|

市场调查报告书

商品编码

1911497

义大利公路货运:市场占有率分析、产业趋势与统计、成长预测(2026-2031 年)Italy Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

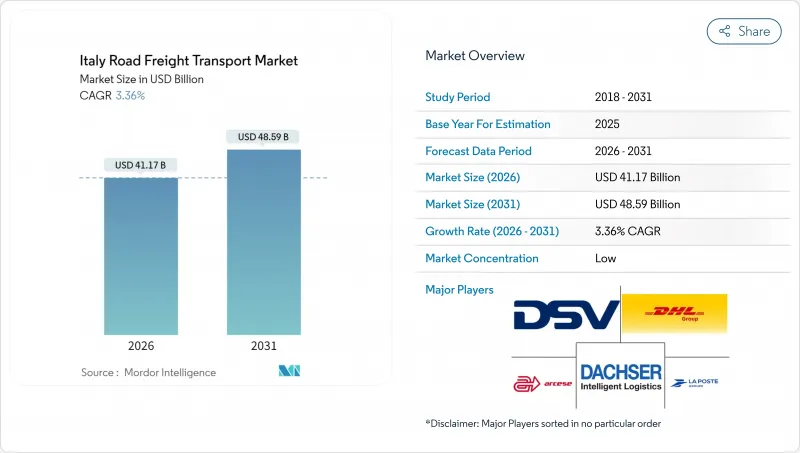

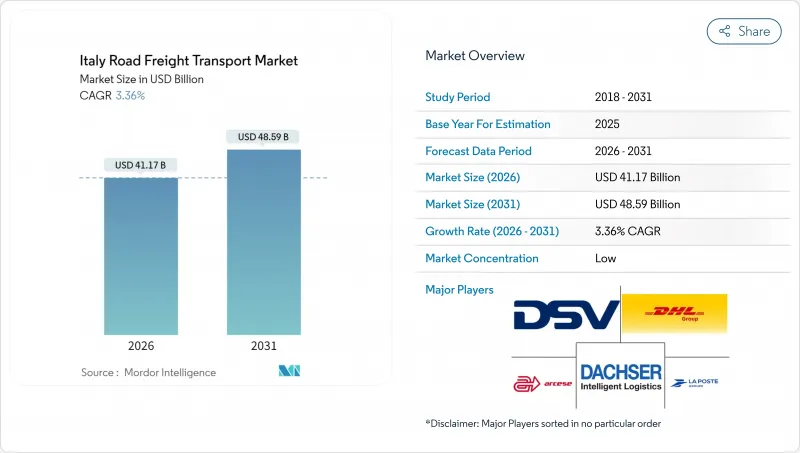

预计到 2026 年,义大利公路货运市场规模将达到 411.7 亿美元,高于 2025 年的 398.3 亿美元。

预计到 2031 年,该市场规模将达到 485.9 亿美元,2026 年至 2031 年的复合年增长率为 3.36%。

儘管2025年第二季GDP季减0.1%,但电子商务交易量的成长、出口导向製造业的逐步復苏以及欧盟基础建设资金的投入,支撑了市场需求。国内货运量仍占63.94%的份额,而随着义大利充分利用其在泛欧交通网络(TEN-T)上的门户地位,国际货运线路的成长速度更快。该网络的建设得益于欧洲投资银行(EIB)提供的18亿欧元(19.8亿美元)贷款。 DSV于2025年4月以143亿欧元(157.8亿美元)收购DB Schenker,重组了整个产业,并重塑了竞争格局。人工智慧路线优化、车辆电气化以及氢化植物油(HVO)的应用等技术进步,正在推动同步创新,使技术驱动型运输公司能够更好地掌握义大利公路货运市场的新机会。

