的技能提升计划以及新加坡吸引区域总部入驻。随着跨国公司采购管道多元化,预计到2024年,该地区年度管理服务合约价值将成长32%。中国的平台復苏和韩国的半导体研发进一步推动了对专业人才的需求。

在欧洲,德国和英国的需求持续稳定,而东欧国家正从单纯的成本优势转型为专业技术中心。 GDPR合规性使得网路安全需求居高不下。中东和非洲的需求虽然落后,但也呈现稳定成长态势,其中沙乌地阿拉伯的智慧城市计划和南非的英语服务中心是显着的需求来源。经汇率调整后,这些市场之间的薪资差异正在影响全球IT人才市场中供应商的利润率策略。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 市场驱动因素

- 加快以人工智慧、云端运算和物联网为中心的数位转型计划的实施。

- 不断扩展的远距和混合办公模式需要分散的员工。

- 强制性网路保险导致对网路安全人才的需求激增。

- 疫情后数位转型预算的復原将推动对更多人才的需求。

- 生成式人工智慧监理角色(提示工程师、模型审核)的出现

- 全球2000强企业间的供应商整合推动了MSP主导的大宗交易

- 市场限制

- 小众技术领域持续存在全球技能短缺

- 薪资上涨给託管服务提供者的计费利润率带来压力

- 基于人工智慧的自助招聘平台将淘汰招聘机构。

- 加强数据主权法律将限制跨境人员流动

- 价值链分析

- 监管环境

- 技术展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业生态系分析

- 主要用例和案例研究

- 宏观经济趋势评估

- 投资分析

第五章 市场区隔

- 按技能集

- 软体开发者

- 测试人员和品质保证工程师

- 系统分析师/业务分析师

- 技术支援专业人员

- 网路与安全专业人员

- 数据与人工智慧工程师

- 其他技能

- 按最终用户行业划分

- 沟通

- 银行、金融服务和保险(BFSI)

- 医疗保健和生命科学

- 製造业

- 零售与电子商务

- 政府和公共部门

- 其他行业

- 按服务类型

- 临时工/合约工

- 全职工作

- 工作说明书(SOW)/企划为基础

- 託管服务供应商(MSP)/外包人员

- 按公司规模

- 大公司

- 小型企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 新加坡

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- TEKsystems Inc.(Allegis Group Holdings Inc.)

- ASGN Incorporated

- Insight Global LLC

- Randstad NV

- Kforce Inc.

- Artech Information Systems LLC

- Consulting Solutions International Inc.

- MATRIX Resources Inc.

- NTT DATA Corporation

- Beacon Hill Staffing Group LLC

- Experis IT(ManpowerGroup Global Inc.)

- Akkodis(Adecco Group AG)

- Kelly Services Inc.

- Motion Recruitment Partners LLC

- Robert Half International Inc.

- Genesis10 Inc.

- Collabera LLC

- PERSOL Holdings Co., Ltd.

- Aquent LLC

- CGI Inc.

第七章 市场机会与未来展望

The IT staffing market is expected to grow from USD 123.30 billion in 2025 to USD 127.75 billion in 2026 and is forecast to reach USD 152.47 billion by 2031 at 3.61% CAGR over 2026-2031.

This steady expansion reflects enterprises realigning talent strategies toward specialized skill acquisition rather than volume hiring, a change reinforced by cloud, artificial intelligence, and cybersecurity spending priorities. Temporary and contract engagements remain the dominant hiring mechanism, yet growth is gravitating toward Statement-of-Work models that shift delivery risk to providers. Generative-AI engineering, edge computing, and cyber-resilience needs are reshaping job requisitions, while persistent global skill shortages sustain upward wage pressure. At the same time, vendor consolidation across Global-2000 clients compresses margins for managed service providers but also deepens their wallet share with retained customers.

Global IT Staffing Market Trends and Insights

Accelerated Adoption of AI-, Cloud- and IoT-Centric Digital-Transformation Projects

Fourteen percent of global tech job postings now demand AI or machine-learning skills, up from 9% a year earlier . Cloud migrations call for specialized DevOps engineers and security architects, while edge-computing investments that are projected to reach USD 139.58 billion by 2030 require blended infrastructure-plus-IoT talent. NTT DATA's program to train 200,000 employees in generative AI further underscores the scale of reskilling underway . Interdisciplinary project teams that connect AI algorithms, cloud resources, and device networks are therefore driving sustained expansion in the IT staffing market.

Expansion of Remote and Hybrid Work Models Requiring Distributed Talent

Sixty-five percent of Dell Technologies personnel use formal flexibility arrangements, signaling lasting normalization of location-agnostic hiring. Employers gain access to broader talent pools, yet must navigate cross-border compliance and rising pay parity expectations. ManpowerGroup's 2025 outlook shows 41% of firms plan to add headcount, with technology roles topping demand charts. Competitive bidding now spans continents, increasing compensation levels and compelling agencies to enhance retention packages that extend beyond salary.

Persistent Global Skill Shortages in Niche Technologies

It is estimates that unresolved digital-skills gaps could cost the global economy by 2034, underscoring structural supply constraints for quantum, advanced AI, and zero-trust security expertise. Universities have not kept curriculum pace, creating multiyear lags before new graduates enter these specializations. The scarcity elevates compensation packages and lengthens project timelines, compelling enterprises to bankroll intensive reskilling initiatives that erode near-term ROI.

Other drivers and restraints analyzed in the detailed report include:

- Surging Demand for Cyber-Resilience Staff Driven by Cyber-Insurance Mandates

- Digital-Transformation Budget Rebound Post-Pandemic Fuels Staff-Augmentation Demand

- Wage Inflation Compressing MSP Bill-Rate Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software developers accounted for 37.05% of IT staffing market share in 2025, reflecting entrenched application modernization projects. Generative-AI engineers are projected to register a 11.75% CAGR through 2031, underscoring growing demand for prompt design, model auditing, and LLM fine-tuning. The IT staffing market size for data and AI engineering is projected to escalate sharply as edge-cloud pipelines scale. Salary corridors signal premium pricing that providers can command when supplying hybrid AI-development expertise.

Traditional testers and QA roles face automation headwinds, pushing many professionals toward AI-enabled verification tools. Systems analysts are pivoting to integration architecture, and network specialists are upskilling in AI-driven threat monitoring. Emerging skills-quantum development, blockchain architecture, and IoT device security-collectively remain a small but rapidly expanding slice of the IT staffing market.

BFSI remained the largest adopter with 24.15% share in 2025, driven by open-banking compliance and fintech platform upgrades. Healthcare emerges as the fastest-growing vertical at 10.25% CAGR, propelled by electronic-health-record modernization and AI-assisted diagnostics. The IT staffing market size for healthcare projects is expected to widen as telemedicine and patient-data interoperability standards take hold.

Manufacturing prioritizes smart-factory deployments requiring IoT and predictive-maintenance talent. Retail and e-commerce continue omnichannel build-outs, while public sector agencies earmark cybersecurity and citizen-service digitization budgets. Energy, automotive, and smart-city programs fill the "Other Industries" category, each demanding bespoke skill combinations and feeding diverse pipelines for the IT staffing market.

IT Staffing Market Report is Segmented by Skill Set (Software Developer, Testers and QA Engineers, Systems Analyst, Technical Support Professionals, Networking and Security Experts, and More), End-User Industry (Telecom, BFSI, and More), Staffing Service Type (Contract Staffing, and More), Enterprise Size (Large Enterprises, and SMEs), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 44.05% share in 2025, supported by deep tech ecosystems, large digital budgets, and rigorous security mandates. Continuous visa policy shifts and wage escalation challenge talent availability, prompting more near-shoring to Canada and Latin America. The United States leads demand due to Silicon Valley software projects and Wall Street cloud overhauls, while Canada provides cost-advantaged hubs in Toronto and Montreal.

Asia-Pacific is the fastest-growing region at an 8.15% CAGR, buoyed by India's IT services scale-up, Japanese reskilling initiatives, and Singapore's regional headquarters attraction. Managed-services annual contract value in the region rose 32% in 2024 as multinationals diversified sourcing. China's platform rebound and Korea's semiconductor R&D add further pull on specialist headcount.

Europe posts stable demand in Germany and the United Kingdom, even as Eastern European destinations evolve from pure cost-arbitrage to niche specialist centers. GDPR compliance maintains high cybersecurity uptake. Middle East and Africa trail but register steady growth; Saudi Arabia's smart-city projects and South Africa's English-language service hubs are notable demand pockets. Currency-adjusted wage differentials across these markets shape provider margin strategies within the global IT staffing market.

- TEKsystems Inc. (Allegis Group Holdings Inc.)

- ASGN Incorporated

- Insight Global LLC

- Randstad N.V.

- Kforce Inc.

- Artech Information Systems LLC

- Consulting Solutions International Inc.

- MATRIX Resources Inc.

- NTT DATA Corporation

- Beacon Hill Staffing Group LLC

- Experis IT (ManpowerGroup Global Inc.)

- Akkodis (Adecco Group AG)

- Kelly Services Inc.

- Motion Recruitment Partners LLC

- Robert Half International Inc.

- Genesis10 Inc.

- Collabera LLC

- PERSOL Holdings Co., Ltd.

- Aquent LLC

- CGI Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated adoption of AI-, Cloud- and IoT-centric digital-transformation projects

- 4.2.2 Expansion of remote and hybrid work models requiring distributed talent

- 4.2.3 Surging demand for cyber-resilience staff driven by cyber-insurance mandates

- 4.2.4 Digital-transformation budget rebound post-pandemic fuels staff-augmentation demand

- 4.2.5 Generative-AI supervision roles (prompt engineers, model auditors) emerge

- 4.2.6 Vendor consolidation among Global-2000 clients boosts MSP-led volume deals

- 4.3 Market Restraints

- 4.3.1 Persistent global skill shortages in niche technologies

- 4.3.2 Wage inflation compressing MSP bill-rate margins

- 4.3.3 AI-based self-service hiring platforms disintermediate agencies

- 4.3.4 Tightening data-sovereignty laws restrict cross-border staff deployment

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porterss Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Skill Set

- 5.1.1 Software Developers

- 5.1.2 Testers and QA Engineers

- 5.1.3 Systems Analysts / Business Analysts

- 5.1.4 Technical Support Professionals

- 5.1.5 Networking and Security Experts

- 5.1.6 Data and AI Engineers

- 5.1.7 Other Skill Sets

- 5.2 By End-User Industry

- 5.2.1 Telecom

- 5.2.2 Banking, Financial Services and Insurance (BFSI)

- 5.2.3 Healthcare and Life Sciences

- 5.2.4 Manufacturing

- 5.2.5 Retail and e-Commerce

- 5.2.6 Government and Public Sector

- 5.2.7 Other Industries

- 5.3 By Staffing Service Type

- 5.3.1 Temporary / Contract Staffing

- 5.3.2 Permanent Placement

- 5.3.3 Statement-of-Work (SOW) / Project-based

- 5.3.4 Managed Service Provider (MSP) / Outsourced Staffing

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TEKsystems Inc. (Allegis Group Holdings Inc.)

- 6.4.2 ASGN Incorporated

- 6.4.3 Insight Global LLC

- 6.4.4 Randstad N.V.

- 6.4.5 Kforce Inc.

- 6.4.6 Artech Information Systems LLC

- 6.4.7 Consulting Solutions International Inc.

- 6.4.8 MATRIX Resources Inc.

- 6.4.9 NTT DATA Corporation

- 6.4.10 Beacon Hill Staffing Group LLC

- 6.4.11 Experis IT (ManpowerGroup Global Inc.)

- 6.4.12 Akkodis (Adecco Group AG)

- 6.4.13 Kelly Services Inc.

- 6.4.14 Motion Recruitment Partners LLC

- 6.4.15 Robert Half International Inc.

- 6.4.16 Genesis10 Inc.

- 6.4.17 Collabera LLC

- 6.4.18 PERSOL Holdings Co., Ltd.

- 6.4.19 Aquent LLC

- 6.4.20 CGI Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment