|

市场调查报告书

商品编码

1537738

全球快递与包裹市场(2024年)Global Express and Small Parcels 2024 |

||||||

价格

简介目录

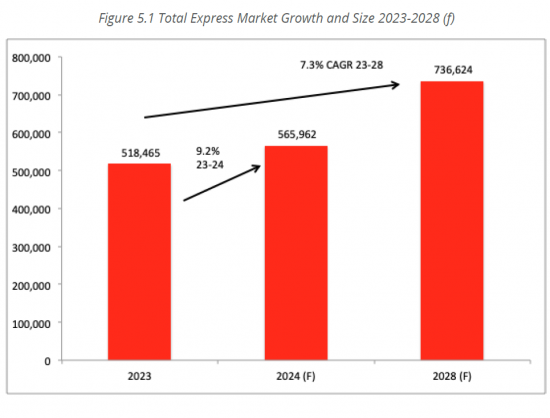

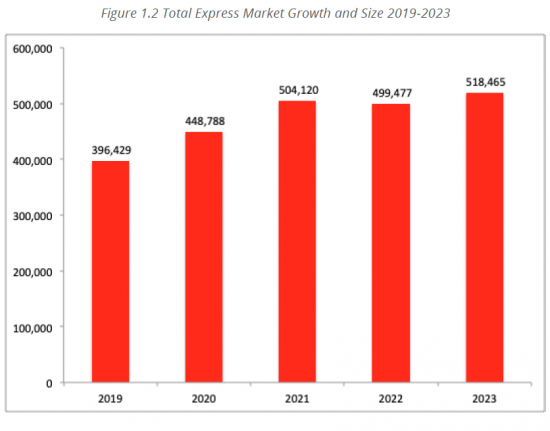

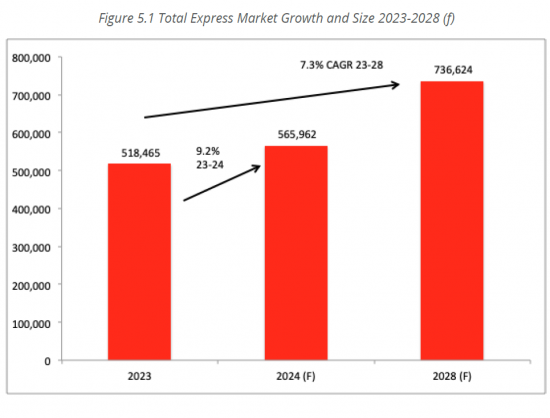

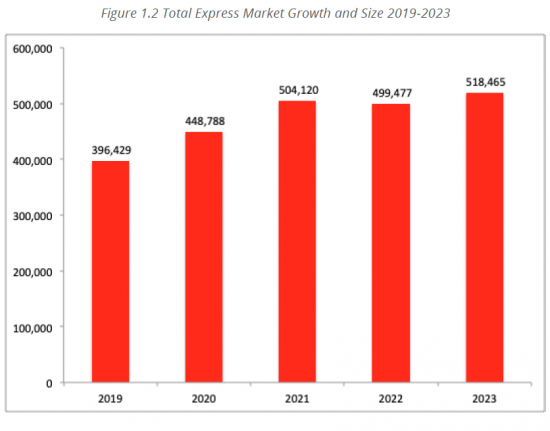

2023年全球快递/包裹市场规模将成长3.8%,2024年将成长9.2%。

范例视图

主要资料和洞察

- 2024年全球快递市场将成长9.2%。

- 2023年全球包裹投递数量增加了6.4%。

- 国内在2023年占80%市场,但国际市场成长较快。

- 到2023年,B2C 将占整个市场的59.4%,并将在到2028年未来五年继续成长61.3%。

- UPS、Fedex 和 DHL以收入计算是最大的包裹承运商。

- 数位零售改变市场,凸显了物流供应商适应不断变化的市场动态的强烈需求。

- 将包裹从郊区仓库运送到送货区解决 "stem mileage" 问题是电动货运自行车的主要经济优势是其中之一其中。

本报告调查全球快递和包裹市场,提供了解市场动态和机会所需的见解和资料,包括市场规模和预测、电子商务市场趋势和竞争格局。

目录

第1章 估算市场规模

- 世界

- 国内和国际

- B2B 和 B2C

- 北美

- 国内和国际

- B2B 和 B2C

- 亚太地区

- 国内和国际

- B2B 和 B2C

- 欧洲

- 国内和国际

- B2B 和 B2C

- 数量分析

- 世界

- 数量:依地区

第2章 市场趋势

- 欧洲的包裹储物柜:主要公司

- InPost

- Geopost

- Royal Mail/GLS

- DHL

- Amazon

- 众包交付和欧盟法规

- 电动轻型商用车:全球 LSP 的使用与采用

- 中国

- 欧洲

- 美国/北美

- 美国和欧盟对中国电动车製造商的贸易制裁

- 城市最后一哩配送的电动货运自行车

第3章 竞争态势

- 前 10 名的供应商

- 收入

- 数量

- 整合商的比较审查

- 国际收入

- 国际息税前利润率

- 国际数量成长

- 每件国际收入

- 地面操作

第4章 简介

- UPS

- Fedex

- Royal Mail (and GLS)