义大利公路货运市场趋势与洞察

电子商务和最后一公里需求激增

义大利电子商务的快速成长正在推动结构性变革,全通路零售商将大量小包裹推向人口密集的城市网路。因此,批发和零售领域预计将实现最快成长,2025年至2030年的复合年增长率将达到4.14%。义大利邮政(Poste Italiane)引进了27,900辆低排放车辆,并扩建了其位于皮亚琴察和卡塞塔的枢纽,以提高小包裹处理能力。 DHL透过其「Locker Italia」计画扩大了配送网络,以满足激增的取货和派送需求。罗马的一项试点计画将自动驾驶机器人与公共运输结合,使最后一公里配送成本降低了7.5%。随着零售商寻求提高取件效率以缓解交通拥堵并遵守排放法规,这些趋势正在加速对小型包裹递送服务的需求。

新冠疫情后製造业出口復苏

儘管2025年3月工业生产下降了1.8%,但义大利的高附加价值产业已重拾成长动能。 2024年,食品出口成长9.8%,药品出口成长9.5%,推动了温控货物的运输量成长。国家復苏与韧性计画将在2025年至2026年间向物流基础建设投入1,000亿欧元(约1,103.6亿美元),以增强出口竞争力。因此,随着工厂海外订单的恢復,2025年至2030年间,国际运输走廊的复合年增长率预计将达到4.14%。货物结构正向高价值、时效性货物转变,使得拥有合规专业知识和现代化车队的承运商更具优势。

司机短缺和劳动力老化

目前约有17,000个司机空缺职位,其中45%的司机年龄超过50岁,这限制了高峰期的车辆运转率。这种情况在北部地区尤其严重,这些地区的工厂出货量不断增加,但司机职位却越来越难抢。计划于2024年实施的3-4%的薪资成长尚未吸引到足够的新人加入。欧盟的培训规定延长了获得资格所需的时间,而建设业和酒店业等生活方式不同的行业则吸引了更多潜在人才。运输公司正在透过提供签约奖金、灵活的工作时间表以及引入车载技术来减少疲劳并提高员工留任率,以应对这项挑战。

细分市场分析

儘管製造业销售额下降了3.4%,但到2025年,製造业仍维持了义大利公路货运市场34.12%的份额。预计2026年至2031年间,与製造业相关的义大利公路货运市场规模将以温和的复合年增长率成长,因为生产商将优先发展药品和特色食品等高附加价值出口产品。批发和零售是成长最快的终端用户,预计2026年至2031年间的复合年增长率将达到4.02%,这主要得益于电子商务和全通路分销策略的推动,这些策略提高了小包裹的配送量。

专业货运领域的利润率正在提升:温控药品和食品运输利用GDP标准和HACCP合规性来确保溢价。由于税收优惠政策结束后住宅需求下降,建筑需求疲软,但公共基础设施项目支撑了部分货运量。在农业、渔业和林业领域,地中海产品的北向货运量保持稳定,而石油、天然气、采矿和采石业的货运量则因炼油量下降而萎缩。 DHL等物流供应商正将其业务转向生命科学和能源领域,以实现收入多元化。

国内路线在密集的国内消费走廊的支持下,占义大利公路货运市场规模的 63.55%(2025 年)。然而,随着托运人利用不断加强的阿尔卑斯山运输网络和不断增长的对美国贸易顺差(2024 年达到 347 亿欧元(382.9 亿美元)),预计 2026 年至 2031 年国际货运量将以 4.03% 的复合年增长率增长。

跨境运输业务可能会因电子海关标记法规 (e-CMR) 和通行费调整而面临更高的合规成本,但每公里盈利也将随之提高。 DSV 收购 DB Schenker 将提升网路密度,为托运人提供无缝衔接的跨阿尔卑斯山运输网路。国内货运的优点包括可预测的班次和更少的文书工作,但运输公司必须适应都市区排放法规以及车队更新的需求。

