|

市场调查报告书

商品编码

1911287

新加坡金融科技:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Singapore Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

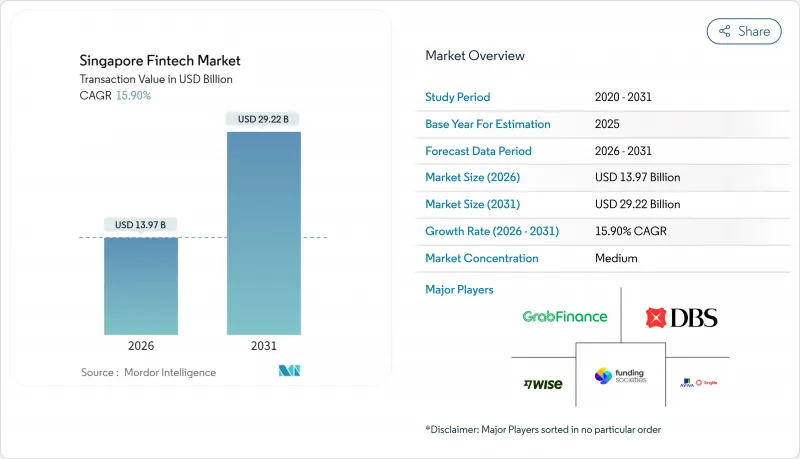

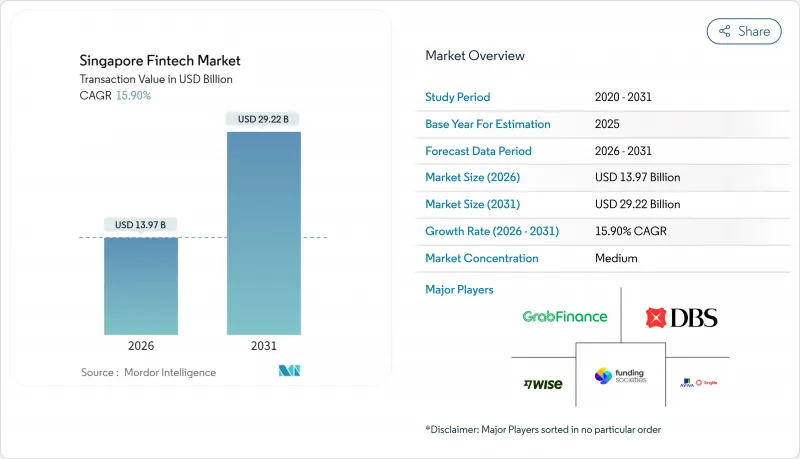

新加坡金融科技市场预计到 2026 年将达到 139.7 亿美元,高于 2025 年的 120.5 亿美元。预计到 2031 年将达到 292.2 亿美元,2026 年至 2031 年的复合年增长率为 15.9%。

强有力的政策支持、先进的数位基础设施以及持续的私人资本流入,使得新加坡金融科技市场在竞争日益激烈和监管审查不断加强的情况下,依然保持快速成长。新加坡金融管理局(MAS)推出的1亿新元(约7,700万美元)FSTI 3.0计划,正是对此市场动能的有力体现。该计画将共同资助抗量子攻击的网路安全技术和人工智慧驱动的风险模型,为早期采用者提供可持续的技术优势。此外,计划于2026年运作的五国即时支付走廊计划「Nexus」预计将缩短结算週期,并为跨境贸易服务供应商开闢新的收入来源。新加坡金融科技市场也受惠于PayNow不断扩大的区域合作,这刺激了从事跨境电商的中小型企业对多币种钱包的需求。同时,针对加密货币和先买后付(BNPL)后付款服务的消费者保护条例日益严格,限制了短期内的收入成长,并促使经营模式转向嵌入式金融和B2B2C分销模式。

新加坡金融科技市场趋势与洞察

即时支付基础设施正在改变支付经济。

Nexus计划于2026年前连接新加坡、马来西亚、泰国、菲律宾和印度的付款基础,届时将不再需要代理行帐户,结算速度也将从T+2提升至即时。这项转变预计将释放1,200亿美元的流动性,并降低跨境交易费用,从而为商家和中小企业带来即时的成本节约。早期整合商预计在B2B贸易融资领域占据更大的份额,因为即时支付能够实现与运输里程碑挂钩的营运资金产品。 PayNow、PromptPay和DuitNow的互联互通在2024年处理了超过250万笔交易,充分展现了客户对即时本地支付的需求。随着支付基础设施的整合,传统银行面临升级旧版API的压力,否则将面临失去利润丰厚的市场份额,敏捷的新兴企业的风险。这项新的基础设施也将支援小额支付和微额保险,从而拓展其在东南亚地区的应用场景。

