|

市场调查报告书

商品编码

1911285

中东和北非金融科技市场:市场份额分析、行业趋势和统计数据、成长预测(2026-2031 年)MENA Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

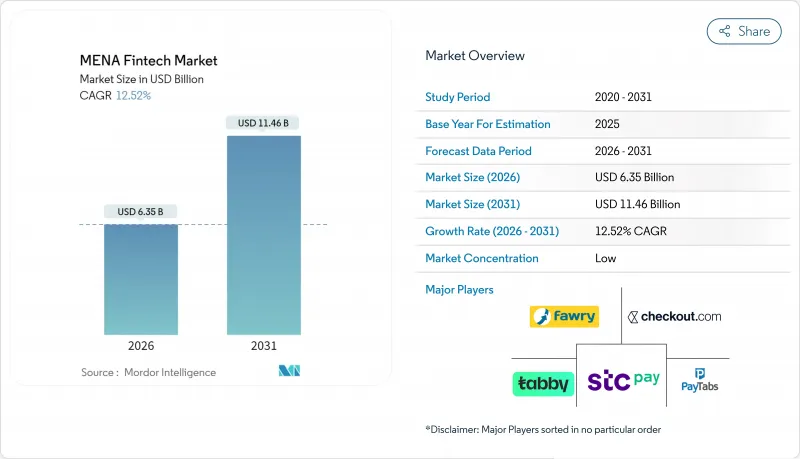

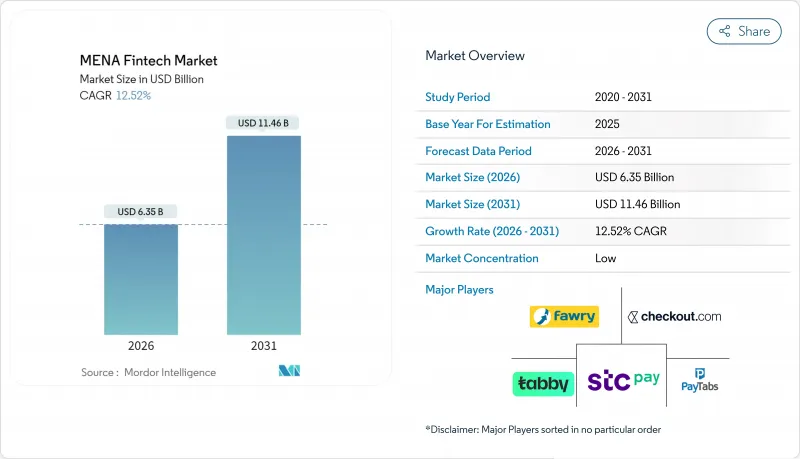

预计到 2026 年,中东和北非的金融科技市场规模将达到 63.5 亿美元。

这意味着从 2025 年的 56.5 亿美元成长到 2031 年的 114.6 亿美元,预计 2026 年至 2031 年的年复合成长率(CAGR)为 12.52%。

无现金支付政策的扩展、智慧型手机普及率的提高以及创业投资的持续流入,正在扩大数位金融服务的目标基本客群。海湾合作委员会(GCC)和埃及的央行数位货币(CBDC)试点计画正在推动支付基础设施的现代化,而沙乌地阿拉伯、阿联酋和约旦的监管沙盒则缩短了产品推出週期。同时,电子商务、零工经济和汇款通道正在推动嵌入式金融应用场景的发展。产业相关人员正透过平台多元化和跨境伙伴关係来应对这些挑战,从而创造新的收入来源并整合分散的业务。

中东和北非金融科技市场趋势与洞察

政府的无现金和普惠金融政策加速了对金融科技的需求。

沙乌地阿拉伯的目标是到2030年实现70%的交易无现金化,埃及的目标是到2025年使50%的成年人拥有银行帐户,而阿联酋的目标是到2024年简化其许可製度。这些目标为推广应用提供了明确的基准,并降低了私人营运商的市场进入门槛。约旦的监管沙盒进一步降低了监管风险,帮助Start-Ups拓展业务,同时降低监管成本。随着各国政府推动工资支付和福利金的数位化,消费者越来越亲和性电子钱包,降低了获客成本。这些政策鼓励零售商采用非接触式支付并扩展支付网路。这些倡议正在形成良性循环,推动中东和北非金融科技市场的成长。

行动互联网普及率的快速成长使得行动优先的资金取得成为可能。

在海湾合作委员会(GCC)国家,智慧型手机普及率已超过80%,行动端已成为银行业务的预设管道。在阿联酋,数位钱包已占销售点消费的18%,预计2027年将达到33%。在埃及和摩洛哥,基于通讯业者的代理模式绕过了分店网点,在降低业务成本的同时扩大了覆盖范围。 Z世代用户透过数位钱包消费占该地区电子商务消费的23%,并正在养成永续的支付习惯。北非地区4G/5G网路覆盖范围的扩展使得远端客户身份验证(KYC)成为可能,从而开拓了新的客户群。行动优先模式正在推动所有消费群体市场份额的快速成长。

按司法管辖区分類的监管措施增加了合规负担。

19种不同的许可证制度要求金融科技公司为每个市场设立独立的法律实体,与统一的框架相比,这会使营运成本增加15%至25%。不一致的资本管制和数据本地化规则阻碍了企业获得许可,并减缓了区域扩张。大型企业可以承担这些成本,但Start-Ups面临资源短缺,创新多样性也受到限制。缺乏相互核准也阻碍了跨境开放API的集成,造成了集成死角。投资者正在将风险因素纳入估值考量,并鼓励企业透过整合来规避跨国扩张。

细分市场分析

到2025年,数位支付将占中东和北非地区金融科技市场54.12%的份额,这主要得益于智慧型手机钱包的普及和积极的商家获客奖励。该细分市场新增了QR码支付和代币化钱包支付等支付管道,进一步提升了客户留存率。数位借贷虽然规模较小,但凭藉即时替代数据评分的优势,正以17.74%的复合年增长率快速成长。 Fawley预计2025年将新增10亿埃及镑的贷款,标誌着该公司正从支付领域扩展到信贷领域。

智能投顾和保险科技公司正透过API优先的管道扩张,而像STC银行这样的新型银行则在将电子钱包用户群转化为全方位服务帐户。监管沙盒正在推动参数化和基于使用量的保险业务,鼓励创新实验。支付品牌正在同一应用程式中添加信贷、投资和保险选项卡,从而创造交叉销售协同效应并提高用户终身价值。这种多元化趋势表明,中东和北非地区金融科技市场的平台融合正在加速。

其他福利

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 政府强制推行无现金交易和普惠金融

- 行动互联网普及率快速成长

- 创业投资与资金筹措沙盒发展

- 透过央行数位货币试点计画实现跨境付款基础

- 电子商务与零工平台蕴含的金融需求

- 即时支付基础设施支援替代贷款数据

- 市场限制

- 不同司法管辖区的监管碎片化

- 在北非,以现金交易为中心的消费习惯正在推高客户获取成本(CAC)。

- 缺乏阿拉伯语人工智慧/机器学习风险评分资料集

- 传统核心银行IT系统存在的瓶颈

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过服务提案

- 数位支付

- 数字借贷和资金筹措

- 数位投资

- 保险科技

- 新银行

- 最终用户

- 零售

- 公司

- 透过使用者介面

- 行动应用

- 网页/浏览器

- POS/物联网设备

- 按地区

- GCC

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 巴林

- 科威特

- 阿曼

- 北非

- 埃及

- 摩洛哥

- 阿尔及利亚

- 突尼西亚

- 黎凡特

- 约旦

- 黎巴嫩

- GCC

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Fawry

- PayTabs

- Checkout.com

- Tabby

- Tamara

- STC Pay

- Paymob

- MNT-Halan

- Geidea

- Network International

- BenefitPay

- Careem Pay

- Lean Technologies

- HyperPay

- YAP

- Telda

- NymCard

- Sarwa

- OPay

第七章 市场机会与未来展望

MENA fintech market size in 2026 is estimated at USD 6.35 billion, growing from 2025 value of USD 5.65 billion with 2031 projections showing USD 11.46 billion, growing at 12.52% CAGR over 2026-2031.

A surge in cash-lite policy mandates, broad smartphone availability, and growing venture-capital inflows are expanding the addressable base for digital financial services. Central-bank digital-currency (CBDC) pilots in the GCC and Egypt are modernizing payment rails, while regulatory sandboxes in Saudi Arabia, the UAE, and Jordan shorten product launch cycles. At the same time, e-commerce, gig-economy, and remittance corridors are fuelling embedded-finance use cases. Industry participants respond through platform diversification and cross-border partnerships that create new revenue streams and consolidate fragmented positions.

MENA Fintech Market Trends and Insights

Government Cash-Lite & Financial-Inclusion Mandates Accelerate Fintech Demand

Saudi Arabia targets 70% cashless transactions by 2030, Egypt aims to bank 50% of adults by 2025, and the UAE streamlined licensing in 2024. These targets provide clear metrics for adoption and reduce go-to-market friction for private players. Sandboxes in Jordan further cut regulatory risk, helping startups scale without prohibitive compliance spend. As governments digitize payroll and welfare transfers, consumer familiarity with e-wallets rises, lowering acquisition costs. The policy push also incentivizes retailers to deploy contactless acceptance, enlarging acceptance networks. Collectively, mandates create a virtuous circle that widens the MENA fintech market.

