|

市场调查报告书

商品编码

1479759

中国大陆半导体及设备市场:分析及製造趋势Mainland China's Semiconductor and Equipment Markets: Analysis and Manufacturing Trends |

||||||

近年来,中国大陆半导体产业经历了显着的成长和转型,在世界舞台上占据了重要地位。作为全球最大的半导体消费国和重要的电子设备生产国,中国半导体市场是投资者、产业利害关係人和政策制定者关注的热门话题。瞭解中国大陆半导体和设备市场的动态、趋势和製造能力对于驾驭这个快速发展和复杂的模式至关重要。

中国大陆半导体产业最显着的趋势之一是本土半导体企业的崛起。SMIC(Semiconductor Manufacturing International Corporation)、HuaweiHiSilicon、YMTC(Yangtze Memory Technologies Corporation)等已成为全球半导体市场的主要进入者,课题现有企业并推动竞争。

另一个重要趋势是越来越关注先进製造技术和能力。中国大陆正在大力投资开发尖端製造製程、封装技术和设备製造。国家积体电路产业投资基金(又称大基金)和中国製造2025策略等措施正协助加速FinFET电晶体、3D封装和先进光刻等先进半导体製造技术的采用。

本报告深入研究中国大陆半导体和设备市场,对主要製造趋势、技术进步、市场动态和竞争格局进行详细分析和洞察。透过研究半导体製造的最新趋势,包括製造流程、封装技术和设备创新,我们揭示了推动中国大陆半导体产业成长和塑造未来的因素。此外,我们也研究了推动中国大陆半导体产业发展的策略性举措、投资和政策,为市场机会、课题和竞争策略提供了宝贵的视角。

目录

第一章简介

- 介绍

第二章 半导体产业

- 介绍

- 中国国内半导体市场

- 中国半导体基础设施

- 政府目标

- 中国半导体製造商

- Wuxi China Resources Huajing Microelectronics

- CSMC Technologies

- Shanghai Huahong Grace Semiconductor (HHGRACE)

- Hangzhou Youwang Electronics

- Huayue Microelectronics

- Semiconductor Manufacturing Int'l (SMIC)

- Advanced Semiconductor Manufacturing (ASMC)

- Fairchild Semiconductor Suzhou

- Shanghai Belling

- SK Hynix

- Toshiba Semiconductor (Wuxi)

- HeJian Technology

- TSMC

- Ningbo BYD Semiconductor

- SIM-BCD

- Intel

- Samsung

- Datung NXP Semiconductors

- UMC

- XMC

- Shanghai Huali Microelectronics Corporation

- YMTC

- CXMT

- Hua Hong

- Thatic

- Zhaoxin

- Semiconductor Manufacturing Electronics

- 后端製造

- 印刷电路板 (PCB) 製造

- 积体电路设计

- 电子元件

- 外国公司的作用

- IC产业评价

附录A:中国设计公司

附录B:中国IC厂商

附录C:中国封测企业

第三章市场分析

- 亚洲经济復苏

- 半导体市场

- IC产业现状

- 中国积体电路製造能力

- 全球记忆体市场

- 中国记忆体市场

- 中国主要铸造厂

- 中国半导体设备市场

- 整个市场

- 中国装备市场,依细分市场

- 中国设备供应商简介

第四章 高新技术领域

- 介绍

- 沟通

- 光电子学

- 软件

- 家电

- 化学品/材料

- 环保产业

- 展示

第五章 高科技产业开发区

- 介绍

- 火炬计划

- 高新技术产业开发区

- 安徽省

- 北京

- 福建省

- 甘肃

- 广东省

- 广西壮族自治区

- 贵州

- 海南省

- 河北省

- 黑龙江省

- 河南省

- 湖北省

- 湖南省

- 内蒙古自治区

- 江苏

- 江西

- 吉林省

- 辽宁

- 陕西省

- 山东省

- 上海

- 山西省

- 四川

- 天津

- 新疆维吾尔自治区

- 云南

- 浙江省

- 自贸区

第六章 经济统计与分析

- 金融情况

- 国内生产毛额

- 就业部门

- 通货膨胀

- 零售销售

- 外贸

- 消费支出

- 投资

- 经济统计

Introduction

The semiconductor industry in Mainland China has undergone remarkable growth and transformation in recent years, positioning itself as a key player on the global stage. As the world's largest consumer of semiconductors and a significant producer of electronic devices, China's semiconductor market is a focal point for investors, industry stakeholders, and policymakers alike. Understanding the dynamics, trends, and manufacturing capabilities within Mainland China's semiconductor and equipment markets is essential for navigating the complexities of this rapidly evolving landscape.

