|

市场调查报告书

商品编码

1911289

马来西亚金融科技市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Malaysia Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

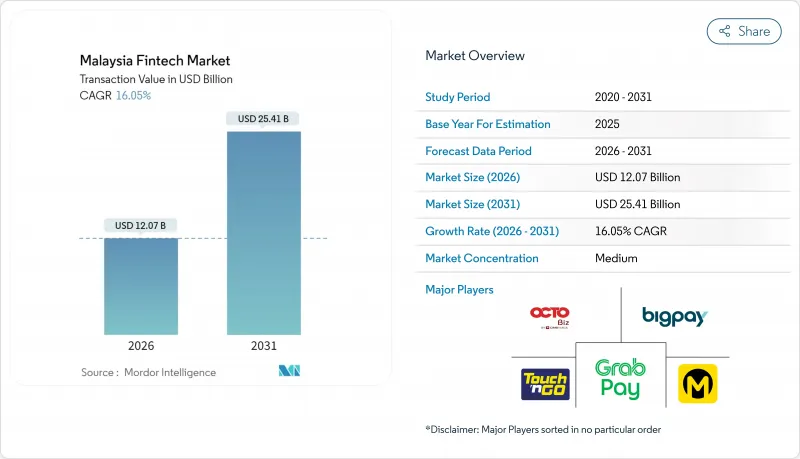

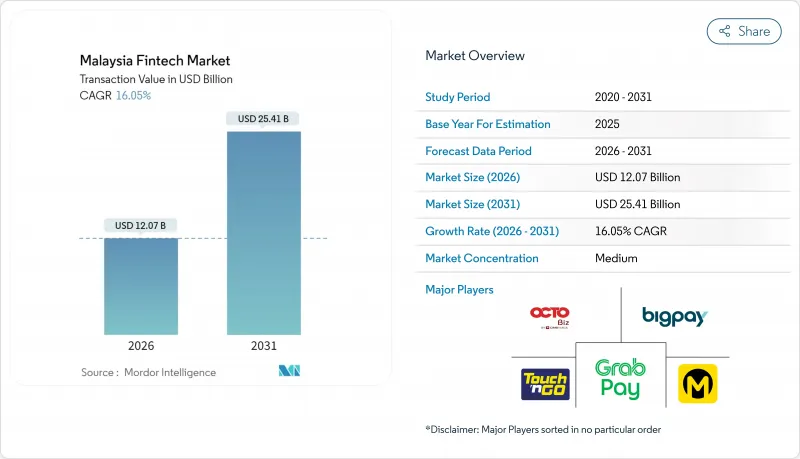

预计到 2025 年,马来西亚金融科技市场规模将达到 104 亿美元,到 2026 年将成长至 120.7 亿美元,到 2031 年将成长至 254.1 亿美元,在预测期(2026-2031 年)内复合年增长率为 16.05%。

马来西亚作为东南亚伊斯兰金融中心的地位、不断扩大的数位化优先消费群以及有利的监管环境,都为这一增长提供了支持。持续发放的数位银行牌照,例如KAF数位银行和永旺银行,在扩大服务范围的同时降低了获客成本。与柬埔寨和新加坡的跨境QR CODE支付整合,提高了交易量,并促进了本地服务提供者的区域扩张。在砂拉越和槟城的公共云端和资料中心投资,正在加强底层基础设施建设,从而实现即时支付和合规分析。随着马来西亚金融科技市场的日趋成熟,竞争策略日益围绕在超级应用生态系统、符合伊斯兰教法的创新以及嵌入式金融功能嵌入零售和中小企业的日常工作流程。

马来西亚金融科技市场趋势与洞察

智慧型手机和网路的高普及率推动了目标市场的扩张

马来西亚的智慧型手机普及率超过85%,网路存取覆盖率达90%,这为金融科技服务拓展了数位化基本客群群。 Touch 'n Go Digital已成功从战略资金筹措处筹集了7500万美元,并有望凭藉这一行动互联网普及率在2025年实现首次全年盈利。电子钱包的使用率已达40%,超过了传统银行服务的普及率。 Google Pay与ShopeePay和TNG eWallet在2024年的合作表明,成熟的基础设施将加速生态系统合作,并促进电子钱包的普及。电子钱包的普及主要由年轻人推动,90%的用户年龄在40岁以下,这构成了未来产品开发的关键目标群。

政府的「我的数字」(MyDigital)和金融部门蓝图倡议促进生态系统发展

「MyDigital」蓝图的目标是到2025年底,数位经济占国内生产毛额(GDP)的25.5%,预计2024年已通过核准的数位投资将达到1,636亿马币(约343.6亿美元),年增250%。由于智慧财产权收入10年零课税优惠政策,目前已有超过3891家获得马来西亚数位认证的公司在全国各地营运。为实现金融业蓝图将现金交易减少75%的目标,政府推出了支付终端补贴政策,并加强了资料保护。数位部在槟城设立北部办事处,旨在为巴生谷地区以外的地区提供激励措施和技术指导,这体现了其区域扩张的努力。

