|

市场调查报告书

商品编码

1708219

茶叶包装市场机会、成长动力、产业趋势分析及2025-2034年预测Tea Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

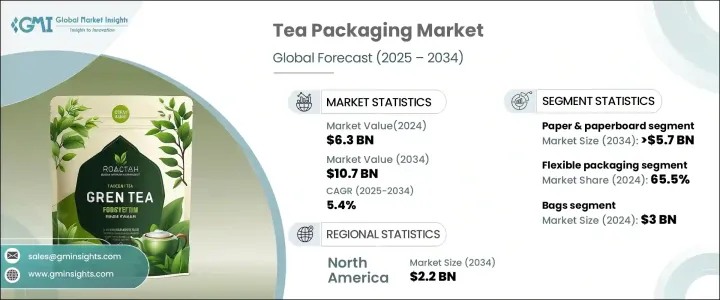

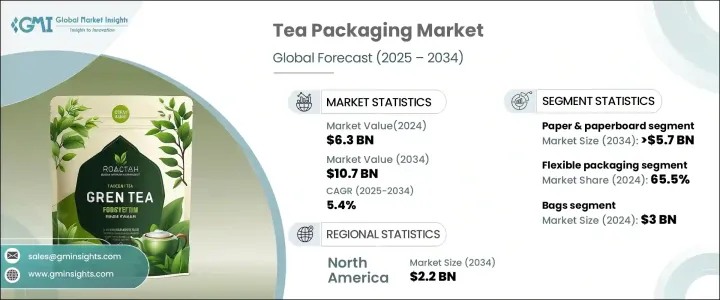

2024 年全球茶叶包装市场价值为 63 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.4%。这一增长受到全球茶叶消费量增长、即饮茶饮选择的快速扩张以及对优质茶产品需求不断增长的推动。由于茶仍然是全球第二大消费饮料,包装製造商面临持续的压力,需要开发创新和高品质的解决方案,以保持茶的新鲜度和香气,同时保持成本效益。现代茶叶消费者重视永续性,推动了对由可生物降解和可回收材料製成的包装的需求。符合这些环保偏好的品牌透过采用环保包装解决方案获得了竞争优势。

此外,有机茶和特色茶的日益普及也加速了对体现产品高品质特性的优质包装的需求。包含可重新密封、防潮和避光功能的包装设计正在成为标准功能,确保产品的寿命并提升消费者体验。随着全球茶叶消费趋势指向更健康的生活方式和对特色饮料的兴趣增加,对先进和永续包装解决方案的需求预计将推动市场大幅成长。此外,电子商务的兴起也增加了对坚固、美观、实用的包装的需求,这种包装必须能够承受运输的严酷考验,同时保持产品的完整性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 63亿美元 |

| 预测值 | 107亿美元 |

| 复合年增长率 | 5.4% |

茶叶包装市场依材料分类,包括塑胶、纸和纸板、金属等。受人们对可生物降解和可回收包装的日益青睐的推动,预计到 2034 年,纸和纸板行业的产值将达到 57 亿美元。由于纸质包装重量轻、可堆肥、可回收等特点,许多茶叶品牌正在转向使用纸质包装。高端品牌和专业品牌也开始采用精心製作的纸板纸盒,以符合其环保的品牌形象并满足消费者对永续实践的期望。随着消费者对环境影响的认识不断增强,提供可堆肥和可重复使用包装选择的品牌正在获得更高的客户忠诚度和市场差异化。

软包装凭藉其重量轻、成本效益高以及出色的保鲜能力,在 2024 年占据了 65.5% 的市场份额。这种包装通常由层压薄膜、小袋和可重复密封的袋子製成,可有效防止水分、氧气和光线,确保茶叶在较长时间内保持其品质。随着对便利性和更长保质期的需求不断增长,灵活的包装解决方案变得越来越受欢迎,尤其是对于即饮茶和特殊茶。

预计到 2034 年,北美茶叶包装市场规模将达到 22 亿美元,这得益于优质和有机茶产品日益普及以及对可持续包装解决方案的日益重视。预计到 2034 年,光是美国市场规模就将成长至 19 亿美元,这得益于茶叶消费量的增加、向高端有机产品的转变以及对环保包装的持续偏好。由于消费者要求保持新鲜度和真实性的特色茶,对有效保持产品品质的包装解决方案的需求从未如此高涨。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 茶叶消费量上升

- 永续包装需求不断成长

- 茶产品的高端化

- 电子商务的扩张

- 即饮茶(RTD)日益流行

- 产业陷阱与挑战

- 永续性和环境议题

- 原料成本波动

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 塑胶

- 纸和纸板

- 金属

- 其他的

第六章:市场估计与预测:依包装类型,2021 年至 2034 年

- 主要趋势

- 软包装

- 硬质包装

第七章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 包包

- 袋装

- 条状包装和小袋装

- 罐子和容器

- 盒子和纸箱

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Amcor plc

- Berry Global Inc.