- La Poste (and DPD)

- Yamato

- Sagawa

- SF Express

- Yunda Express

- YTO Express

- ZTO Express

- STO Express

- DHL

- USPS

第5章 市场预测

- 世界

- 国内和国际

- B2B 和 B2C

- 北美

- 国内和国际

- B2B 和 B2C

- 亚太地区

- 国内和国际

- B2B 和 B2C

- 欧洲

- 国内和国际

- B2B 和 B2C

- 数量分析

简介目录

Detailed analysis of express logistics market size and forecast data, competitive landscape analysis and parcel volume data.

Global express & parcels market grows 3.8% in 2023, and is forecast to grow 9.2% in 2024. Global parcel delivery volume growth recovered in 2023, growing by 6.4%. Ti's new report provides the insight and data you need to understand market dynamics and opportunities.

SAMPLE VIEW

What does the report contain?

- Market size and forecast data for 2023, 2024 and out to 2028, split by region, country, domestic, international & B2B/B2C.

- Volume data & forecasts for 2023, 2024 & out to 2028.

- Market segmentation - domestic vs international & B2B v B2C.

- e-commerce market trend analysis including key parcel locker players, crowdsourcing & EU regulations, electric light commercial vehicles & e-cargo bikes in urban last mile delivery.

- Competitive landscape Top 10 analysis - revenues, & parcel volumes & integrator comparative review.

- Express provider profiles & comparative analysis.

Key Data & Insights:

- In 2024 the global express market will grow 9.2%.

- Global parcel delivery volumes grew 6.4% in 2023.

- Domestic accounted for 80% of the market in 2023, but the international market is growing at a faster rate.

- B2C accounted for 59.4% of the total market in 2023, and is expected to grow 61.3% over the next 5 years to 2028.

- UPS, Fedex and DHL are the largest parcel carriers by revenue.

- Digital retail is transforming the market and highlighting the need for logistics providers to adapt to evolving market dynamics.

- Tackling 'stem mileage' - getting parcels from a suburban depot to the delivery zone - is one of the key economic advantages of e-cargo bikes.

Table of Contents

1. Market Sizing

- 1.1. Global

- 1.1.1. Domestic and International

- 1.1.2. B2B and B2C

- 1.2. North America

- 1.2.1. Domestic and International

- 1.2.2 B2B and B2C

- 1.3. Asia Pacific

- 1.3.1. Domestic and International

- 1.3.2. B2B & B2C

- 1.4. Europe

- 1.4.1. Domestic and International

- 1.4.2. B2B & B2C

- 1.5. Volume Analysis

- 1.5.1. Global

- 1.5.2. Volume by Region

2. Market Trends

- 2.1. Parcel Lockers in Europe: Key Players

- 2.1.1. InPost

- 2.1.2. Geopost

- 2.1.3. Royal Mail/GLS

- 2.1.4. DHL

- 2.1.5. Amazon

- 2.2. Crowdsourcing Delivery and EU Regulations

- 2.3. Electric Light Commercial Vehicles: Global LSP Uses and Uptake

- 2.3.1. China

- 2.3.2. Europe

- 2.3.3. US/North America

- 2.3.4. US/EU trade sanctions against China EV OEMs

- 2.4. E-cargo Bikes in Urban Last Mile Delivery

3. Competitive Landscape

- 3.1. Top 10 Providers

- 3.1.1. Revenue

- 3.1.2. Volume

- 3.2. Integrator Comparative Review

- 3.2.1. International Revenue

- 3.2.2. International EBIT Margin

- 3.2.3. International Volume Growth

- 3.2.4. International Revenue per Piece

- 3.2.5. Ground Operations

4. Profiles

- 4.1. UPS

- 4.2. Fedex

- 4.3. Royal Mail (and GLS)

- 4.4. La Poste (and DPD)

- 4.5. Yamato

- 4.6. Sagawa

- 4.7. SF Express

- 4.8. Yunda Express

- 4.9. YTO Express

- 4.10. ZTO Express

- 4.11. STO Express

- 4.12. DHL

- 4.13. USPS

5. Market Forecast

- 5.1. Global

- 5.1.1. Domestic and International

- 5.1.2. B2B and B2C

- 5.2. North America

- 5.2.1. Domestic and International

- 5.2.2. B2B and B2C

- 5.3. Asia Pacific

- 5.3.1. Domestic and International

- 5.3.2. B2B & B2C

- 5.4. Europe

- 5.4.1. Domestic and International

- 5.4.2. B2B & B2C

- 5.5. Volume Analysis

- 5.5.1. Global

02-2729-4219

+886-2-2729-4219