|

市场调查报告书

商品编码

1910895

德国低温运输物流:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Germany Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

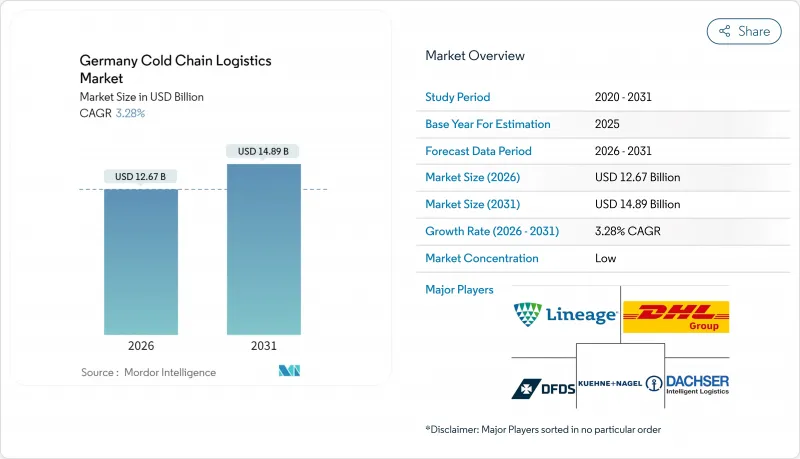

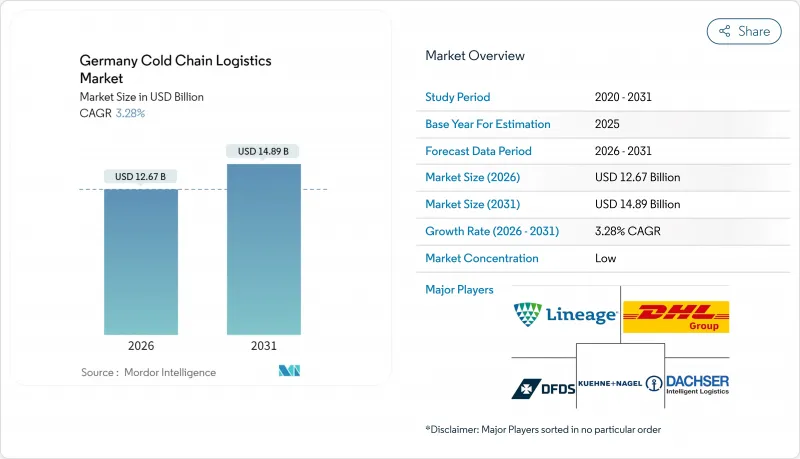

2025年德国低温运输物流市场价值122.7亿美元,预计2031年将达到148.9亿美元,高于2026年的126.7亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.28%。

强劲的电商食品需求、生物製药出口的持续增长势头以及零售商对自动化保鲜管理项目的投资,正支撑着冷链物流市场的近期扩张;而天然製冷剂的维修和电动运输车辆的引入,则提升了长期效率。现有的第三方物流供应商正透过物联网追踪、预测性维护和人工智慧驱动的路线优化等技术,对其网路数位化,以控制不断上涨的能源成本并应对日益严格的环境法规。随着客户寻求端到端的合规解决方案,向超冷库和综合附加价值服务的多元化发展正在扩大利润空间。德国低温运输物流市场持续受益于其位于欧洲贸易路线中心的战略位置,以及政府为支持永续基础设施更新而製定的奖励。

德国低温运输物流市场趋势与洞察

电子商务主导的B2C食品分销扩张

预计到2024年,生鲜食品线上销售额将达到32亿美元,并在2025年进一步成长15-20%。这促使零售商和专业业者建造配备双区自动化系统(2°C和常温)的微型仓配中心,每小时可处理1,000份订单。电动配送车辆,例如Aldi的「Mein Aldi」和Picnic配送中心使用的车辆,可减少排放气体并符合严格的都市区噪音法规。更小的购物车和更短的配送时间正推动成本结构转向更快速、数据驱动的路线规划工具。物流业者正在利用预测分析,根据温度敏感度重新安排配送顺序,从而减少废弃物并缩短最后一公里配送。这些营运效率的提升正在加快德国低温运输物流市场的服务水平,同时扩大其目标消费群。