网路诈骗问题会削弱用户信任并增加合规成本。

日益严峻的网路安全威胁和数位诈骗案件为金融科技的普及带来了巨大阻力,导致整个产业的合规成本较去年同期上涨25%。 2025年4月,马来西亚国家银行和泰国银行签署了网路安全和数位诈骗防范合作备忘录,强调了这些威胁的跨国性质。作为应对措施,马来西亚各银行已在其行动应用程式中添加了恶意软体防护功能,马来西亚国家银行(BNM)推出的国家诈骗门户网站已将诈骗追踪时间缩短了75%,这既表明了问题的严重性,也体现了机构的应对措施。 GXBank推出的「网路诈骗防护」保险产品反映了金融科技公司在应对客户风险规避的同时,努力将安全隐患转化为收益的努力。

细分市场分析

预计到2025年,数位支付将占马来西亚金融科技市场50.72%的份额,这主要得益于Touch 'n Go Digital的多模态和零售整合。政府的无现金支付计画以及区域QR码互通性的提升,进一步巩固了数位支付的领先地位。数位借贷位居第二,占21.03%,这主要得益于Funding Societies筹集了2700万美元,用于扩大其符合伊斯兰教法的中小企业贷款业务。保险科技占15.05%,这主要得益于PolicyStreet获得的1,540万美元B轮资金筹措以及其500万的用户群。

2025年,新银行业务占比将维持在7.35%,但随着免手续费帐户和快速开户服务缩小与传统金融机构的差距,预计其复合年增长率将达到26.12%。数位投资占比将达到5.85%,其中StashAway除了提供符合伊斯兰教法的投资组合外,还推出了比特币/以太坊ETF,以实现收入来源多元化。证券委员会(SC)的数位创新基金正在共同资助15个试点项目,预示着未来服务组合将会转变。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 智慧型手机和网路普及率高

- 政府「我的数字」(MyDigital)和FSB倡议

- 电子商务的快速成长

- 有利的沙盒环境和数位银行牌照

- 伊斯兰金融科技的需求日益增长

- 东协跨境QR码整合

- 市场限制

- 对网路诈骗的担忧

- 对现有银行基础设施的依赖

- 深科技金融科技人才短缺

- 区域数位课税的复杂性

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过服务提案

- 数位支付

- 数字借贷和资金筹措

- 数位投资

- 保险科技

- 新银行

- 最终用户

- 零售

- 公司

- 透过使用者介面

- 行动应用

- 网页/浏览器

- POS/物联网设备

- 按地区

- 巴生谷

- 北部地区

- 南部地区

- 东海岸

- 东马来西亚

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Maybank

- CIMB

- Touch'n Go Digital

- Boost

- BigPay

- GrabPay

- Razer Fintech

- Axiata Digital(Aspirasi)

- Funding Societies

- CapBay

- MoneyMatch

- Jirnexu(RinggitPlus)

- iMoney

- StashAway

- Wahed Invest

- Bursa Digital Exchange

- PolicyStreet

- Tune Protect

- Oyen

- Etiqa Digital

- Prudential Pulse

- GHL Systems

- MyPOSPay

- Soft Space

- FavePay

第七章 市场机会与未来展望

The Malaysia fintech market was valued at USD 10.40 billion in 2025 and estimated to grow from USD 12.07 billion in 2026 to reach USD 25.41 billion by 2031, at a CAGR of 16.05% during the forecast period (2026-2031).

Malaysia's role as Southeast Asia's Islamic finance hub, combined with an expanding digital-first consumer base and supportive sandbox regulations, underpins this growth. Continued licensing of digital banks, such as KAF Digital Bank and AEON Bank, has broadened service offerings while lowering acquisition costs. Cross-border QR payment links with Cambodia and Singapore elevate transaction volumes and position local providers for regional expansion. Public cloud and data-center investments across Sarawak and Penang strengthen the underlying infrastructure, enabling real-time payments and compliance analytics. As the Malaysia fintech market matures, competitive strategies increasingly revolve around super-app ecosystems, Islamic-compliant innovations, and embedded finance integrations into retail and SME workflows.

Malaysia Fintech Market Trends and Insights

High Smartphone & Internet Penetration Drives Addressable Market Expansion

Malaysia's smartphone penetration surpasses 85% and internet connectivity reaches 90% of residents, growing the digital-ready customer pool for fintech services. Touch 'n Go Digital expects its first full-year profitability in 2025 after securing USD 75 million from strategic investors, a milestone enabled by this mobile reach. E-wallet usage already touches 40%, outpacing traditional banking access. Google Pay's 2024 tie-up with ShopeePay and TNG eWallet illustrates how infrastructure maturity accelerates ecosystem partnerships that deepen wallet stickiness. Younger cohorts dominate adoption, with 90% of users aged 40 and below forming the core target for upcoming product launches.

