|

市场调查报告书

商品编码

1750346

益生菌饮料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Probiotic Drinks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球益生菌饮料市场规模达495亿美元,预计到2034年将以9%的复合年增长率增长,达到1169亿美元,这得益于消费者对肠道健康、免疫力和整体健康日益增长的兴趣。益生菌产品最初仅限于优格和补充剂,如今已发展到涵盖功能性饮料、婴儿配方奶粉,甚至动物饲料。益生菌市场的成长得益于科学研究证实了益生菌的健康益处,以及消费者认知度的不断提升。

无论是已开发市场或新兴市场,益生菌饮料的需求都在不断增长,其中北美、欧洲和亚太地区的成长尤为显着。由于人口基数大、可支配收入不断增长以及饮食偏好的转变,亚太市场预计将实现最高成长率。此外,人口老化以及代谢和胃肠道疾病的增加也推动了益生菌产品的需求。研究表明,在食品和饮料(尤其是乳製品)中添加益生菌,显着提高了消费者的接受度和产品稳定性,从而扩大了市场。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 495亿美元 |

| 预测值 | 1169亿美元 |

| 复合年增长率 | 9% |

2024年,乳製品益生菌饮料市场占有39.5%的份额。这类饮料因其营养价值而依然受欢迎,优格饮料和克菲尔在某些地区仍然占据主导地位。然而,市场正见证着向植物性益生菌饮料的转变。这项变化主要源自于人们对纯素、无乳糖和无过敏原替代品日益增长的需求。由大豆、杏仁、椰子和燕麦等原料製成的饮料因其口味和健康益处而越来越受欢迎。

益生菌饮料市场按益生菌菌株分类,其中乳酸桿菌占据主导地位,2024 年的市占率为 29.5%。鼠李糖乳桿菌和嗜酸乳桿菌等乳酸桿菌菌株以促进消化系统健康和增强免疫力而闻名。其他菌株,如双歧桿菌和长双歧桿菌,有助于维持健康的肠道平衡,特别对老年人和儿童有益。随着消费者对益生菌益处的认识不断加深,这些菌株预计将推动市场扩张。

2024年,亚太地区益生菌饮料市场占了34.3%的市占率。该地区正经历快速成长,日本等国家专注于以科学为支撑的益生菌产品,而中国和印度则日益青睐优格和康普茶等注重健康的饮料。北美的健康趋势也日益兴起,对饮用优格和康普茶等功能性饮料的需求日益增长。

在全球益生菌饮料市场,养乐多本社株式会社、达能集团、恆天然合作集团、嘉里集团和拉克塔利斯集团等公司正在采取关键策略来增强其市场影响力。这些策略包括:拓展产品组合,涵盖更广泛的功能性饮料和植物性饮料;利用先进的生产技术提升产品品质;以及透过环保包装和采购实践紧跟永续发展趋势。此外,这些公司还在研发方面投入资金,打造符合消费者不断变化的偏好的创新产品,并专注于提高产品稳定性和增强健康益处。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 製造商

- 经销商

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 供给侧影响(原料)

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 北美洲

- FDA 法规(美国)

- 加拿大卫生部法规

- 欧洲

- 欧洲食品安全局(EFSA)指南

- 欧盟健康声明法规

- 亚太地区

- FOSHU 法规(日本)

- CFDA法规(中国)

- FSSAI法规(印度)

- 世界其他地区

- 衝击力

- 成长动力

- 个性化的健康和保健需求

- 永续性和道德采购

- 转向植物性和非乳製品替代品

- 产业陷阱与挑战

- 生产成本高

- 维持益生菌活力的挑战

- 市场机会

- 新兴市场的扩张

- 产品配方创新

- 电子商务和直接面向消费者的管道的成长

- 植物性替代品的需求不断增长

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 製造工艺和技术

- 製造流程概述

- 原料采购与准备

- 益生菌培养物製备

- 发酵和加工

- 配方和混合

- 包装和储存策略

- 生产成本分析

- 原料成本

- 加工成本

- 劳动成本

- 包装成本

- 製造费用

- 成本优化策略

- 製造设施分析

- 设施扩建计划

- 供应链挑战与解决方案

- 原物料采购

- 整个供应链的品质控制

- 冷链管理

- 库存管理

- 品质保证和控制

- 微生物检测

- 稳定性和保质期测试

- 感官评价

- 製造流程概述

- 消费者行为与市场趋势分析

- 消费者偏好与购买模式

- 消费者人口统计分析

- 消费者意识和教育

- 新兴消费趋势

- 数位转型对消费者参与度的影响

- 消费者回馈分析及启示

- 价格趋势分析

- 影响定价的因素

- 原料成本

- 生产加工成本

- 跨产品细分市场的定价策略

- 高阶市场定位与大众市场定位

- 基于价值的定价方法

- 影响定价的因素

- 区域价格差异和因素

- 价格价值关係分析

- 影响市场的经济指标

- 益生菌饮料的当前科技趋势

- 新兴技术及其潜在影响

- 微胶囊技术

- 合生元配方

- 产品创新趋势

- 功能性成分组合

- 耐储存的益生菌解决方案

- 包装创新

- 永续包装材料

- 主动智慧包装

- 生产和发行中的数位技术

- 物联网和智慧製造

- 区块链用于可追溯性

- 研发活动与创新中心

- 各地区技术采用趋势

- 亚太地区在功能性饮料技术应用方面处于领先地位

- 欧洲强调生产技术的永续性

- 未来技术路线图(2025-2033)

- 个性化益生菌解决方案的开发

- 品质控制系统中的自动化和人工智慧

- 新兴技术及其潜在影响

- 行销策略和品牌分析

- 当前的行销格局

- 数位行销策略

- 传统行销方法

- 健康传播策略

- 主要参与者的品牌分析

- 包装作为行销工具

- 未来行销趋势和策略

- 市场机会和策略建议

- 尚未开发的市场机会

- 给市场参与者的策略建议

- 产品开发策略

- 市场进入和扩张策略

- 竞争优势建构策略

- 未来的成长路径

- 风险评估和缓解策略

- 市场风险

- 需求波动

- 竞争压力

- 营运风险

- 供应链中断

- 生产挑战

- 监理与合规风险

- 食品安全法规的变化

- 标籤和声明法规

- 声誉风险

- 环境和永续性风险

- 风险缓解策略和框架

- 市场风险

- 未来展望与市场演变

- 长期市场预测(2025-2035年)

- 未来市场情景

- 乐观情境

- 现实场景

- 悲观情景

- 新兴产品类别和创新

- 不断变化的消费者偏好和行为

- 技术演变及其影响

- 永续性和循环经济发展

- 未来竞争格局

- 长期成功的策略要务

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 乳製品益生菌饮料

- 益生菌优格饮料

- 克菲尔

- 益生菌乳饮料

- 其他的

- 植物益生菌饮料

- 豆奶饮料

- 杏仁饮料

- 椰子饮料

- 其他的

- 水果和蔬菜益生菌饮料

- 益生菌果汁

- 益生菌蔬菜汁

- 混合蔬果饮料

- 水性益生菌饮料

- 益生菌水

- 益生菌气泡饮料

- 发酵益生菌饮料

- 康普茶

- 格瓦斯

- 其他的

- 益生菌功能饮料

- 益生菌能量饮料

- 益生菌运动饮料

- 益生菌健康饮品

第六章:市场估计与预测:按益生菌菌株,2021 - 2034 年

- 主要趋势

- 乳酸桿菌

- 双歧桿菌

- 链球菌

- 芽孢桿菌

- 酵母菌

- 多菌株配方

第七章:市场估计与预测:依包装类型,2021 - 2034 年

- 主要趋势

- 瓶子

- 纸箱

- 罐头

- 袋装

- 其他的

第八章:市场估计与预测:按目标消费群体,2021 - 2034 年

- 主要趋势

- 一般成年人口

- 儿童和青少年

- 老年人口

- 运动员和健身爱好者

- 注重健康的消费者

第九章:市场估计与预测:按消费场合,2021 - 2034 年

- 主要趋势

- 每日消费

- 代餐

- 随时随地消费

- 运动后恢復

第十章:市场估计与预测:按价格细分,2021 - 2034 年

- 主要趋势

- 经济/大众市场

- 中檔

- 高级/豪华

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 超市和大卖场

- 便利商店

- 特色保健食品商店

- 药局和药局

- 网路零售

- 餐饮业

第 12 章:市场估计与预测:按销售管道,2021 年至 2034 年

- 主要趋势

- B2B

- B2C

第 13 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 14 章:公司简介

- Yakult Honsha Co., Ltd.

- Danone SA

- Nestle SA

- PepsiCo, Inc.

- Coca-Cola Company

- Lifeway Foods, Inc.

- Harmless Harvest

- KeVita (PepsiCo)

- GoodBelly (NextFoods)

- Chobani, LLC

- Groupe Lactalis

- Bio-K Plus International Inc.

- Fonterra Co-operative Group Juicery

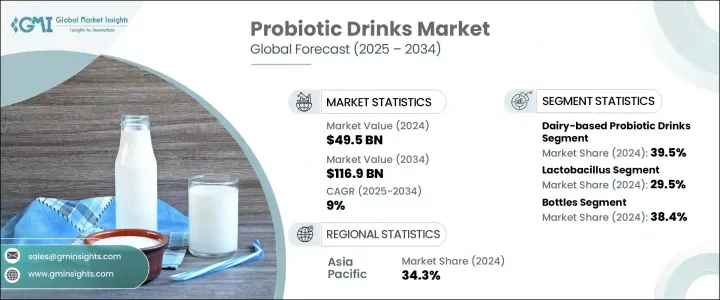

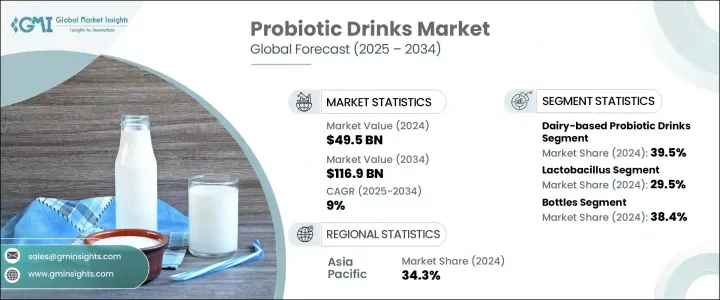

The Global Probiotic Drinks Market was valued at USD 49.5 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 116.9 billion by 2034, driven by a surge in consumer interest in gut health, immunity, and overall wellness. Initially limited to yogurt and supplements, probiotic products have since evolved to include functional beverages, infant formulas, and even animal feed. The market's growth is supported by scientific research confirming the health benefits of probiotics, as well as increasing consumer awareness.

Demand for probiotic drinks is rising across both developed and emerging markets, with particularly high growth in North America, Europe, and the Asia-Pacific region. The Asia-Pacific market is expected to experience the highest growth rates due to its large population, increasing disposable income, and changing dietary preferences. Additionally, an aging population and a rise in metabolic and gastrointestinal disorders are driving the demand for probiotic-based products. Research has shown that incorporating probiotics into food and beverages, especially in dairy products, has significantly increased consumer acceptance and product stability, expanding the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $49.5 Billion |

| Forecast Value | $116.9 Billion |

| CAGR | 9% |

Dairy-based probiotic drinks segment held a 39.5% share in 2024. These drinks remain popular for their nutritional value, with yogurt drinks and kefir continuing to dominate in certain regions. However, the market is witnessing a shift toward plant-based probiotic drinks. This change is largely driven by growing demand for vegan, lactose-free, and allergen-free alternatives. Drinks made from ingredients like soy, almond, coconut, and oat are gaining popularity for their taste and health benefits.

The probiotic drinks market is categorized by probiotic strains, with Lactobacillus taking the lead, representing a 29.5% share in 2024. Lactobacillus strains such as L. rhamnosus and L. acidophilus are well-known for promoting digestive health and boosting immunity. Other strains like B. bifidum and B. longum help maintain a healthy gut balance, especially in the elderly and children. As consumer awareness of the benefits of probiotics grows, these strains are expected to drive market expansion.

Asia-Pacific Probiotic Drinks Market held a 34.3% share in 2024. The region is experiencing rapid growth, with countries like Japan focusing on science-backed probiotic products, while China and India are increasingly embracing health-conscious beverages like yogurt and kombucha. North America is also seeing a rise in wellness trends, with a growing demand for functional beverages such as drinkable yogurts and kombucha.

In the Global Probiotic Drinks Market, companies like Yakult Honsha Co. Ltd., Groupe Danone SA, The Fonterra Co-op Group Ltd., Kerry Group PLC, and Groupe Lactalis are adopting key strategies to strengthen their market presence. These strategies include expanding product portfolios to include a wider range of functional and plant-based drinks, leveraging advanced production technologies to enhance product quality, and aligning with sustainability trends through eco-friendly packaging and sourcing practices. Additionally, these companies are investing in research and development to create innovative products that meet changing consumer preferences, focusing on improving product stability and enhancing health benefits.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.1.6 Impact on trade

- 3.1.7 Trade volume disruptions

- 3.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-side impact (raw materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.1 Supply-side impact (raw materials)

- 3.4 Demand-side impact (selling price)

- 3.4.1 Price transmission to end markets

- 3.4.2 Market share dynamics

- 3.4.3 Consumer response patterns

- 3.5 Key companies impacted

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and future considerations

- 3.8 Supplier landscape

- 3.9 Profit margin analysis

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 North America

- 3.12.1 FDA regulations (United States)

- 3.12.2 Health Canada regulations

- 3.13 Europe

- 3.13.1 European Food Safety Authority (EFSA) Guidelines

- 3.13.2 EU health claims regulation

- 3.14 Asia Pacific

- 3.14.1 FOSHU regulations (Japan)

- 3.14.2 CFDA regulations (China)

- 3.14.3 FSSAI regulations (India)

- 3.15 Rest of the world

- 3.16 Impact forces

- 3.16.1 Growth drivers

- 3.16.1.1 Personalized health and wellness needs

- 3.16.1.2 Sustainability and ethical sourcing

- 3.16.1.3 Shift toward plant-based and non-dairy alternatives

- 3.16.2 Industry pitfalls & challenges

- 3.16.2.1 High production costs

- 3.16.2.2 Challenges in maintaining probiotic viability

- 3.16.3 Market Opportunities

- 3.16.3.1 Expansion in emerging markets

- 3.16.3.2 Innovation in product formulations

- 3.16.3.3 Growth of E-commerce and direct-to-consumer channels

- 3.16.3.4 Rising demand for plant-based alternatives

- 3.16.1 Growth drivers

- 3.17 Growth potential analysis

- 3.18 Porter's analysis

- 3.19 PESTEL analysis

- 3.20 Manufacturing process and technology

- 3.20.1 Manufacturing process overview

- 3.20.1.1 Raw material procurement and preparation

- 3.20.1.2 Probiotic culture preparation

- 3.20.1.3 Fermentation and processing

- 3.20.1.4 Formulation and blending

- 3.20.1.5 Packaging and storage strategies

- 3.20.2 Production cost analysis

- 3.20.2.1 Raw material costs

- 3.20.2.2 Processing costs

- 3.20.2.3 Labor costs

- 3.20.2.4 Packaging costs

- 3.20.2.5 Manufacturing overheads

- 3.20.2.6 Cost optimization strategies

- 3.20.3 Manufacturing facilities analysis

- 3.20.3.1 Facility expansion plans

- 3.20.4 Supply chain challenges and solutions

- 3.20.4.1 Raw material sourcing

- 3.20.4.2 Quality control throughout supply chain

- 3.20.4.3 Cold chain management

- 3.20.4.4 Inventory management

- 3.20.5 Quality assurance and control

- 3.20.5.1 Microbial testing

- 3.20.5.2 Stability and shelf-life testing

- 3.20.5.3 Sensory evaluation

- 3.20.1 Manufacturing process overview

- 3.21 Consumer behavior and market trends analysis

- 3.21.1 Consumer preferences and purchasing patterns

- 3.21.2 Demographic analysis of consumers

- 3.21.3 Consumer awareness and education

- 3.21.4 Emerging consumer trends

- 3.21.5 Impact of digital transformation on consumer engagement

- 3.21.6 Consumer feedback analysis and implications

- 3.22 Pricing trends analysis

- 3.22.1 Factors affecting pricing

- 3.22.1.1 Raw material costs

- 3.22.1.2 Production and processing costs

- 3.22.2 Pricing strategies across product segments

- 3.22.2.1 Premium vs. mass market positionings

- 3.22.2.2 Value-based pricing approaches

- 3.22.1 Factors affecting pricing

- 3.23 Regional price variations and factors

- 3.24 Price-value relationship analysis

- 3.25 Economic indicators impacting the market

- 3.26 Current technological trends in probiotic drinks

- 3.26.1 Emerging technologies and their potential impact

- 3.26.1.1 Microencapsulation technologies

- 3.26.1.2 Synbiotic formulations

- 3.26.2 Product innovation trends

- 3.26.2.1 Functional ingredient combinations

- 3.26.2.2 Shelf-stable probiotic solutions

- 3.26.3 Packaging innovations

- 3.26.3.1 Sustainable packaging materials

- 3.26.3.2 Active and intelligent packaging

- 3.26.4 Digital technologies in production and distribution

- 3.26.4.1 IoT and smart manufacturing

- 3.26.4.2 Blockchain for traceability

- 3.26.5 R&D activities and innovation hubs

- 3.26.6 Technology adoption trends across regions

- 3.26.6.1 Asia-pacific leading in functional drink tech adoption

- 3.26.6.2 Europe emphasizing sustainability in production tech

- 3.26.7 Future technology roadmap 2025-2033

- 3.26.7.1 Development of personalized probiotic solutions

- 3.26.7.2 Automation and ai in quality control systems

- 3.26.1 Emerging technologies and their potential impact

- 3.27 Marketing strategies and brand analysis

- 3.27.1 Current marketing landscape

- 3.27.2 Digital marketing strategies

- 3.27.3 Traditional marketing approaches

- 3.27.4 Health communication strategies

- 3.27.5 Brand analysis of key players

- 3.27.6 Packaging as a marketing tool

- 3.27.7 Future marketing trends and strategies

- 3.28 Market opportunities and strategic recommendations

- 3.28.1 Untapped market opportunities

- 3.28.2 Strategic recommendations for market participants

- 3.28.3 Product development strategies

- 3.28.4 Market entry and expansion strategies

- 3.28.5 Competitive advantage building strategies

- 3.28.6 Future growth pathways

- 3.29 Risk assessment and mitigation strategies

- 3.29.1 Market risks

- 3.29.1.1 Demand fluctuations

- 3.29.1.2 Competitive pressures

- 3.29.2 Operational risks

- 3.29.2.1 Supply chain disruptions

- 3.29.2.2 Production challenges

- 3.29.3 Regulatory and compliance risks

- 3.29.3.1 Changing food safety regulations

- 3.29.3.2 Labeling and claims regulations

- 3.29.4 Reputational risks

- 3.29.5 Environmental and sustainability risks

- 3.29.6 Risk mitigation strategies and frameworks

- 3.29.1 Market risks

- 3.30 Future outlook and market evolution

- 3.30.1 Long-term market forecast 2025-2035

- 3.30.2 Future market scenarios

- 3.30.2.1 Optimistic scenario

- 3.30.2.2 Realistic scenario

- 3.30.2.3 Pessimistic scenario

- 3.30.3 Emerging product categories and innovations

- 3.30.4 Evolving consumer preferences and behaviors

- 3.30.5 Technological evolution and its impact

- 3.30.6 Sustainability and circular economy developments

- 3.30.7 Future competitive landscape

- 3.30.8 Strategic imperatives for long-term success

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Liters)

- 5.1 Key trends

- 5.2 Dairy-based probiotic drinks

- 5.2.1 Probiotic yogurt drinks

- 5.2.2 Kefir

- 5.2.3 Probiotic milk drinks

- 5.2.4 Others

- 5.3 Plant-based probiotic drinks

- 5.3.1 Soy-based drinks

- 5.3.2 Almond-based drinks

- 5.3.3 Coconut-based drinks

- 5.3.4 Others

- 5.4 Fruit and vegetable-based probiotic drinks

- 5.4.1 Probiotic fruit juices

- 5.4.2 Probiotic vegetable juices

- 5.4.3 Mixed fruit and vegetable drinks

- 5.5 Water-based probiotic drinks

- 5.5.1 Probiotic water

- 5.5.2 Probiotic sparkling beverages

- 5.6 Fermented probiotic beverages

- 5.6.1 Kombucha

- 5.6.2 Kvass

- 5.6.3 Others

- 5.7 Probiotic functional beverages

- 5.7.1 Probiotic energy drinks

- 5.7.2 Probiotic sports drinks

- 5.7.3 Probiotic wellness shots

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Billion) (Kilo Liters)

- 6.1 Key trends

- 6.2 Lactobacillus

- 6.3 Bifidobacterium

- 6.4 Streptococcus

- 6.5 Bacillus

- 6.6 Saccharomyces

- 6.7 Multi-strain formulations

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Kilo Liters)

- 7.1 Key trends

- 7.2 Bottles

- 7.3 Cartons

- 7.4 Cans

- 7.5 Pouches

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Target Consumer Group, 2021 - 2034 (USD Billion) (Kilo Liters)

- 8.1 Key trends

- 8.2 General adult population

- 8.3 Children and Adolescents

- 8.4 Elderly population

- 8.5 Athletes and fitness enthusiasts

- 8.6 Health-conscious consumers

Chapter 9 Market Estimates and Forecast, By Consumption Occasion, 2021 - 2034 (USD Billion) (Kilo Liters)

- 9.1 Key trends

- 9.2 Daily consumption

- 9.3 Meal replacement

- 9.4 On-the-Go consumption

- 9.5 Post-exercise recovery

Chapter 10 Market Estimates and Forecast, By Price Segment, 2021 - 2034 (USD Billion) (Kilo Liters)

- 10.1 Key trends

- 10.2 Economy / mass market

- 10.3 Mid-range

- 10.4 Premium / luxury

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Liters)

- 11.1 Key trends

- 11.2 Supermarkets and hypermarkets

- 11.3 Convenience stores

- 11.4 Specialty health food stores

- 11.5 Pharmacy and drug stores

- 11.6 Online retail

- 11.7 Foodservice sector

Chapter 12 Market Estimates and Forecast, By Sales Channel, 2021 - 2034 (USD Billion) (Kilo Liters)

- 12.1 Key trends

- 12.2 B2B

- 12.3 B2C

Chapter 13 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Liters)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Spain

- 13.3.5 Italy

- 13.3.6 Netherlands

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 Middle East and Africa

- 13.6.1 Saudi Arabia

- 13.6.2 South Africa

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Yakult Honsha Co., Ltd.

- 14.2 Danone S.A.

- 14.3 Nestle S.A.

- 14.4 PepsiCo, Inc.

- 14.5 Coca-Cola Company

- 14.6 Lifeway Foods, Inc.

- 14.7 Harmless Harvest

- 14.8 KeVita (PepsiCo)

- 14.9 GoodBelly (NextFoods)

- 14.10 Chobani, LLC

- 14.11 Groupe Lactalis

- 14.12 Bio-K Plus International Inc.

- 14.13 Fonterra Co-operative Group Juicery