|

市场调查报告书

商品编码

1477224

半导体设备市场,按产品类型、按应用、按设备、按最终用途行业、按地理位置Semiconductor Equipment Market, By Product Type, By Application, By Equipment, By End-use Industry, By Geography |

||||||

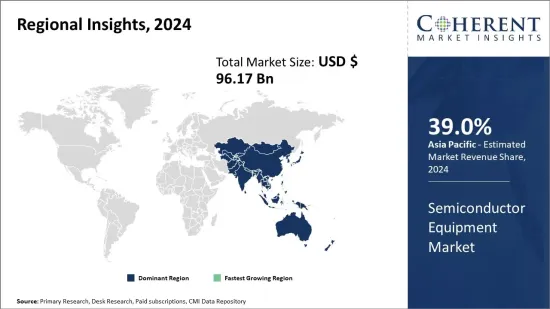

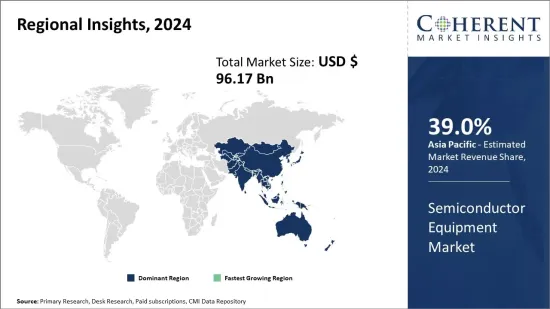

预计2024年全球半导体设备市值为961.7亿美元,预估至2031年将达1,796.3亿美元,2024年至2031年年复合成长率(CAGR)为9.3%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年: | 2023年 | 2024 年市场规模: | 961.7 亿美元 |

| 历史数据: | 2019年至2023年 | 预测期: | 2024年至2031年 |

| 预测 2024 年至 2031 年复合年增长率: | 9.30% | 2031 年价值预测: | 1796.3 亿美元 |

由于人工智慧、5G网路、扩增实境、自动驾驶汽车的进步,全球半导体设备市场在过去几年中出现了显着成长。半导体设备是指用于製造积体电路(IC)和微晶片等半导体的机械。其中包括蚀刻设备、沉积设备、清洁设备和离子注入设备等。

随着消费性电子、汽车、工业自动化等行业技术的快速进步以及对智慧技术的需求不断增加,对半导体的需求呈指数级增长。这增加了对大规模半导体製造的先进半导体设备的需求。主要参与者和政府增加对发展国内半导体生态系统的投资预计将在预测期内推动半导体设备市场的成长。

全球半导体设备市场-动态。

推动半导体设备市场的关键驱动因素包括对智慧型手机、笔记型电脑和平板电脑等消费性电子产品的需求不断增长,以及各行业越来越多地采用物联网和互联设备。此外,製造业和其他行业对自动化的需求不断增长,增加了对半导体积体电路的需求,从而促进了半导体设备的采购。

然而,采购和维护半导体设备所需的高额初始投资仍然是该领域新兴企业和中小企业面临的主要挑战。大宗商品价格波动和地缘政治风险增加了半导体设备製造商供应链的不确定性。

全球对 5G 基础设施开发和 5G 网路部署的日益关注带来了利润丰厚的成长机会。此外,全球无晶圆厂晶片设计能力的扩张以及晶片製造外包的增加预计将增加半导体设备供应商的市场机会。

研究的主要特点:

- 该报告对全球半导体设备市场进行了深入分析,并提供了以2023年为基准年的预测期(2024-2031)的市场规模和年复合成长率(CAGR%)。

- 它阐明了不同细分市场的潜在收入机会,并解释了该市场有吸引力的投资主张矩阵。

- 这项研究还提供了有关市场驱动因素、限制因素、机会、新产品发布或批准、市场趋势、区域前景以及主要参与者采取的竞争策略的重要见解。

- 它根据以下参数描述了全球半导体设备市场的主要参与者——公司亮点、产品组合、主要亮点、财务表现和策略。

- 该报告的见解将使行销人员和公司管理当局能够就未来的产品发布、类型升级、市场扩张和行销策略做出明智的决策。

- 全球半导体设备市场报告迎合了该行业的各个利益相关者,包括投资者、供应商、产品製造商、分销商、新进业者和财务分析师。

- 利害关係人可以透过用于分析全球半导体设备市场的各种策略矩阵轻鬆做出决策。

第一章:研究目标与假设

- 研究目标

- 假设

- 缩写

第 2 章:市场范围

- 报告说明

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map (COM)