Government MyDigital & Financial Sector Blueprint Initiatives Catalyze Ecosystem Development

The MyDigital roadmap aims for the digital economy to contribute 25.5% of GDP by end-2025, supported by MYR 163.6 billion (USD 34.36 billion) in approved digital investments in 2024, a 250% jump year-on-year. More than 3,891 Malaysia Digital-status firms now operate nationwide, buoyed by tax incentives granting 0% on IP income for a decade. The Financial Sector Blueprint's 75% cashless-transaction goal releases subsidies for payment terminals and data-protection upgrades. Regional expansion is evident as the Digital Ministry opened its northern office in Penang to funnel incentives and technical mentorship beyond Klang Valley.

Cyber-fraud Concerns Erode User Trust and Increase Compliance Costs

Rising cybersecurity threats and digital fraud incidents create significant headwinds for fintech adoption, with compliance costs increasing 25% year-on-year across the industry. Bank Negara Malaysia and Bank of Thailand signed a memorandum of understanding in April 2025 for cybersecurity and digital fraud cooperation, highlighting the cross-border nature of these threats. Malaysian banks responded by adding malware shielding to mobile applications, while BNM's National Fraud Portal launch reduced fraud tracing time by 75%, demonstrating both the severity of the problem and institutional responses. GXBank's introduction of Cyber Fraud Protect insurance products reflects how fintech companies are monetizing security concerns while addressing customer risk aversion.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Boom Amplifies Payment Volume Growth

- Favourable Sandbox & Digital Bank Licences Lower Entry Barriers

- Reliance on Incumbent Banking Rails Limits Fintech Uptime Guarantees

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital payments captured 50.72% of Malaysia fintech market share in 2025, anchored by Touch 'n Go Digital's multi-modal transport and retail integrations. Government cashless incentives and regional QR interoperability continue to widen this moat. Digital lending ranks second at 21.03%, boosted by Funding Societies' USD 27 million raise that broadened Shariah-compliant SME lines. Insurtech holds 15.05%, validated by PolicyStreet's USD 15.4 million Series B and a 5 million-strong user base.

Neobanking, though only 7.35% in 2025, is projected to grow at a 26.12% CAGR, narrowing gaps with incumbents through fee-free accounts and rapid onboarding. Digital investments stand at 5.85%, where StashAway's launch of Bitcoin and Ethereum ETFs alongside Shariah portfolios diversifies revenue. The Securities Commission's Digital Innovation Fund has co-financed 15 pilots, signalling future service-mix shifts.

The Malaysia Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending & Financing, Digital Investments, Insurtech, Neobanking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (Klang Valley, Northern Region, Southern Region, East Coast, East Malaysia). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Maybank

- CIMB

- Touch 'n Go Digital

- Boost

- BigPay

- GrabPay

- Razer Fintech

- Axiata Digital (Aspirasi)

- Funding Societies

- CapBay

- MoneyMatch

- Jirnexu (RinggitPlus)

- iMoney

- StashAway

- Wahed Invest

- Bursa Digital Exchange

- PolicyStreet

- Tune Protect

- Oyen

- Etiqa Digital

- Prudential Pulse

- GHL Systems

- MyPOSPay

- Soft Space

- FavePay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High smartphone & internet penetration

- 4.2.2 Government's MyDigital & FSB initiatives

- 4.2.3 E-commerce boom

- 4.2.4 Favourable sandbox & digital bank licences

- 4.2.5 Rising demand for Islamic fintech

- 4.2.6 ASEAN cross-border QR-code integration

- 4.3 Market Restraints

- 4.3.1 Cyber-fraud concerns

- 4.3.2 Reliance on incumbent banking rails

- 4.3.3 Shortage of deep-tech fintech talent

- 4.3.4 Regional digital tax complexity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending & Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Geography

- 5.4.1 Klang Valley

- 5.4.2 Northern Region

- 5.4.3 Southern Region

- 5.4.4 East Coast

- 5.4.5 East Malaysia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Maybank

- 6.4.2 CIMB

- 6.4.3 Touch 'n Go Digital

- 6.4.4 Boost

- 6.4.5 BigPay

- 6.4.6 GrabPay

- 6.4.7 Razer Fintech

- 6.4.8 Axiata Digital (Aspirasi)

- 6.4.9 Funding Societies

- 6.4.10 CapBay

- 6.4.11 MoneyMatch

- 6.4.12 Jirnexu (RinggitPlus)

- 6.4.13 iMoney

- 6.4.14 StashAway

- 6.4.15 Wahed Invest

- 6.4.16 Bursa Digital Exchange

- 6.4.17 PolicyStreet

- 6.4.18 Tune Protect

- 6.4.19 Oyen

- 6.4.20 Etiqa Digital

- 6.4.21 Prudential Pulse

- 6.4.22 GHL Systems

- 6.4.23 MyPOSPay

- 6.4.24 Soft Space

- 6.4.25 FavePay

7 Market Opportunities & Future Outlook

- 7.1 Embedded finance for SMEs via POS/IoT

- 7.2 Digital wealth for aging affluent segment