抗量子创新基金加速竞争优势

新加坡金融管理局(MAS)将透过其金融系统技术计画(FSTI)3.0,为实施抗量子加密技术和基于人工智慧的风险分析的计划提供高达50%的共同资助。这项津贴将降低中型金融科技公司的资本投资门槛,并使其能够在监管要求之前加强网路安全基础设施建设。网路技术韧性专家小组(CTREX)的合作将确保从微软、亚马逊和谷歌云端等公司获取知识,使国内标准与全球最佳实践接轨。领先采用者已在试点可抵御Shor演算法攻击的量子安全支付通讯协定,从而确保在后量子密码技术成为强制性要求时能够合规。采用量子安全金钥交换的银行将保护高价值资金流动,并使新加坡在安全金融託管方面获得先发优势。从长远来看,量子增强优化可望提高信用风险建模和投资组合再平衡的效率,进而提升整个产业的生产力。

客户获取成本对金融科技公司的收入模式带来压力。

智慧型手机的近乎普及使得潜在基本客群趋于饱和,获取新客户的边际成本持续上升。到2024年,电子钱包註册奖励预算将飙升40%至60%,将使小规模金融科技公司的投资回收期延长至30个月以上。随着消费者更倾向于使用Grab等集网约车、外卖和支付于一体的多功能超级应用,应用饱和进一步降低了行销支出的回报率。这一趋势迫使独立营运商转向嵌入式金融伙伴关係,透过将服务整合到提供者和平台生态系统中来分摊客户获取成本。 B2B2C分销模式也有助于改善单位经济效益。例如,中小企业软体供应商可以整合与发票关联的信用额度,从而将行销成本分摊到多个收入来源。因此,不断上升的客户获取成本起到了一种筛选机制的作用,有利于拥有强大生态系统和差异化知识产权的金融科技公司,而迫使资金匮乏的Start-Ups进行整合或退出市场。

细分市场分析

到2025年,数位支付将占新加坡金融科技市场的26.20%,反映出其在日常交易中的核心地位。在SGQR+互通性、商家软POS机普及以及PayNow区域整合的推动下,预计到2031年,该领域将以16.95%的复合年增长率成长。透过帐户间转帐绕过卡片付款流程,可以降低支付手续费,从而鼓励商家优先考虑QR CODE支付和即时支付。同时,数位借贷领域的替代信用评分虽然成长速度不如支付,但仍持续为零工人员提供快速小额贷款。保险科技公司正在将小额保险嵌入叫车和外带应用程式中,以扩大客户群,而无需用户单独购买保单。 StashAway等财富科技平台正透过低成本ETF投资组合扩大规模,并挑战私人银行在高净值资产领域的地位。新加坡金融管理局(MAS)的监理沙盒支援支付、贷款和保险整合的实验,从而促进提供全面的金融服务。到 2030 年,综合平台预计将处理该国 40% 以上的零售交易金额,使支付成为更广泛的金融科技生态系统的基石。

随着数位钱包业者扩大信用额度和保险附加服务,传统细分市场的界线日益模糊,竞争也愈发激烈。超级应用利用自身消费资料优化信用评估,而现有业者则开放API以维持其在商家支付流程中的地位。因此,新加坡金融科技市场将继续青睐那些能够掌控销售点并为高频支付场景提供高利润附加服务的营运商。监管机构对代币化存款和网路代币化的支持将进一步提升安全性和互联互通的经济效益。随着即时支付基础设施的日趋成熟,支付收入中来自增值数据分析、忠诚度计画和支付服务的比例将逐渐增加,而非单笔交易手续费。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 即时付款基础(PayNow、Project Nexus)的快速普及