截至2025年,整车运输服务将占义大利公路货运市场的81.92%,这反映了直飞路线的成本优势。随着电子商务的碎片化加剧托盘货物的运输,预计2026年至2031年零担货运(LTL)的价值将以3.82%的复合年增长率增长。因此,在人工智慧路线规划的助力下,零担货运在义大利公路货运市场的份额将在2031年之前逐步提升。人工智慧路线规划能够即时匹配货源和回程传输货源。

儘管面临司机短缺和道路交通事故成本上升的挑战,但随着製造业的復苏,整车运输 (FTL) 营运商仍将保持稳定的运转率。零担运输 (LTL) 营运商将投资于枢纽辐射取货效率、物联网追踪系统和 API 集成,以满足零售商的次日达需求。随着中型承运商寻求透过共用网路和数位化调度平台获得成本优势,产业整合将加速进行。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 按经济活动分類的GDP分配

- 按经济活动分類的GDP成长

- 经济表现及概况

- 电子商务产业的趋势

- 製造业趋势

- 运输和仓储业部门的GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输营运成本

- 卡车运输车队规模(按类型)

- 主要卡车供应商

- 公路货运量趋势

- 公路货运价格趋势

- 透过交通方式分享

- 通货膨胀

- 法律规范

- 价值炼和通路分析

- 市场驱动因素

- 电子商务和最后一公里需求激增

- 感染疾病后製造业出口的復苏

- 欧盟资助的道路和桥樑大型企划

- OEM车辆现代化改造及HVO(先进柴油机油)的应用

- AI优化的空置回程传输替换

- 适用于阿尔卑斯走廊的OEM可更换电池卡车

- 市场限制

- 驾驶人和劳动力老化

- 柴油和电力价格

- 边境电子CMR资料合规成本

- 义大利南部桥樑荷载等级降级

- 市场创新

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 终端用户产业

- 农业、渔业、林业

- 建造

- 製造业

- 石油天然气、采矿和采石

- 批发和零售

- 其他的

- 目的地

- 国内的

- 国际的

- 卡车装载规范

- 整车运输 (FTL)

- 零担货运 (LTL)

- 货柜运输

- 货柜运输

- 非货柜运输

- 距离

- 长途

- 短程交通

- 货物类型

- 液体货物

- 固态货物

- 温度控制

- 非温控型

- 温度控制

第六章 竞争情势

- 市场集中度

- 关键策略倡议

- 市占率分析

- 公司简介

- Alpina Italiana SpA

- Arcese Trasporti SpA

- DACHSER

- DHL Group

- DSV A/S(Including DB Schenker)

- Fercam SpA(FERCAM HOLDING Srl)

- Fiege Logistics

- GEODIS

- Girteka

- Gruppo Di Martino

- Kuehne+Nagel

- La Poste Group(Including BRT)

- Lannutti Group

- Number 1 Logistics Group SpA

- Poste Italiane

- Raben Group

- Savino Del Bene

- STEF Group

- Transmec Group

- United Parcel Service of America, Inc.(UPS)

第七章 市场机会与未来展望

Italy road freight transport market size in 2026 is estimated at USD 41.17 billion, growing from 2025 value of USD 39.83 billion with 2031 projections showing USD 48.59 billion, growing at 3.36% CAGR over 2026-2031.

Rising e-commerce volumes, a gradual rebound in export-oriented manufacturing, and European Union infrastructure funding underpin demand even as GDP slipped 0.1% quarter-over-quarter in Q2 2025. Domestic freight retains a 63.94% share, yet international corridors grow faster as Italy maximizes its gateway role along TEN-T routes upgraded through a EUR 1.8 billion (USD 1.98 billion) EIB facility. Consolidation reshapes the competitive field after DSV closed the EUR 14.3 billion (USD 15.78 billion) DB Schenker acquisition in April 2025. Parallel advances in AI-enabled routing, fleet electrification, and hydrotreated vegetable oil (HVO) adoption position technology-centric carriers to capture emerging opportunities across the Italy road freight transport market.