This comprehensive report offers a deep dive into Mainland China's semiconductor and equipment markets, providing in-depth analysis and insights into key manufacturing trends, technological advancements, market dynamics, and competitive landscapes. By examining the latest developments in semiconductor manufacturing, including fabrication processes, packaging technologies, and equipment innovations, the report sheds light on the factors driving growth and shaping the future of the industry in Mainland China.

Furthermore, the report explores the strategic initiatives, investments, and policies driving Mainland China's semiconductor industry, offering valuable perspectives on market opportunities, challenges, and competitive strategies. From the rise of domestic semiconductor companies to the impact of global trade dynamics and technological disruptions, this report provides a holistic view of Mainland China's semiconductor ecosystem and its implications for global stakeholders.

Whether you're a semiconductor manufacturer, equipment supplier, investor, or policymaker, this report serves as an indispensable resource for understanding the dynamics of Mainland China's semiconductor and equipment markets, identifying growth opportunities, and making informed strategic decisions in an increasingly interconnected and dynamic industry landscape.

Trends

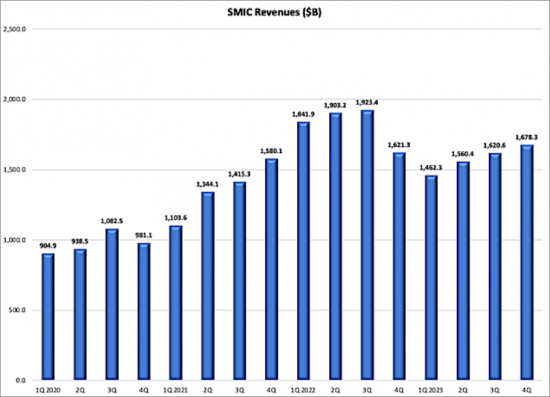

One of the most notable trends in Mainland China's semiconductor industry is the rise of domestic semiconductor companies. Fueled by government support, strategic investments, and technological innovation, Chinese semiconductor firms have been making significant strides in various segments of the industry, from design and manufacturing to packaging and testing. Companies such as SMIC (Semiconductor Manufacturing International Corporation), Huawei's HiSilicon, and Yangtze Memory Technologies Corporation (YMTC) have emerged as major players in the global semiconductor market, challenging established incumbents and driving competition.

Another key trend is the increasing focus on advanced manufacturing technologies and capabilities. Mainland China has been investing heavily in the development of cutting-edge fabrication processes, packaging technologies, and equipment manufacturing. Initiatives such as the National Integrated Circuit Industry Investment Fund (also known as the Big Fund) and the Made in China 2025 strategy have been instrumental in accelerating the adoption of advanced semiconductor manufacturing techniques, including FinFET transistors, 3D packaging, and advanced lithography.

Additionally, Mainland China's semiconductor industry has been actively pursuing collaborations and partnerships with international players to bolster its technological capabilities and expand its market reach. Joint ventures, technology licensing agreements, and strategic alliances with leading semiconductor companies from countries such as the United States, South Korea, and Taiwan have become increasingly common, facilitating knowledge transfer, technology exchange, and access to global markets.

Impact of U.S. Sanctions

In recent years, Mainland China's semiconductor and equipment markets have faced significant challenges due to escalating trade tensions and U.S. sanctions. These developments have reshaped the landscape of the semiconductor industry in China, prompting the country to accelerate efforts to achieve self-sufficiency and reduce its reliance on foreign technologies. Against this backdrop, analyzing the trends in Mainland China's semiconductor and equipment markets becomes crucial for understanding the impact of these sanctions and identifying opportunities and challenges for industry stakeholders.

One prominent trend in Mainland China's semiconductor market is the rapid growth of domestic semiconductor companies. Faced with restrictions on access to key technologies and components from foreign suppliers, Chinese semiconductor firms have ramped up efforts to develop indigenous capabilities in chip design, fabrication, and packaging. This has led to the emergence of a robust ecosystem of domestic semiconductor companies, supported by government policies and investments. These companies are increasingly focused on developing advanced semiconductor products tailored to the needs of domestic and global markets.