- Constantia Flexibles

- Coveris

- Duropack Limited

- Huhtamaki

- Mondi

- Printpack

- ProAmpac

- Sappi

- Sonoco Products Company

- SPG-Pack

- Sprinpak

- Swisspac Packaging

- Transcontinental Inc.

- WestRock Company

- Winpak LTD.

The Global Tea Packaging Market was valued at USD 6.3 billion in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. This growth is fueled by the rising global consumption of tea, the rapid expansion of ready-to-drink options, and the increasing demand for premium tea products. As tea remains the second most widely consumed beverage globally, packaging manufacturers are under constant pressure to develop innovative and high-quality solutions that preserve freshness and aroma while maintaining cost-effectiveness. Modern tea consumers prioritize sustainability, driving the need for packaging made from biodegradable and recyclable materials. Brands that align with these environmental preferences are gaining a competitive edge by adopting eco-friendly packaging solutions.

Additionally, the growing popularity of organic and specialty teas is accelerating the demand for premium packaging that reflects the high-quality nature of the product. Packaging designs that incorporate resealable options, moisture barriers, and light protection are becoming standard features, ensuring product longevity and enhancing the consumer experience. As global tea consumption trends point toward healthier lifestyles and increased interest in specialty beverages, the need for advanced and sustainable packaging solutions is expected to drive substantial market growth. Moreover, the rise of e-commerce has increased the need for sturdy, attractive, and functional packaging capable of withstanding the rigors of shipping while maintaining product integrity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 5.4% |

The tea packaging market is categorized by materials, including plastic, paper and paperboard, metal, and others. The paper and paperboard segment is expected to generate USD 5.7 billion by 2034, driven by the increasing preference for biodegradable and recyclable packaging. Many tea brands are shifting toward paper-based packaging due to its lightweight, compostable, and recyclable nature. Premium and specialty brands are also embracing crafted paperboard cartons to align with their environmentally friendly brand image and meet consumer expectations for sustainable practices. As consumer awareness around environmental impact grows, brands that offer compostable and reusable packaging options are experiencing higher customer loyalty and market differentiation.

Flexible packaging held a dominant 65.5% market share in 2024 due to its lightweight nature, cost-effectiveness, and superior ability to preserve the freshness of tea. This type of packaging, often made from laminated films, pouches, and resealable bags, provides exceptional protection against moisture, oxygen, and light, ensuring the tea maintains its quality for extended periods. As the demand for convenience and longer shelf life grows, flexible packaging solutions are becoming increasingly popular, especially for ready-to-drink and specialty teas.

The North America Tea Packaging Market is expected to reach USD 2.2 billion by 2034, propelled by the rising popularity of premium and organic tea products and a growing emphasis on sustainable packaging solutions. The U.S. market alone is forecasted to grow to USD 1.9 billion by 2034, driven by increased tea consumption, a shift toward higher-end organic products, and an ongoing preference for eco-conscious packaging. As consumers demand specialty teas that maintain freshness and authenticity, the need for packaging solutions that effectively preserve product quality has never been higher.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising tea consumption

- 3.2.1.2 Growing demand for sustainable packaging

- 3.2.1.3 Premiumization of tea products

- 3.2.1.4 Expansion of e-commerce

- 3.2.1.5 Rising popularity of ready-to-drink (RTD) teas

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Sustainability and environmental concerns

- 3.2.2.2 Fluctuating raw material costs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Paper & paperboard

- 5.4 Metal

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Flexible packaging

- 6.3 Rigid packaging

Chapter 7 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn & Kilo Tons)

- 7.1 Key trends

- 7.2 Bags

- 7.3 Pouches

- 7.4 Stick pack & sachets

- 7.5 Jars & containers

- 7.6 Boxes & cartons

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Berry Global Inc.

- 9.3 Constantia Flexibles

- 9.4 Coveris

- 9.5 Duropack Limited

- 9.6 Huhtamaki

- 9.7 Mondi

- 9.8 Printpack

- 9.9 ProAmpac

- 9.10 Sappi

- 9.11 Sonoco Products Company

- 9.12 SPG-Pack

- 9.13 Sprinpak

- 9.14 Swisspac Packaging

- 9.15 Transcontinental Inc.

- 9.16 WestRock Company

- 9.17 Winpak LTD.