Mobile & Internet Penetration Surge Enables Mobile-First Financial Access

Smartphone penetration tops 80% in GCC states, turning mobiles into the default banking channel. The UAE already sees digital wallets covering 18% of POS spend, on track for 33% by 2027. Egypt and Morocco extend reach through telco-based agent models, bypassing branch infrastructure and shrinking operating costs. Gen Z users account for 23% of regional e-commerce spend via digital wallets, establishing lasting payment habits. Growing 4G/5G coverage in rural North Africa enables remote KYC onboarding, unlocking new customer pools. The mobile-first model thus propels rapid share gains across consumer cohorts.

Regulatory Fragmentation Across Jurisdictions Increases Compliance Burden

Nineteen different licensing regimes require fintechs to form market-specific entities, adding 15-25% to overheads versus unified frameworks. Disparate capital and data-localization rules hinder passporting and delay regional scaling. Larger incumbents absorb the cost but startups face resource strain, limiting innovation diversity. Lack of mutual recognition also hampers cross-border open-API linkage, creating integration dead-zones. Investors price the risk into valuations, nudging consolidation as a workaround for multi-country reach.

Other drivers and restraints analyzed in the detailed report include:

- VC Funding & Sandbox Momentum Fuel Startup Formation

- CBDC Pilots Enabling Cross-Border Rails Create Common API Infrastructure

- Cash-Centric Habits Inflate Customer-Acquisition Costs in North Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital payments controlled 54.12% of MENA fintech market share in 2025, underpinned by near-ubiquitous smartphone wallets and aggressive merchant-acquiring incentives. The sub-segment added new rails such as QR and tokenized wallet checkout, further cementing stickiness. Digital lending, though smaller, is growing at an 17.74% CAGR on the strength of real-time alternative-data scoring. Fawry's EGP 1 billion disbursement surge in 2025 illustrates payments-to-credit adjacency.

Robo-advisory and insurtech expand via API-first distribution, while neobanks like STC Bank convert wallet bases into full-service accounts. Regulatory sandboxes allow parametric and usage-based policies, fostering experimentation. Cross-sell synergies emerge as payments brands add credit, investment, and insurance tabs within the same app, stretching user lifetime value. The diversification push points to escalating platform convergence across the MENA fintech market.

The MENA Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending & Financing, Digital Investments, Insurtech, Neobanking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (GCC, North Africa, Levant). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Fawry

- PayTabs

- Checkout.com

- Tabby

- Tamara

- STC Pay

- Paymob

- MNT-Halan

- Geidea

- Network International

- BenefitPay

- Careem Pay

- Lean Technologies

- HyperPay

- YAP

- Telda

- NymCard

- Sarwa

- OPay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Govt cash-lite and financial-inclusion mandates

- 4.2.2 Mobile & internet penetration surge

- 4.2.3 VC funding & sandbox momentum

- 4.2.4 CBDC pilots enabling cross-border rails

- 4.2.5 Embedded-finance demand from e-commerce and gig platforms

- 4.2.6 Instant-payment rails unlocking alternative lending data

- 4.3 Market Restraints

- 4.3.1 Regulatory fragmentation across jurisdictions

- 4.3.2 Cash-centric habits inflating CAC in North Africa

- 4.3.3 Scarcity of Arabic AI/ML risk-scoring datasets

- 4.3.4 Legacy core-bank IT bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending & Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Geography

- 5.4.1 GCC

- 5.4.1.1 Saudi Arabia

- 5.4.1.2 United Arab Emirates

- 5.4.1.3 Qatar

- 5.4.1.4 Bahrain

- 5.4.1.5 Kuwait

- 5.4.1.6 Oman

- 5.4.2 North Africa

- 5.4.2.1 Egypt

- 5.4.2.2 Morocco

- 5.4.2.3 Algeria

- 5.4.2.4 Tunisia

- 5.4.3 Levant

- 5.4.3.1 Jordan

- 5.4.3.2 Lebanon

- 5.4.1 GCC

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Fawry

- 6.4.2 PayTabs

- 6.4.3 Checkout.com

- 6.4.4 Tabby

- 6.4.5 Tamara

- 6.4.6 STC Pay

- 6.4.7 Paymob

- 6.4.8 MNT-Halan

- 6.4.9 Geidea

- 6.4.10 Network International

- 6.4.11 BenefitPay

- 6.4.12 Careem Pay

- 6.4.13 Lean Technologies

- 6.4.14 HyperPay

- 6.4.15 YAP

- 6.4.16 Telda

- 6.4.17 NymCard

- 6.4.18 Sarwa

- 6.4.19 OPay

7 Market Opportunities & Future Outlook

- 7.1 Cross-border GCC-North Africa remittance corridors via tokenized wallets

- 7.2 Green Islamic fintech products aligned with ESG & Sharia mandates