- 新加坡金融管理局津贴加速人工智慧和量子金融科技创新

- 跨境电商推动多币种钱包发展

- 纯数位银行牌照开闢了新的细分市场

- ESG和绿色金融指令创造了新的金融科技收入来源

- 小型企业贷款短缺催生了替代贷款平台

- 市场限制

- 激烈的应用程式竞争导致获客成本不断上升。

- 新加坡金融管理局加强了对加密资产和后付款服务的消费者保护条例

- 由于人工智慧/网路安全人才短缺,营运成本(OPEX)增加。

- 互通性和传统核心银行系统整合的障碍

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过服务提案

- 数位支付

- 数字借贷和资金筹措

- 数位投资

- 保险科技

- 新银行

- 最终用户

- 零售

- 公司

- 透过使用者介面

- 行动应用

- 网页/浏览器

- POS/物联网设备

- 按地区

- 中部地区

- 东部地区

- 北部地区

- 东北部地区

- 西部地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Grab Financial Group

- DBS Bank

- OCBC Bank

- UOB Bank

- PayPal Singapore

- Wise

- Stripe Singapore

- Adyen Singapore

- Nium

- Thunes

- FOMO Pay

- Funding Societies

- Validus

- StashAway

- Endowus

- Singlife with Aviva

- Bolttech

- GXS Bank

- Trust Bank

- ANEXT Bank

- Revolut Singapore

第七章 市场机会与未来展望

Singapore fintech market size in 2026 is estimated at USD 13.97 billion, growing from 2025 value of USD 12.05 billion with 2031 projections showing USD 29.22 billion, growing at 15.9% CAGR over 2026-2031.

Strong policy support, deep digital infrastructure, and sustained inflows of private capital keep the Singapore fintech market on a steep expansion path, even as competitive intensity and regulatory scrutiny increase. Market momentum reflects the Monetary Authority of Singapore's (MAS) SGD 100 million (USD 77 million) FSTI 3.0 program, which co-funds quantum-safe cybersecurity and AI-driven risk models, giving early adopters a durable technology lead. Additional uplift comes from Project Nexus-the five-country instant-payment corridor that is scheduled to go live by 2026-which will compress settlement cycles and open new revenue pools for cross-border trade service providers. The Singapore fintech market also benefits from PayNow's growing regional linkages, accelerating demand for multi-currency wallets among SMEs engaged in cross-border e-commerce. At the same time, tightened consumer-protection rules for crypto and buy-now-pay-later (BNPL) products temper near-term revenue growth, prompting business-model pivots toward embedded finance and B2B2C distribution.

Singapore Fintech Market Trends and Insights

Real-Time Payment Rails Transform Settlement Economics

Project Nexus will connect payment rails in Singapore, Malaysia, Thailand, the Philippines, and India by 2026, eliminating the need for nostro accounts and cutting settlement from T+2 to real-time . The shift frees up an estimated USD 120 billion in trapped liquidity and reduces cross-border transaction fees, generating immediate cost savings for merchants and SMEs. Early integrating fintech firms will gain share in B2B trade finance, where real-time settlement unlocks working-capital products tied to shipment milestones. PayNow's bilateral links with PromptPay and DuitNow processed more than 2.5 million transactions in 2024, demonstrating proven customer appetite for instant regional payments. As rails converge, traditional banks must overhaul legacy APIs or risk ceding high-margin corridors to nimble challengers. The new infrastructure also supports micropayments and micro-insurance, widening addressable use cases across Southeast Asia.

Quantum-Ready Innovation Funding Accelerates Competitive Differentiation

Through FSTI 3.0, MAS co-funds up to 50% of projects deploying quantum-resistant encryption and AI-powered risk analytics. The subsidy lowers capex barriers for mid-tier fintechs, enabling them to harden cybersecurity stacks ahead of regulatory mandates. Collaboration inside the Cyber and Technology Resilience Experts (CTREX) panel ensures knowledge transfer from Microsoft, Amazon, and Google Cloud, aligning domestic standards with global best practices. Early movers already test quantum-safe payment protocols that withstand Shor-algorithm attacks, positioning them for compliance once post-quantum cryptography becomes compulsory. Banks adopting quantum-secure key exchange safeguard high-value treasury flows, giving Singapore a first-mover lead in safe-harbor financial hosting. Over the long term, quantum-enhanced optimization may also streamline credit-risk modelling and portfolio rebalancing, boosting sector productivity.

Customer Acquisition Costs Strain Fintech Profitability Models

Nearly universal smartphone ownership produces a saturated addressable base, making marginal customer wins increasingly expensive. Incentive budgets for e-wallet sign-ups ballooned by 40-60% in 2024, pushing payback periods for small fintechs beyond 30 months. App fatigue further erodes return on marketing spend because consumers prefer multifunction super-apps such as Grab, which bundle ride-hailing, food delivery, and payments. The trend forces standalone providers to pivot toward embedded-finance partnerships, integrating services into merchant or platform ecosystems to share acquisition costs. B2B2C distribution also improves unit economics; SME software vendors, for example, can embed invoicing-linked credit lines, spreading marketing costs across multiple revenue streams. Elevated acquisition costs therefore act as a filtering mechanism, rewarding fintechs with strong ecosystems or differentiated IP, while pushing under-capitalized startups to consolidate or exit.

Other drivers and restraints analyzed in the detailed report include:

- Cross-Border E-Commerce Growth Drives Multi-Currency Innovation

- Digital Banking Licenses Create Niche Market Opportunities

- Regulatory Tightening Constrains High-Growth Fintech Segments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, digital payments accounted for 26.20% of the Singapore fintech market size, reflecting their central role in day-to-day commerce. The segment is on track to expand at a 16.95% CAGR through 2031, propelled by SGQR+ interoperability, merchant SoftPOS adoption, and PayNow's regional links. Card-rail bypass via account-to-account transfers reduces interchange fees, encouraging merchants to prioritize QR and instant payments. Meanwhile, alternative credit scoring in digital lending continues to unlock quick-turnaround microloans for gig workers, albeit at a slower growth than payments. Insurtech firms embed bite-sized coverage within ride-hailing and delivery apps, widening reach without requiring stand-alone policy purchases. Wealth-tech platforms such as StashAway scale on low-cost ETF portfolios, challenging private banks for mass-affluent assets. MAS's regulatory sandbox supports experiments that bundle payments, lending, and insurance, fostering holistic financial offerings. By 2030, integrated platforms are expected to direct more than 40% of domestic retail transaction value, cementing payments as the linchpin of broader fintech ecosystems.

Competition intensifies as digital-wallet providers extend credit lines and insurance add-ons, blurring traditional segment boundaries. Super-apps leverage first-party consumption data to refine underwriting, while incumbents open APIs to retain relevance within merchant checkout flows. The Singapore fintech market, therefore, continues to reward providers that control the point of sale and can layer higher-margin, add-on services onto high-frequency payment use cases. Regulatory support for tokenized deposits and network tokenization further improves security and interchange economics. As real-time rails mature, payments revenue will increasingly derive from value-added data analytics, loyalty, and payment services rather than per-transaction fees.

The Singapore Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending & Financing, Digital Investments, Insurtech, Neobanking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (Central Region, East Region, North Region, North-East Region, West Region). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Grab Financial Group

- DBS Bank

- OCBC Bank

- UOB Bank

- PayPal Singapore

- Wise

- Stripe Singapore

- Adyen Singapore

- Nium

- Thunes

- FOMO Pay

- Funding Societies

- Validus

- StashAway

- Endowus

- Singlife with Aviva

- Bolttech

- GXS Bank

- Trust Bank

- ANEXT Bank

- Revolut Singapore

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid real-time payment rail adoption (PayNow, Project Nexus)

- 4.2.2 MAS grants spurring AI & quantum-ready fintech innovation

- 4.2.3 Cross-border e-commerce fueling multi-currency wallets

- 4.2.4 Digital-only banking licences opening new niches

- 4.2.5 ESG & green-finance mandates creating new fintech revenue pools

- 4.2.6 SME credit gap boosting alternative lending platforms

- 4.3 Market Restraints

- 4.3.1 High customer-acquisition costs amid intense app competition

- 4.3.2 Tightened MAS consumer-protection rules on crypto & BNPL

- 4.3.3 Talent shortages in AI / cybersecurity raising OPEX

- 4.3.4 Interoperability & legacy core-bank integration hurdles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending & Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Geography

- 5.4.1 Central Region

- 5.4.2 East Region

- 5.4.3 North Region

- 5.4.4 North-East Region

- 5.4.5 West Region

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Grab Financial Group

- 6.4.2 DBS Bank

- 6.4.3 OCBC Bank

- 6.4.4 UOB Bank

- 6.4.5 PayPal Singapore

- 6.4.6 Wise

- 6.4.7 Stripe Singapore

- 6.4.8 Adyen Singapore

- 6.4.9 Nium

- 6.4.10 Thunes

- 6.4.11 FOMO Pay

- 6.4.12 Funding Societies

- 6.4.13 Validus

- 6.4.14 StashAway

- 6.4.15 Endowus

- 6.4.16 Singlife with Aviva

- 6.4.17 Bolttech

- 6.4.18 GXS Bank

- 6.4.19 Trust Bank

- 6.4.20 ANEXT Bank

- 6.4.21 Revolut Singapore

7 Market Opportunities & Future Outlook

- 7.1 Embedded finance in non-financial super-apps

- 7.2 Green fintech solutions for carbon-credit trading