|

市场调查报告书

商品编码

1685221

二手卡车市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Used Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

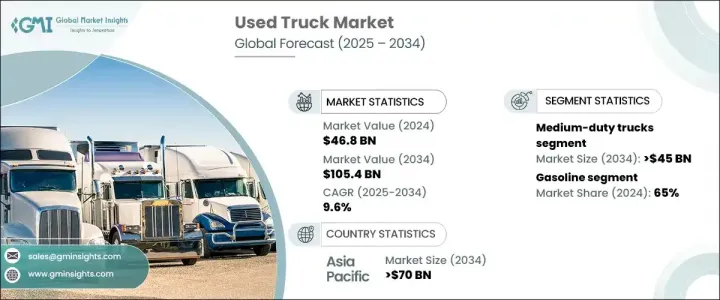

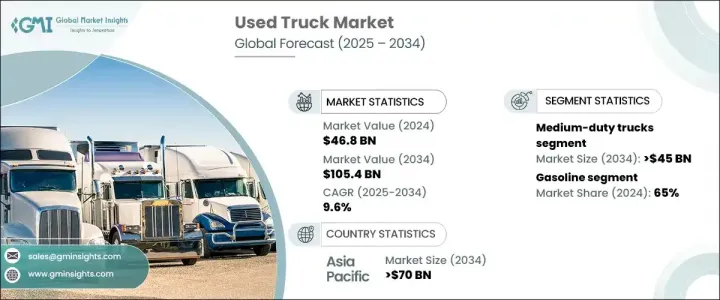

2024 年全球二手卡车市场价值为 468 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 9.6%。这一增长可归因于建筑、农业和电子商务等行业对经济高效、可靠的运输解决方案的需求不断增长。许多企业都开始使用二手卡车,以便在不牺牲性能或效率的情况下最大限度地降低开支。对于希望扩大车队的公司或寻求经济实惠的交通选择的个人来说,二手卡车提供了有价值的解决方案。

二手卡车的前期成本较低,这对于想要精打细算的小型企业和企业家来说尤其有吸引力。随着全球对高效物流的需求不断增长,二手卡车市场预计将受益于更多公司优先扩大车队同时控製成本。由于卡车类型多种多样,从轻型到重型,卡车行业也受到卡车效率技术进步的推动,进一步增强了二手车的吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 468亿美元 |

| 预测值 | 1054亿美元 |

| 复合年增长率 | 9.6% |

二手卡车市场分为轻型、中型和重型类别。 2024年,中型卡车占据超过45%的市场份额,占据领先地位。这些卡车适用于多种应用,包括运输、建筑和牵引,预计到 2034 年将创造 450 亿美元的收入。它们的多功能性使其成为需要可靠运输以完成重型任务而又无需投资全新车辆的企业的首选。对经济实惠的车队解决方案的需求不断增长,也推动了人们对二手中型卡车的兴趣,因为它们提供了性能和成本的完美平衡。

就燃料类型而言,二手卡车市场分为汽油卡车、柴油卡车和电动卡车。 2024年,汽油动力二手卡车占据65%的市场。虽然汽油仍然是主要的燃料类型,但电动卡车虽然仍处于早期阶段,但正在迅速受到关注。人们越来越重视降低营运成本、减少排放和遵守促进永续发展的政府法规,这推动了人们向电动车的转变。燃料成本降低和技术改进预计将推动电动卡车在二手卡车市场的份额。随着电动车基础设施的不断发展,该领域可能会扩大,并吸引更多寻求面向未来的车队的企业。

2024 年,亚太地区占全球二手卡车市场的 70%,预计到 2034 年将创下 700 亿美元的市场规模。中国处于这一成长的前沿,预计同期其市场规模将达到 340 亿美元。中国二手卡车需求的激增可归因于其物流业的快速成长、城市地区的扩张以及工业基础的不断增加。随着企业寻求经济的解决方案来有效地运输货物,二手卡车被视为明智的投资。随着支持汽车效率和环境责任的政策越来越普及,二手卡车的采用将在整个地区增加,进一步推动全球市场的扩张。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原始设备製造商 (OEM) 和经销商