第 3 章:市场动态、法规与趋势分析

- 市场动态

- 司机

- 限制

- 机会

- 影响分析

- 主要亮点

- 监管场景

- 产品发布/批准

- PEST分析

- 波特的分析

- 併购场景

第 4 章:全球半导体设备市场 - 冠状病毒 (COVID-19) 大流行的影响

- COVID-19 流行病学

- 供给面和需求面分析

- 经济影响

第 5 章:2019-2031 年全球半导体设备市场(依产品类型)

- 介绍

- 半导体前端设备

- 半导体后端设备

第 6 章:2019-2031 年全球半导体设备市场(按应用)

- 介绍

- 分离式半导体

- 光电器件

- 感应器

- 积体电路

第 7 章:全球半导体设备市场,依设备划分,2019-2031 年

- 介绍

- 晶圆加工

- 组装与包装

- 检测设备

第 8 章:2019-2031 年全球半导体设备市场(依最终用途产业)

- 介绍

- 件

- 智慧型手机

- 电视机组装和包装

第 9 章:2019-2031 年全球半导体设备市场(按地区)

- 介绍

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 东协

- 澳洲

- 韩国

- 亚太地区其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 海湾合作委员会国家

- 中东和非洲其他地区

第 10 章:竞争格局

- 公司简介

- Applied Materials Inc.

- ASML

- Nordson Corporation

- Cohu, Inc.

- Lam Research Corporation

- Tokyo Electron Limited

- KLA-Tencor Corporation

- Teradyne Inc.

- ASM International NV

- Nikon Corporation

- Canon Inc.

- BE Semiconductor Industries NV (Besi)

- Veeco Instruments Inc.

- Rudolph Technologies, Inc.

- Onto Innovation Inc.

- Ultratech, Inc.

- Nova Measuring Instruments Ltd.

- Mycronic AB

- SPTS Technologies Ltd.

第 11 章:分析师建议

- 命运之轮

- 分析师观点

- 连贯的机会图

第 12 章:部分:

- 研究方法论

- 关于我们

Global semiconductor equipment market is estimated to be valued at US$ 96.17 Bn in 2024 and is expected to reach US$ 179.63 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 9.3% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 96.17 Bn |

| Historical Data for: | 2019 to 2023 | Forecast Period: | 2024 to 2031 |

| Forecast Period 2024 to 2031 CAGR: | 9.30% | 2031 Value Projection: | US$ 179.63 Bn |

Global semiconductor equipment market has been witnessing significant growth over the past few years due to Advancements in artificial intelligence, 5G networks, augmented reality, autonomous vehicles. Semiconductor equipment refers to the machinery used for manufacturing of semiconductors such as integrated circuits (ICs) and microchips. These include etching equipment, deposition equipment, cleaning equipment, and ion implantation equipment, among others.

With rapid technological advancements across industries such as consumer electronics, automotive, industrial automation and increasing demand for smart technologies, the demand for semiconductors is growing exponentially. This boosts the need for advanced semiconductor equipment for large scale manufacturing of semiconductors. Increasing investments by key players as well as governments towards developing domestic semiconductor ecosystem is expected to boost the semiconductor equipment market growth during the forecast period.

Global Semiconductor Equipment Market- Dynamics

The key drivers propelling the semiconductor equipment market include growing demand for consumer electronics such as smartphones, laptops and tablets coupled with increasing adoption of IoT and connected devices across industries. Furthermore, rising need for automation across manufacturing and other sectors has boosted demand for semiconductor ICs, and this boostssemiconductor equipment procurement.

However, high initial investments required for procurement and maintenance of semiconductor equipment remains a key challenge for emerging players as well as small and medium enterprises in this space. Volatile commodity prices and geopolitical risks add to supply chain uncertainties for semiconductor equipment manufacturers.

Increasing focus towards development of 5G infrastructure and deployment of 5G networks worldwide presents lucrative growth opportunities. Moreover, expansion of fabless chip design capabilities globally and growing outsourcing of chip manufacturing are anticipated to boost market opportunities for semiconductor equipment suppliers.

Key features of the study:

- This report provides in-depth analysis of the global semiconductor equipment market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2024-2031), considering 2023 as the base year.

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global semiconductor equipment market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include Applied Materials Inc., ASML, Nordson Corporation, Cohu, Inc., Lam Research Corporation, Tokyo Electron Limited, KLA-Tencor Corporation, Teradyne Inc., ASM International N.V., Nikon. Corporation, Canon Inc., BE Semiconductor Industries N.V. (Besi), Veeco Instruments Inc., Rudolph Technologies, Inc., Onto Innovation Inc., Ultratech, Inc., Nova Measuring Instruments Ltd., Mycronic AB, SPTS Technologies Ltd.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- Global semiconductor equipment market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global semiconductor equipment market.

Detailed Segmentation-

- By Product Type

- Semiconductor Front-end Equipment

- Semiconductor Back-end Equipment

- By Application

- Discrete Semiconductor

- Optoelectronic Device

- Sensors

- Integrated Circuits

- By Equipment

- Wafer Processing

- Assembly & Packaging

- Testing Equipment

- By End-use Industry

- PCs

- Mobile Handsets

- Televisions Assembly & Packaging

- By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

- Key Players Insights

- Applied Materials Inc.

- ASML

- Nordson Corporation

- Cohu, Inc.

- Lam Research Corporation

- Tokyo Electron Limited

- KLA-Tencor Corporation

- Teradyne Inc.

- ASM International N.V.

- Nikon Corporation

- Canon Inc.

- BE Semiconductor Industries N.V. (Besi)

- Veeco Instruments Inc.

- Rudolph Technologies, Inc.

- Onto Innovation Inc.

- Ultratech, Inc.

- Nova Measuring Instruments Ltd.

- Mycronic AB

- SPTS Technologies Ltd.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Product Type

- Market Snapshot, By Application

- Market Snapshot, By Equipment

- Market Snapshot, By End Use

- Market Snapshot, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Semiconductor Equipment Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Semiconductor Equipment Market, By Product Type, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019-2031

- Segment Trends

- Semiconductor Front-end Equipment

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

- Semiconductor Back-end Equipment

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

6. Global Semiconductor Equipment Market, By Application, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019-2031

- Segment Trends

- Discrete Semiconductor

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

- Optoelectronic Device

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

- Sensors

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

- Integrated Circuits

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

7. Global Semiconductor Equipment Market, By Equipment, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019-2031

- Segment Trends

- Wafer Processing

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

- Assembly & Packaging

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

- Testing Equipment

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

8. Global Semiconductor Equipment Market, By End-use Industry, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019-2031

- Segment Trends

- PCs

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

- Mobile Handsets

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

- Televisions Assembly & Packaging

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Bn)

9. Global Semiconductor Equipment Market, By Region, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019-2031

- North America

- Regional Trends

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Equipment, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Billion)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Equipment, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Billion)

- U.K.

- Germany

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Equipment, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Billion)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Equipment, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Billion)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Equipment, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Billion)

- South Africa

- GCC Countries

- Rest of the Middle East & Africa

10. Competitive Landscape

- Company Profiles

- Applied Materials Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- ASML

- Nordson Corporation

- Cohu, Inc.

- Lam Research Corporation

- Tokyo Electron Limited

- KLA-Tencor Corporation

- Teradyne Inc.

- ASM International N.V.

- Nikon Corporation

- Canon Inc.

- BE Semiconductor Industries N.V. (Besi)

- Veeco Instruments Inc.

- Rudolph Technologies, Inc.

- Onto Innovation Inc.

- Ultratech, Inc.

- Nova Measuring Instruments Ltd.

- Mycronic AB

- SPTS Technologies Ltd.

11. Analyst Recommendation

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

12. Section:

- Research Methodology

- About Us