扩大生物製药和mRNA药物的出口

预计到2024年,德国药品出口额将达到1,058亿欧元(1,167.6亿美元),其中对温度敏感的生技药品成长最为迅速。光是DHL集团就计画在2030年投资20亿欧元(22亿美元),用于建造符合GDP认证的物流中心、配备感测设备以及组成多温区运输车队,以保障生技药品和细胞疗法产品的运输安全。法兰克福和慕尼黑週边的生物技术走廊目前需要对-70°C至+25°C范围内的货物进行持续监控,这推动了即时追踪、监管链文檔记录以及人工智慧驱动的冷却优化升级。这些能力正在巩固德国作为欧洲领先的新型治疗方法出口门户的地位,并推动德国低温运输物流市场的加值服务收入成长。

合格冷冻技术人员短缺

截至2024年,超过60%的冷冻技师职缺仍未填补,这反映出劳动力老化和新入行者(尤其是女性)的缺乏。人才短缺导致维修前置作业时间延长和服务成本上升,迫使营运商采用远距离诊断和预测性维护。儘管学徒制改革取得了一定进展,但德国低温运输物流行业的技能短缺预计至少还会持续两年。

细分市场分析

到2025年,冷藏运输将占德国总收入的60.55%,巩固德国作为欧洲门户的地位。公路、铁路、海运和空运线路相互连接,有效率运输温控货物。黑格尔曼集团安装的200台配备远端资讯处理功能的冷王(Thermo King)设备便是该领域技术优势的有力例证。在预测期内,自动化和电动车(EV)的普及应用将促进跨境物流,并持续保障生物製药和高端食品的品质。

附加价值服务预计将以4.55%的复合年增长率成长,成为该细分市场中成长最快的领域。日益严格的GDP(温度控製配送计画)和HACCP(危害分析和关键控制点)合规监管要求,推动了对专业包装、批次级监控和文件支援服务的需求。像Lineage 物流这样的仓储营运商正在将自动化拣货和包装系统与即时仪錶板集成,并将仓储、运输和合规活动整合到单一服务合约中。因此,随着製造商将复杂操作外包,监管机构的审查力度加大,德国低温运输物流市场增值解决方案的市场规模预计将在未来几年内持续成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务主导了B2C生鲜配送的成长

- 扩大生物製药和mRNA药物的出口

- 零售商推广「双鲜」自有品牌

- 电动车相容型多温卡车车身需求激增

- 海产加工向北海沿岸港口近岸转移

- 改用氨/二氧化碳天然冷媒的维修给予税收优惠

- 市场限制

- 合格冷冻技术人员短缺

- 大型冷藏仓库的电力价格波动

- 各城市对夜间送货的噪音排放规定有差异

- 新建仓库的规划核准程序冗长

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按服务类型

- 冷藏保管

- 公共仓库

- 私人仓库

- 冷藏运输

- 道路运输

- 铁路运输

- 海上运输

- 空运

- 附加价值服务

- 冷藏保管

- 按温度类型

- 冷藏(0-5 ℃)

- 冷冻(-18 至 0°C)

- 环境的

- 极低温度(低于-20 度C)

- 透过使用

- 水果和蔬菜

- 肉类和家禽

- 鱼贝类

- 乳製品和冷冻甜点

- 麵包和糖果

- 速食食品

- 药品和生物製药

- 疫苗和临床试验用品

- 化学品/特殊材料

- 其他生鲜产品

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Kuehne+Nagel International AG