- 独立二手卡车经销商

- 拍卖行和经纪商

- 租赁公司

- 网路市集和平台

- 利润率分析

- 成本明细

- 价格分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 全球对电动和混合动力重型卡车的需求不断增加

- 北美货运活动不断成长

- 中小企业数量不断增加

- 亚太地区基础建设投资不断增加

- 成本效益和可负担性

- 产业陷阱与挑战

- 经济衰退和低经济成长

- 法规遵从和政府法规

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 轻型卡车

- 中型卡车

- 重型卡车

第六章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 电的

第 7 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- 特许经销商

- 独立经销商

- 点对点

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Arrow Truck Sales

- Copart

- Daimler

- Enterprise Truck Rental

- Hino Motors

- International Used Trucks

- Isuzu Motors

- JD Power

- Knight-Swift Transportation

- Mascus

- Navistar International

- PACCAR

- Penske Used Trucks

- Ritchie Bros. Auctioneers

- Ryder System

- Schneider National

- TATA Motors

- TruckPaper

- Volvo Trucks

- Werner Enterprises

The Global Used Truck Market was valued at USD 46.8 billion in 2024 and is expected to grow at a CAGR of 9.6% from 2025 to 2034. This growth can be attributed to the increasing demand for cost-effective, reliable transportation solutions across industries like construction, agriculture, and e-commerce. Many businesses are turning to used trucks as a way to minimize expenses without sacrificing performance or efficiency. For companies looking to expand their fleets or for individuals seeking affordable transportation options, used trucks provide a valuable solution.

The lower upfront costs associated with pre-owned trucks make them especially attractive to small businesses and entrepreneurs who want to manage their budgets carefully. As the global demand for efficient logistics continues to rise, the used truck market is projected to benefit from more companies prioritizing fleet expansion while keeping costs under control. With a broad variety of truck types available, from light-duty to heavy-duty, the sector is also being driven by technological advancements in truck efficiency, further enhancing the appeal of pre-owned vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.8 Billion |

| Forecast Value | $105.4 Billion |

| CAGR | 9.6% |

The market for used trucks is divided into light-duty, medium-duty, and heavy-duty categories. In 2024, medium-duty trucks led the way with more than 45% of the market share. These trucks, which are ideal for a wide range of applications, including delivery, construction, and towing, are expected to generate USD 45 billion by 2034. Their versatility makes them the go-to choice for businesses that need reliable transportation for heavy-duty tasks without investing in brand-new vehicles. The growing demand for affordable fleet solutions is also driving interest in used medium-duty trucks, as they offer the perfect balance of capability and cost.

When it comes to fuel types, the used truck market is segmented into gasoline, diesel, and electric trucks. In 2024, gasoline-powered used trucks accounted for 65% of the market share. While gasoline remains the dominant fuel type, electric trucks, though still in the early stages, are rapidly gaining attention. The shift toward electric vehicles is fueled by the growing emphasis on reducing operational costs, cutting emissions, and complying with government regulations promoting sustainability. The benefits of lower fuel costs and technological improvements in electric trucks are expected to push their share in the used truck market. As electric vehicle infrastructure continues to develop, the segment will likely expand and attract more businesses looking to future-proof their fleets.

The Asia Pacific region accounted for 70% of the global used truck market in 2024 and is expected to generate USD 70 billion by 2034. China is at the forefront of this growth, with its market projected to reach USD 34 billion over the same period. The surge in demand for used trucks in China can be attributed to the rapid growth of its logistics sector, the expansion of urban areas, and the increasing industrial base. With businesses seeking economical solutions to transport goods efficiently, pre-owned trucks are seen as a smart investment. As policies supporting vehicle efficiency and environmental responsibility become more widespread, the adoption of used trucks is set to increase across the region, further driving the global market's expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Original Equipment Manufacturers (OEMs) & dealerships

- 3.2.2 Independent used truck dealers

- 3.2.3 Auction houses & brokers

- 3.2.4 Leasing & rental companies

- 3.2.5 Online marketplaces & platforms

- 3.3 Profit margin analysis

- 3.4 Cost breakdown

- 3.5 Price analysis

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for electric & hybrid heavy-duty trucks across the globe

- 3.9.1.2 Growing freight transportation activities across North America

- 3.9.1.3 The rising number of small and medium-sized businesses

- 3.9.1.4 Rising investments in infrastructure development activities in Asia Pacific

- 3.9.1.5 Cost effectiveness and affordability

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Economic downturns and low economic growth

- 3.9.2.2 Regulatory Compliance and Government Regulations

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Light-duty truck

- 5.3 Medium-duty truck

- 5.4 Heavy-duty truck

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Franchised dealer

- 7.3 Independent dealer

- 7.4 Peer-to-peer

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Arrow Truck Sales

- 9.2 Copart

- 9.3 Daimler

- 9.4 Enterprise Truck Rental

- 9.5 Hino Motors

- 9.6 International Used Trucks

- 9.7 Isuzu Motors

- 9.8 J.D. Power

- 9.9 Knight-Swift Transportation

- 9.10 Mascus

- 9.11 Navistar International

- 9.12 PACCAR

- 9.13 Penske Used Trucks

- 9.14 Ritchie Bros. Auctioneers

- 9.15 Ryder System

- 9.16 Schneider National

- 9.17 TATA Motors

- 9.18 TruckPaper

- 9.19 Volvo Trucks

- 9.20 Werner Enterprises