Furthermore, Mainland China's semiconductor industry is witnessing increased investment in research and development (R&D) to drive innovation and technological advancements. With the goal of achieving technological parity with global leaders, Chinese semiconductor companies are investing heavily in areas such as artificial intelligence (AI), 5G, Internet of Things (IoT), and high-performance computing. These investments are aimed at developing cuttingedge semiconductor technologies and products that can compete on a global scale and reduce the country's dependence on foreign suppliers.

Moreover, the sanctions imposed by the United States have prompted Mainland China to accelerate efforts to enhance its semiconductor manufacturing capabilities. This includes investments in advanced manufacturing facilities and equipment, as well as the development of domestic supply chains for critical semiconductor materials and components. Additionally, Mainland China is exploring collaborations with other countries and regions to access advanced semiconductor technologies and expertise.

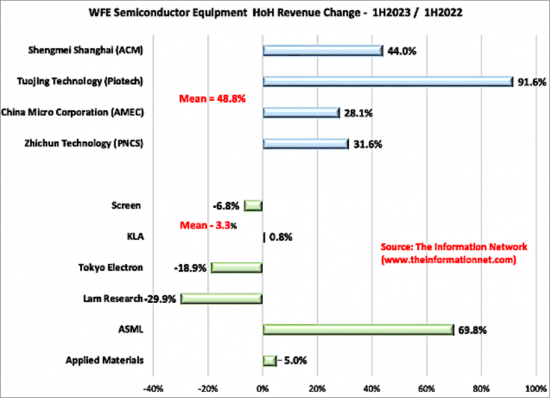

In the semiconductor equipment market, Mainland China is investing in the development and deployment of advanced manufacturing equipment to support its growing semiconductor industry. This includes investments in lithography machines, etching systems, deposition tools, and inspection equipment to enable the production of advanced semiconductor products. Domestic equipment manufacturers are also emerging as key players, supported by government subsidies and incentives to enhance their competitiveness in the global market.

Overall, Mainland China's semiconductor and equipment markets are undergoing rapid transformation in response to U.S. sanctions and the drive for self-sufficiency. While these developments present challenges, they also create opportunities for domestic companies to innovate, grow, and compete on a global scale.

What's Included in This Report:

The Mainland China's Semiconductor and Equipment Markets: Analysis and Manufacturing report delves into the intricate dynamics of one of the most rapidly evolving sectors in the global economy. It meticulously analyzes various facets of the semiconductor industry within mainland China, providing readers with invaluable insights to navigate this dynamic landscape, including:

Market Overview: This section offers a panoramic view of the semiconductor market in mainland China, encompassing its size, growth trajectory, and the primary factors propelling or inhibiting its expansion. It delves into historical data and current trends to provide a comprehensive understanding of the market dynamics.

Competitive Landscape: An in-depth analysis of the key players operating in mainland China's semiconductor industry is crucial for understanding market dynamics and competitive strategies. This segment evaluates the market share, growth strategies, R&D initiatives, and recent developments of major semiconductor companies in the region.

Manufacturing Trends: Manufacturing trends are pivotal indicators of the industry's health and trajectory. This section examines capacity expansions, investment patterns, technological advancements in fabrication facilities, and shifts in manufacturing strategies adopted by semiconductor manufacturers in mainland China.

Market Segmentation: The semiconductor market in mainland China is multifaceted, catering to diverse product types, applications, and end-user industries. This segment dissects the market into various segments, providing insights into their growth trajectories, market size, and key drivers.

Table of Contents

Chapter 1. Introduction

- 1.1. Introduction

Chapter 2. Semiconductor Industry

- 2.1. Introduction

- 2.2. China's Domestic Semiconductor Market

- 2.3. China's Semiconductor Infrastructure

- 2.4. Government Goals

- 2.5. Semiconductor Manufacturers In China

- 2.5.1. Wuxi China Resources Huajing Microelectronics

- 2.5.2. CSMC Technologies

- 2.5.3. Shanghai Huahong Grace Semiconductor (HHGRACE)

- 2.5.4. Hangzhou Youwang Electronics

- 2.5.5. Huayue Microelectronics

- 2.5.6. Semiconductor Manufacturing Int'l (SMIC)

- 2.5.7. Advanced Semiconductor Manufacturing (ASMC)

- 2.5.8. Fairchild Semiconductor Suzhou

- 2.5.9. Shanghai Belling

- 2.5.10. SK Hynix

- 2.5.11. Toshiba Semiconductor (Wuxi)

- 2.5.12. HeJian Technology

- 2.5.13. TSMC

- 2.5.14. Ningbo BYD Semiconductor

- 2.5.15. SIM-BCD

- 2.5.16. Intel

- 2.5.17. Samsung

- 2.5.18. Datung NXP Semiconductors

- 2.5.19. UMC

- 2.5.20. XMC

- 2.5.21. Shanghai Huali Microelectronics Corporation

- 2.5.22. YMTC

- 2.5.23. CXMT

- 2.5.24. Hua Hong

- 2.5.25. Thatic

- 2.5.26. Zhaoxin

- 2.5.27. Semiconductor Manufacturing Electronics (Shaoxing)

- 2.6. Back-End Manufacturing

- 2.7. Printed Circuit Board (PCB) Manufacturing

- 2.8. IC Design

- 2.9. Electronics Components

- 2.10. Role Of Foreign Companies

- 2.11. IC Industry Assessment

Appx A: China Design Companies

Appx B: China IC Manufacturers

Appx C: China Packaging and Testing Companies

Chapter 3. Market Analysis

- 3.1. Economic Recovery In Asia

- 3.2. Semiconductor Market

- 3.2.1. IC Industry Status

- 3.2.2. China IC Fab Capacity

- 3.2.3. Global Memory Market

- 3.2.4. Chinese Memory Market

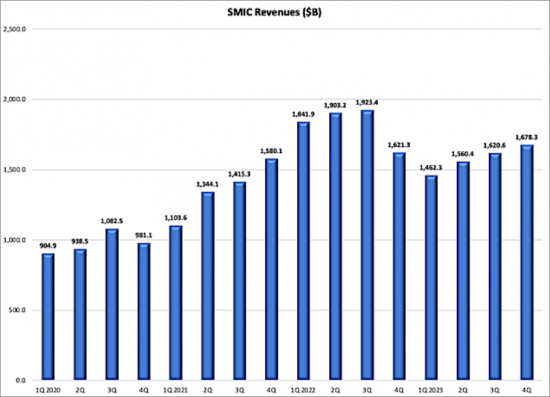

- 3.2.5. China's Leading Foundry

- 3.2.5.1. SMIC

- 3.2.5.2. Hua Hong

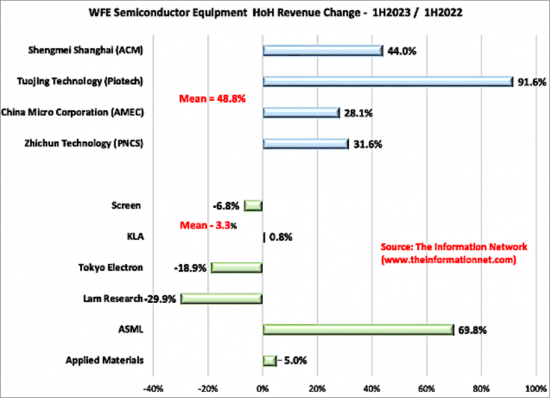

- 3.3. China Semiconductor Equipment Market

- 3.3.1. Overall Market

- 3.3.2. China Equipment Market by Segment

- 3.3.2. Chinese Equipment Supplier Profiles

- 3.3.3.1. AMEC

- 3.3.3.2. ACM Research

- 3.3.3.3. AccoTest

- 3.3.3.4. Naura

- 3.3.3.5. Anji Microelectronics

- 3.3.3.6. PNC

- 3.3.3.7. Kingsemi

- 3.3.3.8. Changchuan

- 3.3.3.9. SMEE

- 3.3.3.10. Hwatsing

- 3.3.3.11. Piotech

- 3.3.3.14. Raintree Scientific Instruments

Chapter 4. High-Tech Sectors

- 4.1. Introduction

- 4.2. Telecommunications

- 4.3. Optoelectronics

- 4.4. Software

- 4.5. Consumer Electronics

- 4.6. Chemicals/Materials

- 4.7. Environmental Industry

- 4.8. Display

- 4.8.1. TFT-LCD Technology

- 4.8.2. OLED Technology

Chapter 5. High Technology Industry Development Zones

- 5.1. Introduction

- 5.2. Torch Program

- 5.3. High Technology Industry Development Zones

- 5.3.1. Anhui Province

- Hefei High And New Technology Industry Development Zone

- 5.3.2. Beijing

- Beijing Experimental Zone For The Development Of New Technology Industries

- Changping Park Of Bez

- Fengtai Park Of Bez

- 5.3.3. Fujian Province

- Fuzhou Science And Technology Park

- Xiamen Torch High Technology Industry Development Zone

- 5.3.4. Gansu Province

- Lanzhou High And New Technology Industry Development Zone

- 5.3.5. Guangdong Province

- Foshan High And New Technology Industry Development Zone

- Guangzhou Tianhe High And New Technology IndustryDevelopment Zone

- Huizhou Zhongkai New Technology Industry Development Zone

- Shenzhen Science And Technology Industrial Park

- Zhongshan High & New Technology Innovation Service Center

- Zhuhai High And New Technology Industry Development Zone

- 5.3.6. Guangxi Zhuang Autonomous Region

- Guilin High And New Technology Industry Development Zone

- Nanning New Technology Industry Development Zone

- 5.3.7. Guizhou Province

- Guiyang Xintian New Technology Industry Development Zone

- 5.3.8. Hainan Province

- Hainan International Industrial Park

- 5.3.9. Hebei Province

- Baoding New Technology Industry Development Zone

- Shijiazhuang High And New Technology Industry Development Zone

- 5.3.10. Heilongjiang Province

- Daqing High And New Technology Industry Development Zone

- Harbin High And New Technology Industry Development Zone

- 5.3.11. Henan Province

- Luoyang High And New Technology Industry Development Zone

- Zhengzhou High And New Technology Industry Development Zone

- 5.3.12. Hubei Province

- Wuhan Donghu New Technology Development Zone

- Xiangfan High And New Technology Industry Development Zone

- 5.3.13. Hunan Province

- Changsha High And New Technology Industry Development Zone

- Zhuzhou High And New Technology Industry Development Zone

- 5.3.14. Inner Mongolia Autonomous Region

- Baotou Rare Earth High And New Technology Industry Development Zone

- 5.3.15. Jiangsu Province

- Changzhou High And New Technology Industry Development Zone

- Nanjing High And New Technology Industry Development Zone

- Suzhou High And New Technology Industry Development Zone

- Wuxi High And New Technology Industry Development Zone

- 5.3.16. Jiangxi Province

- Nanchang High And New Technology Industry Development Zone

- 5.3.17. Jilin Province

- Changchun High And New Technology Industry Development Zone

- Jilin High And New Technology Industry Development Zone

- 5.3.18. Liaoning Province

- Anshan High And New Technology Industry Development Zone

- Dalian High And New Technology Industrial Park

- Shenyang New-High-Tech Industrial Development Zone

- 5.3.19. Shaanxi Province

- Baoji High And New Technology Industry Development Zone

- Xi'an New Technology Industry Development Zone

- 5.3.20. Shandong Province

- Ji'nan High And New Technology Industry Development Zone

- Qingdao High-Tech Industrial Park

- Weifang High And New Technology Industry Development Zone

- Zibo High And New Technology Industry Development Zone

- 5.3.21. Shanghai

- Incubator Center Of High-Technology Of China Textile International

- Shanghai High And New Technology Industry Development Zone

- Shanghai Zhangjiang Hi-Tech Park

- 5.3.22. Shanxi Province

- Taoyuan High And New Technology Industry Development Zone

- 5.3.23. Sichuan Province

- Chengdu High And New Technology Industry Development Zone

- Chongqing High And New Technology Industry Development Zone

- Mianyang High And New Technology Industry Development Zone

- 5.3.24. Tianjin

- Tianjin New Technology Industrial Park

- 5.3.25. Xinjiang Uygur Autonomous Region

- Urumqi High And New Technology Industry Development Zone

- 5.3.26. Yunnan Province

- Kunming High And New Technology Industry Development Zone

- 5.3.27. Zhejiang Province

- Hangzhou High And New Technology Industry Development Zone

- 5.3.1. Anhui Province

- 5.4. Free Trade Zones

Chapter 6. Economic Statistics And Analysis

- 6.1. Economic Climate

- 6.2. GDP

- 6.3. Employment Sector

- 6.4. Inflation

- 6.5. Retail Sales

- 6.6. Foreign Trade

- 6.7. Consumer Spending

- 6.8. Investments

- 6.9. Economic Statistics

List of Figures

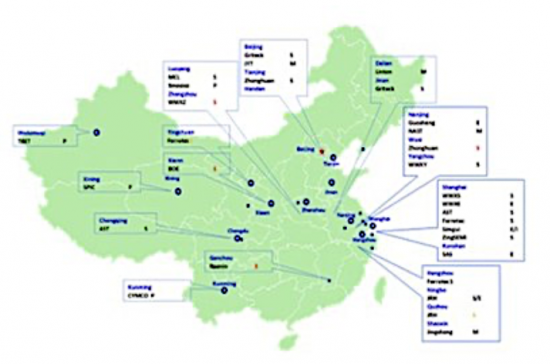

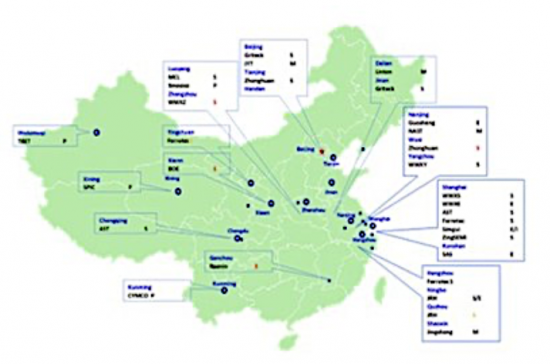

- 2.1. Fab Construction By China Region

- 2.2. Number of Design Houses in China

- 3.1. China's GDP

- 3.2. China's Internal IC Production

- 3.3. China's IC Demand

- 3.4. China's Internal IC Production/Total Demand

- 3.5. IC Imports to China

- 3.6. China's IC Supply/Demand

- 3.7. China's IC Fab Capacity

- 3.8. IC Fab Capacity by Region

- 3.9. China's IC Fab Capacity by Wafer Size

- 3.10. China's 12" Fab Capacity By Company

- 3.11. China's IC Fab Capacity by Geometry

- 3.12. China's IC Production by Application

- 3.13. NAND Market By Region

- 3.14. DRAM Market By Region

- 3.15. TSMC Revenue By Process

- 3.16. TSMC and SMIC Revenues by Process Node

- 3.17. Semiconductor Equipment Forecast

- 3.18. Top Semiconductor Equipment Spenders

- 3.19. Semiconductor Equipment Revenue By Region By Quarter

- 3.20. Semiconductor Equipment Revenues To China By Quarter

- 3.21. Semiconductor Equipment Purchases By CXMT and YMTC

- 4.1. China's Consumer Electronics Exports

- 4.2. Materials Forecast By Region

- 5.1. Map Of Regions Of China

- 6.1. China's GDP Growth

List of Tables

- 2.1. Chinese IC Fab Construction

- 2.2. Chinese Foundry Construction

- 2.3. Chinese Fab Capacity

- 2.4. China IC Packaging And Testing Firms: Wholly-Owned Int'l Firms

- 2.5. China IC Packaging And Testing Firms: Joint Ventures

- 2.6. China IC Packaging And Testing Firms: Wholly-Owned Taiwan Firms

- 2.7. China IC Packaging And Testing Firms: Locally-Owned Firms

- 2.8. China fabless IC design firms

- 2.9. Main Pure-Play Foundry Revenues

- 3.1. China's IC Market

- 3.2. Bit Growth Change For DRAMSs By Manufacturer

- 3.3. Bit Growth Change For NAND By Manufacturer

- 3.4. DRAM Roadmap By Manufacturer

- 3.5. 3D NAND Roadmap By Manufacturer

- 3.6. Top Semiconductor Foundries

- 3.7. SMIC Fabs

- 3.8. SMIC Major Customers

- 3.9. SMIC Revenues By Process Vs TSMC

- 3.10. Initial Volume Production Comparison Between TSMC and SMIC

- 3.11. Chip Costs Per Node

- 3.12. Hua Hong Fabs

- 4.1. China's Import Electronic ICs And Microassemblies

- 4.2. China's Leading Export/Import Partners For High-Tech Products

- 4.3. China's Export Electronic Products

- 4.4. Main Software Parks In China

- 4.5. TFT-LCD Plants In China

- 4.6. OLED Plants In China

- 5.1. National High Technology Industry Development Zones

- 2.1. Chinese IC Fab Construction

- 2.2. Chinese Foundry Construction

- 2.3. Chinese Fab Capacity

- 2.4. China IC Packaging And Testing Firms: Wholly-Owned Int'l Firms

- 2.5. China IC Packaging And Testing Firms: Joint Ventures

- 2.6. China IC Packaging And Testing Firms: Wholly-Owned Taiwan Firms