- DHL Group

- Lineage Logistics LLC

- DFDS Logistics

- Dachser SE

- DSV

- Pfenning Logistics

- NewCold Advanced Logistics

- Heuer Logistics GmbH & Co. KG

- BLG Logistics

- Frigolanda Cold Logistics

- Scan Global Logistics

- Nordfrost GmbH & Co. KG

- Thermotraffic GmbH

- HAVI Logistics GmbH

- Fiege Logistik Stiftung & Co. KG

- CEVA Logistics

- Yusen Logistics

- Hellmann Worldwide Logistics

- Rhenus Logistics

第七章 市场机会与未来展望

The Germany Cold Chain Logistics Market was valued at USD 12.27 billion in 2025 and estimated to grow from USD 12.67 billion in 2026 to reach USD 14.89 billion by 2031, at a CAGR of 3.28% during the forecast period (2026-2031).

Robust e-commerce grocery demand, sustained biologics export momentum, and retailer investments in automated freshness programs underpin near-term expansion, while natural-refrigerant retrofits and electrified transport fleets reinforce long-term efficiencies. Established third-party logistics providers are digitalizing networks with IoT tracking, predictive maintenance, and AI-driven route optimization to contain rising energy costs and comply with tightening environmental rules. Portfolio diversification into ultra-low-temperature storage and integrated value-added services is widening margins as clients look for end-to-end compliance solutions. The Germany cold chain logistics market continues to benefit from the country's geographic position at the heart of European trade lanes and from public incentives supporting sustainable infrastructure upgrades.

Germany Cold Chain Logistics Market Trends and Insights

E-commerce-led rise in B2C grocery fulfillment

Online fresh-food sales reached USD 3.2 billion in 2024 and are expected to climb a further 15-20% in 2025, prompting retailers and pure-play operators to build micro-fulfillment centers equipped with dual-zone automation that can process 1,000 orders per hour at 2°C and ambient temperatures. Electric-vehicle delivery fleets, as adopted by Aldi's "Mein Aldi" and Picnic's hub model, reduce emissions and meet strict urban noise caps. Smaller basket sizes and shorter delivery windows have shifted cost structures toward high-velocity, data-driven routing tools. Logistics providers now deploy predictive analytics to re-sequence drops by thermal sensitivity, trimming spoilage and last-mile mileage. These operational upgrades accelerate the Germany cold chain logistics market's service standard while enlarging its addressable consumer base.

Growth of biologics & mRNA-based pharma exports

Germany exported EUR 105.8 billion (USD 116.76 billion) in pharmaceuticals during 2024, with temperature-sensitive biologics providing the fastest lift. DHL Group alone is investing EUR 2 billion (USD 2.20 billion) by 2030 in GDP-certified hubs, sensing equipment, and multi-temperature fleets to safeguard biologics and cell-therapy shipments. Biotech corridors around Frankfurt and Munich now demand continuous -70 °C to +25 °C visibility, triggering upgrades in real-time tracking, chain-of-custody documentation, and AI-enabled cooling optimization. These capabilities cement Germany's role as the preferred European export gateway for novel therapies, boosting premium service revenue across the Germany cold chain logistics market.

Scarcity of licensed refrigeration technicians

More than 60% of open refrigeration jobs remained unfilled in 2024, reflecting an aging workforce and limited new entrants, particularly women. Shortfalls elevate maintenance lead times and service costs, compelling operators to deploy remote diagnostics and predictive maintenance. Apprenticeship reforms are in place, yet the Germany cold chain logistics industry faces at least a two-year skill-gap overhang.

Other drivers and restraints analyzed in the detailed report include:

- Retailer push for "Doppelte Frische" (Double-Fresh) private labels

- Surge in EV-Compatible multi-temp truck bodies

- Grid-Energy price volatility for large cold stores

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated transportation supplied 60.55% of 2025 revenue, underscoring Germany's status as a pan-European gateway where motorway, rail, sea, and air corridors interlock to move temperature-controlled cargo efficiently. Hegelmann Group's deployment of 200 telematics-enabled Thermo King units exemplifies the segment's technological edge. Over the forecast horizon, automation and EV adoption will continue to smooth cross-border flows and guarantee integrity for biologics and premium grocery lines.

Value-added services are forecast to expand at a 4.55% CAGR, the fastest within this classification. Rising regulatory burdens around GDP and HACCP compliance fuel demand for specialized packaging, batch-level monitoring, and documentation support. Storage operators such as Lineage Logistics are integrating automated pick-and-pack systems and real-time dashboards that merge warehousing, transport, and compliance activities into single-service agreements. The Germany cold chain logistics market size for value-added solutions is therefore primed for multi-year compound expansion as manufacturers outsource complexity and regulators tighten oversight.

The Germany Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, Pharmaceuticals & Biologics and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kuehne + Nagel International AG

- DHL Group

- Lineage Logistics LLC

- DFDS Logistics

- Dachser SE

- DSV

- Pfenning Logistics

- NewCold Advanced Logistics

- Heuer Logistics GmbH & Co. KG

- BLG Logistics

- Frigolanda Cold Logistics

- Scan Global Logistics

- Nordfrost GmbH & Co. KG

- Thermotraffic GmbH

- HAVI Logistics GmbH

- Fiege Logistik Stiftung & Co. KG

- CEVA Logistics

- Yusen Logistics

- Hellmann Worldwide Logistics

- Rhenus Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-Commerce-led Rise in B2C Grocery Fulfilment

- 4.2.2 Growth of Biologics & mRNA-Based Pharma Exports

- 4.2.3 Retailer Push for "Doppelte Frische" (Double-Fresh) Private Labels

- 4.2.4 Surge in EV-Compatible Multi-Temp Truck Bodies

- 4.2.5 Near-Shoring of Seafood Processing to North Sea Ports

- 4.2.6 Tax Incentives for Ammonia/CO2 Natural-Refrigerant Retrofits

- 4.3 Market Restraints

- 4.3.1 Scarcity of Licensed Refrigeration Technicians

- 4.3.2 Grid-Energy Price Volatility for Large Cold Stores

- 4.3.3 Patchwork Municipal Noise-Emission Limits on Night-Time Deliveries

- 4.3.4 Lengthy Planning Approvals for Green-Field Warehouses

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5°C)

- 5.2.2 Frozen (-18 to 0°C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20°C)

- 5.3 By Application

- 5.3.1 Fruits and Vegetables

- 5.3.2 Meat and Poultry

- 5.3.3 Fish and Seafood

- 5.3.4 Dairy and Frozen Desserts

- 5.3.5 Bakery and Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals and Biologics

- 5.3.8 Vaccines and Clinical Trial Materials

- 5.3.9 Chemicals and Specialty Materials

- 5.3.10 Other Perishables

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Kuehne + Nagel International AG

- 6.4.2 DHL Group

- 6.4.3 Lineage Logistics LLC

- 6.4.4 DFDS Logistics

- 6.4.5 Dachser SE

- 6.4.6 DSV

- 6.4.7 Pfenning Logistics

- 6.4.8 NewCold Advanced Logistics

- 6.4.9 Heuer Logistics GmbH & Co. KG

- 6.4.10 BLG Logistics

- 6.4.11 Frigolanda Cold Logistics

- 6.4.12 Scan Global Logistics

- 6.4.13 Nordfrost GmbH & Co. KG

- 6.4.14 Thermotraffic GmbH

- 6.4.15 HAVI Logistics GmbH

- 6.4.16 Fiege Logistik Stiftung & Co. KG

- 6.4.17 CEVA Logistics

- 6.4.18 Yusen Logistics

- 6.4.19 Hellmann Worldwide Logistics

- 6.4.20 Rhenus Logistics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment