|

市场调查报告书

商品编码

1684681

自行车传动系统卡式磁带市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Bicycle Drivetrain Cassette Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球自行车传动系统卡式磁带市场规模达到 4.658 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.5%。由于骑自行车作为健身活动、休閒活动和竞技运动越来越受欢迎,该市场正在经历强劲增长。随着越来越多的人选择骑自行车锻炼和出行,对高性能传动系统卡式零件的需求持续上升。骑自行车作为一种低衝击、全身运动的运动,其吸引力推动了休閒骑行和专业骑行的激增。此外,自行车技术的进步和户外活动的日益普及也推动了对高效、耐用、轻巧的传动系统卡式磁带的需求。城市交通计划和追求卓越性能的骑行者数量的增加进一步促进了市场的扩张。随着骑乘者越来越重视在各种地形上的换檔效率和可靠性,全球向永续交通的转变和对自行车旅游日益增长的兴趣也在推动需求方面发挥着重要作用。

消费者对高阶自行车零件的偏好日益增加,进一步支持了市场的成长。随着骑自行车成为一种生活方式的选择,消费者正在投资于可提高性能和耐用性的高品质零件。电动自行车和混合动力自行车的兴起也增加了对传动系统卡式磁带的需求,因为这些自行车需要先进的组件来支援其独特的功能。此外,人们对环境永续性的意识不断增强以及对生态友善交通选择的推动,鼓励了更多的人骑自行车,从而推动了传动系统卡式磁带市场的发展。电子换檔系统等智慧技术的整合是推动市场创新和成长的另一个因素。这些进步满足了休閒骑士和专业骑乘者的需求,确保了无缝、高效的骑乘体验。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.658 亿美元 |

| 预测值 | 7.128 亿美元 |

| 复合年增长率 | 4.5% |

按自行车类型划分,某一类别在 2024 年占据了 40% 的市场份额,预计到 2034 年将创造 3 亿美元的产值。寻求冒险和健身的骑乘者数量不断增加,导致对配备先进传动系统卡式轮毂的自行车的需求增加。无论出于竞赛还是娱乐目的,平稳、高效的换檔仍然是骑士的首要任务。人们对户外探险和耐力运动的兴趣日益浓厚,进一步推动了精密工程自行车零件的销售,支持了市场的成长。

就重量等级而言,2024 年一个细分市场占据了 69% 的份额,占据了市场主导地位。竞技自行车手优先考虑轻型传动系统卡式磁带,以优化重量分布,从而提高速度、加速度和控制力。无论是参加公路赛、铁人三项赛还是耐力自行车赛,注重表现的骑士都需要能够最大限度地提高效率同时最大限度减轻重量的零件。这种偏好在职业自行车运动中尤其明显,即使是轻微的重量减轻也会显着影响骑乘品质和竞技表现。

2024 年,欧洲将占据全球自行车传动系统卡式磁带市场的 32%,其中德国在该地区的成长中发挥关键作用。该地区成熟的自行车文化、广泛的自行车基础设施以及对高品质自行车零件的强劲消费需求巩固了其市场地位。骑自行车在休閒和交通方面的广泛应用使得传动系统卡式磁带的需求保持高位。此外,欧洲全面的城市和越野自行车道网路继续支持市场成长,鼓励对先进自行车技术的投资。对永续交通的重视和日常生活中自行车的日益使用进一步推动了对耐用和高性能传动系统部件的需求。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 原物料供应商

- 零件供应商

- 传动系统卡式磁带製造商

- 自行车製造商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 定价分析

- 衝击力

- 成长动力

- 骑自行车健身和休閒越来越受欢迎

- 自行车零件的技术进步

- 专业自行车越来越受欢迎

- 电动自行车的普及率不断提高

- 永续发展趋势与生态友善交通

- 产业陷阱与挑战

- 优质自行车零件成本高昂

- 技术限制和相容性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:自行车市场估计与预测,2021 - 2034 年

- 主要趋势

- 登山车

- 公路自行车

- 砾石自行车

- 其他的

第 6 章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 钢

- 铝

- 钛

- 其他的

第 7 章:市场估计与预测:按盒式磁带尺寸,2021 - 2034 年

- 主要趋势

- 11-28T

- 14-28T

- 11-34T

- 10-50吨

- 其他的

第 8 章:市场估计与预测:按速度/檔位数量,2021 - 2034 年

- 主要趋势

- 入门级(7-8)

- 中檔(9-10)

- 高性能(11-13)

第 9 章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 10 章:市场估计与预测:按重量等级,2021 - 2034 年

- 主要趋势

- 轻的

- 重量级

第 11 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 12 章:公司简介

- Box Components

- Campagnolo

- Ethirteen Components

- Full Speed Ahead

- Garbaruk

- KCNC International

- KMC Chain

- Leonardi Cassettes

- Miche.it

- microSHIFT

- Rotor bike components

- Shimano

- SRAM

- Sunrace

- Varia

- Vision Sprocket

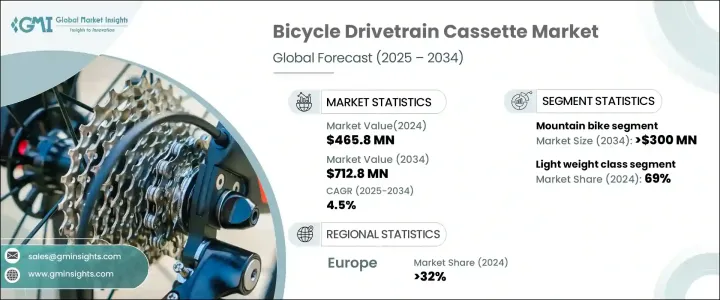

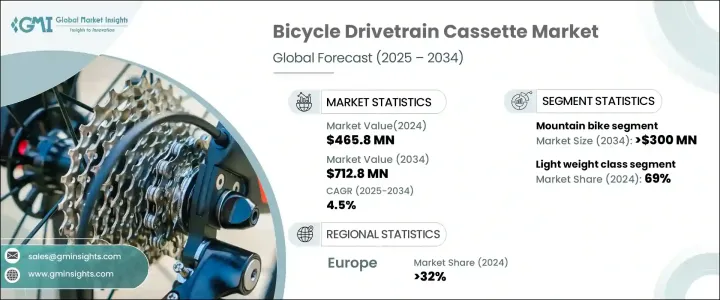

The Global Bicycle Drivetrain Cassette Market reached USD 465.8 million in 2024 and is expected to grow at a CAGR of 4.5% from 2025 to 2034. The market is witnessing robust growth due to the increasing popularity of cycling as a fitness activity, leisure pursuit, and competitive sport. As more individuals adopt cycling for exercise and transportation, the demand for high-performance drivetrain cassette components continues to rise. Cycling's appeal as a low-impact, full-body workout has driven a surge in both recreational and professional riding. Additionally, advancements in bicycle technology and the growing trend of outdoor activities are fueling the need for efficient, durable, and lightweight drivetrain cassettes. Urban mobility initiatives and the rising number of cyclists seeking superior performance further contribute to the market's expansion. The global shift toward sustainable transportation and the growing interest in cycling tourism is also playing a significant role in driving demand as riders increasingly prioritize gear-shifting efficiency and reliability across various terrains.

The market's growth is further supported by the increasing consumer preference for premium bicycle components. As cycling gains traction as a lifestyle choice, consumers are investing in high-quality parts that enhance performance and durability. The rise in e-bikes and hybrid bicycles has also contributed to the demand for drivetrain cassettes, as these bikes require advanced components to support their unique functionalities. Moreover, the growing awareness of environmental sustainability and the push for eco-friendly transportation options have encouraged more people to adopt cycling, thereby boosting the market for drivetrain cassettes. The integration of smart technologies, such as electronic shifting systems, is another factor driving innovation and growth in the market. These advancements cater to the needs of both casual riders and professional cyclists, ensuring a seamless and efficient riding experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $465.8 Million |

| Forecast Value | $712.8 Million |

| CAGR | 4.5% |

By bike type, one category accounted for 40% of the market share in 2024 and is projected to generate USD 300 million by 2034. The increasing number of cyclists seeking adventure and fitness has led to a higher demand for bikes equipped with advanced drivetrain cassettes. Whether for competitive or recreational purposes, smooth and efficient gear shifting remains a top priority for riders. The growing interest in outdoor exploration and endurance sports has further driven sales of precision-engineered bicycle components, supporting the market's growth.

In terms of weight class, one segment dominated the market with a 69% share in 2024. Competitive cyclists prioritize lightweight drivetrain cassettes to optimize weight distribution, which enhances speed, acceleration, and control. Whether participating in road racing, triathlons, or endurance cycling, performance-oriented riders demand components that maximize efficiency while minimizing weight. This preference is particularly evident in professional cycling, where even minor weight reductions can significantly impact ride quality and competitive performance.

Europe held a 32% share of the global bicycle drivetrain cassette market in 2024, with Germany playing a key role in the region's growth. The region's well-established cycling culture, extensive bike infrastructure, and strong consumer demand for high-quality components have solidified its market position. The widespread adoption of cycling for both recreation and transportation has kept the demand for drivetrain cassettes high. Additionally, Europe's comprehensive network of urban and off-road cycling paths continues to support market growth, encouraging investments in advanced bicycle technologies. The emphasis on sustainable transportation and the increasing use of bicycles in daily life has further driven demand for durable and high-performance drivetrain components.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Drivetrain cassette manufacturers

- 3.1.4 Bicycle manufacturers

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising popularity of cycling for fitness and recreation

- 3.8.1.2 Technological advancements in bicycle components

- 3.8.1.3 Increasing popularity of specialized bicycles

- 3.8.1.4 Growing adoption of e-bike

- 3.8.1.5 Sustainability trends and eco-friendly transportation

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High cost of premium bicycle components

- 3.8.2.2 Technological limitations and compatibility issues

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Bike, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Mountain bike

- 5.3 Road bike

- 5.4 Gravel bike

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Aluminum

- 6.4 Titanium

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Cassette Size, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 11-28T

- 7.3 14-28T

- 7.4 11-34T

- 7.5 10-50T

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Speed/Gear Count, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Entry-level (7-8)

- 8.3 Mid-range (9-10)

- 8.4 High-performance (11-13)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Weight Class, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Light weight

- 10.3 Heavy weight

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Box Components

- 12.2 Campagnolo

- 12.3 Ethirteen Components

- 12.4 Full Speed Ahead

- 12.5 Garbaruk

- 12.6 KCNC International

- 12.7 KMC Chain

- 12.8 Leonardi Cassettes

- 12.9 Miche.it

- 12.10 microSHIFT

- 12.11 Rotor bike components

- 12.12 Shimano

- 12.13 SRAM

- 12.14 Sunrace

- 12.15 Varia

- 12.16 Vision Sprocket