Italy Road Freight Transport Market Trends and Insights

Surge in E-Commerce and Last-Mile Demand

Italy's e-commerce boom propels structural change as omnichannel retailers push parcel volumes into dense urban networks. Wholesale and retail trade therefore record the fastest segment growth at a 4.14% CAGR between 2025-2030. Poste Italiane deployed 27,900 low-emission vehicles and expanded its Piacenza and Caserta hubs to boost parcel capacity. DHL strengthened reach via the Locker Italia venture, capturing pickup-drop-off demand spikes. A Rome pilot combining autonomous robots with public transit cut last-mile costs by 7.5%. These dynamics accelerate less-than-truck-load service uptake as retailers seek consolidation to relieve congestion and emissions limits.

Manufacturing Export Rebound Post-COVID

Despite a 1.8% industrial production dip in March 2025, Italy's high-value subsectors regained momentum. Food exports grew 9.8% and pharmaceuticals 9.5% in 2024, lifting temperature-controlled freight volumes. The National Recovery and Resilience Plan channels EUR 100 billion (USD 110.36 billion) into logistics upgrades that sharpen export competitiveness over 2025-2026. International corridors consequently show a 4.14% CAGR (2025-2030) as plants restore overseas orders. Cargo mix shifts toward higher-value and time-sensitive loads that reward carriers with compliance expertise and modern fleets.

Driver Shortage and Aging Workforce

Vacancies stand near 17,000 and 45% of drivers are older than 50, capping fleet availability at peak periods. Northern regions feel the pinch most acutely as factories ramp shipments yet struggle to schedule outbound slots. Wage increases of 3-4% failed to draw sufficient entrants during 2024. EU training mandates lengthen qualification timelines, while lifestyle alternatives in construction and services lure potential recruits. Carriers respond with signing bonuses, modular schedules, and in-cab technology that lowers fatigue to stabilize retention.

Other drivers and restraints analyzed in the detailed report include:

- EU-Funded Road-Bridge Megaproject Pipeline

- OEM Fleet Modernization and HVO Adoption

- Diesel and Power Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing maintained a 34.12% share of the Italy road freight transport market in 2025 despite a 3.4% sector turnover decline that year. The Italy road freight transport market size attached to manufacturing is expected to expand at a muted CAGR from 2026-2031 as producers prioritize value-added exports such as pharmaceuticals and specialty foods. Wholesale and retail trade is the fastest-growing end user, registering a 4.02% CAGR between 2026-2031, buoyed by e-commerce and omnichannel distribution strategies that intensify parcel flows.

Specialized freight niches fortify margins: temperature-controlled hauls for drugs and food leverage GDP and HACCP compliance to secure premiums. Construction demand lags amid residential weakness following tax incentive withdrawal, yet public infrastructure works provide offsetting volume. Agriculture, fishing, and forestry maintain steady northbound flows of Mediterranean produce, while oil, gas, mining, and quarrying shipments retreat alongside refining throughput. Logistics providers such as DHL pivot to life sciences and energy segments to defend revenue diversity.

Domestic lanes accounted for 63.55% of the Italy road freight transport market size in 2025, supported by dense internal consumption corridors. International freight, however, posts a 4.03% CAGR between 2026-2031 as carriers exploit upgraded Alpine links and growing U.S. trade surpluses totaling EUR 34.7 billion (USD 38.29 billion) in 2024.

Cross-border operations experience higher compliance costs from e-CMR and toll changes but benefit from superior yield per kilometer. DSV's acquisition of DB Schenker broadens network density, offering shippers seamless trans-Alpine coverage. Domestic freight advantages include predictable scheduling and lower paperwork, yet carriers must adapt to urban emissions caps that raise fleet upgrade necessities.

Full-truck-load services represented 81.92% of the Italy road freight transport market in 2025, reflecting direct-route cost advantages. Less-than-truck-load values are forecast to rise at 3.82% CAGR (2026-2031) as e-commerce fragmentation increases palletized movements. The Italy road freight transport market share for LTL therefore climbs gradually through 2031, buoyed by AI routing that matches loads and backhauls in real time.

FTL carriers battle driver scarcity and rising road tolls but leverage manufacturing rebound for steady outbound utilization. LTL providers invest in hub-and-spoke consolidation, IoT tracking, and API integrations to satisfy retailers' next-day expectations. Consolidation accelerates as mid-tier fleets seek cost advantage via shared networks and digital dispatch platforms.

The Italy Road Freight Transport Market Report is Segmented by End User Industry (Manufacturing, and More), Destination (Domestic and International), Truckload Specification (FTL and LTL), Distance (Long Haul and Short Haul), Goods Configuration (Fluid Goods and Solid Goods), Temperature Control (Non-Temperature and Temperature Controlled), and by Containerization. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alpina Italiana SpA

- Arcese Trasporti SpA

- DACHSER

- DHL Group

- DSV A/S (Including DB Schenker)

- Fercam SpA (FERCAM HOLDING Srl)

- Fiege Logistics

- GEODIS

- Girteka

- Gruppo Di Martino

- Kuehne+Nagel

- La Poste Group (Including BRT)

- Lannutti Group

- Number 1 Logistics Group SpA

- Poste Italiane

- Raben Group

- Savino Del Bene

- STEF Group

- Transmec Group

- United Parcel Service of America, Inc. (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 GDP Distribution by Economic Activity

- 4.3 GDP Growth by Economic Activity

- 4.4 Economic Performance and Profile

- 4.4.1 Trends in E-Commerce Industry

- 4.4.2 Trends in Manufacturing Industry

- 4.5 Transport and Storage Sector GDP

- 4.6 Logistics Performance

- 4.7 Length of Roads

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Pricing Trends

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Road Freight Tonnage Trends

- 4.15 Road Freight Pricing Trends

- 4.16 Modal Share

- 4.17 Inflation

- 4.18 Regulatory Framework

- 4.19 Value Chain and Distribution Channel Analysis

- 4.20 Market Drivers

- 4.20.1 Surge in -E-Commerce and Last-mile Demand

- 4.20.2 Manufacturing Export Rebound Post-COVID

- 4.20.3 EU-funded Road-bridge Megaproject Pipeline

- 4.20.4 OEM Fleet Modernisation and HVO Adoption

- 4.20.5 AI-optimised Empty-backhaul Exchanges

- 4.20.6 OEM Battery-swap Trucks for Alpine Corridors

- 4.21 Market Restraints

- 4.21.1 Driver Shortage and Ageing Workforce

- 4.21.2 Diesel and Power Prices

- 4.21.3 Border E-CMR Data-compliance Costs

- 4.21.4 Bridge Load-class Downgrades in South Italy

- 4.22 Technology Innovations in the Market

- 4.23 Porter's Five Forces Analysis

- 4.23.1 Threat of New Entrants

- 4.23.2 Bargaining Power of Buyers

- 4.23.3 Bargaining Power of Suppliers

- 4.23.4 Threat of Substitutes

- 4.23.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Alpina Italiana SpA

- 6.4.2 Arcese Trasporti SpA

- 6.4.3 DACHSER

- 6.4.4 DHL Group

- 6.4.5 DSV A/S (Including DB Schenker)

- 6.4.6 Fercam SpA (FERCAM HOLDING Srl)

- 6.4.7 Fiege Logistics

- 6.4.8 GEODIS

- 6.4.9 Girteka

- 6.4.10 Gruppo Di Martino

- 6.4.11 Kuehne+Nagel

- 6.4.12 La Poste Group (Including BRT)

- 6.4.13 Lannutti Group

- 6.4.14 Number 1 Logistics Group SpA

- 6.4.15 Poste Italiane

- 6.4.16 Raben Group

- 6.4.17 Savino Del Bene

- 6.4.18 STEF Group

- 6.4.19 Transmec Group

- 6.4.20 United Parcel Service of America, Inc. (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment