|

市场调查报告书

商品编码

1910896

拉丁美洲润滑油市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Latin America Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

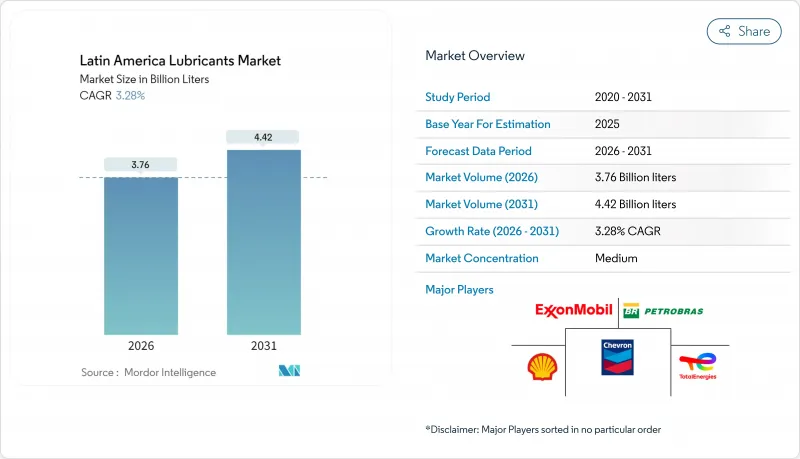

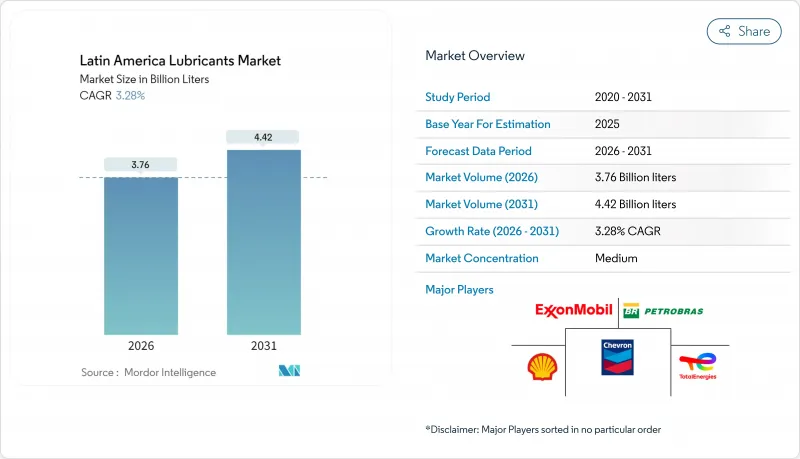

预计拉丁美洲润滑油市场将从 2025 年的 36.4 亿公升成长到 2026 年的 37.6 亿公升,到 2031 年将达到 44.2 亿公升,2026 年至 2031 年的复合年增长率为 3.28%。

这一扩张得益于工业復苏、汽车保有量成长以及采矿、电力和近岸外包主导製造业资本支出的恢復。巴西石油公司(Petrobras)1,110亿美元的投资计划,包括其第二类基础油部门,将确保区域原料供应并降低进口依赖。预计到2029年,墨西哥的近岸外包浪潮将吸引460亿美元的投资,加速该国快速成长的製造业丛集对润滑油的需求。同时,随着南美洲崛起为重要的海上钻井中心,计画于2024年在南美洲钻探的全球36口高影响力油井中的10口,将推动专用钻井液的使用。最后,石化燃料提供三分之二的总能源,而可再生提供60%的电力,这种双能源格局使得对传统润滑油和先进合成润滑油的需求相互重迭。

拉丁美洲润滑油市场趋势及展望

汽车保有量增加和车辆老化

预计巴西2024年的汽车产量将成长9.7%,恢復到疫情前的水准。这显示润滑油需求强劲,主要受换油週期缩短以及老旧车辆引擎机油消费量增加15-20%的推动。墨西哥以出口主导的製造业基地正在经历商用卡车数量的成长,从而带动了对液压油和齿轮油的需求。在整个拉丁美洲大陆,车龄超过10年的车辆占总车队的一半以上,确保了对润滑油加註服务的稳定需求。因此,儘管电气化程度不断提高,但由于15-20年的换油週期,拉丁美洲润滑油市场仍保持持续的需求。润滑油调配商正在增加针对成本敏感型细分市场老旧引擎的中级合成油配方,在保持销售量的同时提升销售。

製造业和工业资本投资的復苏

在墨西哥,受近岸外包推动的工业生产復苏使空置率降至历史新低,从而提振了新厂对金属加工液的需求。预计到2025年,巴西的液体燃料需求将成长1.4%,证实了工业的全面復苏,而油压油是製程设备的重要燃料。拉丁美洲的润滑油市场正受益于计划的石化、水泥和钢铁计划,这些项目旨在透过提高黏度指数基础油的生产效率。巴西和墨西哥的本地调配激励措施将进一步刺激国内添加剂的消费,缩短前置作业时间,并缓解全球供应衝击。工业用户正在实施状态监测计划,这提高了合成润滑油在其润滑油总支出中的比例。

电动车的普及抑制了对引擎油的需求。

27个拉丁美洲国家已根据《巴黎协定》承诺实现交通运输电气化目标,波哥大和墨西哥城正在对其城市公车车队进行改造。电动动力系统无需使用曲轴箱润滑油,从而降低了都市区维修店的需求。然而,电池冷却液和变速箱油等新兴细分市场引入了合成酯类产品,这些产品在散热的同时还能最大限度地降低导电性,部分抵消了需求下降的影响。充电基础设施的匮乏仍然是大都会圈以外地区推广电动车电气化的主要障碍,预计内燃机在本世纪的大部分时间里仍将占据主导地位。因此,拉丁美洲润滑油市场向电动车相容型润滑油的过渡预计将是一个渐进的过程,而不是突然的转变。

细分市场分析

到2025年,机油将占拉丁美洲润滑油市场份额的57.05%,这主要得益于内燃机的持续主导地位以及车辆平均车龄超过12年。销售量与巴西产量的成长和墨西哥卡车运输业的扩张密切相关,而多级润滑油产品由于其更优异的冷启动性能,正在蚕食单级润滑油的市场份额。变速箱油和齿轮油的销售与商用车的普及密切相关,而液压油则供应给在智利和秘鲁高海拔恶劣环境下作业的矿业部门。金属加工液受惠于近岸外包投资,墨西哥的工业用地面积较2019年翻了一番。

其他产品类型是成长最快的类别,预计到2031年将以3.74%的复合年增长率成长,这主要得益于可再生能源计划和精密製造业对特殊配方的需求。风力发电机齿轮箱依赖PAO酯类混合物,其使用寿命超过10,000小时,而太阳能追踪器致动器需要低温润滑脂。无锂聚脲和磺酸盐钙复合润滑脂因其成本和性能优势而备受关注。虽然电动车冷却液仍处于发展初期,但它们代表着未来对高介电常数流体需求的主要驱动力。因此,随着设备复杂性的增加,拉丁美洲润滑油市场特殊润滑油的规模成长速度超过了整体消费量的成长速度。

拉丁美洲润滑油报告按产品类型(发动机油、变速箱油和齿轮油、液压油等)、终端用户行业(汽车、发电、重型机械、冶金和金属加工、其他终端用户行业)以及地区(巴西、墨西哥、阿根廷、哥伦比亚、智利、秘鲁、拉丁美洲其他地区)进行细分。市场预测以公升为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 车辆拥有数量增加和车辆老化

- 製造业和工业资本投资的復苏

- 用于采矿和能源产业的高性能合成油

- 电子商务最后一公里配送车辆数量迅速成长

- 对本地混合工厂的激励措施

- 市场限制

- 电动车的普及抑制了对引擎油的需求。

- 优质润滑油延长更换週期

- 添加剂包装供应瓶颈

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 机油

- 变速箱油和齿轮油

- 油压

- 金属加工油

- 润滑脂

- 其他产品类型

- 按最终用户行业划分

- 车

- 发电

- 重型机械

- 冶金与金属加工

- 其他终端用户产业

- 按地区

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 智利

- 秘鲁

- 其他拉丁美洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- BP plc

- Chevron Corporation

- Exxon Mobil Corporation

- GULF OIL INTERNATIONAL LIMITED

- Motul

- Petrobras

- Repsol

- Roshfrans

- Shell plc

- TotalEnergies

- Valvoline Inc.

第七章 市场机会与未来展望

The Latin America Lubricants Market is expected to grow from 3.64 Billion liters in 2025 to 3.76 Billion liters in 2026 and is forecast to reach 4.42 Billion liters by 2031 at 3.28% CAGR over 2026-2031.

Expansion is anchored in industrial recovery, a rising vehicle parc, and renewed capital spending across mining, power, and nearshoring-led manufacturing. Petrobras' USD 111 billion investment plan, which includes a Group II base-oil unit, secures regional feedstock and lowers import reliance. Mexico's nearshoring wave, expected to draw USD 46 billion through 2029, accelerates lubricant demand in fast-growing manufacturing clusters. Meanwhile, the continent's emergence as a key offshore drilling arena, with 10 of 36 global high-impact wells slated for 2024, stimulates specialized drilling-fluid use. Lastly, a dual energy matrix, where fossil fuels supply two-thirds of total energy yet renewables deliver 60% of electricity, creates overlapping needs for both conventional and advanced synthetic lubricants.

Latin America Lubricants Market Trends and Insights

Vehicle-parc Expansion and Ageing Fleet

Brazilian auto production grew 9.7% in 2024, returning to pre-pandemic output and signaling robust lubricant pull-through as older vehicles require shorter drain intervals and consume 15-20% more engine oil. Mexico's export-led manufacturing base has added commercial trucks that heighten demand for hydraulic fluids and gear oils. Across the continent, vehicles older than 10 years already represent over half of the total fleet, locking in a steady service-fill requirement. The Latin America lubricants market therefore enjoys durable demand even as electrification gains momentum because turnover cycles span 15-20 years. Blenders increasingly formulate mid-tier synthetics aimed at aging engines in cost-sensitive segments, preserving volume while upselling performance.

Manufacturing and Industrial Capex Rebound

A nearshoring-fueled revival in Mexican industrial output is pushing vacancy rates to historic lows and inflating demand for metalworking fluids in newly commissioned plants. Brazil's 1.4% liquid-fuel demand upturn in 2025 confirms a broader industrial rebound that requires hydraulic oils for process equipment. The Latin America lubricants market benefits from project pipelines in petrochemicals, cement, and steel, each seeking productivity gains through high-viscosity-index base stocks. Local blending incentives in Brazil and Mexico further stimulate domestic additive consumption, shortening lead times and buffering global supply shocks. Industrial users, in turn, embrace condition-monitoring programs that raise the share of synthetics in total lubricant spend.

EV Penetration Curbing Engine-oil Demand

Twenty-seven Latin American nations have enshrined transport electrification targets under the Paris Agreement, triggering city-bus fleet conversions in Bogota and Mexico City. Electric drivetrains do not use crankcase oils, shaving volume off urban service bays. Yet the new battery-coolant and reduction-gear fluid niches partly compensate by introducing synthetic esters that must dissipate heat while conducting minimal electricity. Uptake outside large cities remains slow due to limited charging infrastructure, keeping internal-combustion engines dominant through most of this decade. Consequently, the Latin America lubricants market expects a gradual, not abrupt, transition toward EV-ready fluids.

Other drivers and restraints analyzed in the detailed report include:

- High-performance Synthetics for Mining and Energy

- Local Blending-plant Incentives

- Longer Drain-intervals for Premium Lubricants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine oils accounted for 57.05% of the Latin America lubricants market share in 2025, propelled by sustained ICE dominance and a fleet whose average age tops 12 years. Volumes correlate closely with Brazil's production uptick and Mexico's trucking expansion, while multigrade formulations capture share from monogrades due to improved cold-start protection. Transmission and gear oils piggyback on commercial-vehicle proliferation, whereas hydraulic fluids supply a mining sector operating across harsh altitudes in Chile and Peru. Metalworking fluids enjoy a tailwind from nearshoring investments that double Mexican industrial space compared with 2019 levels.

Other Product Types represent the fastest-growing category, clocking a 3.74% CAGR to 2031 as renewable-energy projects and precision manufacturing seek niche formulations. Wind-turbine gearboxes rely on PAO-ester blends offering more than 10,000-hour service life, while solar-tracker actuators need low-temperature greases. Lithium-free polyurea and calcium-sulfonate complex greases gain traction on cost and performance grounds. Electric-vehicle coolant growth, though nascent, seeds future demand for high-dielectric fluids. The Latin America lubricants market size for specialty grades, therefore, advances faster than overall consumption as equipment complexity rises.

The Latin America Lubricants Report is Segmented by Product Type (Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, and More), End-User Industry (Automotive, Power Generation, Heavy Equipment, Metallurgy and Metalworking, and Other End-User Industries), and Geography (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Rest of Latin America). The Market Forecasts are Provided in Terms of Volume (Liters).

List of Companies Covered in this Report:

- BP p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

- GULF OIL INTERNATIONAL LIMITED

- Motul

- Petrobras

- Repsol

- Roshfrans

- Shell plc

- TotalEnergies

- Valvoline Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Vehicle-Parc Expansion and Ageing Fleet

- 4.2.2 Manufacturing and Industrial Capex Rebound

- 4.2.3 High-Performance Synthetics for Mining and Energy

- 4.2.4 E-Commerce Last-Mile Fleet Boom

- 4.2.5 Local Blending-Plant Incentives

- 4.3 Market Restraints

- 4.3.1 EV Penetration Curbing Engine-Oil Demand

- 4.3.2 Longer Drain-Intervals for Premium Lubes

- 4.3.3 Additive-Package Supply Bottlenecks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oils

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Metalworking Fluids

- 5.1.5 Greases

- 5.1.6 Other Product Types

- 5.2 By End-User Industry

- 5.2.1 Automotive

- 5.2.2 Power Generation

- 5.2.3 Heavy Equipment

- 5.2.4 Metallurgy and Metalworking

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Mexico

- 5.3.3 Argentina

- 5.3.4 Colombia

- 5.3.5 Chile

- 5.3.6 Peru

- 5.3.7 Rest of Latin America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BP p.l.c.

- 6.4.2 Chevron Corporation

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 GULF OIL INTERNATIONAL LIMITED

- 6.4.5 Motul

- 6.4.6 Petrobras

- 6.4.7 Repsol

- 6.4.8 Roshfrans

- 6.4.9 Shell plc

- 6.4.10 TotalEnergies

- 6.4.11 Valvoline Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment